This post is also available in:

Executive Summary

This ENV Media White Paper provides an essential analysis of the iGaming industry across key Latin American markets. It highlights the substantial growth and evolving sector dynamics from 2024 onwards.

The comprehensive review highlights the impact of regulatory changes and the increasing role of international investment in shaping the markets’ future. As gambling jurisdictions become more structured and mature, and technology drives market accessibility, Latin America is certain to become the focus of attention in the iGaming sector.

iGaming in Latin America: Key Findings

- Regulatory Evolution – Nations like Brazil and Colombia are leading with proactive legislation. Most others in the region also strive to encourage market stability and protect consumers, confirming a trend in the region.

- Technological Impact – The widespread adoption of mobile platforms and the integration of advanced technologies such as AI and blockchain are enhancing user experiences. This also provides more operational transparency and promotes broader market engagement among stakeholders.

- Growth in Investment – International capital is nurturing competition and market expansion. Mergers and acquisitions are common strategies to consolidate market presence and enhance technological capabilities.

Predictions for the Future

- Increased Market Formalization – More countries will formalize their iGaming regulations, leading to improved investor confidence and enhanced player protection.

- Innovations Driving Change – Applied technological innovations in mobile gaming and payment solutions will continue to evolve, making the market more accessible and secure.

- New Markets Heading for Maturity – New markets will continue to emerge in terms of player pools and product niches. More significantly, the bigger industry actors will exploit regulatory and technological advances, broadening their scope and ensuring a sustainable presence.

In brief, this White Paper suggests that the iGaming industry in Latin America is on a trajectory toward greater maturity and stability. The market will continue offering opportunities for a wide range of iGaming stakeholders.

Introduction

The following report is based on a structured overview of the gambling industry of Latin America, with specific focus on online gaming for real-money (iGaming). Based on public data, industry reports, legislative motions and government figures, we explain key current trends and provide concise forecasting of the sector’s overall mid-term trajectory after 2024.

The study covers the state of iGaming across the leading LATAM markets such as Brazil, Mexico, Peru, Argentina, Colombia and Chile, and presents an overview of the rest of the South and Central American gambling landscape. We examine crucial factors like regulatory environment, market potential and technological advancements that impact industry performance.

By providing a thorough analysis of these elements, the White Paper can serve as a comprehensive resource for stakeholders looking to understand or invest in Latin America’s iGaming sector.

The Current State of iGaming in Latin America

We will present and justify our analysis of the current landscape of the iGaming market in Latin America by focusing on the biggest markets – Brazil, Mexico, Peru, Argentina, Colombia and Chile. However, we will also track and explain important changes in the online gaming scene across South and Central America.

The six nations listed above are the standout jurisdictions not only because they are the biggest in economic and demographic terms. All have been (recently) fully regulated, including all real-money gaming verticals. Based on contextual rules, all online gaming platforms will become a legitimate entertainment option for their residents.

A side note on why we have excluded the Caribbean from our analysis. On one hand, this was done because the multitude of jurisdictions and their approach to gaming regulations make it extremely challenging to draw a concise profile of the region. Additionally, there are still a number of colonies (European and American).

There is also the notorious image of Caribbean jurisdictions known for granting online gaming licenses to operators which then offer their services in unregulated markets. Thus, more than a few gaming platforms have exploited legislative voids and allowed unrestricted online access to their services in a globalized entertainment market.

Agreeably, most Caribbean gaming authorities are experienced and perform stringent licensing tests, requirements, procedures. Still, this report aims to assess only the domestic coverage of the more significant Latin American gambling jurisdictions, given that the majority have entered the public eye following market liberalization.

Brazil – the Biggest Regulated Gaming Market

We have already analyzed in detail the importance and still unexpressed potential of the Brazilian gambling market. In order to provide the complete picture for the current report, we will summarize the key insights, including market figures, user demographics and regulatory environment.

Brazil’s gambling market is not only the most significant in LATAM but also the single biggest regulated one, globally (considering the fragmented US framework and the lack of liberalization in the largest Asian markets). Gambling in Brazil generates an estimated annual turnover of BRL 50 billion (~USD 10 billion).

If we consider all gaming segments – including casual and non-paid games – Brazil still ranks 5th in the World. Real-money games alone have seen substantial growth and have passed 100 million participants. Key gambling verticals include lotteries, sports betting, and casino games, with sports betting and lotteries leading in popularity.

The Brazilian gambler naturally reflects diverse demographics, yet we can still speak of a typical player profile – an average age of 39, mostly males but with growing female participation. Socio-economic data shows a significant portion of gamblers come from middle-class households. Most players engage in gambling occasionally for recreation, with expenditures typically under BRL 50 (~USD 10) per month.

Legislative updates have brought full regulation in the past few years, with licensing procedures underway in 2024. This has laid the foundation for a more transparent and protective environment for players. The regulatory setup aims to curb illegal gambling and ensure consumer safety, enhancing the market’s stability and credibility.

Mexico – Growth and Challenges

ENV Media’s research team has also dedicated a separate study to the Mexican gambling market, examining its recent growth trends and regulatory hurdles.

Despite having less population than Brazil, real-money gaming in Mexico draws comparable volumes of annual turnover (over USD 10 billion). With a user pool estimated at 80 million, the sector enjoys the patronage of the majority of adults in the country.

Recently, there have been more legislative changes, aimed at enhancing government oversight significantly and reducing dependency on physical gambling establishments. The end of 2023 saw a ban on slot machines in physical locations, affecting both existing and new installations. New concessions have been halted and existing ones can go on for a maximum of 15 years. If these rules hold over the next few years, experts foresee a drop in gaming tax revenues of up to 90%.

As expected, this measure does not impact the online segment, which is projected to reach 70% growth over the next three years, potentially hauling a revenue of USD 4.63 billion alone. The majority of Mexican gamblers, a tech-savvy and youthful demographic, are expected to increasingly turn to online platforms due to the recent legal changes.

Peru – Emerging Opportunities

The Peruvian gambling market also comprises online and land-based outlets as legitimate and licensable channels. Valued at approximately USD 2.5 billion annually, key verticals include online casinos and sports betting alongside traditional lotteries and slot machines.

Once again, we see a mostly youthful demographic (5 million total estimates), with a substantial presence in urban areas like Lima.

The regulatory landscape has evolved greatly in the past few years, involving all gambling verticals since 2022 and finalizing the licensing procedure as of 2024. The new comprehensive approach ensures better oversight of both local and international companies to maintain market integrity and consumer protection.

The first phase of licensing applications in Peru ended with 145 submissions from domestic and foreign operators, in addition to 144 service providers and 7 international labs for game certification. Ongoing efforts to authorize technological platforms and game types have seen a total of 184 applications, underlining an active engagement with the new regulatory requirements.

Argentinian Gambling Market Overview

The way Argentina has developed its gambling regulation is unique within Latin America due to its decentralized nature, where individual provinces manage their regulations.

After seeing the National Lottery monopoly end in 2018, Buenos Aires Province was among the first to regulate online gambling in March 2019 through Provincial Law 15.079. This approach has led provinces like Corrientes, Mendoza, and Santa Fe to fast-track their online gambling frameworks, particularly during the pandemic. This coincided with a growing concern of a rise in illegal betting activities and providing legitimate gaming outlets was seen as the logical solution.

As of today, 17 out of 23 provinces, along with the Capital City of Buenos Aires, have introduced some form of gambling regulation.

Economic Impact and Player Base

The gambling market in Argentina continued growing significantly throughout these regulatory changes. Current estimates indicate turnovers of around USD 2.5 billion annually with an active player base of approximately 8 million people. (Alternative market studies provide even higher estimates – USD 3.36 in 2019 and currently surpassing USD 4 billion).

What is indisputable is that the sector has seen a remarkable increase in revenue, reportedly 80% over previous years. In-depth market analysis projects that by the end of 2024, the online gambling segment alone could be worth USD 1.39 billion.

Notably, the penetration rate of gambling among adults is about 25.87%, influenced by an expanded range of gaming options and increased online engagement.

Taxation and Social Considerations

Recent legislative updates include a progressive tax implemented by the Federal Administration of Public Revenues (AFIP) on all gambling operations. The levy varies from 2.5% for domestic licensed operators to 15% for offshore operators.

This tax strategy, alongside additional levies imposed by provincial and local authorities on operators’ gross gaming revenue (GGR), aims to balance market growth with social responsibilities, promoting responsible gambling and preventing underage gambling.

Gaming Culture and Player Tastes

Real-money gaming in Argentina is widely accepted, with diverse offerings across sports betting, casinos and other betting venues. Surveys from 2022 indicate that the most significant portion of the adult population engages in sports betting, with online platforms becoming increasingly popular (preferred by 70% of active gamers).

Out of the total gamer pool, a reported 47.3% bet on sports, followed by lottery (41.8%), online slots (29.1%) and card games (18.2%). Physical gaming machines still attract 27.3% of gamblers, reflecting a diverse gaming preference among Argentinians. While these shares most likely overlap, they certainly add up the total adult market penetration of about 25%, seen above.

Remarkably, 44% of the market sampled sports betting for the first time in the last year, influenced by regulatory publicity and growing female participation. This trend is supported by the growing legalization and public awareness campaigns promoting legal and responsible betting.

Overview of Gambling in Colombia

The Colombian gambling industry operates under a government monopoly, established constitutionally and regulated by Law 643 enacted in 2001. This law positioned Colombia as a pioneering country in Latin American gambling regulation. Then, in 2016, the regulation was adapted with a particular focus on online gaming and providing better consumer protection in digital contexts.

Coljuegos, the national gambling regulatory body, is responsible for oversight and implementation of Responsible Gaming requirements. The National Council of Games of Luck and Chance (made up of Finance and Social Ministries, representatives for Governors, Municipalities and health worker associations) counsels on socio-economic issues, shapes policy and advises on operational requirements for gambling businesses.

With 20 national and approximately 360 local betting operators, along with 15 lotteries and over 2600 gaming establishments, the sector was still in expansion in 2019. Despite only 17 operators offering online services, these alone account for 35% of the market’s turnover.

Coljuegos actively pursues website blocks of unlicensed operators, trying to uphold legal and responsible gambling practices. For those authorized, online games are mandated to have a minimum payout rate (RTP) of 83%, and the regulator conducts random audits based on the previous year’s operations.

Additionally, operators must pay taxes equating to 15% of their net gaming revenue, along with an annual fee based on 811 legal monthly minimum wages and 1% of exploitation rights to Coljuegos.

Market Size and Recent Dynamics

In 2019, the Colombian gambling market had a turnover of approximately COP 6.9 billion (just over USD 2 billion). By 2022, the gambling sector had seen further growth, especially the online segment. According to the national statistics agency DANE, gambling contributed about 1.7% to the GDP, outpacing many traditional industries.

Coljuegos reported revenues of over COP 796 billion (USD 210 million) from licensing fees alone, marking an 18% increase from the previous year. Government estimates placed the sector’s overall market value at USD 5.57 billion, accounting for 80% of the entire entertainment sector.

The sector also provides significant employment opportunities. The industry is vital in funding health and social services through tax revenues, and academic studies highlight these socio-economic benefits.

Market Penetration and Player Insights

The adoption of online gambling has surged noticeably since the pandemic, with 776.6 million visits to betting websites recorded in 2023, coming from 9.5 million unique users. The online casino segment saw the highest growth, followed by bingo, poker, and sports betting.

Approximately 55% of adult Colombians engage in some form of gambling, translating to nearly 20 million active players. Sports betting is the most popular (with 65.7% of gamblers), followed by lottery (44.3%) and online slots (22.9%). Quite a large chunk of real-money gamers still prefers physical gambling machines placed in front of them (21.4%).

Chilean Gambling Market, a Concise Look

Just like its LATAM peers, Chile’s real-money gaming industry has been posting record numbers recently. In 2023, with a 9.1% rise in revenue year-over-year, it reached CLP 513.68 billion (approximately USD 530 million).

This boost was supported by a 12% increase in casino visitors, totaling 7.1 million people. The average player spending per session was given at USD 80.

The Superintendency of Casino Games (SCJ) cites the sector’s market turnover at USD 670 million in 2019, with net tax contributions totaling USD 210.2 million, including gambling-specific taxes and VAT. Slot machines dominated, accounting for 83.2% of total revenues, followed by card games and roulette.

Despite some consistent success of land-based venues, there has been a noticeable shift toward online platforms as casino performance began to wane in the past couple of years.

The overall gambling market in Chile is projected to grow at a 6.9% between 2020 and 2026, spurred by increasing legalization and regulation of online casinos and sports betting. Meanwhile, Chilean activity at offshore casinos is estimated to grow by at least 10% annually, potentially moving up to USD 170 million yearly. With 900 online betting sites on the radar, this growth remains largely untaxed and underregulated.

The sum of the above figures takes the market to at least USD 840 million, without being able to fully estimate the weight that global online competitors have on the local market. These amounts also do not take into account the economic spill-overs from employment creation and supporting economic activity.

Market Penetration and Player Base

Such estimates suggest a player base of over 7 million from the adult population of 15.4 million, implying a high market penetration of 45%. This figure is still debated and yet, Polla Chilena noted in the early 2010s that nearly 60% of adults engaged in real-money games. Interestingly, the overwhelming majority of slot players are female in those reports.

Following calculations along these lines, the average annual revenue per player (ARPU) would amount to around USD 120. We expect, however, that repeat players quite likely boost the user pool and bring down the ARPU in the above-cited government estimates.

Undeniably, the gambling culture in Chile has deep roots, particularly connected to sports, with football as the standout fan favorite. The industry’s importance is easy to spot as online betting platforms sponsor 11 of the 16 Chilean first division football teams.

The rise of mobile gaming, coupled with increased disposable income and international investments, has significantly driven the growth of the online betting market in Chile. Local efforts to promote responsible gambling are also positively impacting the industry.

Still, some major global players are considering exiting the market due to the long wait for returns. Others await final regulatory decisions before committing to a sustained presence.

Regulatory Developments and Historical Context

Before 1990, the only legal gambling in Chile was on horse races. The scene evolved with Polla Chilena‘s introduction of fixed odds betting in 2008. The monopolist operator (and only land-based sportsbook in the country) was then able to install over 2000 betting terminals across Chile.

Today, the gambling culture in Chile thrives, supported by technological advancements after the rollout of 5G networks. The country’s internet coverage extends to 90% of the population, aiding the evolution of remote gambling.

Recent legislation seeks to establish a competitive and regulated online gaming market. A bill introduced in March 2022 was approved by Chile’s Chamber of Deputies in December 2023 and is now under Senate review.

The bill mandates stringent requirements for operators, including their formation as closed corporations, a list of technical, financial and advertisement standards, and extends regulatory oversight to various existing national bodies. Operators also need to allow remote access to their systems by the SCJ and the Internal Revenue Service.

In terms of taxation, it largely mirrors Spain’s licensing system, with 20% on online GGR and 3% additional fees (2% earmarked for sports and 1% for responsible gaming initiatives). Player winnings are taxed at 15%.

In late 2023, the Supreme Court mandated a 12-month “cooling-off period” for what are considered grey-market operators, postponing their shot at being registered and licensed. The move is seen as a plain attempt to protect state-owned entities during the transition.

This is an obvious point of contention, as it holds back the swift adaptation of the Federal Gambling Bill. Meanwhile, monopolistic practices by the three major Chilean operators – Loteria Concepción, Polla Chilena, and Teletrak Chile – are creating barriers, including legal actions against foreign operators, which further complicates market liberalization.

All hopes are that Chile would have a provisional working system by the end of 2024 or early 2025.

Common Regulatory Traits Across Latin America’s Gambling Markets

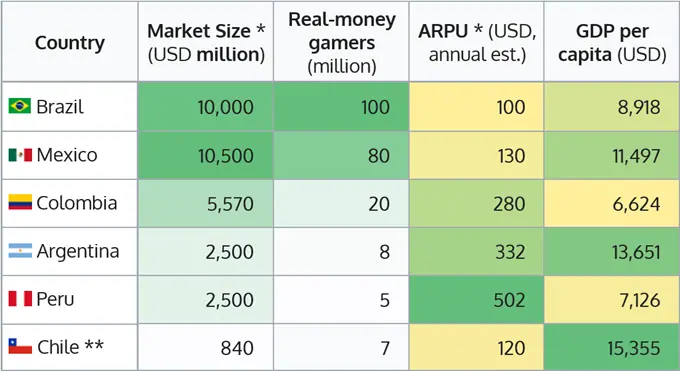

Based on secondary data sources, public financial reports and industry estimates, we can present a complete picture of the top 6 gambling markets in Latin America.

All of these are fully or almost fully regulated, even when recent developments can still lead to fiscal, regulatory and licensing adjustments and rule updates. What is important for the real-money gaming industry, however, is that in all of the biggest six markets there are ways to operate legitimately and work toward making these markets more transparent, sustainable and mature.

* ARPU and market size estimates – More precise figures can only be obtained after several years of complete regulation and publicly available tax records.

** Chile – Full online regulation still pending approval/enactment, likely leading to current market undervaluation.

We need to point out why estimated APRU is shown side by side with GDP per capita. This allowс us to visualize the correlation between purchasing power, gaming culture and spending habits and their mutual impact on player profiles and market potential.

The underlying theme is quite evident – be that for one factor or another among these (player pool, purchasing power and gaming culture), the top 6 LATAM markets will increasingly and sustainably be the focus of attention of the biggest iGaming businesses on a global scale.

Other Markets in Latin America to Watch

Since this is a detailed review of the regulatory landscape and market progression for iGaming across Latin American countries, we need to take into consideration other nations outside the top 6. While some markets are much smaller or have a player base with modest disposable income, we take a look at those with the highest relevance to the iGaming industry in LATAM.

Gambling has been illegal in Ecuador since 2011. On the other hand, the government recognizes that many of its citizens play at offshore platforms and is said to be keen on taxing online gaming companies based abroad.

Gambling in Guatemala is formally illegal, yet practiced almost everywhere with no restrictions, since gambling halls ignore the outdated (1880) gambling laws. Same goes for online gambling, as the country does not have an adequate regulatory framework for that kind of paid gaming.

In Bolivia, the Government has banned “unlicensed” gambling since 2010 but it never defined a clear process for granting such licenses. There is a Gaming Authority, however, which in 2023 has openly started to discuss online gaming and its popularity among Bolivians.

Uruguay is a nation which has made land-based gambling available to its citizens and visitors for nearly two centuries, albeit mostly in tourist areas or limited to state-owned sports betting outlets. Still, legislative changes in 2018 and especially in 2022 brought forth the issue of online gaming as an inevitable step. That bill is still very much alive with the public debate ongoing.

And then, there is the peculiar case of gambling regulations in Costa Rica. This is a country which has no specific regulation on gambling but requires mere business approval. Without dedicated regulatory agencies, registering a gaming company is possible and done by both domestic and foreign operations.

There is a common denominator here, in all of the above recent developments cited. Authorities are following consumer trends and not anticipating gaming demand (or even responding to it) by regulating the market. Where concrete action is not taken, offshore operators have taken over, particularly in sports and casino verticals.

Yet, despite a seemingly “too little, too late” policy, awareness is growing, especially for online real-money gaming. Slowly but surely most South American jurisdictions will choose to act, given the vast potential of the industry.

Across Latin America, the popularity of online real-money gaming highlights the need for clear gaming laws. Authorities are increasingly aware – just as most players are – of the need to prioritize the definition, regulation, taxation and monitoring of paid digital entertainment.

The desired end result of coordinated sector standardization is a high channelization rate – the proportion of (online) gambling done through legitimate and licensed outlets. This is the only way to ensure all gaming activities are safe and legal, and the key to managing a growing industry.

The few remaining LATAM jurisdictions that still need to design and pass domestic regulations will hopefully find the means to address the elephant in the room sooner rather than later.

Recurring Consumer Trends and Player Behavior

A 2022 survey highlighted an increase in sports betting across the region – only 12% of players reported betting less frequently than the previous year, while 34% were betting for the first time and over half either increased their frequency or maintained it. Inevitably, global events like the World Cup boost engagement, with excitement and potential winnings being primary motivators.

The same survey outlined the most common reasons to play real-money games in LATAM. The top 3 player responses were:

- I want to win money

- I like the excitement/experience

- It makes watching/following a game more interesting

According to 2023 Similarweb data, most countries also saw growth in online betting visits. Brazil experienced the most significant increase at 96.66%, followed by Argentina (+63.58%), Peru (+55.66%), Chile (+27.33%) and Colombia (+12.96%).

Mexico experienced a 4.45% decrease due to market saturation and transparency issues with foreign casinos and sportsbooks.

Technological Innovations Shape the Future of iGaming in Latin America

In Latin America, just as much as elsewhere where online gambling is practiced, the sector is heavily impacted by ongoing technological advancements. Smartphone penetration continues to increase and, in some cases, surpasses the domestic population count. Mobile gaming is the preferred mode of access for users across the region, improving user engagement as better technology becomes more affordable.

Most iGaming platforms take great care in optimizing their platforms to growing expectations and easy mobile access. Only a few state-run or old-fashioned operators (i.e., paper-based lotteries) still need to adapt or become obsolete for new generations.

And then, there is the question of secure transactions on the go. Below we will take a closer look at the standout payment solutions for each of the top 6 LATAM markets. By necessity, all innovations that the industry adopts serve to make the gaming experience smooth and seamless, and that includes fast and easy online transactions (particularly withdrawals, often decisive for online gamers’ satisfaction).

Blockchain and cryptocurrencies also find their place in iGaming, delivering namely fast transactions and heightened security for users and operators alike. Blockchain-based hash seeds can also enable players to verify the fairness of games, improving player trust through actual game-tech transparency.

Behind the scenes, software providers and casino operators adopt advanced data analytics and artificial intelligence is improving their performance. This is just as important for marketing purposes (e.g., targeted promotions) as it is for delivering a personalized gaming experience, effectively increasing player satisfaction and retention.

The ENV Media research team also employs multi-level data analysis to produce insights into player behavior and aid iGaming stakeholders in developing strategies corresponding to consumer preferences and market demands.

The Impact of Mobile Gaming on Market Growth

The adoption of mobile devices and affordable internet plans have truly transformed digital entertainment in Latin America. Easy access to online platforms by wider audiences is what made the sector a fertile environment for some of the biggest brands in iGaming.

Over 80% of adult consumers in major markets like Brazil and Mexico use smartphones, making mobile platforms essential to market success. Real-money operators attract younger, tech-savvy players and make their product light and responsive, even when it comes to immersive live casino games.

Betting apps (with easy navigation and quick loading times) are popular in sports betting contexts above all, while online casinos rely on mobile-friendly browser integration of their games.

Mobile technology also provides a wide range of solutions able to overcome previous challenges related to payment security and data safety.

Next Generation Payment Methods and Actual Cryptocurrency Use in iGaming

As mentioned above, the iGaming industry in Latin America has seen major benefits stem from the adoption of new-generation online payments.

Cryptocurrency has often been talked up by technology experts as the big leap in online gaming. Rightly so, when it comes to blockchain-based solutions to security and privacy issues. And to an extent, we have seen the likes of Bitcoin and Ether enjoy certain adoption levels for quick and “anonymous” online transactions.

Arguably, the biggest operators active in LATAM do accept digital currencies as payments on their platforms. This may expand audiences, tapping into niche gaming communities and cross-border player pools.

On the other hand, this is mostly the case of the leading cryptocurrencies. Crypto payments in iGaming have not grown as fast as repeatedly forecast in media publications and industry analyses. In the Brazilian market, our popular payments survey has shown, the instant payment system PIX is rated as the one with the highest levels of security and trust by iGamers (82%). Cryptocurrencies have shown moderate trust levels (at 36%), falling behind bank cards, boleto and eWallets.

Only 8% of Brazilian real-money players reportedly use crypto payments. This is not a neglectable share but not as important as many analysts would have us believe. Evidently, despite the “buzz” around cryptocurrencies, they remain a niche payment method for online gamblers.

Crypto transactions in gaming are much more significant in pay-to-earn models and NFT-based gaming environments. But their real dimension remains, so far, optimal as investment instruments and much less popular as payment tender for online gambling.

What is more, the latest Brazilian regulations have truly shaken the payment solution market that serves the iGaming sector. Credit card and cryptocurrency payments for real-money gaming transactions have been banned (along with almost any kind of incentives), forcing operators to adapt to new norms in the matter of months.

All transactions will have to be channeled through electronic transfers such as Pix, Brazil’s instant payment system, or traditional bank transfers authorized by the Central Bank. This change marks a shift toward tighter oversight and the definition of trusted payment environments.

Authorities insist the focus is on rapid transaction times and increased security. What this means in practice, however, is the possible end of crypto payments and an almost total transition to instant payment methods, mostly Pix and some compatible eWallets.

As for the rest of Latin America, while cryptocurrencies remain an option on the payment scene, the Brazilian approach might influence further regulatory adjustments across the region.

Naturally, LATAM markets differ in terms of domestic market leaders among payment providers, yet some common traits persist. Mobile payments and eWallets are well received, and players regard seamless deposit and withdrawal of funds an essential part of their gaming experience.

Instant Payment Solutions Peak across Latin America

For Brazil, we recently analyzed in our popular payment methods research paper how the instant payment platform PIX has been highly successful and efficient in Brazil. It has quickly become a massively favored payment method for its speed and user-friendly features, with the iGaming sector no exception.

Among its neighbors, we have seen that many have followed suit. The Central Bank of Peru demands that the two most popular electronic wallets in the country – Yape and Plin – provide sufficient interoperability to ensure instant payments and better service to consumers.

Moreover, The Electronic Clearing House of Peru (CCE) has also addressed the efficiency of instant payment systems, the positive influence they have on the market transparency and possibility of oversight. As a consequence, the CCE has presented plans to design and launch a Peruvian instant payment system based on improved clearance mechanisms. (As of the time of writing, no such framework has been deployed).

In December 2020, the instant payment system of Argentina, called Transferencias 3.0, was officially implemented by the Central Bank of Argentina. Designed to provide lightning-fast peer account transfers (A2A), it soon gained ample popularity across the nation.

The Colombian Central Bank started the process bottom-up, with a Payment System Forum tasked with the development of a national instant payment framework. The transaction clearing house delivered guidelines for the interoperability of a new generation payment system.

The resulting instant clearance platform of Colombia is called Transfiya. It provides real-time P2P mobile transactions. The existing bank infrastructure was used as the basis of a secure solution but the new interface and system integration made electronic payments much more accessible, effectively raising financial inclusion across the nation.

Financial regulators in Colombia are now pushing for better interoperability among other apps and eWallets. A standard payment code is being developed as a way of making cross-platform transactions compatible.

In Mexico, the so-called CoDi (Cobro Digital) is a platform introduced by the Bank of Mexico to support instant payments via QR codes and NFC technology. It also aims at increasing the share of digital transactions and improving financial inclusion.

Mexico also has a real-time bank transfer system named SPEI (Sistema de Pagos Electrónicos Interbancarios). It’s extensively used for both corporate and personal transactions, offering immediate payment settlements.

All of the above solutions we have presented are part of a broader regional trend. Central banks across Latin America are moving in proactively and implementing technological standards and regulations to speed up local payment ecosystems.

The growth in usage of instant payment systems throughout the region is opening up possibilities for new financial products. More importantly for the iGaming industry, it widens the pool of active digital consumers and gives them access to paid online entertainment.

The Role of International Investment

International investment has been key to the expansion and sophistication of the iGaming industry in Latin America. The influx of foreign capital has not only driven forward the technological infrastructure of iGaming platforms but has also increased the competitive edge of local markets.

As a result, over the years we have seen the introduction of advanced gaming features and the broadening of player access to international gaming networks.

Benefits for the Local Markets

Market expansion is the first linear consequence of foreign investment in the sector. It has helped locally registered operators scale quickly to meet the growing demand for iGaming services. This includes expanding into new gaming categories and incorporating mobile gaming solutions, which are vital given the high mobile penetration in the region.

Gaming investments have also, indisputably, led to technological advancement. The introduction of cutting-edge technologies such as AR/VR and AI has ushered personalized gaming experiences. Blockchain integration, on the other hand, is a prime example of improving game fairness and security. These technologies are crucial for gaining consumer trust and enhancing user engagement.

Sustainable investment has ultimately improved the regulatory compliance of the sector. International investors come in with certain expectations of standardization and compliance, and their involvement accelerates the development and enforcement of local regulations, along with some global standards. The synergy of both paradigms has proven beneficial for most markets’ long-term sustainability.

Risks and Undesirable Consequences

Market volatility and regulatory changes are the main types of challenges in the sector, anywhere around the World.

While foreign capital can drive growth, it also brings exposure to global market fluctuations that can spill over on local operations. On the other hand, the iGaming industry is also often affected by domestic policy changes – or simply changing attitudes toward offshore stakeholders – that can alter the market dynamics overnight.

In the end, gaming ventures inevitably need to pose as a cultural fit to local consumer demands. A particular gaming culture translates into a multi-layered set of player preferences which foreign investors need to be sensitive to. Inability to align with consumer expectations can lead to poor market reception and underperformance of gaming platforms.

Current Investment Climate

Recent trends show a significant increase in merger and acquisition (M&A) activities in the iGaming market. Major companies seek to consolidate their positions in the market. One of the shortest ways of expanding geographically (entering new markets) is by making strategic acquisitions of competitors. Brazil and Peru are explicitly pointed as potentially “highly lucrative markets” by investment consultancies.

Besides the scaling of operational capabilities and market coverage, M&As usually leads to product diversification, making the gaming portfolios richer and better prepared to respond to emerging opportunities and local market specifics.

Ultimately, international investment is expected to bring a series of benefits to the Latin American iGaming market. Yet, it also requires careful navigation of the region’s unique challenges and first-hand understanding of the local market specifics. Gaming companies must stay agile, aligning their strategies with local market conditions and regulatory landscapes to fully capitalize on their investments.

Future Trends and Market Predictions

So far, we have exposed current trends, relevant innovations and regulatory environments in most Latin American markets. This allows us to analyze and explain the iGaming market dynamics but also enables us to project certain trends and make predictions for the short to mid-term future (2-4 years) of the industry.

Here are our forecast key points on the online gambling industry in LATAM:

1. Increased Regulation and Market Formalization

Across Latin America, there’s a clear trend towards the formalization and regulation of the iGaming industry. Just recently, countries like Brazil and Colombia have made significant strides in establishing central legal frameworks for online gambling. This trend is expected to continue, with more countries formalizing their regulatory environments. This will likely lead to:

- Greater market stability and investor confidence – As regulations become clearer and more consistent, we can expect increased international and domestic investment in the iGaming sector.

- Enhanced player protection – With formal regulations, there will be a stronger focus on responsible gambling, player protection, and anti-money laundering (AML) practices.

- Increased market entry barriers – While regulation brings stability, it also means higher compliance costs, which could limit market entry to well-capitalized players.

2. Technological Innovation and Mobile Gaming

The penetration of smartphones and the internet continues to rise in Latin America. Mobile gaming may not be a novelty but it is still a key growth area for the iGaming industry. With further tech-based breakthroughs, this is expected to lead to:

- Ubiquitous mobile gaming – The already significant role of mobile platforms in gaming will continue to grow. The decreasing number of LATAM operators that have not made it a priority, will have to optimize their offerings for mobile users.

- Adoption of new technologies – Technologies such as virtual reality (VR), augmented reality (AR), and blockchain could become more mainstream in iGaming, offering immersive and secure gaming experiences.

3. Expansion of Instant Payment Solutions

The diversification of payment solutions is an ongoing process in LATAM. The integration of fast eWallets and digital currencies will become more pronounced. This process is driven by the demand for caster, more secure, convenient (and possibly anonymous) payment methods. Predictions include:

- Slower than expected but eventually wider acceptance of cryptocurrencies – As both operators and players seek more efficient transaction methods, the use of Bitcoin and other cryptocurrencies will increase, aligned with their growing acceptance globally.

- Innovation in payment technologies – Payment service providers will continue to innovate, offering faster, more secure transactions with lower fees, enhancing the user experience. Following the example of some LATAM pioneers, other nations might be able to launch their own payment systems.

4. Rise of Younger Markets and New Consumer Segments

As the iGaming industry matures in established markets like Mexico, new markets will assume more significance on a global scene. Brazil is an easy pick, already big enough to top investor interest. However, countries that are currently under the radar, such as Peru and Chile, could see substantial growth due to regulatory improvements and increased interest from international operators.

Additionally, untapped consumer segments will get increasing attention, including female gamers and older demographics, leading to a more diverse market.

5. Challenges – Regulation, Competition, and Market Saturation

While the future holds much promise for the iGaming industry in Latin America, it will not be without its challenges:

- Regulatory unpredictability – As countries refine their regulatory frameworks, ongoing changes could pose demands for operators needing to adapt quickly (e.g., see outlawing of slot machines in Mexico and certain payment methods in Brazil).

- Increased competition – As the market becomes more attractive, competition will intensify, putting pressure on margins and calling for more differentiation in a “crowded” market.

- Market saturation – With the proliferation of online casinos and sports betting platforms, player acquisition and retention will become increasingly challenging.

Seizing the Opportunity – iGaming’s Bright Future in Latin America

We end our comprehensive review of the iGaming industry in Latin America with the clear conviction that the sector is set for years of constant growth. Regulatory improvements and technological advancements are fueling a fertile market for businesses and a wealth of choices for consumers.

As LATAM jurisdictions appear determined to make real-money gaming safer, fairer and more accessible, we can only foresee strong competition spurring market expansion and maturity. New technology will also enrich the gaming experience, making it more engaging and secure.

With the above in mind, Latin America will likely become one of the most important macro regions in iGaming. Compared to the fragmented markets in Asia and North America, it is clear why we expect to see increasingly easier and safer operations in LATAM.

For a wide range of gaming stakeholders, now is the time to seize the opportunities presented by this dynamic region. Those able to adapt quickly to the evolving regulatory and technological environment will find themselves well-positioned to succeed in this growing market.