The aim of this study is to determine which Indian States and Cities have the biggest online gambling penetration and presence. After matching secondary research statistics to our proprietary primary analytical data, we would like to share some industry insights.

Key report findings:

- By breaking down ENV Media’s own Google Analytics feedback we could highlight trends in territorial online gambling traction and geo audience split;

- Levels of overall development, income and local socio-cultural habits point to 6 major urban agglomerations and their surrounding regions/States which could contribute up to 2/3 of all online casino players of any given i-Gaming platform.

What is the Relation between Microeconomic Factors, Demographic Trends and Online Gaming Propensity

Market size matters and online casinos and i-gaming platforms can hardly prove an exception to this rule of thumb. With its population of almost 1.4 billion, India has grown into one of the most exciting gambling markets for online offshore operators and casino verticals.

India’s practically unlimited potential is supported by its prosperous economy, young population, and gaming habits revealing largely its traditional consumerism.

Yet, to be able to gamble – and even enjoy in-app purchases and freemium upgrades – players need a certain disposable income. For the purpose of our study, we cannot afford to mix up market size, penetration and player value; yet we want to be able to explore how basic socio-economic factors determine which areas and cities, in particular, have taken the lead in adopting a series of online gaming products which were somewhat foreign to Indian culture up until a few years ago.

Hence, to measure online gambling penetration in geographically concentrated areas – or at least identifiable regions – we start by outlining the most important socio-economic characteristics which differentiate the Indian States and Union Territories.

Indian Government publications and foreign consultant surveys corroborate – India is becoming increasingly urban. The urban population was a third of the total already in the mid-2010s. While in 2010 it was about 30.9%, seven years later it had already risen to 33.53% of the total population. There are currently 54 urban agglomerations with over 1 million inhabitants.

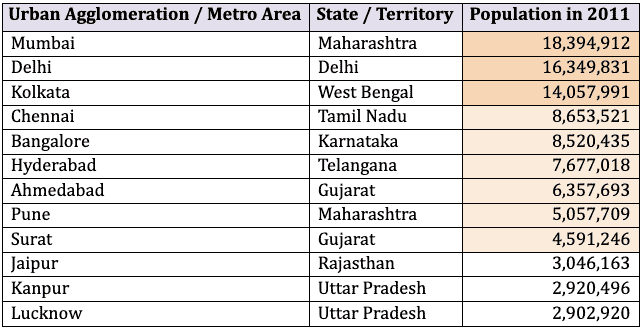

Even though the last comprehensive Census was back in 2011, we can get a pretty good idea of the size and scope of those metropolitan areas:

Considering the fact that over the past decade a number of the above – i.e. Bangalore, Hyderabad, Ahmedabad Pune and Surat – are estimated to have been growing by more than 3% annually, we can only expect these urban centres to exercise more economic and socio-cultural influence, including by setting consumption trends.

In 2016 the World Bank carried out a study of population trends by age group in India, showing that its population below the age of 45 was 1.01 billion, up from 984.73 million in 2011. This translates into an “increase of gaming consumer base” by 2.84%, while the male population had been growing at 1% annually. We cannot stress the above figures enough – more than 75% of India’s population is below 45. Such volumes make India the largest potential online gaming market.

The fact that the desi population becomes increasingly urban only facilitates and speeds up gaming market growth in India.

What Is Considered Middle Class in India

While India’s middle and upper economic classes are defined thresholds in annual income (respectively between and above USD 4,000 and USD 21,000), the concept of a stable Indian middle class is still hard to grasp for some analysts.

First of all, because desi middle class is rather dynamic in size and even shape. With the latter, we mean to address the fact that the standard of living in India varies greatly from state to state. And while as of 2019 India relinquished the title of “nation with the largest population under poverty”, significant inequality and differences in definition and perception do not help frame a stable core of its middle class.

Keeping all of the above in mind, the Indian middle class is reported as reaching 300-350 million of its total population. Within that group alone, we can find many inequalities, with metropolitan cities boasting world-class facilities in every socially significant sector (healthcare, entertainment, sports) and being comparable to many developed nations. Then again, an income of USD 4000 annually maybe qualifies an Indian working person as middle class but USD 10 a day does not allow them to access many of those services, let alone spend regularly on entertainment, leisure and – in our case – gaming products.

At the other end of the spectrum is the 1/4 of India’s population which earns less than USD 1 (PPP) a day. While it is true that in nominal terms that was only USD 0.25 in 2005; and that this share is down from 42.1% in 1981; still we see 41.6% of Indians (~540 million people), to this day, living below the international poverty line. Undoubtedly, the current COVID-19 related economic crisis will have its direct effects both on the size of India’s middle class and its already huge impoverished masses.

Realistically, however, Indians have always gambled and will find ways and resources to play – within their means or not. And that is the cultural side of gaming which we have explored in more detail in a previous research piece. Customs, religious holiday stimuli and local product preferences are dimensions which well-established operators already exploit to their advantage when positioning their offer on the desi online casino market. As a mere reference point to a horizontally related product category, reports show that in 2018 Indian gamers spent the impressive amount of USD 1.73 billion in online sports betting alone.

Put simply, what the above numbers point to is that a large portion of Indian citizens spend more of their annual income on primary necessities (food, shelter, transportation) but those who seek gaming opportunities are driven by a series of factors and not only by the net amount of disposable income left. While the already huge middle class is spending a smaller portion of their net income on such necessities and more on healthcare, education and recreation – including gaming.

Economic Differences by State

Gambling in India is historically an immensely popular activity in both urban and rural settings. For offline and land/sea-based casinos, industry stakeholders know, Goa, Sikkim and Daman are still the only zones where gambling is legally possible. Crucially, Goa accounts for up to 95% of that revenue stream (with the market dominated by Delta Corp and the Pride Group).

As many of us know, even admission regulations in Goa are a complex issue, with certain local provisions placing additional requirements and limits to impede access to locals and youth, aiming to reduce direct negative effects to their population. It has not impeded Goa to have the highest average economic development indicators, as per Indian Government data.

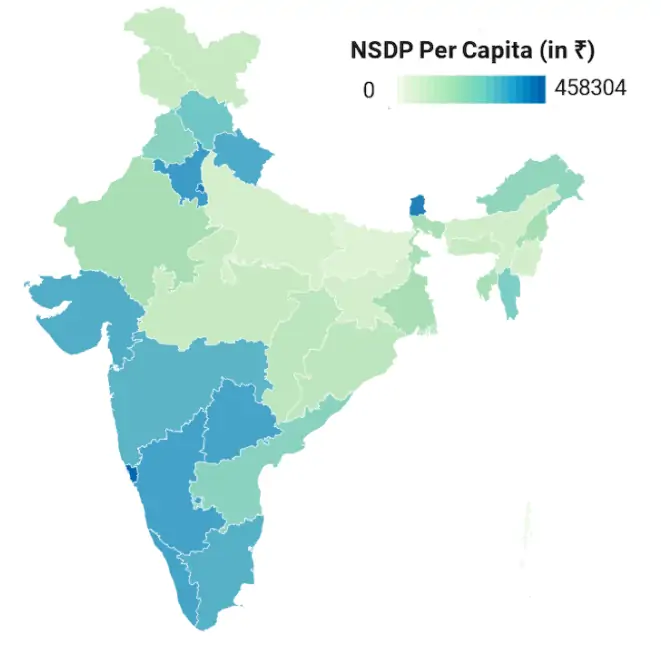

The below table shows the so-called Net State Domestic Product, instrumental in calculating GDP per Capita (in INR):

This spatial distribution shows that the States of Goa, Sikkim, Delhi, Haryana, Karnataka, Telangana, Kerala, Uttarakhand, Gujarat, Tamil Nadu and Maharashtra all have an annual output above INR 200,000 (~EUR 2300) per capita.

Our task is to tie those numbers to the trends which stand out in relation to gambling penetration, operator/affiliate traction and online access to gaming. That is why we provide (below) our proprietary GA data in direct relation to economic development indices.

Another relevant indicator of stable economic development is the poverty scorecard in the SDG Index 2019-20 (i.e. UN’s Sustainable Development Goals Index), as reported by the Government Agency NITI Aayog just before 2019 ended. The latest edition made it clear that India is far from what is considered its First goal, no poverty by 2030. What makes the current outlook worse is that the country’s overall score (50/100) was, in fact, lower than the 54 the year before.

The decline was “across states”, except for two which improved somewhat – Andhra Pradesh and Sikkim. The worst drop in performance was reported in Arunachal Pradesh with 18 points; Bihar and Odisha by 12 pts; Goa and Jharkhand by 9 pts.

More importantly, however, is that there have been relatively stable or neutral levels in Andhra Pradesh, Meghalaya, Sikkim, Himachal Pradesh, Telangana, Maharashtra. We will see how those states rate in internet penetration and actual online gambling presence reported.

The same group, incidentally, performs well in the share of their State population which lives below the poverty line. Goa rates best (with only 5.09%), followed closely by Kerala (7.05%), Himachal Pradesh (8.06%) and Sikkim (8.19%), with the States of Punjab, Andhra Pradesh, Telangana, Jammu and Kashmir also managing to keep above the poverty line more than 90% of their total population.

Technological Aspects that Drive Online Gaming Adoption and Penetration

Conventional knowledge of gambling regulations in India has convinced operators, affiliates and players that only online (offshore) gaming allows you to play legally, unrestrictedly and nation-wide. With some notable State exceptions in terms of potential and currently evolving legislation (see below), there has not been a single Indian-based licensed online casino so far.

Thus, as long as potential players have a stable internet connection (mostly 4G in India’s case), they are able to enjoy casino games, online betting and many pay-per-play types of games. And with computers not always a viable option for most, a smartphone remains the preferred device to access i-gaming platforms and Apps.

This is where the importance of India’s sheer market size of young mobile users (largest globally) comes into play, having surpassed China in that category some years ago.

Internet Penetration

India is reported to have more than 750 million active online users as of the end of 2020. According to the ‘Digital in India’ report by the Internet & Mobile Association of India (carried out in cooperation with NIELSEN), not only mobile usage is increasing but internet penetration as well.

After the National Capital Territory (NCT) of Delhi (sitting on top with 68%), Kerala registered the second-highest internet penetration, 56% statewide. These two lead the other States by quite a margin, even the relatively technologically developed South. Karnataka, one of the major IT hubs in the country, has only 42 % internet penetration.

Combined with their share of Internet penetration, we must consider the total population size of the State or Urban area, as it amplifies the traction that that particular territorial unit provides to IT products or services. Thus, even with good percentage penetration, Bengaluru comes a distant third numerically, with an estimated 6.6 million users, while Kolkata (6.3 million) and Chennai (6 million) complete the top 5 cities in terms of user number.

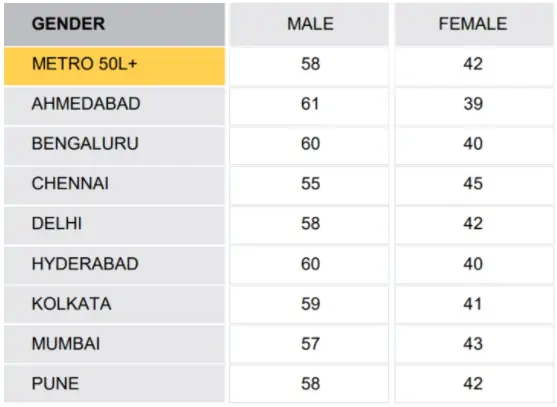

The below charts denote active Internet user gender shares (above 12 years of age), by leading cities:

Significantly, the Eastern States altogether have been reported to grow by 24% in 2019 alone. However, they had a quite low Internet penetration, to begin with, historically and comparatively always lagging behind the rest of India in IT aspects.

Nevertheless, for a nation which had an Internet penetration rate of about 4% back in 2007 to be able to reach 50% as of today, it is a considerable success in its own right.

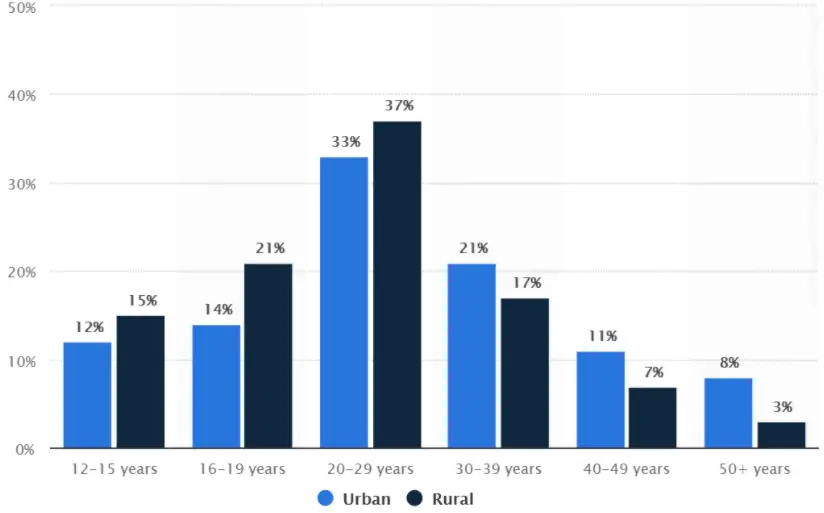

Shares of Internet users, according to Statista.com survey carried out in 2019:

What the last series of numbers show us is that probably for the first time we see that the digital divide which one expects to see between urban and rural realities (on a global scale), in India is no longer an issue. Rural Indian internet users are approximately equal to urban ones. And that is not the end of this trend – even with strong annual growth of ~18% in rural markets, there is still plenty of potential for improvement, given that almost 70% of India’s rural population does not access the Internet.

If anything, there are still far more male internet users in the country compared to female users. This digital gender gap is only more pronounced in rural hinterlands compared to urban metros.

Total internet users – across all platforms and devices, measuring higher than mobile ones and excluding citizens below 12 years of age – add up to 750 million currently (second only to China) and 900 mln. estimated by 2025.

Online Gaming Industry Indicators

India’s online gaming industry is growing at a rate of ~22% currently, as per a recent KPMG report. The majority of India’s “digital population” tends to access the Internet on their smartphones.

Currently, about half of all Indians may be classified as mobile Internet users. This alone is not sufficient to keep driving up the sales of online gambling services and gaming packages. There have been several other drivers of growth which also shape the online gambling market in terms of accessibility.

The key factor amongst them is the proliferation of low cost smartphones, both amongst urban and rural population. By mid 2010s about 75% of the market is reported as being dominated by entry-level or sub-INR 10,000 smartphones. Mobile phones are – and will remain – preferred devices. A mere side note: experienced gamers tend to “shift” to larger screens, if and when they spend more time with the product.

Modern transaction methods such as e-wallets and prepaid vouchers have made depositing and withdrawing safe. This had been a huge hurdle to paid services, not only gambling. But over a period of only a few years, a multitude of solutions have sprung up and funneled payments via offshore and India based platforms. Cheaper data plans have done their part as well, as only recently India has seen more and better offers of consistent data packages.

A diversified monetization structure has helped offer a choice to different types of users and ease the transition to paid content. Since many Indians do not assign sufficient intrinsic value to paid gaming content, online games have been adopted in stages – free, multiplayer, casual, social; with in-game purchases; additional premium content, etc.

The last barrier has been empirically identified as the low localized content – linguistically, related to traditional desi games and other consumer expectations. But India has turned into both a provider and consumer of all stages of a gaming experience, with the investor-developer-promoter-consumer chain being closed and more and more localized content being created for national consumption.

Thus, current online mobile game user penetration has been reported at 12.6% (out of the total population), and is expected to hit 16.1% by 2025. One can already regularly see young urban middle classes enjoying their pre-installed mobile casino apps, playing even while commuting to work or at lunch.

An Integrated Development Picture

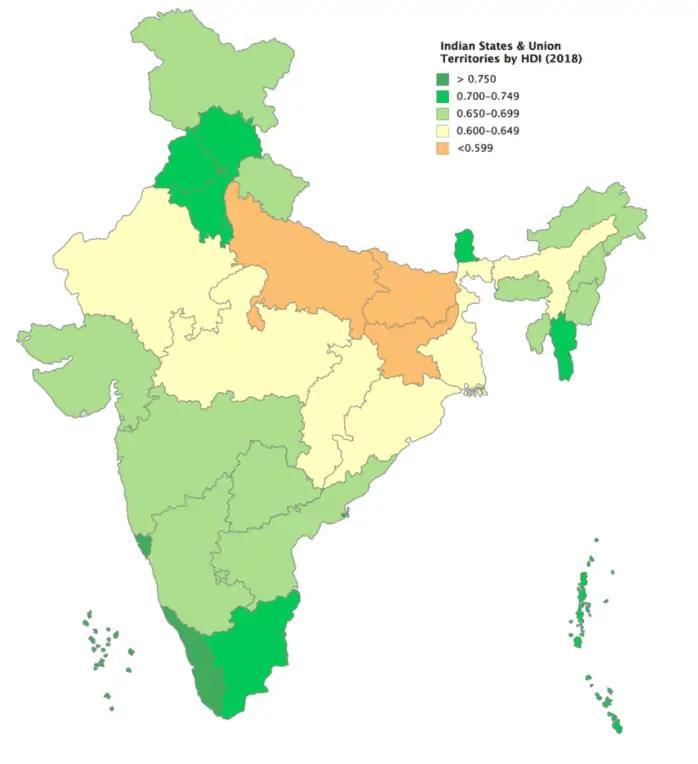

One fairly structured indicator which factors in integrated social and economic development is the Human Development Index (HDI). It is a “statistic composite” index of life expectancy, education (including literacy rates, school enrollment and attendance ratios), and per capita income levels. HDI is used to rank countries into four tiers of human development.

In other words, this composite index provides a simplified yet cross-sectional and integrated picture of a number of circumstances directly proportional to creating the conditions in which a society would be able to spend on secondary necessities such as leisure and entertainment.

As of 2018, the average HDI for all Indian States and Union Territories stood at 0.647.

Kerala leads with 0.779, followed closely by Goa (0.761) and Delhi (0.746). In the top third we can also see Himachal Pradesh, Punjab, Sikkim, Naryana, Tamil Nadu, Mizoram and Maharashtra – those are also above the “global medium Human Development Index” of 0.7. We would also highlight – standing above average Indian HDI – Karnataka, Gujarat, Telangana, Andhra Pradesh and West Bengal, the latter just around the desi average of 0.641.

N.B. The above shortlist excludes small island territories (e.g. Andaman and Nicobar Islands) and territorially dispersed units (e.g. Puducherry) which do not have a significant influence on entertainment consumption and are thus practically irrelevant to our study.

When industry experts speak of a significant positive relationship between geographical accessibility, gambling advertising and gambling behavior, one thing is easily apparent – we cannot intend physical or any other kind of organizational or spatial accessibility. Development levels include namely the means and conditions that enable types of consumption which are directly relevant to our product segment.

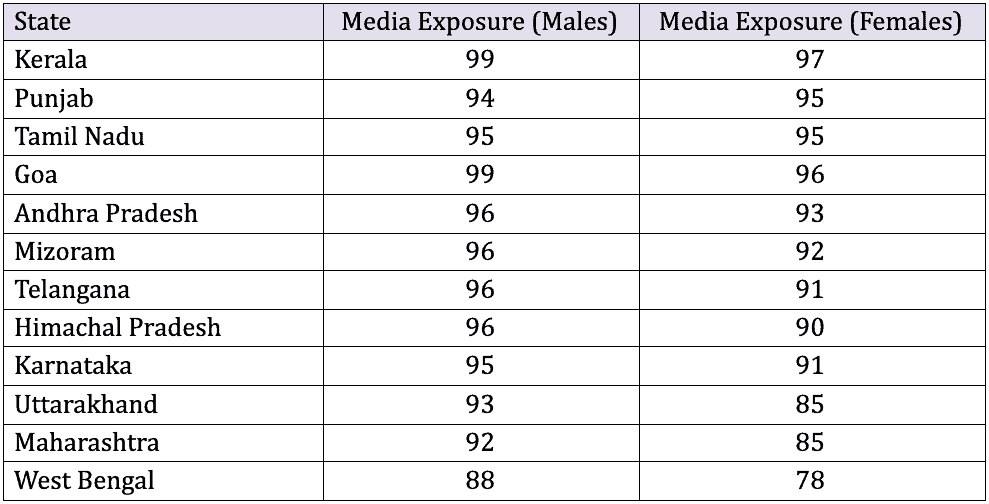

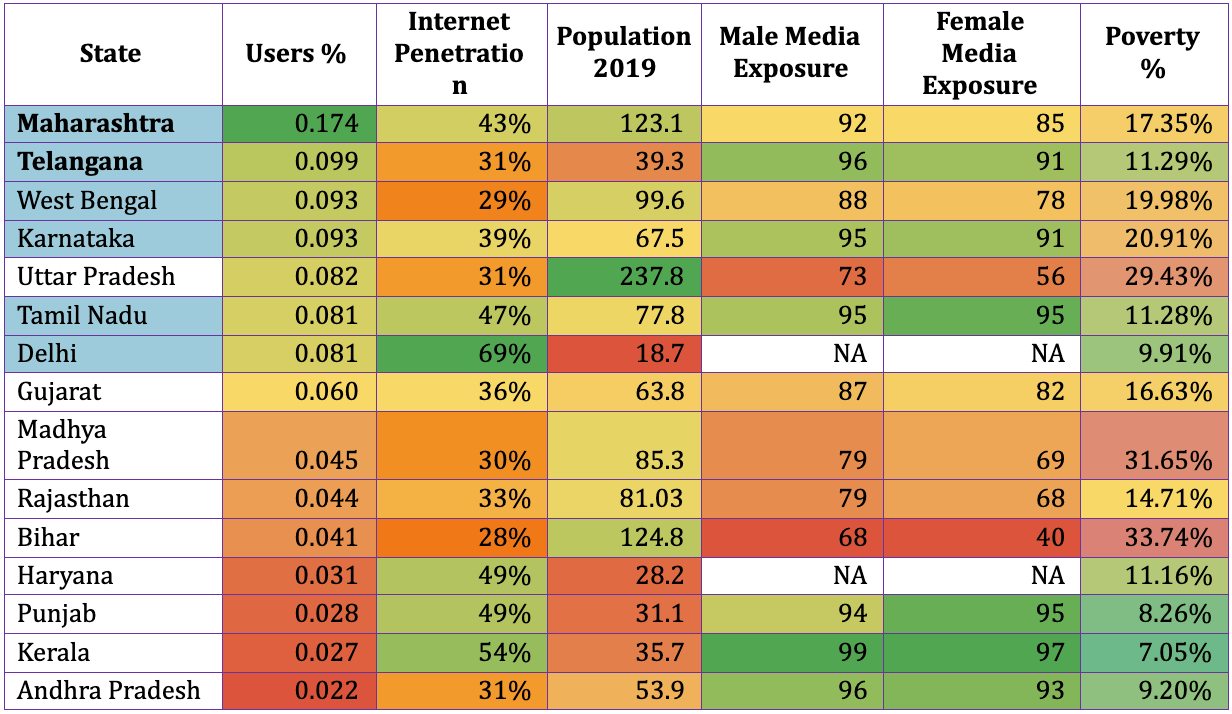

Last but not least, our analysis explores any correlation between regional exposure to major media outlets and the propensity to gamble online. Once again, we will match these numbers to direct comparative responses in terms of online affiliate access and acquisition levels.

As per Ministry of Health and Family Welfare (MoHFW) data, the following States occupy the top spots in media exposure nationally:

The spread of COVID19 has brought the demand for online gambling to peak levels. That was merely the trigger that pushed it to where it is now, with the above major factors paving the way – increased digitization coupled with secure digital payment options, more than anything.

This type of consumption goes hand-in-hand with social media usage, especially for a young and dynamic consumer base such as the Indian one. Social Media Marketing currently drives customer engagement with 36%, while its future outlook hovers around 55%. With social media channels continuing to evolve, gaming operators and affiliates need to be able to exploit its massive powers to efficiently channel marketing campaigns.

The below is a graphical representation of the main drivers to online gaming growth in India, summarizing the above findings.

Source: KPMG Report “Online gaming in India: Reaching a new pinnacle”, 2017

Ultimately, one of these factors alone is not able to radically alter Indian customs or consumption paradigms; nor can it change the most loyal players or inherent gambling traditions and convictions in India. Together, they add up to those and help shape contemporary consumption means.

Those have also a direct influence on online casino market expectations on behalf of consumers, those young, tech-savvy Indian players who lead the way by defining the consumer profile. They are the ones driving consumption volumes. Said volumes, in turn, effectively determine the market offer, with even image-centered offshore (i.e. EU) companies starting to notice the need for more localization and content specialization.

How India’s Fragmented Legal Framework Leads to a Common Understanding on Online Gambling

India’s disjointed (federal) legal stance on gambling and online gaming is hardly a secret to anyone with some interest in the sector. The issue is mostly addressed on a regional level, by every State. And it’s fully regulated and permitted in only two of the above states (Goa, Sikkim) and the Union Territory of Dadra and Nagar Haveli and Daman and Diu (DNHDD).

But with a number of additional limits on casino venues (on floating vessels and 5-star hotels), no wonder Indian players have discovered the liberty of playing online and offshore, where no specific regulation was foreseen to restrain consumers. Most states do not outlaw the practice explicitly or leave loopholes which are ably exploited by online casino gaming platforms and offshore operators.

Are There Changes on the Horizon?

For better or worse, there have been some recent developments which are worth mentioning. The Council of Ministers in Andhra Pradesh recently stated that a ban on online gaming is forthcoming. The decision seems to concern Indian residents hosting locally and organizing online gaming and betting within State limits, with the threat of 1-2 years of imprisonment and huge fines becoming a reality. Players do not seem to be targeted particularly, as they are more difficult to trace, while envisioned penalties would be much less severe.

The move comes in the wake of the Central Government’s clash with China in the Security and IT sector, leading to more than 200 Chinese mobile Games and Apps being banned, including the top performer PUBG (PlayerUnknown’s Battlegrounds) and TikTok. This was both treated as a security issue and an opportunity for the Indian IT sector and game developers. But for all intents and purposes, if and when this treatment of online gaming extends to Andhra Pradesh casino game operators, it may hurt somewhat the image of the sector and the penetration of online gaming in the State.

Then there’s the positive trend in reviewing and updating some obsolete legislation which is completely out of touch with the current digital gaming paradigm. The State of Maharashtra leads the way with preliminary announcements and plans to possibly legalize and regulate online betting. While this may be treated as pure formality, as “following in the footprints” of Sikkim, State revenues that might compensate for some COVID-related financial woes are not to be overlooked as a pragmatic reason.

Precisely the same argument has been used in Andhra Pradesh in calls to limit the socio-economic burden of offshore gambling on the population. At the same time, not only Maharashtra but also Karnataka have been viewing it as an opportunity to break the chains of stagnation and illegality in the gaming sector. The surge in online gambling activity (during COVID-19 lockdown but also continuing after) was quoted as the main justification for granting an “in-principle approval” to the Bangalore Turf Club to start organizing online betting as a “means of salvaging its season”.

Initially, changes are supposed to concern multiplayer casino games played over the internet – e.g. Rummy and Poker, among the favorites. But further content customization is inevitable in order to make up for any perception of limitations to availability, just as it is a cornerstone of providing desi players with quality market offers via casino apps and online gambling platforms.

These brief notes on legal provisions lead us to reiterate that regulations do not play a significant role in limiting the willingness and ability of Indian players to access online casino games. If anything, the legal framework might change in favor of most foreign operators. The only requisite for formal legality at this point for players is to pay their taxes on winnings, whether at the source of declaring them later personally.

For a full legal picture on gambling taxation laws and regulations, you can read ENV Media’s article review.

Insights from Our Geo Audience Data and Google Analytics Feedback

Time to unveil some proprietary ENV data. It shows which States and Union territories have gained the most traction in online gambling player visits and acquisitions.

The reference period is from 1 April (in full lockdown) until 15 September, more or less the end Summer 2020. Google Analytics data comes from ENV Media’s own property (www.sevenjackpots.com), one of the most reliable sources for online gambling which channels and measures traffic for the leading EU and offshore operators.

We juxtapose and compare some of the above publicly available statistics to our user flows and geographical distribution and, accordingly, analyze preliminary expectations and conclusions as to the position of States in online gambling traction and penetration.

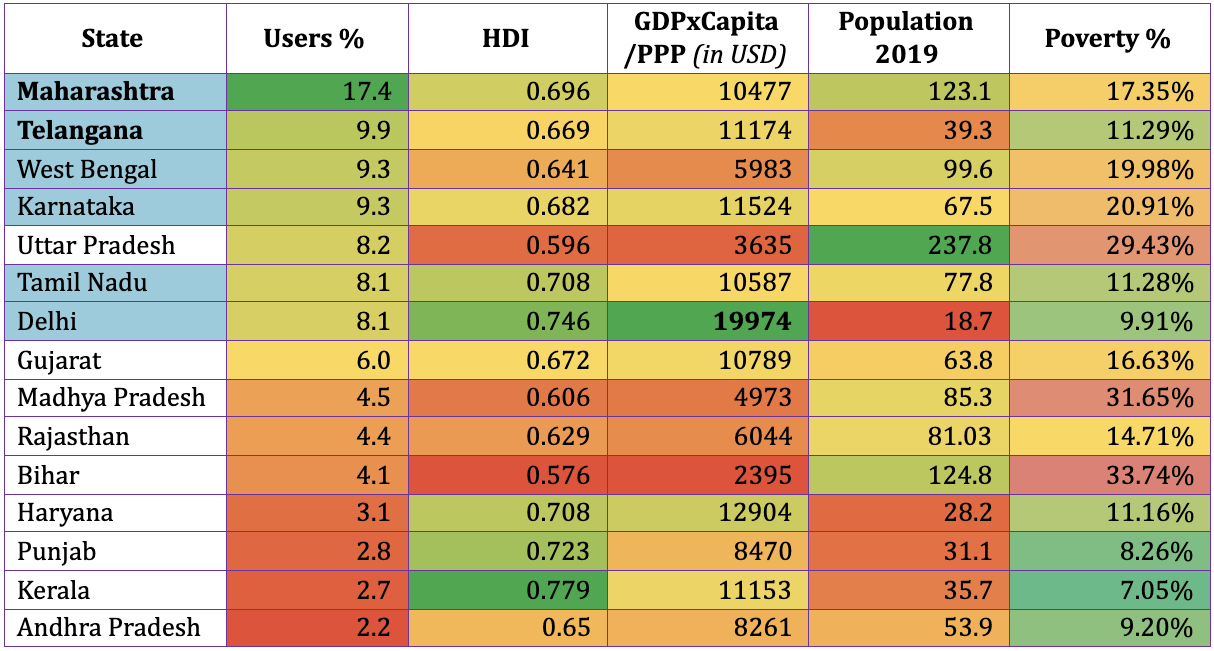

We immediately see that the State of Maharashtra leads by a lot in traffic generation, with Telangana, West Bengal and Karnataka also performing quite well with around 10% of the share. The latter two States have a somewhat heavier social burden of people living around and below the poverty line, while still not as high as the average in India.

Telangana is low on poverty, high on income per capita and rates quite well for the less than 40 million inhabitants it has. Maharashtra has all of the above plus a huge population (close third) and a relatively high HDI. All these factors are sufficient for resident players to contribute to more than 1/6 of all user visits, with some of it inevitably attributable culturally to the way inhabitants of Mumbai and Pune see online gambling in relation to their own free time and disposable income.

In the above table Goa and Sikkim are notably missing in terms of relevant acquisition numbers and visitors in general. The reasons are also easily explained: beside the actual presence of offline options in those territories, there is the mere fact that they are too small to have a significant numerical influence on online gambling presence and penetration. In fact, Goa and Sikkim come 1st and 3rd, respectively, in the GDP x Capita list but have about a million people each.

Haryana and Kerala are also well ahead in the GDP x Capita and HDI indicators, as well as with low poverty, high internet penetration and media exposure (Haryana data is incomplete on the last topic). But they do not figure among the leading States in volume, accounting together for less than half the population of the State of Bihar, to give an example.

Other than that, we see the same States and Agglomerations performing well in the previous chart, as well as the latter.

Uttar Pradesh deserves a note aside: it has the largest population among all Indian States, 12 times the population of the National Capital Territory of Delhi. And yet, it has the same total number of active users recorded over the summer of 2020. So it is not that it does not count in terms of user volume, 8% is quite substantial for any single State. It is just impossible to target a precise urban location, with Uttar Pradesh having at least 10 cities above a million residents (but all of those below 3 mln).

We have already seen some geographical divisions within the Indian subcontinent which designate different development patterns between North, South, West and East India. Those appear to be more or less directly proportional to online gambling market segments. North India is currently estimated to occupy the lion’s share in the online gambling market by 2027 based on the rapid and continuous rise in smartphone usage and better high-speed internet infrastructure. The Southern part of the country will also account for a conspicuous share of the market due to its catching up in internet usage and services and constant economic growth which leads to more spending on entertainment and leisure.

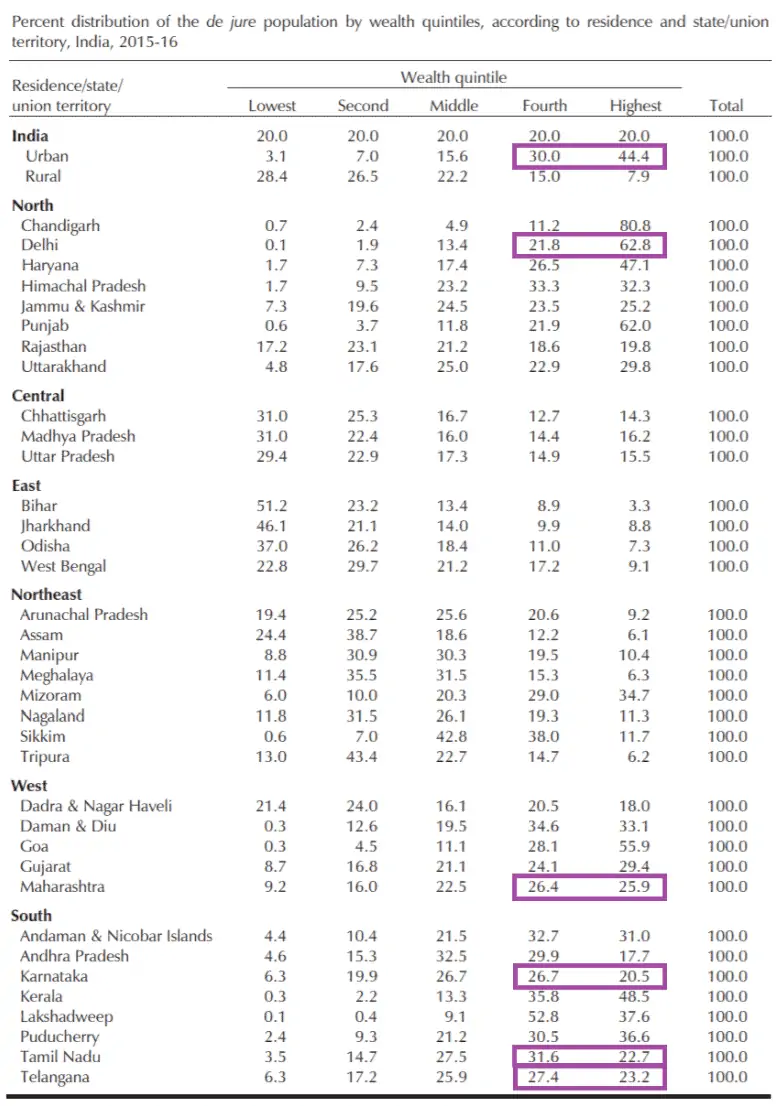

Another look at territorial income distribution in India is provided for us by the “wealth quintiles” by State. Let us match those to some of our findings in the affiliate traffic and gambling penetration data so far.

Source: Indian Ministry of Health and Family Welfare (MoHFW), 2016

We can clearly see that urban territories assign the top two income quintiles to 3/4 of their population. While most of the States performing well in our traffic and acquisition analysis (Maharashtra, Karnataka, Tamil Nadu, Telangana) rate quite well – at least 50% going to the top 2 quintiles. Delhi even places 84.6% of its residents among upper or upper-middle class citizens.

India’s Sports Betting as a Cornerstone Sub-Segment

ENV Media proprietary Google Analytics data allows us to also take a closer look at sports betting as a phenomenon and a specific segment of online gambling in India. By using the same format – including an identical time span as the above online casino overview – we present user segmentation from the sports betting affiliate property www.betrallyindia.com.

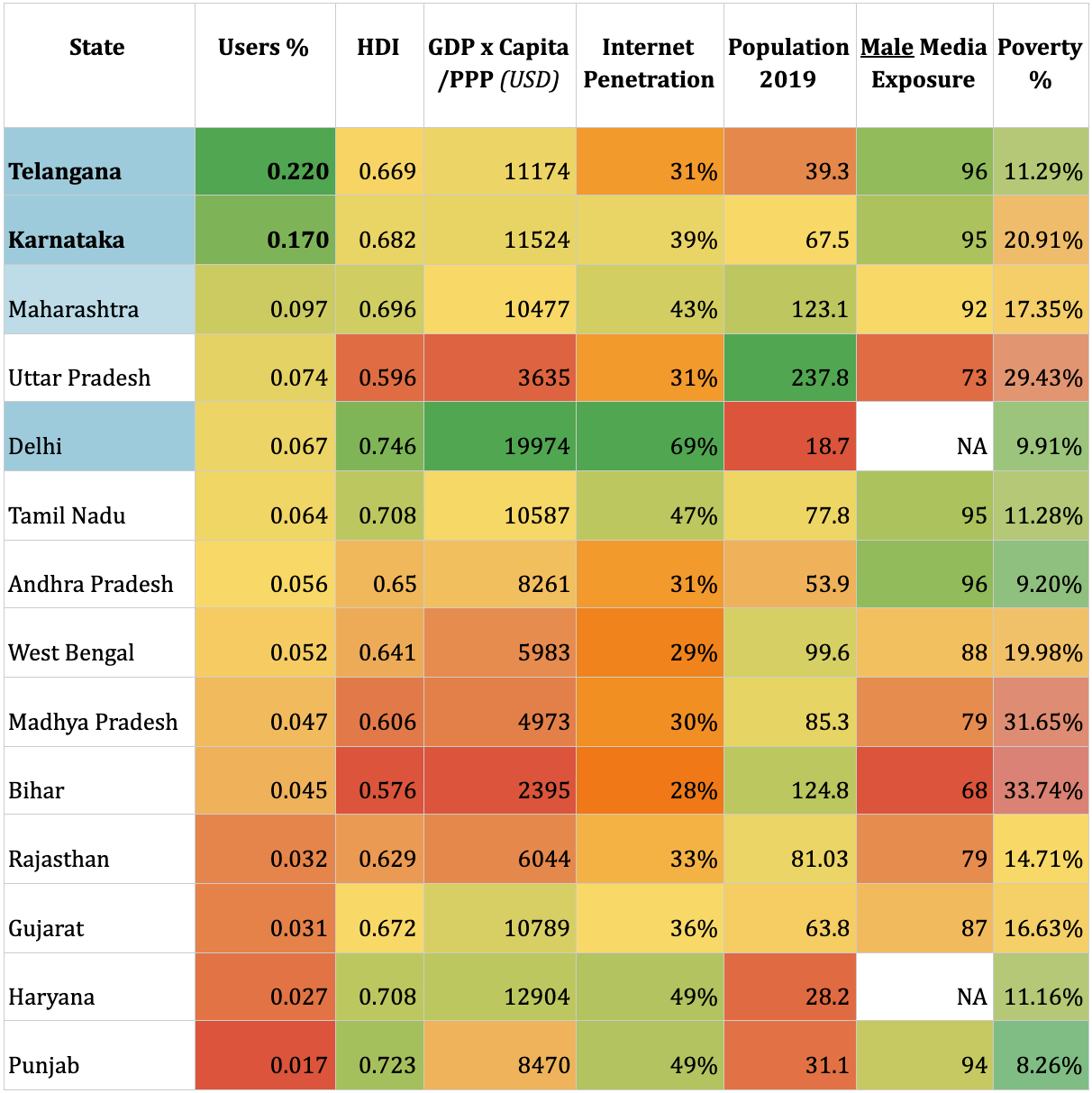

A first look at the above results does not show a substantial difference in the national landscape. The notable exception is represented by the shift in importance of Telangana and Karnataka. The former, especially, represents almost a quarter of all sports betting clients, having a comparably inferior population to Maharashtra, Uttar Pradesh and many others down the list.

The similarities between Telangana and Karnataka user bases are, on the other hand, easy to spot. They are close 6th and 7th in terms of GDP per capita (State-level) and maintain their population predominantly above the poverty line, just as they stand above the average Indian HDI.

But a stable economic development is not a sufficient answer for the geographically referenced user data difference between casino and sports betting. First and foremost, there are some recent legislative developments. The Telangana Gaming Amendment Act of 2017 included games of skill to the banned activities listed in the original 1974 gambling Law. Notably, online gaming, gambling and betting was outlawed explicitly. Andhra Pradesh followed suit in 2020. Thus, many popular games could not be offered anymore within state limits, prompting fans and players to seek alternatives.

Additionally, the two States share another common trait – they host some of India’s most important tech and digital hubs. Hyderabad in Telangana and Bengaluru (Bangalore) in Karnataka are home to young professionals who appreciate innovation, cutting-edge digital products and global services (both in their line of work and personal consumption trends). An instant reference is provided by the gradual cryptocurrency offer as an online gaming payment alternative.

Regulatory limitations are insufficient to explain why Telangana and Karnataka outperform other States by a landslide. Customs, consumption predispositions and product preferences are all dimensions which add up towards a particular client pool related to sports betting.

The immensely popular fantasy sports platforms are one exemplary illustration. They face mounting challenges by Google India’s Playstore – even including a temporary block on gaming app Paytm First Games. As Google’s own competitive payment service promotes its cricket cashback offers, it takes down apps which provide or facilitate sports betting and daily fantasy sports. Yet, leading franchises such as Dream11 and MPL continue to thrive in these two particular urban agglomerations.

Moreover, while Maharashtra has been dominated by cricket in sports, that is not so much the case for Telangana and Andhra Pradesh (the two Telugu speaking States). They have had some prominent badminton talent, playing a leading role in the Premier Badminton League franchise. Furthermore, the contact sport of Kabaddi is the official state game for Telangana and Karnataka, as well as for Maharashtra and Uttar Pradesh.

Hyderabad has a decent football team competing in the Indian Super League, and the local franchise has strategic partnerships with European clubs aimed at promoting grassroots football development in India. Of course, they also have a well-performing team in the top-level IPL Cricket league of India, having recently won the League and employing leading foreign cricket players.

The sheer diversification of sports interests, contents, platforms and channels results in a sports betting demand in Telangana and Karnataka which far exceeds average Indian levels. As a result, clients seek to bet on Asian, Australian and European leagues and tournaments – cricket, football, kabaddi, tennis, horse racing and the like. Not having a single Indian-based licensed casino so far contributes significantly to both user search volumes and actual conversion rates.

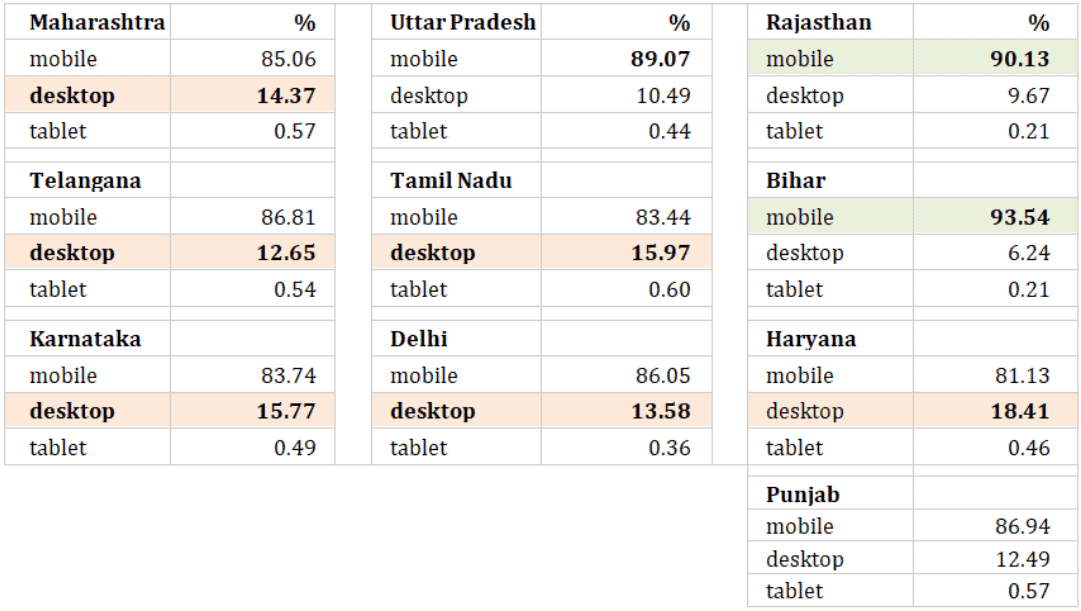

Mobile vs. Desktop Sports Betting Data by State

According to the Telecom Regulatory Authority of India, as of mid-2020 almost 97% of all internet subscribers are using mobile devices to access online services. Wired internet subscribers are only 3.08% of the total and frequently account for some of the declining narrowband connections still in use.

And yet, primary data from our affiliate property reveals that even the leading states by volume and conversion performance indicate a much higher desktop use and access to online gambling. This fact only corroborates the scenario which sees office professionals indulging in online gambling from their daily workstations.

Rural Rajasthan and Bihar users report back mobile usage rates above 90%, while the high desktop access statistics for Haryana are attributed to its largest city (Faridabad) being an integral part of the Delhi Capital Region.

So Which Are the Cities that Rate Well in Online Gambling?

According to India’s Economic Times, a survey conducted back in 2013 showed that some 30% of all passengers flying into Goa were gamblers. Whether this trend holds true to this day is another story but it speaks of Goa’s image as a physical gambling destination which does not need online operators to prosper. Those ready to spend their money in floating and land casinos are not on the internet gambling map, apart from the fact that the entire State has less than 2 million residents.

On the other hand for many other relatively well-developed Indian States – an indicative example being Maharashtra – still have to face strict and archaic laws related to gambling. This leaves them little option but to turn to online gaming for a safe and secure gambling experience. Again, this is significantly true even without the growing popularity of online mobile gaming platforms and gambling apps. We find further proof of this in the fact that despite some legal obstacles, Mumbai is quoted as having a “thriving gambling culture” and being a “major contributor to the ₹11 lakh crore industry” (N.B. ~ EUR 124 billion, although such recent estimates have not yet found regular confirmation).

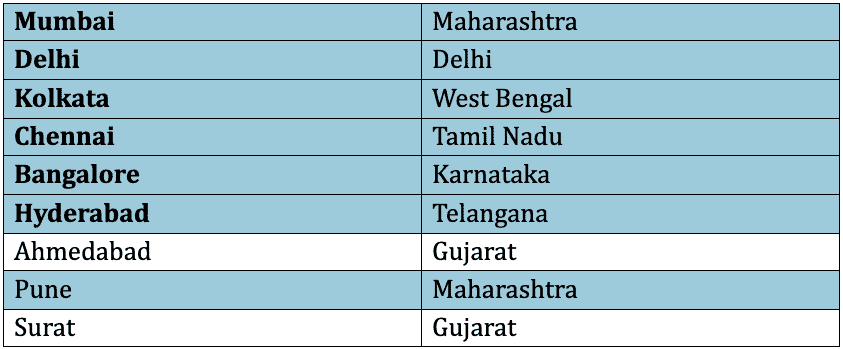

The table below lists the largest urban agglomerations (in order of their size):

Integrating all of the above data and industry reports has allowed us to safely claim that the larger and more developed an Indian metropolis is, the more visible and influential it is in the online gambling scene.

While we saw that Ahmedabad and Surat obviously help Gujarat gain some industry exposure (for a total 6% in our case), the top 6 cities are the ones who ensure the most traction for online gambling and represent almost two thirds (62.1%) of all active online casino customers evaluated through our proprietary resources.

With annual online gambling market growth predicted at over 16% (globally) and at around 22% in India alone – through 2026 by Global Market Insights – we expect these urban centers of socio-economic gravity to become even more influential in creating online gaming demand.

Beyond the Pure Economics of Online Gambling

Money is sure to always matter, especially in sectors which are centered around financial transactions, even if gaming companies are meticulous in creating fantastic added entertainment value.

Yet, even in (online) gambling it is not everything. There is the choice to gamble, where and how. There are the opinions, attitudes, behaviors and habits of players, interests and lifestyles of Indian consumers and whole communities; the so-called digital villages centered around a particular service, a favourite game.

A perfect example of gambling habits which are mostly exclusionary to online platforms are those of Indian high rollers. Quite simply, they prefer to play abroad – in Macau, Singapore, recently in Malaysia; even a trip to Europe or Las Vegas is not out of the question. But they would not create volumes, even with extremely high potential LTV.

Then there are the Sri Lanka casinos which specifically target Southern Indian metropolitan areas –Chennai, Bengaluru, Cochin, Madurai. Being closer than Goa, they attract offline activity and many organized trips.

Finally, there is the habit of placing casino bets in unlicensed casino houses. Indians don’t mind doing it and will continue to adhere to such practices. And although the numbers above confirm the equal amounts of mobile and internet users between rural and urban areas, they suggest that more densely populated and more developed areas turn to online gaming more consistently than rural regions. That is easily and pragmatically justified, without needing to overanalyze it.

For many urban young middle class Indians – but not limited to them by any means! – socializing via online gaming is becoming a “new normal”. Until recently an innovative trait of online gaming, this has become as important in urban settings as the game itself. Whether in enforced isolation or merely away from friends and family, players respond positively to the opportunity to indulge in competition even with complete strangers.

A Nielsen primary survey among urban online gamers revealed that friends are a key trigger for initiating online gaming. On the other hand, “stress relief” and “social interaction” are quoted as key reasons for continuing to play.

During festivities such as Diwali and Holi gambling increases up to 40-50%, and avoiding having to place bets in improvised illegal casinos is reassuring and consistently possible through a mobile phone. Thus, even lower income players among the larger tech-savvy masses can join in on the gaming experience. It is true that lower income players favor mostly social gaming which offers limited gambling options: average revenue per user (ARPU) is reported at €2.37. However, those are trends which draw legitimate traffic and trends matter more than anything among young consumers.

Last but not least is the question of localized content which does not fundamentally determine urban player demands but responds perfectly to their clearly demonstrated needs.

What is considered a “first wave” of real-money online gaming in India was established by Rummy and Poker (notably Adda52), two local favorites. The “second wave” was represented by Fantasy games and e-Sports, e.g. Mobile Premier League, Dream 11. To this day, Teen Patti, Andar Bahar, Rummy (Paplu) and some Poker versions maintain their high ratings and attract the most audiences to the platforms and apps which host them.

Localized content also provides an ideal link to Social Gaming. Teen Patti is considered by many a social game, its absolute top App rankings confirm such standing. This is true because it is frequently based on freemium models, but also because such “small gambling” is socially accepted, traditionally beloved and even considered family friendly. The same is valid for Rummy with some due considerations.

Localized content is perfectly complemented by apposite language versions of the platforms and games, where possible – Hindi, Bengali, Marathi, Telugu, Tamil, Gujarati or Urdu, to name a few.

For an in-depth analysis of local product preferences, you can read our analysis on the ENV Media site.

What Are the Conclusions about the Indian Online Gambling Market and Its Geo Distribution

- The natural growth of India’s online gambling market is attributed mostly to better internet penetration and rise in mobile device usage. Cheaper data packages and convenient cashless payment modes keep driving up the market size.

- Foreign online gambling sites can easily offer gambling to desi players. Contrasting signals from political and legislative bodies do not currently have an effect on any State adoption and usage patterns.

- The COVID-19 pandemic has grounded practically every offline sector, and online gambling and i-gaming helped gamers create communities and socialize.

- India’s gambling population is rather diverse in economic and demographic terms, with complex behaviors, habits and consumption patterns.

- Mumbai, Delhi, Kolkata, Chennai, Bangalore and Hyderabad lead the way. To a relative extent, Pune, Ahmedabad and Surat also contribute to a better online gambling penetration in India.

With Maharashtra (Mumbai and Pune) and Karnataka (Bangalore) being the most vocal in their attempts to legalize online gambling in some form, it is not a surprise that this is not only a political stance but a reflection of a bottom-up culture of gaming habits (mostly urban at this point).

Its users would like to see things easier, more legal and technologically friendly. And their local governments would love to be able to draw in substantial online gambling taxation revenues.

Bibliography

- The impact of gambling on rural communities worldwide: A narrative literature review – Rural Mental Health, April 2015; DOI: 10.1037/RMH0000030

- Gambling emerging as a major passion in India; biz of casinos alone accounts for Rs 500 cr – The Economic Times, 12 October, 2013

- State/UT wise Aadhaar Saturation – Unique Identification Authority of India, 31 May, 2020

- Gaming in India: An Evaluation of the Market’s Potential, a White Paper – Global Market Advisors, 2016

- Andhra Pradesh bans online gaming, betting platforms – The Hindu, September 4, 2020

- Is India’s middle class actually poor? – BBC.com, 15 November 2017

- The prevalence, patterns, and correlates of gambling behaviours in men: An exploratory study from Goa, India – Urvita Bhatia et al, Asian Journal of Psychiatry, June 2019, vol. 43; DOI: 10.1016/J.AJP.2019.03.021

- Skill Gaming in India. The changing landscape – A Deloitte joint report with the Rummy Federation of India, July 2018

- Online gaming industry in India is expected to grow at a CAGR of 47% by FY22 – The Financial Express, May 26, 2020.

- SDG India Index & Dashboard 2019-2020 – NITI Aayog

- National Family Health Survey (NFHS-4) – Indian Ministry of Health and Family Welfare, 2016

- Digital in India – a report by the Internet & Mobile Association of India (IAMAI) and NIELSEN, 2019

- Maharashtra looks at proposal to legalise online betting, mop up Rs 2,500 crore –

The Times of India, September 19, 2020

- Online gaming in India: Reaching a new pinnacle – A study by KPMG in India and Google, May 2017

- Proprietary site analytics data and traffic reports – www.sevenjackpots.com, ENV.Media