Entertainment, media, and gaming have rapidly and definitively transitioned to online environments on a global scale. While content may be market-specific, most types of platforms, tech means, and main global trends have led to a convergence of factors affecting demand and supply.

The report looks at the main global socio-economic and technological patterns that are likely to drive change in the real-money gaming niche (RMG) and crossover entertainment markets in the near future. More importantly, it explores existing or imminent features that define the adoption of innovative expressions and genres of gaming and related entertainment.

India is a particular market and a recurring focus of these research series – its immense size and potential place it at the forefront of global gaming. Yet, domestic traits like low channeling, capitalization inefficiency, and legal hurdles remind us that it still has not fully emerged to fulfill those prospects.

Likewise, while some cultural foundations explain the desi passion for gaming that is still strongly tied to regional high-context content, younger generations push adoption patterns and consumption volumes that look towards novel entertainment forms and progressive gaming communities.

Ultimately, technology-driven societal transformation affects gaming faster than most relevant global economic segments, as gamification is set to become a defining rationale in both work and pleasure contexts.

Global Trends Shape the Future of the Gaming Industry

Contemporary casual and RMG solutions tend to diversify their channeling strategies – offering both single-app gaming and integrated gaming platforms. Practically all offer online gameplay, updates, and peer competitions. The leading gaming websites and online platforms (i.e., stores, virtual worlds, and various communities) almost always support games made by multiple gaming studios and payment providers.

This leads to considerable complexity in terms of technical, financial, and even stylistic integration of gaming content. Vice versa, following and adapting to such market dynamics requires a profound understanding of domestic and global trends that influence gaming demand – including cutting-edge tech solutions and dynamic social changes.

Market research agencies look recurrently into big data and follow media exposure of national and worldwide events that might impact the vertical. In many ways, the mobile-first global gaming community provides only some clues related to the future of gaming logistics or content evolution. What will the environment of future gaming look like? What would the actual logistics of various gaming segments comprise of – from blockchain technology to metaverse visualization?

Newfound Motivations for Online Gaming

If we are to talk about new directions in gaming evolution, we need to also explore any modern driving forces behind such changes. Consequently, innovative gaming patterns and trends inevitably affect the entire spectrum of player interests – from casual to action-based to RMG genres. But the underlying mechanics of new-age demand are to be sought in the (altering) motivations of players and present-day consumers as a whole.

Several months after physical distancing became a reality and a normal way of organizing one’s day, studies began to confirm that global gaming audiences have started valuing the social aspect of such entertainment solutions more than ever before. As much as 84 percent of gamers in mature markets agreed that the community feeling was a major factor behind the popularity of many top online games.

Finding some proper gaming partners and opponents became a driving force for consistent gameplay sessions, as over three-quarters of active gamers revealed that they increased online playtime (compared to time dedicated to offline game apps). Thus, gamers felt less isolated, and that was particularly the case of adolescents and other young players, namely Generation Z (see more below).

Crossing over to and from social media, video games help build such communities even when distancing measures are not in place. Linking to strangers with similar interests knits together the digital tribe centered on one’s gaming and entertainment interests or purely social needs. Gaming peers themselves replicate and transmit these self-attributed values, which is particularly true for younger users – some would go as far as calling them friendships.

Real-life examples most of us are familiar with include over-the-top (OTT) content streaming with friends and relatives who are far away (i.e., film night), as much as video chats and games of all kinds and engagement levels. Statistically, billions of consumers and casual users have turned to such tech-driven solutions to satiate their daily social needs.

Scientific studies have explored more rigorously the features of online games that facilitate social interactions and add value to our playtime. The experiences of online gamers paint the picture of a psychological phenomenon that lists several cornerstone effects which support its adoption and growth: “social rewards, experiential enhancement, growth, identity, and tension reduction.” This makes for a thoroughly rewarding experience, regardless of whether players have won or spent money, met in-game objectives, or had other personal goals.

Nevertheless, some specific motivators remain stable across gaming solutions – previous reports have shown that this is especially valid for most RMG and in-game wagering. As market sizes have grown consistently in the past couple of years, this has translated into the absolute growth of previously less notable niches such as eSports and computer-simulated leagues, among prime examples.

Statistical analyses show that e-World cups, FIFA eSports tournaments, and cricket simulations might even end up being more popular among bettors than actual sporting events, particularly during “low season” and low-profile offshore real-world events. This is largely attributed to a generational shift and a more tech-savvy player pool which we discuss below in the context of online betting and innovative sports wagering.

Generational Influences Emerge

Primary data commonly lies at the bottom of ENV research. We have already highlighted trends that establish the importance of younger age groups among online gamers. However, the nature of their impact, the motivators, and the channeling of these novel consumption styles need further exploration.

Traditional references to “young” user groups encompass ages between 18 and 40. Numerically, bigger gamer communities are found in the South (i.e., Bangalore, Chennai, and Hyderabad), while the influence of the nation’s leading urban areas (Delhi, Mumbai, Kolkata) is also easily observable. Young metropolitan self-employed gamers were found to prefer skill games for money involving original Indian content.

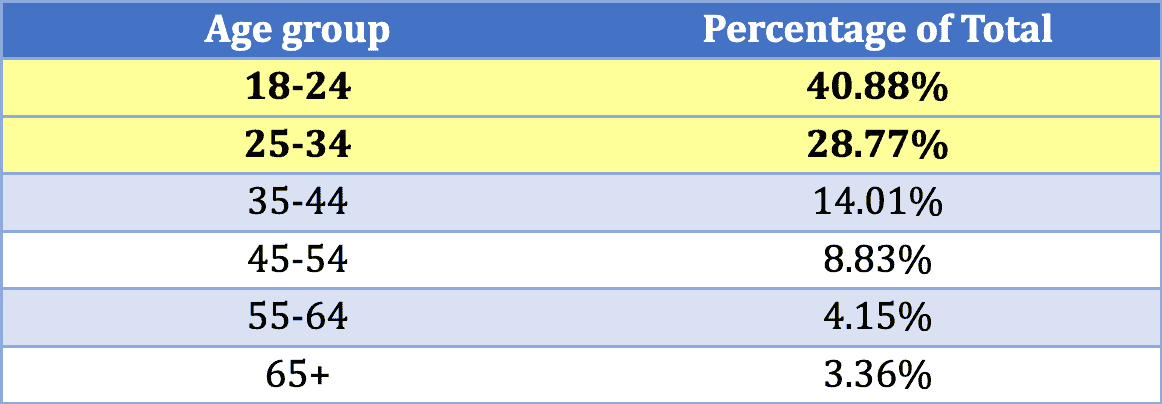

Recent insights provided by PureWin.com data suggest that player groups with a defining influence on gaming traffic and the industry’s social visibility are even younger. Aggregate data collected between January and November 2021 reveals that more than two-thirds are below 34 years of age, while in some states, the player base is coming predominantly from the 18-24 age group.

The table below covers both Casino and Sports betting products and is extracted from Google Analytics:

Age groups responsible for casino and sports betting activity. Source: PureWin BI unit

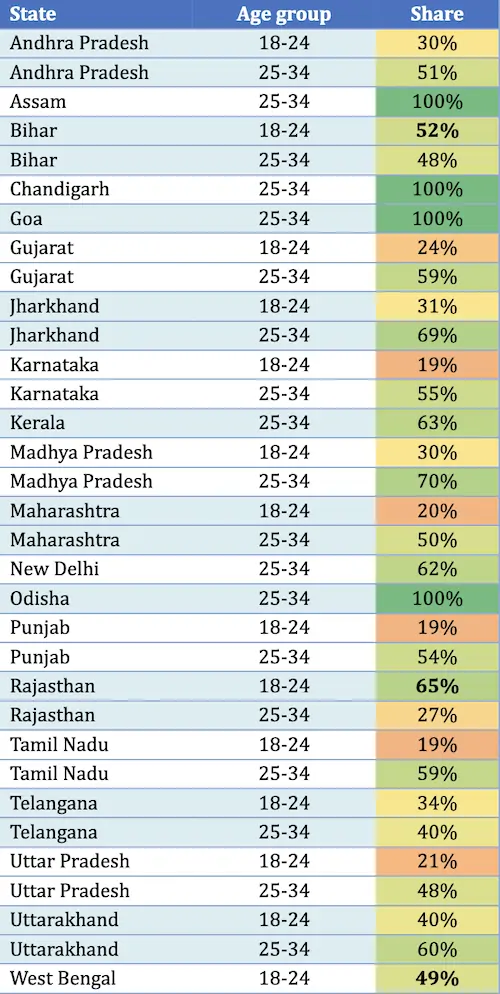

We clearly see some emphatically consistent gamer communities among younger players, with nearly 70% of all gaming activity coming from registered users below 34 years of age. While proxy access and possible abuses of age limits are not considered, we can also observe how some regional gaming communities consist mostly of the youngest age group, 18-24 – notably Rajasthan (with 2/3), Bihar, and West Bengal (with half).

Share of converted traffic by State origin. Source: Purewin

Combined, the aggregate share of all users below 34 is rarely below 70%. In some states, it is above 80% or even the entire active player traffic. Ultimately, the 25-34 age cohort is still the dominant one, with Assam, Chandigarh, Goa, and Odisha even reporting a complete dependence on the late-Millennial age group for online RMG activity.

The findings are largely in line with previous analyses of the largest gambling communities in India, including the necessity of stable disposable income that many young professionals acquire a few years after their first employment.

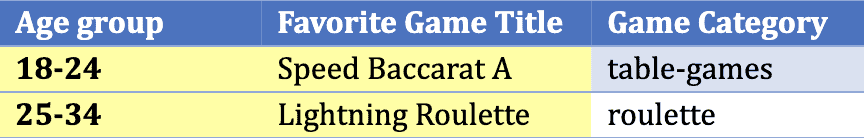

Overall, the favorite games by age cohorts reveal the preference for instant and quick-play versions of classic casino games, as shown below. These games include high-tech features (recommended for better mobiles) and make the gaming experience more immersive and dynamic.

Favorite game by age group: Purewin.com

Despite not representing a desi gaming tradition, we have also seen slots emerge as another option for a fast-paced reinvention of classic casino entertainment.

However, the new kind of attitude is particularly notable in sports betting. Audiences are looking to transition from passive to active, engaging in multiple virtual content streams and crossing over between real events, virtual simulations, and media-rich gaming platforms. Underlying bettor motivations remain the same (i.e., money, thrills) but merely transfer the passion and engagement towards genres like eSports, Fantasy, and Simulated Reality Leagues (SRL).

Sports Betting a Driver of Change

We have seen these niche games acquire more online visibility than ever until now, rating higher in SERP listings than generic sports betting search results. Their rising economic and social relevance is supported by mass-media outlets, fueling the evolution and of new-age expressions of sports betting.

The regulatory framework in India is among the main reasons why fantasy, eSports, and SRL may be seen as the future of sports betting. These skill-based RMG genres are regularly upheld as legitimate by courts and standard business practices. A genuine alternative to traditional sports betting, they offer interactive player engagement through turn-based strategies and topical knowledge. They come, of course, with multi-layered wagering schemes covering player performance within and outside the context of actual sports teams.

Young Indians attribute significant value to such flexibility and the immersive nature of virtual sports, growing from 40 to 100 million between 2018 and 2021. Fantasy leagues have become massive engagement tools for the sports franchises, above and beyond gaming crossovers and direct economic effects. The same network effects make fantasy sports overlap with the idea of sports entertainment in real life, bringing in substantial sponsorships, partner agreements, and media visibility. While fantasy sports’ direct market value is projected to reach only 50 billion rupees by 2025 (~EUR 600 million), spillover effects are perceivably far-reaching and worth much more to the vertical.

The fact that a modern (virtual) sports experience allows “flexible” betting opportunities is among the reasons why the Law Commission recommended (in 2018) that sports betting become the first gambling segment to be legalized in the context of a new strategy for the RMG sector. Fantasy and eSports, in a way, have become gateway genres to legitimate sportsbooks by emphasizing the skill element in judging actual or simulated sports performances.

Both of the above segments involve AI teams, tournaments, and professional or semi-professional competitions. Much wider in scope and definition, eSports do not only cover video simulations of football and cricket sessions. The niche includes games like multiplayer online battle arenas (MOBA), first-person shooters (FPS), martial arts, card games, and real-time strategies (RTS), among the most prominent types.

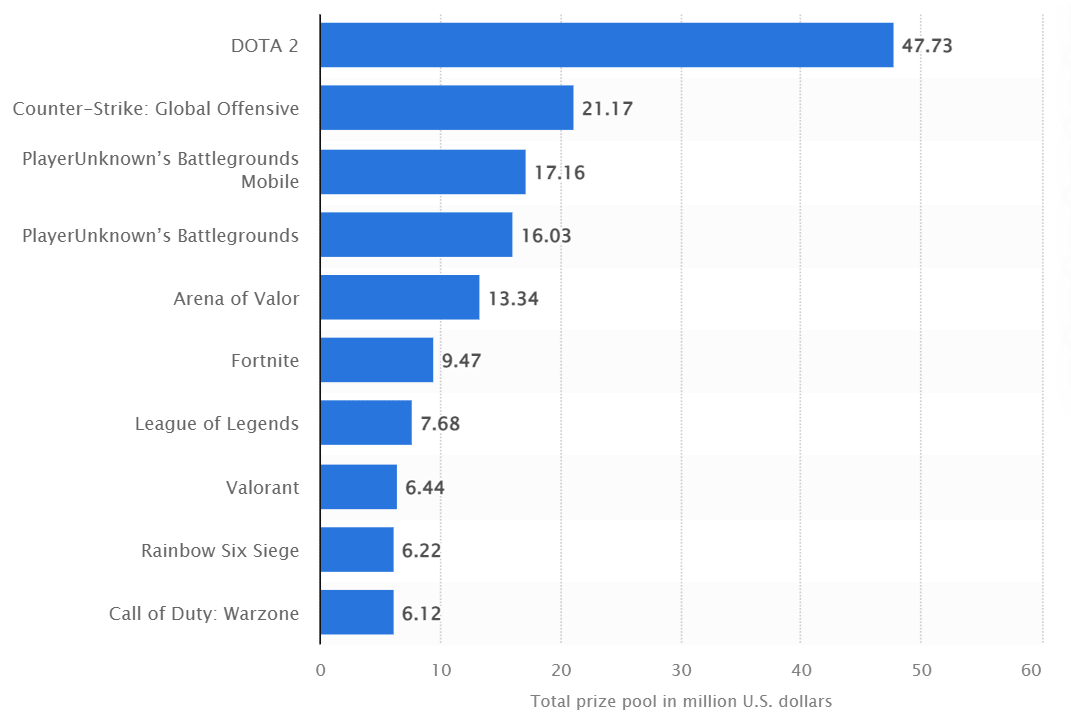

The table below shows the leading eSports in 2021 by cumulative tournament prizes (in USD) reported globally.

Source: Statista, 2022

What brings these games closer to the common understanding of sports and gambling is that millions of users bet on their outcomes – as single encounters and league series. Players back up teams in public platforms and forums, even if they do not actually take part but only observe or follow textual updates.

This has turned “second-hand” participation into yet another tool for social engagement, via streaming in particular. 2021 saw almost half a billion people watch eSports alone (465.1 million, to be precise), stressing the growing importance of these alternative and immersive events.

In the end, the direction in which modern-era RMG is heading is easily explained by certain textbook definitions of some of the main factors that drive change and evolution in (virtual) supply chains and economic paradigms. Technology, digital economics, and social changes are all forces that characterize India’s young generations and their inherent interests. Inevitably, new generation gaming – including content, UX features, and channels – is likely to continue along the path of innovation.

Millennials’ Age Cohort as Digital Ancestors

Millennials were, in practice, the first global generation. Facilitated by the Internet explosion, they grew familiar with household technology – computers, video games, video cameras, and other gadgets. These evolved into handheld devices, and the web2.0 became social media more than anything else. Scholars call the millennials the first “digital natives.”

Consumers born in the 1980s and early 1990s relatively easily learned how to look for ubiquitous digital information and where to find relevant resources. This shook the paradigm of education and skills training, bringing gamification to the forefront.

Information in the past two decades has gone from fast to instant. Millennials learned (and loved!) to multitask, preferring graphics to text, and networking to isolation. Above all, digital convenience promoted instant (and frequent) rewards as the main form of gratification when dealing with digital natives. Elevated accessibility and speed are among the reasons for the success of quick-play and instant genres like slots or lightning casino games (see above).

And finally, Millennials were the first to “admit” preferring video games to traditional adult work. They made the video gaming sector grow and made the inclusion of gamification elements a norm in many social contexts – be it work, life, entertainment, or education. In such a way, a host of new skills, abilities, and digital knowledge received their due recognition and even formal certification.

Now reaching the 40s, Millennials possess the necessary disposable income to indulge in RMG and are not yet too conservative in adopting new entertainment and gaming expressions – whether as a concept, a platform, or a novel in-game feature. Millennials enable the transition to the following generations, as today’s youth is likely to repeat and upgrade their digital behaviors.

Generation Z Takes Over

It comes as no surprise that the Zoomers (or Gen Z) simply raise the level and intensity of digital immersion. Digital natives by birth – after 1997 by most definitions – have never seen a world without the Internet or various domestic technology. This translates into exceptional technical, operational, and social networking skills, mostly through mobile devices.

The innate capacity to find their way around data and rich media makes them feel comfortable in online environments but may sometimes blunt their creativity in relation to “old-fashioned” social interactions, situations, and problems – known as soft skills. On the contrary, Gen Z users strongly believe in technology’s capacity to transform our daily lives. Their confidence is well-grounded in their digital and tech skills, especially when those hold value in current and upcoming professional fields.

Leading educational and professional organizations have accepted by now that the young adults of Generation Z need gamification elements as a standard way of challenging their performance. Higher engagement levels for the Gen Z user means being involved in the virtual gamer community (e.g., Fortnite), creating the very game environment (e.g., Roblox, Minecraft), or being immersed in the AR/VR world. Therefore, many industry analysts expect more jobs, education, and socialization opportunities to be “located” in metaverse settings for a generation currently replacing the global workforce.

Games for Gen Z have meaning when perceived as “virtual hangouts,” creating their own experiences and sharing the journey with peers. With Artificial Intelligence (AI) and Machine Learning (ML) technology valued mostly for their support functions, Gen Z users are expected to detach from these virtual environments when needed, seamlessly moving in and out of technological settings. This would make them the first “cross-realities” generation.

The expanding influence of Gen Z consumers is likely to drive software and hardware competition as companies try to stay flexible and responsive. Foreseeing new global trends in such a context remains a challenge, but adapting quickly to market demand is deemed possible with the help of tech solutions.

Snap claims in a recent report that Zoomers will be the ones driving post-pandemic economic recovery. A tech-based economy is more efficient in its nature, with digital marketing and delivery being able to make the right impact faster than ever before.

The global AR market alone is expected to grow four times by next year (2023). Tech skills will increasingly be required for anything from the job market to casual entertainment. Problem-solving will need to be based on tapping into the right digital library or media, while creativity (i.e., performance in gamified settings) is encouraged as a way to add value to social and economic transactions.

India’s Generation Z presents some differences from its Western counterpart. Only about 5% of desi gamers have owned or own consoles (~20-25 million). The gaming industry boom is a relatively recent phenomenon. Most players skip a technological step and directly ride the mobile gaming wave (around 80% of all gamers play exclusively on mobile).

What do the above factors mean for desi gaming companies and marketers? They need to diversify their channeling efforts (converting more players to their legitimate gaming platforms) and their monetization strategies (reaching more player niches and gaming genres).

While mature gaming markets rely on ad revenues for as little as 2-3 percent of their turnovers, ad proceeds in India generate as much as 40 percent of the gaming market revenue. Online gaming ecosystems are expected to raise the income from in-app purchases as the market develops more mature traits. This, however, is possible in some game types only, making cross-over genres a particularly feasible way to attempt improving monetization options.

At the end of the day, gamification and new-age digital solutions contribute to narrowing the digital divide between generations – the so-called digital natives or digital immigrants. Online games also put users on a somewhat level plane of urban, rural, richer, and poorer communities. Generational differences remain, mostly in terms of disposable income, free time, and played game titles. The rapid adoption of online and mobile gaming does not seem to be slowing down anytime soon.

Online Gaming Market Scope and Evolving Prospects

Having extensively discussed why online gaming is set for a paradigm shift, our report needs to zoom out and look at the industry cornerstones. Where does the sector stand in post-Covid terms (both globally and in India)? Where are the above consumption patterns likely to take the industry?

Market research consultancies largely agree on the size of the global gaming market – valued between USD 173.7 billion and USD 180.3 billion in 2021. After an exceptionally robust pandemic-induced expansion in 2020, it is still expected to maintain annual growth rates of just under 10%, passing USD 300 billion by 2027.

The increment is mostly due to the mobile games’ rising share (by 7.3% YoY, see below total shares for mobile), as over 3 billion players are expected to continue driving engagement and revenue levels. Crucially, 55% of the global (mobile) player base is reportedly based in the Asia-Pacific region (APAC).

In addition, the unrelenting growth of Internet usage transformed relatively recent phenomena into the new normalcy in entertainment – open-source broadcasting tools and live game streaming being prime examples. In a market where original content is key, live gaming and game-related content is fresh and dynamic enough to engage millions of viewers on a daily basis. It also promotes competition on multiple levels, not the least of which has monetary grounds.

A further macro technological factor is the state of connectivity – rapidly improving on a global scale, with 5G and cloud gaming allowing hosts, players, and viewers to experience high-end games on simple handheld devices. More often than ever before, smartphones (and tablets) have sufficient network connectivity and resource capacity to overtake and practically eliminate gaming consoles and PCs from the equation. Cloud gaming, in turn, efficiently delivers content and related services in a way that corresponds to what younger generations require from a social entertainment solution.

On the one hand, these tangible improvements in accessibility increase the demand for handheld entertainment and gaming in particular. On the other hand, they push expectations for faster and more exciting technological advancements (i.e., AR/VR tools), possibly also at affordable prices, so that user experience (UX) can noticeably benefit in quality and not only in quantity. This is no surprise for analysts, as mobile gaming has relied on new technology for its boom in the past decade.

Of course, there are certain risks to the sector’s sustainable growth. Hardware component supply shortages are among the leading potential challenges to short-term growth. After a couple of years of world-shattering events, manufacturers hope to have adopted sufficient mitigation measures to ensure flexibility and resilience for key industrial processes in the mid-term.

A thorough consideration of the gaming industry’s evolution cannot disregard the dynamic development of various existing gaming genres and the genesis of new ones. The continuous rise of the casual mobile segment, for once, is blunted by monetization barriers and extreme competition. Changes in national and transnational policies often affect gaming revenues, with advertisement proceeds suffering above all. Apple’s IDFA and the EU’s GDPR have made targeted advertising more challenging than ever before. This has also impacted user acquisition, prompting game developers to develop innovative content (not more of the same) and marketers to seek novel advertising and monetization strategies.

Ultimately, most digital sectors’ highly competitive landscape is an established trait, and gaming can hardly be an exception. A very fragmented vertical, online gaming currently experiences a wave of notable takeovers and acquisitions pointing to a growing integration between stakeholders – console platforms buying third party solutions, mobile marketing companies acquiring development studios, publishers buying local content creators, and support services. Still, a healthy influx of new gaming and tech startups keeps the gaming industry’s foundations stable.

Technological evolution plays a large role in all of the above factors: company development and business decisions; product innovation and platform competitiveness; in-game features and UX aspects. Understanding these tech-driven trends leads to a better appreciation of the social role and value of gaming in today’s interconnected society.

Legal experts have emphasized the importance of technology as an equalizer and a disruptor, particularly in the fast-paced entertainment and gaming segments. Naturally, such impacts also extend to work contexts (e.g., video conferencing or connectivity via proxies and VPNs) or the educational sphere (particularly important for poorer communities through remote and continuous training).

Besides revolutionizing the economy, technology has proven its power in challenging the status quo by expanding legal definitions and testing rules. Whenever proper regulations are not present, technological developments evoke them, as they evidence the demand for formal recognition of trends, products, or services which were simply not there before.

Online gaming has also brought along a technological disruption in most markets. Gambling platforms and apps are an excellent illustration in that sense, coming to the forefront of public, political, and legislative debate after acquiring wider online visibility and marketing attention. While India is still struggling to decide upon the nature of its nationwide regulation of gambling, most mature markets (e.g., EU, US) have taken decisive steps towards licensing regimes.

On the content front, digital giants seem to have always acknowledged the potential of linking the gaming market potential with the germinating force of new technology. In 2021 Google (Alphabet) announced it would be enriching its cloud gaming offer with hundreds of new game titles, including global favorites like the Far Cry and FIFA franchises.

Earlier, Electronic Arts (EA) revealed it would launch a major new racing game every year, despite owning several important racing franchises such as Formula 1, Need for Speed, and DIRT. While some choose to raise integration levels with next-generation consoles, platforms, and virtual stores, others go for more original content and better quality.

Throughout these developments, the APAC region has still held the largest market share. China, Japan and South Korea have significant business interests through several tech giants, while India and the Indochinese Peninsula stand out for their startups and fast-developing gamer communities. The entire macro-region is involved in substantial digital exports (in gaming and beyond), and continuous innovation in terms of new games and tech solutions.

Some of the world’s most intense digital rivalries have taken root in APAC. Sony, Nintendo, and Microsoft are clashing over gaming consoles, distribution paradigms, and cloud gaming domination.

In other digital verticals, for example, the major regional powers seem to have less in common – while China hit all virtual assets hard in 2021, Japan approved its first cryptocurrency (Enjin Coin, ENJ), and India is still largely undecided on how to regulate crypto markets, but at least such intent was publicly declared.

India Already a Global Player

The Subcontinent is notable for its rich gaming history and significant present potential, as well as for growing into an industrial and technological factor. In a closely connected global economy, this means that most trends are replicated and amplified in India, while others are generated or at least strongly influenced by its domestic market.

The gaming scene is set up against the backdrop of fragmented regulation and a moralistic notion of gambling (for the most part). Often, this makes it inadequate to host the thriving young generation of new-age gamers destined to shape its future.

Industry research estimates desi online gamers at around 430 million in 2021, expected to pass 500 million by the end of 2022. Players come mostly from the metro areas of Mumbai, Delhi, Bengaluru, Chennai, Kolkata, and Hyderabad, with rural areas quickly catching up in comparative total volumes.

Mobile gaming shares are higher than the global average due to PC and gaming console costs and lower levels of digital literacy of older generations. High adoption rates for mobile do not translate into sufficient mobile gaming revenues per player. However – estimates place the market at nearly USD 6 billion in 2025, up from around USD 2 billion currently.

Still, such important growth rates and player bases stress the status of India as a global gaming heavyweight in a number of categories. Engagement levels and visibility are already skyrocketing among young adults and adolescents, and the Union has established a strong claim to market leadership in times of economic hardships. While other economic sectors might have slowed down in the 2020-2022 biennial, the digital sector and online gaming, in particular, have picked up speed – if only as a form of “escapism” for many casual players. By mid-2020, India was clocking around 1.5 billion mobile game downloads per month.

In 2021 the domestic market’s leading game titles and platforms included the fantasy sports franchise Dream11, the multi-game Mobile Premier League (MPL), and a traditional desi favorite like Ludo King. All three are based locally and include popular RMG features.

KPMG splits the gaming market into four major categories – casual, RMG, eSports, and fantasy. Casual gaming (mostly online but including some offline app gameplay) has led in revenues for a couple of years, driven by ad integration. Real-money gaming comes next in total turnovers. Besides various Ludo versions, multiplayer RMG titles like Rummy, Teen Patti, and Poker are consistently among the leading game apps in terms of downloads and overall revenues.

While casual gaming continues relying on ad revenue, the other three segments push more in-app purchases, subscriptions, and prize pool buy-ins as monetization schemes. RMG completed FY2021 with around INR 50 billion in total revenues (~USD 660 million), while fantasy sports gathered INR 24.3 billion (~USD 322 million) and eSports responsible for only INR 1.7 billion (~USD 22 million). However, these numbers do not reflect the substantial offshore gaming revenue streams or the wagering opportunities that eSports and simulated sports events present contextually (see below analysis on sports betting).

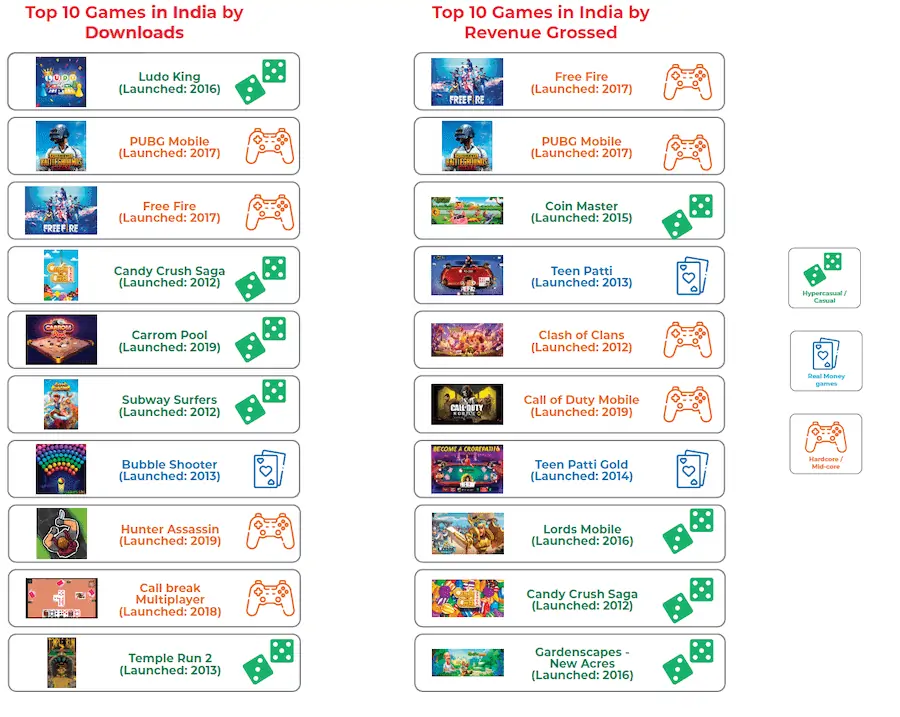

The figure below illustrates the type of games and the major titles that have gathered top player interest and activity in the fall of 2021.

Source: Google Play Store India (September 2021); RedSeer.com report

We can see that many of the above-discussed global trends are also valid for the desi gaming market, with casual titles holding key positions and dedicated gamers turning to more engaging “hardcore” titles (increasingly placed in the eSports category) – battle, shooter, and action games among others. The top performers include both global and domestic/regional leaders.

We also distinguish a confirmation of the claim that gaming is a social phenomenon, with some titles finding their roots in traditional desi culture and rapidly evolving into new forms, expressions, and platforms, or simply moving over to mobile – ludo, carom, and teen patti, above all.

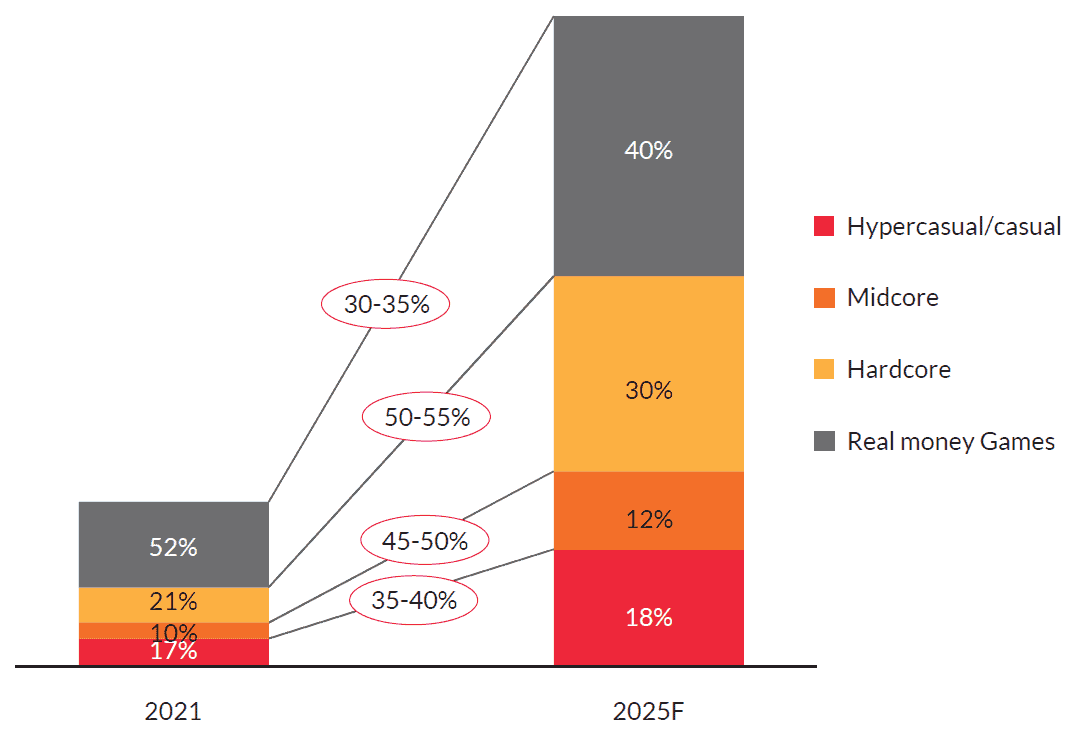

The Internet and Mobile Association of India (IAMAI) has carried out a profound study of the e-gaming ecosystem in India, stressing the “paradigm shift” of digital gaming becoming part of mainstream consumption, almost a daily necessity for hundreds of millions. Across all macro gaming categories, the market is expected to maintain solid growth in the next 2-3 years:

Source: IAMAI and Redseer, November 2021

The genre split provides a different interpretation of online gaming sub-segments from the one detailed in the above KPMG study. Genres are grouped according to player involvement and resource engagement (including time, attention, and session intensity), hardware, software, and spending requirements.

Thus segmented, games involving real-money spending hold the largest share (with roughly half currently), and they are expected to continue being the most relevant category in the near- to mid-term forecast. However, IAMAI expects more immersive (hardcore) games to increase their share and become even more relevant in India. As market maturity is expected to gradually shift the industry away from ad-based monetization, the shrinking share of real-money games (not in absolute numbers or players!) would have to be compensated by innovative, crossover, and hybrid forms of in-game monetization.

The survey provides additional insights into what is considered hardcore gaming: users often spend time not only playing but also watching eSports and third-party gaming sessions. With numerous sub-genres and niche games, this makes players more involved and the entire experience even more immersive. Both hardcore and mid-core games offer a range of monetization options via in-game transactions, all the while focusing on smooth game flow.

The fact is that India has become the largest mobile market in terms of gaming app downloads. The above figures (~1.5 billion monthly) add up to at least 12% of the global total. This leads the IAMAI and Redseer analysts to raise total value forecasts between USD 6 and 7 billion for India’s mobile gaming market in 2025.

Naturally, investor interest is growing as well. There were already two established gaming unicorns in India in 2021 – Dream11 and MPL – but other tech startups continue receiving financial backing and takeover approaches. Cross-border acquisitions are not rare anymore: just recently, the Swedish Stillfront Group acquired Bengaluru-based Moonfrog Labs, the makers of top-ranking Teen Patti and Ludo titles. The Modern Times Group (also Swedish) took over another game studio in Karnataka’s tech startup capital, PlaySimple, for a reported USD 360 million. IPOs and financing rounds are announced at regular intervals both on Dalal Street and leading stock exchanges abroad.

The Future of Gaming Logistics – Platforms, Payments, Enabling Features

One concept is never questioned, in a mid-term perspective at least – the dominance of mobile. With an estimated 4.95 billion internet users (as of January 2022), or nearly two-thirds of the global population, there are even more unique mobile phone users (5.31 billion). The GWI, a leading audience targeting company, provides sound statistical evidence that user acquisition and support will be further consolidated over mobile and handheld hardware.

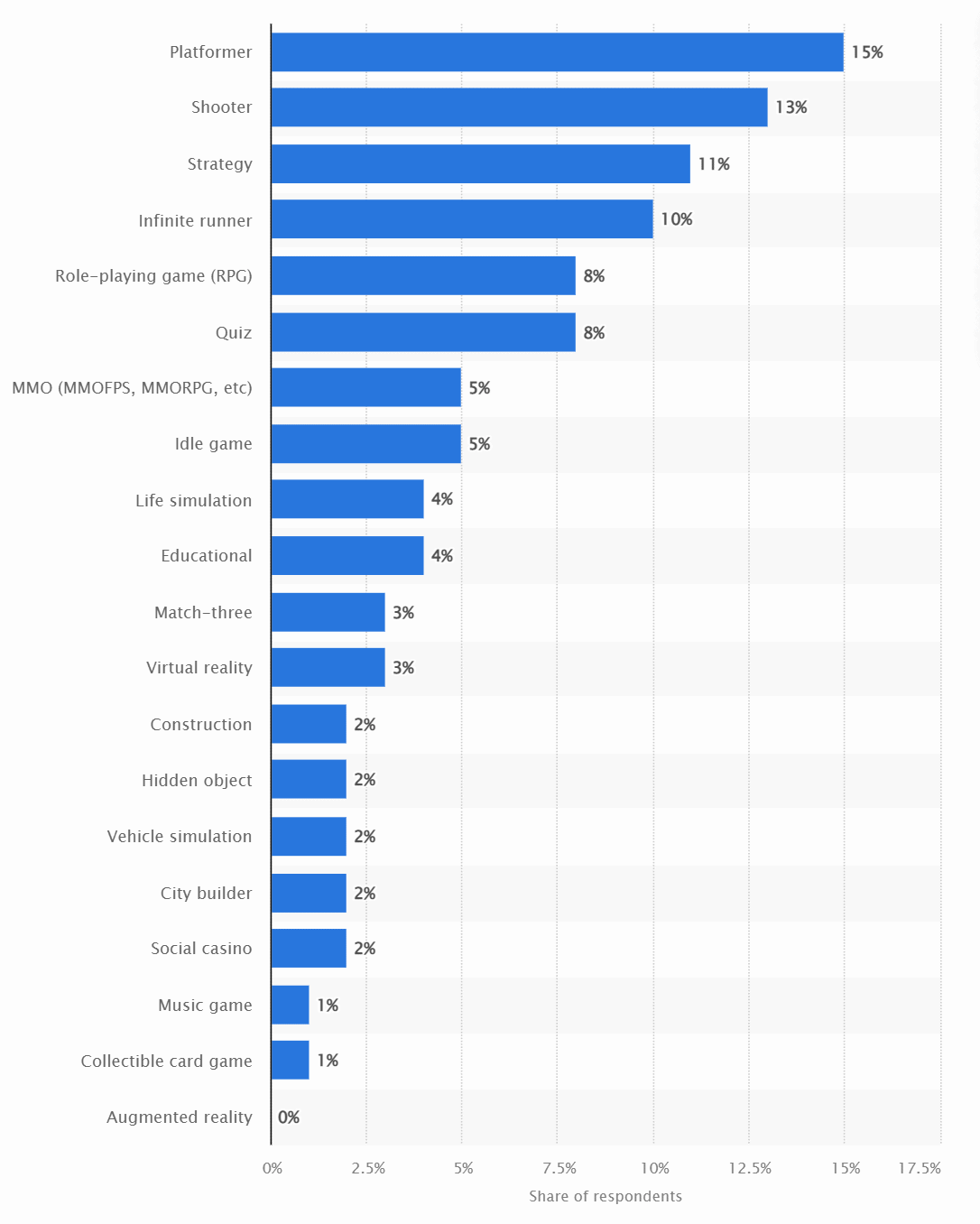

User channeling, almost inevitably, passes through free mobile apps and platforms, meaning free-to-play games (F2P) as a macro-category. Some F2P genres manage to attract more players and, more relevantly, manage to monetize better overall. The below table shows feedback from F2P developers on which game types have generated the most income in their experience (in 2020):

Source: Statista, 2021

We can see that the above categories are quite diverse but also somewhat overlapping, with different features that might place games in one definition or another. Monetization is fundamental, if not defining the game’s nature, to the point that it alone promotes the integration of more flexible approaches, channels (i.e., single-app, platform), and payment options (virtual or fiat currency, crypto, banking systems, etc.). Gaming studios, put simply, aim to cover more feature groups and functions so that they answer the expectations and engagement capacities of wider player bases.

The monetization aspect brings us to considerations on financial technology available for gaming solutions. Already quite well-developed and rapidly expanding their adoption, fintech applications allow flawless and instant micro-transactions, contextual paid in-game upgrades and purchases, and anything else the player might want or decide.

Despite an expanding spectrum of fintech solutions and the overall digitization in Indian society, monetization of its domestic gaming market has not grown sufficiently. The world’s second-biggest online player base reports average revenues per user (ARPU) amongst the lowest globally at USD 12-15 per year for FY 2020. Even developing markets with much fewer gamers – e.g., Indonesia with 100 to 120 million – have annual ARPU closer to USD20. Markets considered mature post much more consistent figures, with China (650 million players) given at around USD 70 in late 2020 and the US (with almost 200 million gamers) at over USD 200.

The fact that the most popular instant payment system in the Union (the locally developed UPI) has raised gaming transaction minimums to Rs50 (~60 euro cents) is not necessarily a good thing. Yet there are a number of in-game methods to bypass such limitations without impeding user experience.

Not only has the average desi player skipped the PC and console age, but they have also skipped traditional banking to a large extent. Younger generations love the fintech solutions, which pose fewer limitations and fees, and above all allow peer transfers. The above-defined digital natives are expected to drive fintech adoption further, across all applications, with gaming integration a prime case use for the majority – from casual to hardcore gamers.

Fintech companies might have helped establish partnerships with a range of new-age companies, but the very business models of many “classic” gaming operators might need to be updated to get in touch with younger generations. Market analyses show that several desi tech startups are operating in the children’s fintech niche. More importantly, the passion for gaming is a true entryway for those willing to tap into the modern understanding of community, friendship, free time, and daily chores.

Employing fintech solutions and integrating them with gaming platforms bears good news for parents and policymakers. They allow setting limits, age, spending controls, and much more in the context of responsible gaming. These are constantly evolving features that need to be taken seriously by all stakeholders with any relation to RMG.

Getting into less “tangible” territory, we also observe the growing importance of blockchain-facilitated gaming. The straightforward way of integrating crypto assets into gaming is to accept existing virtual currencies as payment; most reputable online casinos do accept at least one of the major cryptocurrencies. A growing number of game apps do as well.

The true innovation of exploiting blockchain for gaming revenues has exploded with the adoption of non-fungible tokens (NFT) across the ecosystem. Looking to diversify their revenue streams – and make the best out of blockchain security and privacy – eSports operators and game studios were among the pioneers of pushing NFTs to monetize on (and increase) player engagement.

NFTs are, undoubtedly, a big part of the gaming industry’s plans for the future. We can already see their presence widely advertised as metaverse currency and gaming settings that involve digital identities (avatars) and other virtual features. The widely anticipated alternative gaming economy – with real estate, goods and services, banking, and even police – is already a reality, albeit virtual and within certain game worlds. But it has given rise to businesses that consider their activities in terms of sales “direct to Avatar” (D2A) instead of aimed at physical consumers. We take a more detailed look at metaverse gaming cases further down this report.

More Immersive than Ever Before

Having observed the early onset of AR and VR adoption, analysts agree that the immersive nature of gaming is also a foregone conclusion. However, the nature of player engagement is not always and exclusively dependent on incremental UX features. Currently, global gaming audiences still find casual games (single- or multi-player) most attractive, keeping titles like Clash of Clans and Candy Crush at the top of many related rankings.

Regional differences indicate the preference of certain audiences, especially in the APAC region, to more graphically absorbing games that offer more thrills, like the Battle Royale genre (e.g., Fortnite or PUBG). These are often available without the need for particular hardware add-ons to render the intended experience. The fact remains that more casual titles are the dominant games of choice for people towards their middle age, played between chores. First-person shooters (e.g., Call of Duty), battle royale (e.g., DOTA), and sports-related games (FIFA, eCricket, NBA) are more popular amongst younger players.

Another split of the macro-genres sees a large group go under the definition of Massive Multiplayer Online Games (MOMG or MMO). As discussed above, the large gamer numbers create the feeling of a community, even if it’s based in virtual battle arenas and direct competition. This is namely the game category that is considered hardcore: detailed, multi-faceted, with complex logic, structure, and features.

The global MMO market has been valued at USD 43 billion in 2021, up from USD 25 billion in 2017. These are both F2P and pay-to-play (P2P) games. In-game spending maintains the former as the sub-segment with more revenues, with the APAC region recording a particularly strong MMO presence.

MMOs are predicted to expand within the macro category and become a more dominant gaming segment in India and APAC as much as on a global scale. Technological developments and UX advances will spur their growth in the foreseeable future. The anticipated evolution is based on the improvement of existing concepts and solutions – like cloud gaming, AR/VR, and AI. Widely expected to improve access and gamer satisfaction, gaming consumption in India will be based on the next step to adopt more “secondary” advancements in technology.

At present, they are somewhat secondary merely because the widespread usage of smartphones is backed by the more affordable types, even sub Rs 10,000 pieces. The logic of considering hardware investments a superfluous activity holds back the consumer market development on the demand side. Yet the growing capitalization in the desi gaming ecosystem provides tech studios with sufficient tools to create certain quantities of “pulled” demand by integrating more emerging technology features, preferably keeping affordability as a base requirement.

Last but not least, the full rollout of 5G connectivity is likely to transform the desi gaming landscape definitively. The switch will double current speeds – and allow rural users to move up a level where some still rely on 3G or even 2G.

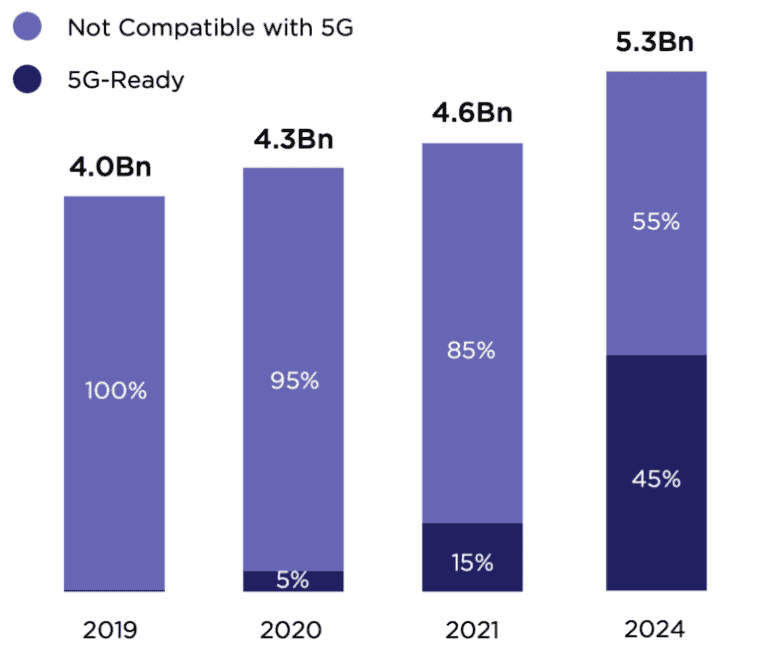

Globally, 5G compatibility is forecast to narrow some of that gap in the next few years:

Global 5G compatibility of mobile phones. Source: NewZoo Global Games Market Report, 2022

As of year-end 2021, only 15.4% of the world’s mobile phones are reported as 5G-ready or compatible. Although such figures are more than double the absolute quantity (+231%) from the year earlier, global averages still lag compared to consumer expectations. By the end of 2024, analysts expect almost half of all mobile devices to be 5G-ready.

Combined with cloud-based platforms and content, such connectivity creates multiple levels of value for the gaming industry. Streaming services, for one, will foster the growth of eSports and other gaming genres even more. Popular streaming channels are discussed as a form of new-age media below, but gamers are undoubtedly among the most evident beneficiaries of such content delivery. Professional gamers and amateurs stream even practice sessions on Twitch or YouTube, while tips and tricks have also grown into a huge market contributing to the millions of active gaming channels.

The AR/VR market is also expected to take off with a higher online resolution possible via 5G. Likewise, more platforms are predicted to offer 8K content. Low latency should almost eliminate lag risks, offering a better quality UX to more gamers.

Moreover, the very nature of cloud gaming will make edge computing standard practice. Console developers have already shifted many subscription services to the cloud. The resulting virtual economy of scale brings down costs for end-users and regular gamers (including upgrades and add-ons).

Hardware advances close the circle of upcoming innovations. Third-party manufacturers fill the void for Original Equipment (OEM) with affordable generic or off-brand accessories, both for mobile and console. Gaming hardware add-ons like console-style controllers and triggers, headphones, and battery packs are widely available online. As of early 2022, there are even VR headsets for as low as EUR 50 on the market.

Gaming Companies Forced to Innovate

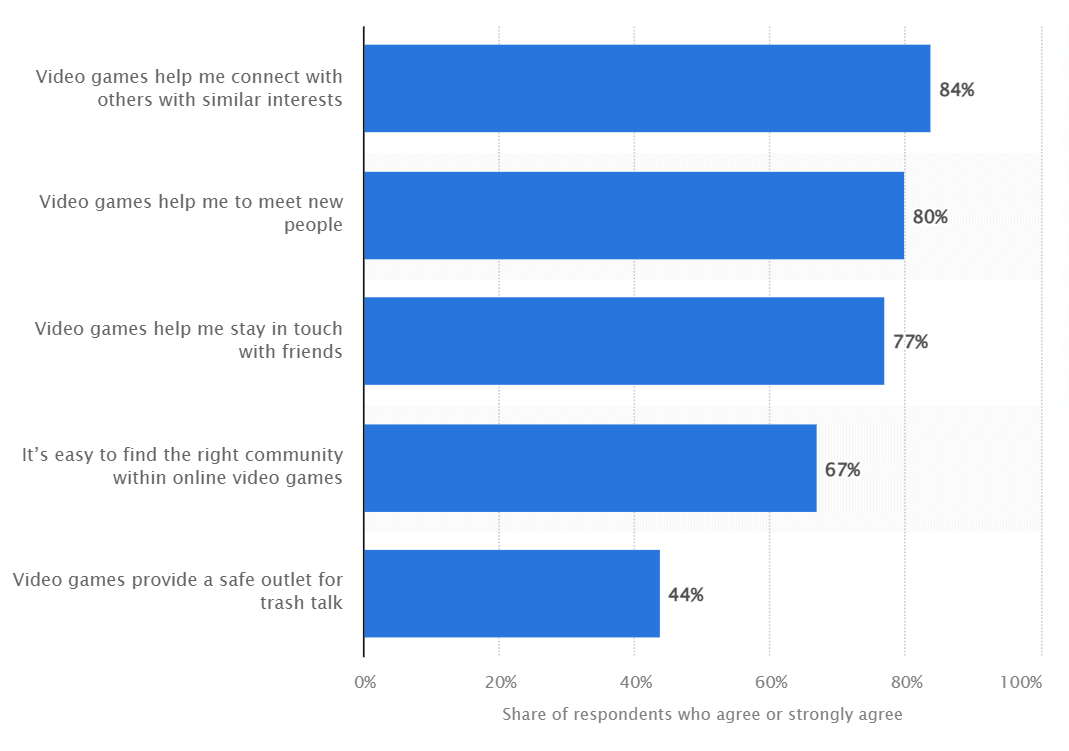

Gaming studios, platform operators, and other stakeholders in the vertical are growing increasingly aware of the importance of social aspects for online gamers. The leading motivations for tapping into gaming worlds are pictured below, as reported in a recent survey of global gamer attitudes.

Source: Statista, 2021

Online gaming companies are implicitly forced into seeking ways to provide more of the above conditions and in-game opportunities within a single product or platform. A game that keeps satisfying more of the above social motivations is likely to receive more favorable gamer reception and ultimately achieve commercial success.

Thinking along such lines, companies have come up with mini-games played within the very mobile apps, even when these are not initially or directly game-related. This is the case of WeChat in China, among the global giants. These easy-play mini-games reproduce “vital” social interactions and have been accepted quite well by WeChat users. In early 2021, the company publicized its plans to upgrade integrated gaming functions with video streaming and PC compatibility while enhancing in-app purchasing options.

Crucially, this approach does not compete with or take away gaming consumption – these cross-over innovations are seen as a way to nurture the gaming market.

Other examples include the Korean NCSOFT releasing an update of its famous MMO RPG (role-playing game) franchise “Blade & Soul 2” by making it playable on PC and mobile – separately and concurrently. The cross-platform multiplayer function made it a huge success. We can also point out Zynga launching a “Harry Potter” game (also in South Korea) with local contexts and extensive exploitation of the film-to-game crossover genre.

Netflix was somewhat overdue in announcing in late 2021 the company’s intent to bring out mobile games based on five of its own OTT shows (e.g., Stranger Things, Shooting Hoops, Card Blast). Initially available for Android and only later for iOS, this was an almost inevitable business move.

The success of the above practices establishes the relative liberty of innovating within the gaming world – provided that the necessary technology is available. A novel concept (or even a seemingly eclectic approach) could involve platform, features, or content and still access a range of separately desirable characteristics and game elements.

The underlying logic of similar game development and market placement explains the success of online casino games based on TV game shows. The game show formula follows and upgrades the live table concept by adding elements from popular culture, quiz features, and other games of chance not typically found in online casinos.

Evolution Gaming was the first company to enrich their product line with game-show elements and stand-alone titles. Their success made competing studios replicate the concept, with Pragmatic Play, NetEnt and Playtech as prime examples. Features like big wheels spun live, treasure hunts, and live peer quiz contests have brought a new wave of excitement for live online casinos. Such titles’ immersive and inclusive nature offers extra excitement and an above-average feeling of social significance (some might define this as the perception of glamor).

Cash and Crash types of games are excellent examples of such live game shows. Offering a binary choice to players (cash out or continue), they often and quickly raise potential winnings during live sessions. Most players enjoy the easy gameplay that leaves the excitement as a leading element, all in settings where contestants feel they are among a few select peers. The live game stage is even more immersive if players have access to high-quality hardware that can properly reproduce AR elements.

The above factors shape forward-thinking company strategies among gaming studios. This is something that Todd Haushalter, the CPO of Evolution Gaming Group, has affirmed in his iGaming talks. As the industry is developing and getting the feel of upcoming trends and in-demand features, there could be no topic, idea, or concept that is off-limits. Gaming companies need to be “idea factories,” naturally using tech innovations as a stepping stone.

Younger generations have already confirmed the hypothesis of having a largely dissimilar understanding of gambling compared to classic online casinos. They dabble in stock-market “bets” (e.g., apps like Robinhood) or mix luck with skills in draft team and fantasy betting (e.g., Draftkings). While these may all be direct competitors to mainstream gambling operators, the new-generation and cross-over betting genres help develop the market, enrich the gaming offer and provide for a fertile online gambling ecosystem.

Media Platforms Evolve with the Gaming Product

We have already mentioned the top trend in media coverage of online gaming. Live streaming (and recordings) of gaming sessions have gotten global recognition as a powerful vehicle for promoting game franchises, platforms, and communities. The fact that people could consume broadcasts of others playing their favorite game might be foreign to previous generations but is the norm for Generation Z.

Twitch has been particularly well advertised and widely accepted as a leading streaming platform for gamers across all devices. The most watched games in March of 2022, ranked by total live viewership hours, reveal that Fantasy, MMO, and RPG titles have a commanding share of the global gaming viewership community. (Just Chatting sits on top but it may be used for anything from games to political campaigns). Slots come in 11th place with 37 million viewer hours per month, while FIFA 22 is 14th (with 25 million hours).

The above numbers reflect global streaming trends, but streamers have largely ignored Twitch and are instead active on YouTube when it comes to India. Some have tens of millions of subscribers on their channels. YouTube executives for the Subcontinent recognize that gaming and shorts stood out in 2021, while female content creators were particularly productive in quantity and quality compared to previous years.

“Shorts” is a relatively new feature for YouTube, but gaming communities have found a true refuge and socialization alternative in some of these channels. Five of the top ten content creators are gamers; four among the fastest-growing (breakout) ones are also gamers – both numbers point to a solid bottom-up structure of gaming demand. Quite significantly, new generation gaming expressions and shared online narratives have given female creators the chance to establish a deserved presence in the gaming vertical. Media executives also agree that the segment is not dependent on one game or a single genre.

The above popularity of game-related media is why multi-feature platforms like the digital giant Facebook (or Meta, rather) have been trying to enter the streaming space in India and on a global scale. Facebook has its largest market in Bharat, with 330 million registered users and nearly 400 million using its WhatsApp subsidiary. Facebook Gaming is already some domestic records, clocking in over 100 million monthly gameplay sessions (e.g., 234 million in July and August of 2021).

The market is highly competitive, particularly dynamic and responsive to new games, releases, and features. The goal of Meta is to offer an integrated concept to gamers – a platform where they can play, stream and interact within the community. Gaming studios are “encouraged” to publish HTML5 versions of their original gaming content so that it can be played by wider audiences. The ambitious approach of Facebook Gaming enables it to grow faster than many dedicated gaming solutions.

However, Twitch still dictates gameplay in the streaming scene worldwide, generating around 25 billion hours of live game viewership, YouTube hovers around 5 billion, and Facebook Gaming manages slightly less at 4.7 billion.

The layered business logic that merges game promotion, media exposure, and distribution paradigms lead us to a natural crossover between online stores and streaming platforms serving new-generation player communities. Steam has been around as a gaming platform since 2004, boasting historically successful titles like Counter-Strike, Grand Theft Auto, and Football Manager among its more than 10 thousand currently available games.

Steam offers a wide range of cloud services – from digital rights management (e.g., for game studios) and primary game distribution to video streaming, server hosting, and social networking features. It has developed user-friendly installation and smooth automatic updates of popular games, enriched by community traits like groups, friend lists, individual cloud storage and, in-game call and chat features. Such functionalities make it immensely popular, reaching peaks of over 28 million concurrent users and over 130 million total registered players in 2021.

However, it is clear that in the coming years, the online gaming industry is likely to experience a higher product and attribute integration between media, distribution platforms, streaming channels, and cross-over content. New-age media is also in demand: with first-person points of view immersive features, based increasingly on technological advancements.

What Will RMG Look Like in the Metaverse

Ever since Facebook was renamed to Meta and announced it would focus on increased virtualization and integration of its products, the Metaverse has been a real buzzword even for uninitiated observers. The truth is, the gaming industry was already among the pioneer fields introducing games within other games, apps, or other digital contexts.

The gaming community has already experienced the early growth of various play-to-earn games based on blockchain technology. They have had a notable rise in popularity in developing nations where the prospect of additional income – and a series of lockdowns – made many seek alternative working environments even in virtual worlds.

A prerequisite to playing such games is the purchase of NFTs from the platform. After that, players can earn based on their available time, abilities, and dedication to the gaming world, contributing to its development and popularity in the process.

Axie Infinity is a leading game (virtual world) offering such features. Its NFT (Axies) is unique and applicable only within the Axie Metaverse, generating business value mainly through player demand and transaction fees. In fact, the purchase of new crypto tokens is the very foundation of the ecosystem, and it invariably requires new player signup and spending.

Decentraland is another virtual world based on browser 3D rendering. It sells the MANA currency, with the tokens valid for purchasing land, goods, and services in turn. This enables avatars to trade and bet on “cosmetic” features, creating a second-hand RMG market. Both Axies and MANA are based on the Ethereum blockchain.

However, gamers have already seen and experienced actual casinos within a game, in the proper sense. Rockstar Games opened the virtual casino within Grand Theft Auto (GTA) in 2019. This gave GTA players the chance to gamble on blackjack, roulette, poker, slots, horse racing, lucky wheels, and much more. Winnings include chips convertible to in-game currency but also cosmetics, cars, and the like. Players could spend their tokens on luxury upgrades related to the perception of real-world casinos such as valet parking or even penthouse suites.

GTA in-game Blackjack screenshot

The next chapter in metaverse gaming is destined to affirm crafting games allowing players to build their own experience. The flexibility of Roblox was met with substantial approval, and the parent Corporation launched an IPO that shot its valuation to USD 40 billion.

Further prominent cross-over between entertainment genres that are already making waves in the tech industry include events held within gaming worlds – e.g., virtual concerts in Fortnite. However, these are only exploiting the popularity of certain games and are steadily moving towards metaverse platforms that had initially fallen behind on the supply side for such hybrid entertainment opportunities.

The above industry trends indicate that a “metaverse centric” gaming future is founded on personal expression forms. Digital identities (avatars) get more opportunities and richer contexts, also included in RMG and gambling genres. Virtual worlds are likely to grow into the dominant form of social hubs for many urban communities driven by tech-savvy young players.

Loot Box Gambling as an Established Form of Betting

The same digitally astute Generation Z users are constantly pushing the limits of existing definitions and authorizations. Real-money gaming bans are in place in a few Indian states, and desi youth has been looking for ways to circumvent such limitations.

For a market with almost half a billion avid online gamers, it is not a surprise to see bans create black markets and unauthorized gaming activity. Media reports estimate that at least 71 million children under 12 habitually log into games using their parents’ mobile devices.

The “skin gambling” phenomenon has first gained mainstream popularity with games like Counter-Strike (CS:GO) and PUBG and concerns primarily the above-defined cosmetic virtual attributes. The add-on game content – termed otherwise loot boxes – can be downloaded or achieved but also bought, won, and bet upon.

On the one hand, these features make the gaming experience more engaging and fulfilling. These accessories may be “cool” new avatars, weapons, bonus tokens, and anything else useful for in-game functions or appearances. On the other hand, loot boxes have given an extra impulse to the popularity of such games, as young adults with disposable funds engage in interactive gambling experiences within the games or in third-party marketplaces.

The handicap of the unknown reward does not deter players from paying real-world money to access the loot box contents. On the contrary, spending a certain sum on an uncertain reward adds to the game’s challenging nature, effectively making it a form of straightforward gambling.

Academic research on the motivations for loot box spending confirms the “structural and physiological” link to gambling. As much as 40 percent of adolescent gamers in the UK have reportedly pursued loot boxes – by opening through in-game merit or purchasing them. Thus is more common in young men, while certain correlations to age and education levels also exist. Quite importantly, an estimated 5 percent of gamers contribute to about half of all in-game loot box revenues.

Skin wagering extends to many virtual gaming communities as well. FIFA players not only pay for game add-ons, but they also bet on the outcome of professional or amateur encounters through the exchange of skins. Skins rose to prominence after 2016 when Valve announced decorative elements and weapons within CS:GO, and gamers grew aware of the possibility of selling them for fiat money.

Interestingly enough, Valve also runs the Steam marketplace (explained above), allowing certain interfacing with third parties. Initially, the company noted that their online arms bazaar would allow players to experience the “thrills of black-market weapons trafficking” without its real-world dangers. With time, this led to an actual gambling market based upon these skins. Gamers can buy, trade, or use skins to place online bets on GS:GO battle outcomes.

In early 2022 Valve was acquitted in a long-standing court battle. Despite being the actual creator of these skins, the company does not own or control skin-gambling sites and in no way encourages such practices. Most players that participate hear about skin gambling from friends, and their participation is actually in violation of their Steam agreement, despite them rarely being caught or blocked for such behavior.

Fortnite, another immensely popular game with over 350 million player accounts, does not allow skin or loot box wagering. Despite that, players find a way to challenge themselves for in-game rewards by bidding for other people’s characters. Fortnite accounts are regularly sold on black markets for hundreds or even thousands of dollars. Media accounts reveal a massive effort involved in hacking and breaching Fortnite accounts to steal and resell them, with annual turnovers as high as USD 1 billion.

Much like with other gambling regulations, many European mature markets have taken measures to establish a national policy for in-game wagering. Belgian and German authorities have restricted loot box access for underage users as part of their gaming licensing system. France, Sweden, and the UK are currently developing legislation changes to categorize skins and loot boxes as games of chance, which they actually are.

As repeatedly noted by industry exponents, India does not have a coordinated national policy on gaming. This makes catching up with the times more difficult, as in-game wagering comes way down the priority list, which should see online RMG take precedence. Some desi games like Ludo King provide “spin-the-wheel” chances and in-app purchases, but most players turn to foreign and offshore titles.

Moving Forward: RMG Perspectives and Expectations

Emerging technology and real-world gaming solutions often outpace formal definitions and the legal framework relevant to the industry. This is almost inevitable as modern trends and resulting demand evolve at blinding speed in the tech sector.

Despite and because of its cultural roots, Indian gaming is an active part of the dynamic economic and societal transformation that mass digitization has brought along. Novel betting forms are most easily noticed in fantasy and eSports, but the convenience of mobile gaming quickly brings gamers to explore and share other in-game opportunities. The willingness to play a part (preferably rewarded) in an exciting parallel world evokes multiple crossover gaming and entertainment solutions.

Desi gamers are becoming a more active audience through immersive scenarios where the Metaverse will become a household staple, particularly through more affordable AR add-ons and successfully merging AI with first-person game-crafting applications. In-game bidding and trading will continue in private channels, and public platforms as account limitations and closures are insufficient as a measure as much as they are impractical.

RMG motivations complement gaming experiences where they are not the only (or dominant) reason for playing. Young desi adults appreciate the thrills and rewards associated with side-bets on seemingly unrelated online gaming genres. In the next few years, such hybrid wagering is expected to involve more mainstream gamers, if not most.

As mobile games become more elaborate in visual and content terms, the importance of a strong national and regional narrative will emerge for hardcore games and involve more casual players. Even now, Indian themes and features find fertile ground among local players, and the trend points to a more rewarding and immersive progression within the numerous cultural contexts of gaming communities across the Union.

The legal climate halts some of the industry’s long-term plans, admittedly. As the boundaries between skill and chance games become increasingly blurred, the hope is that political solutions take account of the market transformation and offer a legitimate alternative to underground and offshore gambling.

The good news is that the Central government tends to support tech development, digital literacy, and new-age social connectivity. Publicly financed initiatives promote startup incubation and support the animation, VFX, gaming, and comics sector (AVGC). Ultimately, this can lead to a bigger pool or more skillful gamers – both as creators and consumers – and more diverse and accessible gaming and entertainment solutions.