This post is also available in:

Despite the undeniable popularity of real-money games in Latin America’s largest economy, a Brazilian gambler profile is hard to define. The market faces a number of challenges, yet the legalization of sports and fixed-odds betting has sparked renewed debates on the regulation of the entire gaming spectrum. iGaming stakeholders renewed their interest towards the market and started monitoring bottom-up demand trends and player traits.

In this context, our analysis dives deep into the Brazilian gaming landscape, shining the spotlight on player profiles and preferences. We aim to illustrate how these insights can guide industry stakeholders and legislators alike in optimizing the market and delivering superior gambling products and services.

Gambling Demographics Survey Reveals How Brazilian Gamblers Think and Act

ENV Media has commissioned a primary data survey, carried out in mid-2023 among Brazilian adults in some of the most active gambling communities. Our team has gathered opinions and tastes related to Brazilian gaming habits, as well as player perceptions of the iGaming scene in general.

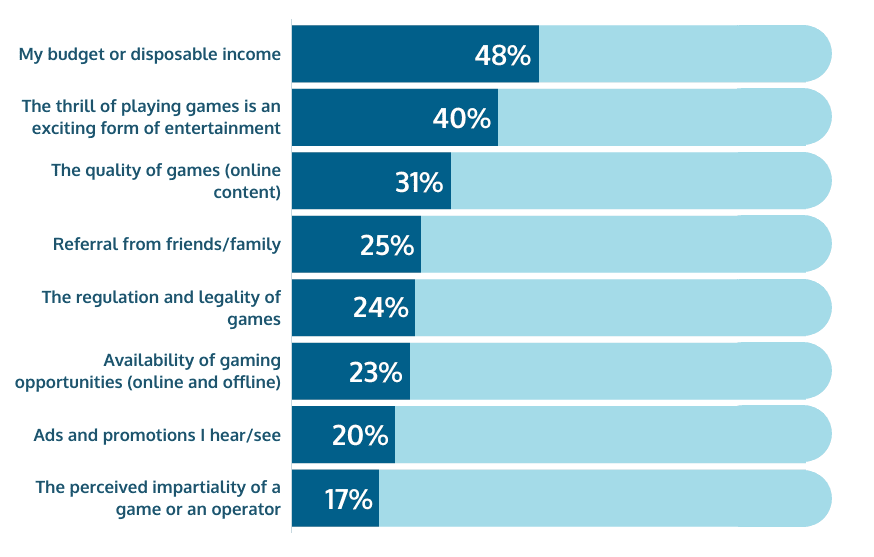

One of the most relevant insights that the field study produced was about user motivations and market facilitators – i.e., which factors influenced their decision to gamble (or not) online? (Multiple answers were possible and selected).

Naturally, the availability of disposable income is the leading trigger factor (48%) for those who enjoy playing real-money games. The thrill and excitement of the games is the second most common (40%) influencing factor – that would possibly be the first, if budget was not an issue.

The third most relevant motivator is the quality of (online) games, for 31% of people, followed by recommendations by friends or relatives (25%) and the regulation of the market (24%).

Interestingly enough, the availability and accessibility of games, any marketing efforts and even the perceived industry fairness have a more limited impact on players’ decisions – around or less than 1 in 5 players said those aspects influence them at all.

This simply means that the majority of real-money gamers would find an outlet and play regardless of accessibility or commercial practices. And this is more than a clear signal to authorities and iGaming stakeholders that they should work towards a fully regulated and transparent market – maximizing public benefits and delivering efficient player protection above all.

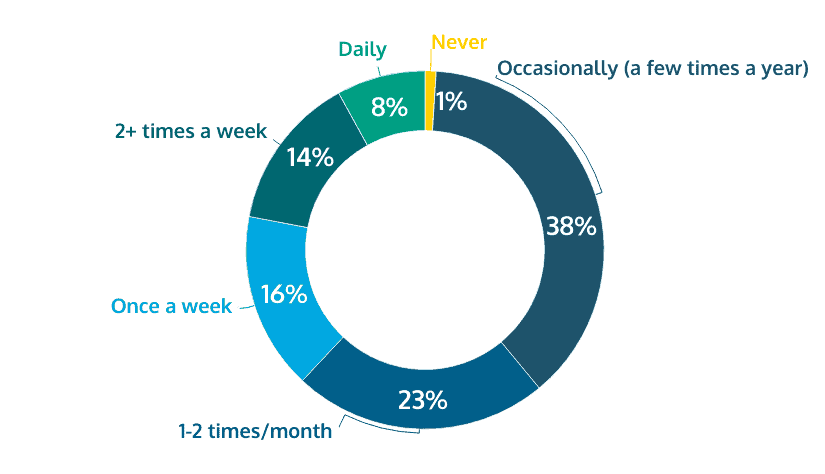

As in the above question, when considering online real-money games only, respondents were asked “how often” they play. We see that most players approach iGaming casually and responsibly.

The frequency of playing online largely confirms the recreational nature of iGaming, which is quite satisfactory for all stakeholders. Most people play occasionally throughout the year or about once a month – combining for 61%. Only 22% play 2 or more times a week and 8% do it daily.

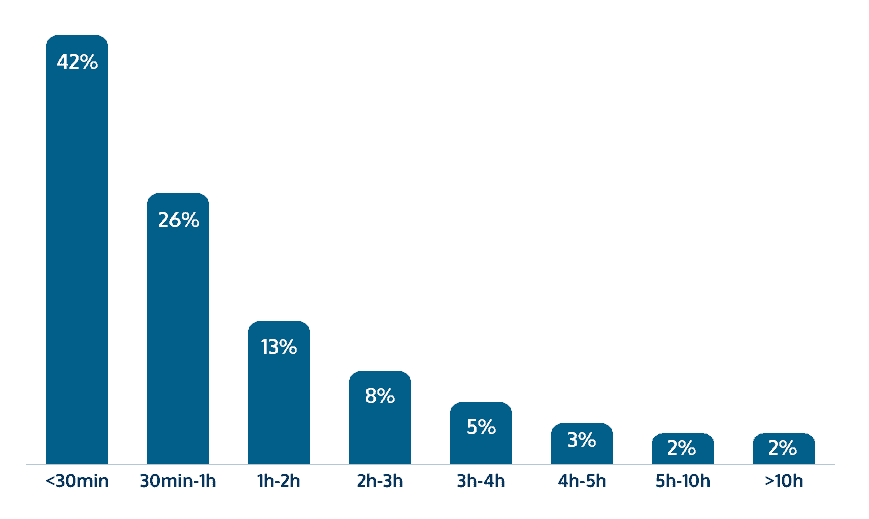

Similar disposition is also seen in the total duration of online gaming sessions, estimated on a weekly basis:

Most people spend less than 30 minutes per week (42%) or at most under an hour (68%). Player shares rapidly decrease when weekly duration rises. Slightly above 2% spend more than an hour a day.

Naturally, the survey was also meant to get a consolidated and precise picture of the players – who they are and what describes the typical real-money gamer from Brazil.

Brazil Gambling Demographics

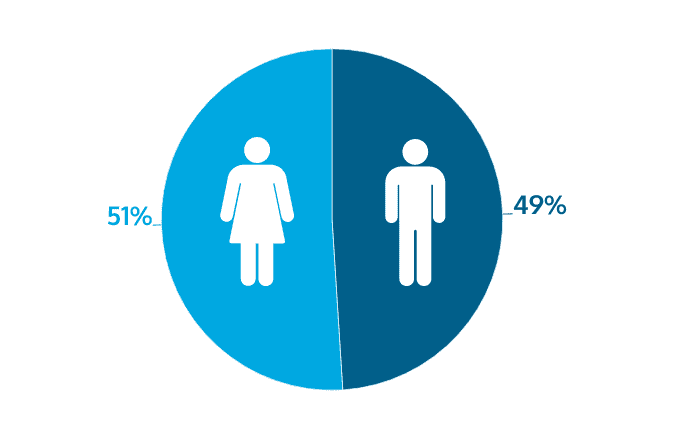

Starting with the fundamentals, we see the feedback on active gamers according to gender and age. (Only two gender options were provided for statistical simplification purposes.)

-

Gender and age

Online players’ gender

We see that the two main genders are almost equally represented, despite some claims to the contrary in previous industry studies (read on for more on that issue).

The average reported age is 39.24. Again, we have a minor inconsistency with some previous studies which, however, were conducted several years ago, citing slightly lower average ages. Various consumer market segments have repeatedly shown in the past few years that a mass digitization has engaged more demographics than ever before.

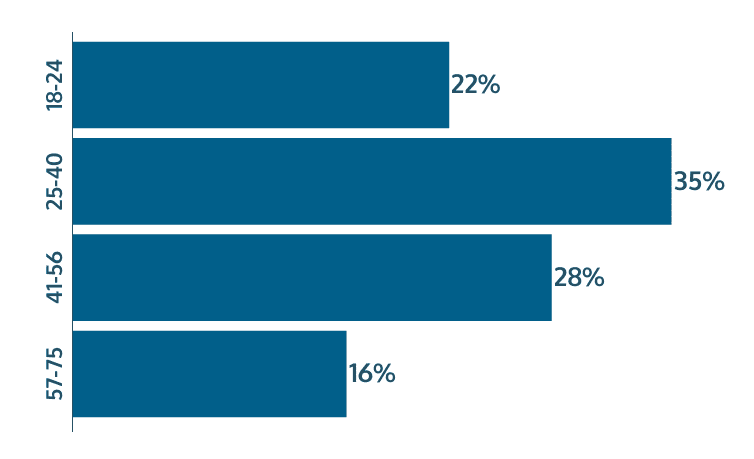

And indeed, the largest age group is 25-40, with more than half (57%) below 49. There is also a considerable share of middle-aged gamers and punters – the second-largest age cohort is 41-56, over a quarter of the total (28%).

There were no real-money gamers (or actual respondents) registered below 18 or above 75 years of age.

-

Socio-economic levels

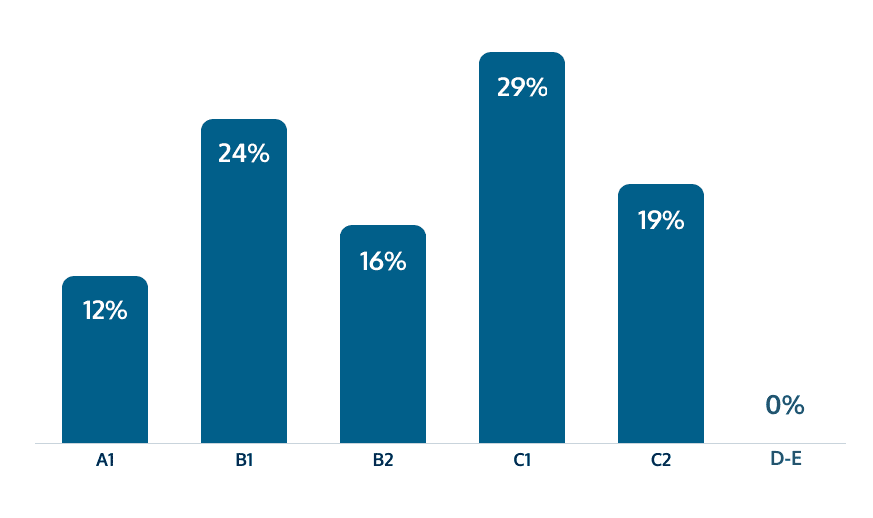

The diagram above shows the distribution of active real-money gamers in Brazil according to the socio-economic classification of their household.

The Brazilian Economic Classification Criteria (CCEB) are based on the Household Budget Survey of the Brazilian Institute of Geography and Statistics. They have become a standard of the Brazilian Market Research Association (ABEP), last updated in 2022 and available on their site.

Socio-economic brackets start from A (more affluent households), go down through B1, B2 (roughly comparable to upper- and lower-middle class), C1, C2 and finish with D–E (families or individuals with practically no disposable income).

CCEB variables include education levels, access to public services, household appliances, facilities and other amenities that improve one’s quality of life. All indicators are directly related to household income brackets and, in turn, to access to modern communication and recreation means. In the context of our research, this is particularly relevant since online entertainment and real-money gaming are rightly considered premium consumption categories.

As might be anticipated, levels A and B make up over half of the real-money gamers (52% combined), compared to the 48% of C-level households that are still a significant share of the player pool. It’s worth noting that Brazilian citizens that fall into the C-level CCEB are 47.4% on a national level – more or less proportional to their weight as gaming consumers.

However, A-level households are only 2.9% in Brazil (ibid, 2022 data), while B1-B2 consumers are reported as 21.8% in total. This simply means that B-level players are slightly more prominent than their actual population share, while A-level players are heavily overrepresented among real-money gamers. Again, these are largely expected trends, especially in the context of recreational online gaming and mobile sports betting.

-

Place of residence

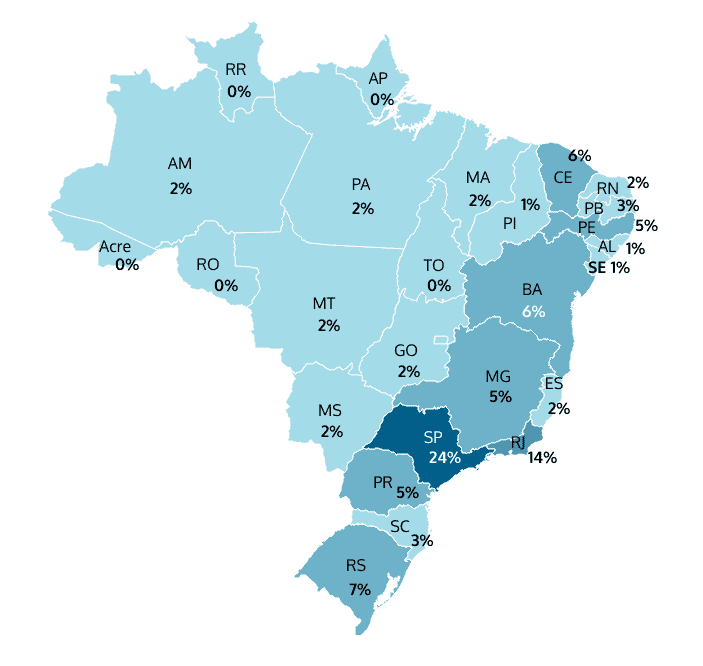

N.B. There are no actual “zeros” in the percentage shares of players by state, the lowest is 0.2% from Tocantins and Acre. The above shares are rounded off to the nearest whole integer.

The biggest share of real-money players come from the state of São Paulo – nearly a quarter (24%), followed by Rio de Janeiro with 14%. We also see solid gaming traction in the states of Rio Grande do Sul (7%), Bahia (6%), Ceará (6%), Paraná, Minas Gerais, Pernambuco, Goias and the Federal District (the last five with around 5% each).

This outcome is in line with the findings of recent studies on active real-money participation in Brazil’s states and metropolitan areas. The coastal states in the South-East and South are above the rest in online gaming traction – due to their big metropolitan areas, well-developed communication infrastructure and overall levels of social and economic well-being.

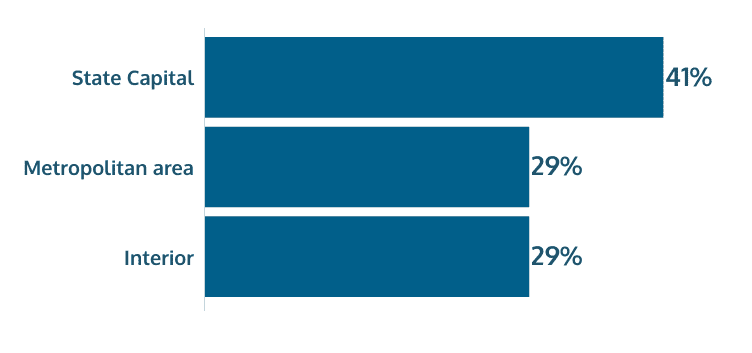

Accordingly, this is reflected also in the residence of players on a more granular level. The cities where they come from are mostly state Capitals or at least urbanized/metropolitan areas:

Less than a third (29%) reside in the countryside or other “interior” (or more rural) territories.

-

Education levels and current occupation

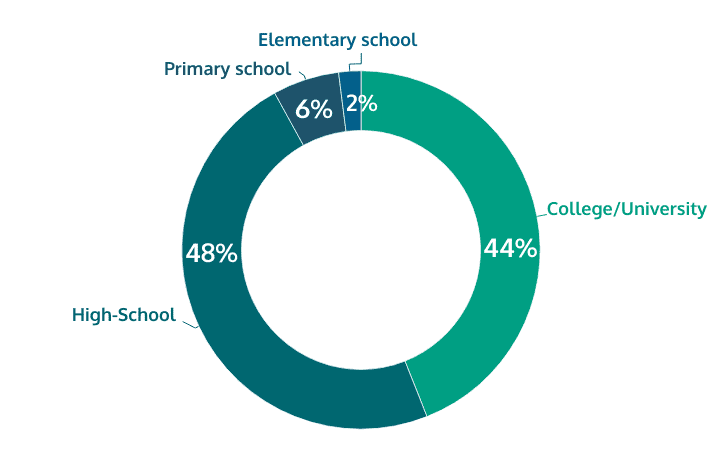

The link between average demand for real-money gaming and education levels is also not hard to trace. Education levels, statistically, result in higher potential income, and in turn disposable income.

The biggest share of players has indicated at least high school as completed – 48%. University and college graduates come close second (44%). Only minor shares of the total player pool struggled in school and barely completed primary (2%) or elementary (6%) school levels. There have been no illiterate respondents.

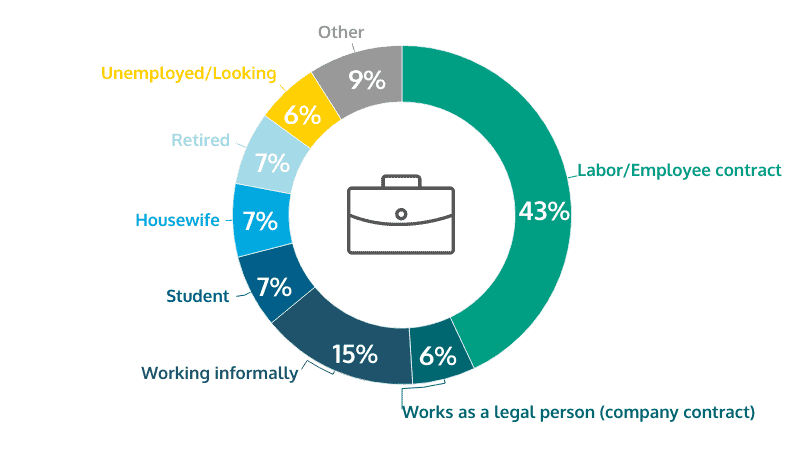

The graphic below illustrates the actual current occupation of real-money gamers in Brazil:

Those with stable jobs are roughly half of all players – 49% in total between contract employees and company owners. Nearly two thirds (64%) have some kind of a job, while only 6% claim to be unemployed and currently looking for an occupation.

There are equally noticeable shares of pensioners, housewives and students (7% each). Experts take this as a sign of a maturing market, one in which improving products and an established gaming culture expand player interest into practically all demographics.

Gender Gap More Fluid in Gambling

One of the more surprising facts we uncovered was that women gamers were in the majority, if only by a little. Last year data had shown that non-sport games for real-money are the segment that boosts female participation:

- In terms of sports betting alone, 54% of men bet among the surveyed adult population, while this is the case of only 38% of females.

- In non-sport gambling, men still have somewhat higher engagement, with 69%, while women respond with 62% on average.

- 25–34-year-olds are cited as the most active age cohort for both sexes, followed by the youngest adult group in men (18 to 24) and the one above in women (35 to 44).

In all of the above age cohorts, when we include all forms of real-money gaming, men play in nearly three quarters of cases (72-73%), while women gamblers are more than the half (51-57%) – still more than half of female adults.

However, alternative studies agree with our most recent findings about a much closer gap and also put females as the majority of gamers in Brazil overall (51% to 49%). This is particularly the case in the mobile games market (including more casual titles) where they dominate with 60.4%.

They go as far as affirming that the majority of gamers are also black (“Preto”) or multiracial (“Pardo”) – combining for 54.1% – but these figures are only relevant for the online gaming market in general and we cannot verify their validity for real-money games alone.

Uncovering Player Choices – Channels, Genres and Popular Game Types

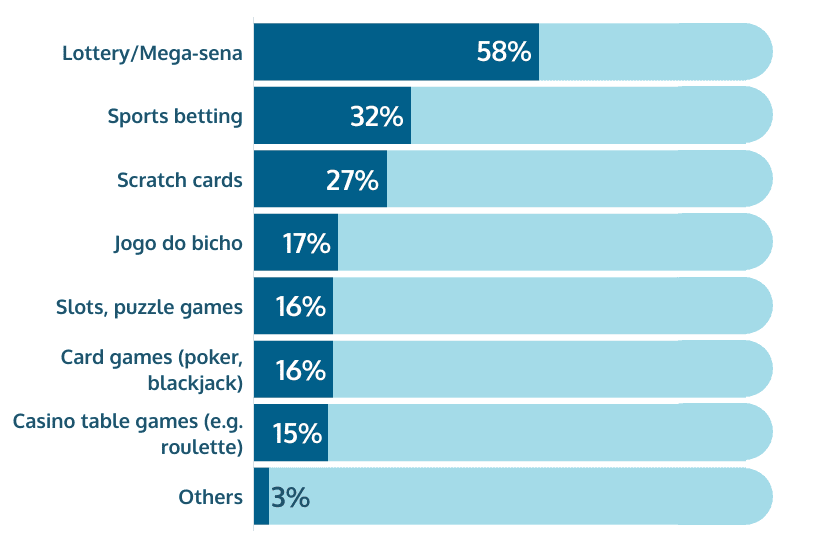

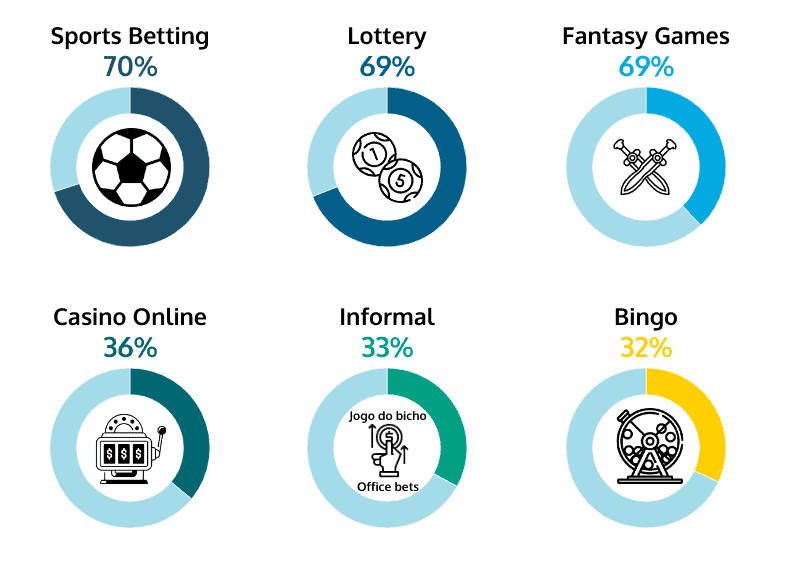

Another key element of the ENV Media survey was built around the types of gambling activities people usually participated in. Multiple answers were possible, with both in-person and online games included.

Lottery has a commanding market share – in all of its forms and derivatives, including scratch cards, bingo and raffles. Over half (58%) of all surveyed adults play lottery games of some kind. Most respondents identify and divide these games into their proper categories, with some overlapping in active usage.

More importantly, this explains the high engagement levels for age cohorts above 40 and up to 75, since lottery draws and similar games are seen as more traditional, widely available (both online and offline) and typically legitimate across the nation.

Sports betting comes second, with roughly a third of all players confirming their interest for a booming segment.

As much as 17% of users admit to playing unlicensed grey-market “jogo do bicho” games, also considered a custom for generations of Brazilians.

Edging close to that group are a number of casino games – slots and card games are equal favorites, followed by classic table games like roulette. We must emphasize that recent hit genres like online crash games are often identified as slot games. That is mostly because of their clean and simple gamification interface and the multitude of fast-play titles that have come out in that segment in the past year alone.

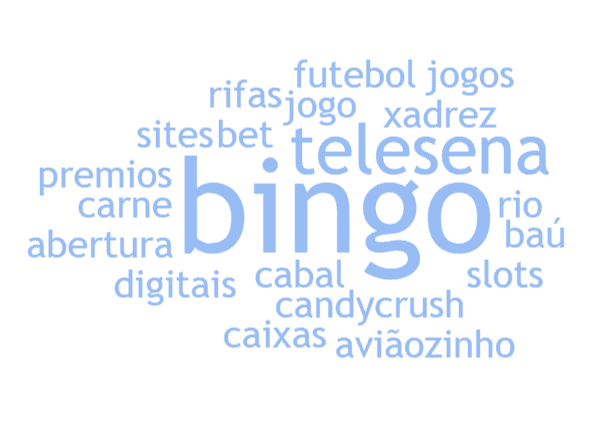

When asked about “other” real-money games, respondents indicated a wide selection of genres and keywords (see the word-cloud below). Lottery variants were again most common, followed by slots and crash games (e.g. aviãozinho), while some even cited “opening loot boxes” and casual non-paid games like “candy crush”.

The so-called multiplicity index of 2.4 (which summarizes the net score of all active player shares) shows that on average, users have more than one favorite game category – in fact, most play more than two.

This is why it is not surprising to see that more than two thirds (69%) would be interested in trying new or different types of betting activities, genres or games, if made available in Brazil. That is also a distinct possibility for the majority because around three quarters of Brazilian players (74%) have some or current experience with online real-money games, a segment known for innovation, fast deployment and exciting marketing delivery.

Some Sports Betting Statistics

Sports betting is, essentially, more linear as a consumption model. It has multiple bet types (a.k.a. “markets”) and athletic disciplines within its scope, even completely virtual ones. Yet, all follow comparable transaction mechanics and gamification principles and, in the majority of cases, depend on real-world events.

It is close second to lottery in terms of size but it is possibly the loudest when it comes to media coverage and advertisement investments in Brazil.

According to topical market research data, 31.06% of sports bettors play a few times a week; 9.47% do so once a month; and 18.86% bet on sports a few times a year or less. More relevantly, as much as 86.43% of sports betting fans practice this activity mostly online (via mobile sites or apps). This is almost 50% more than what analysts register as grey-market and informal bets – among friends, colleagues and other peers – and a good sign for Brazil’s growing and legitimate betting industry.

Online Gambling Behavior

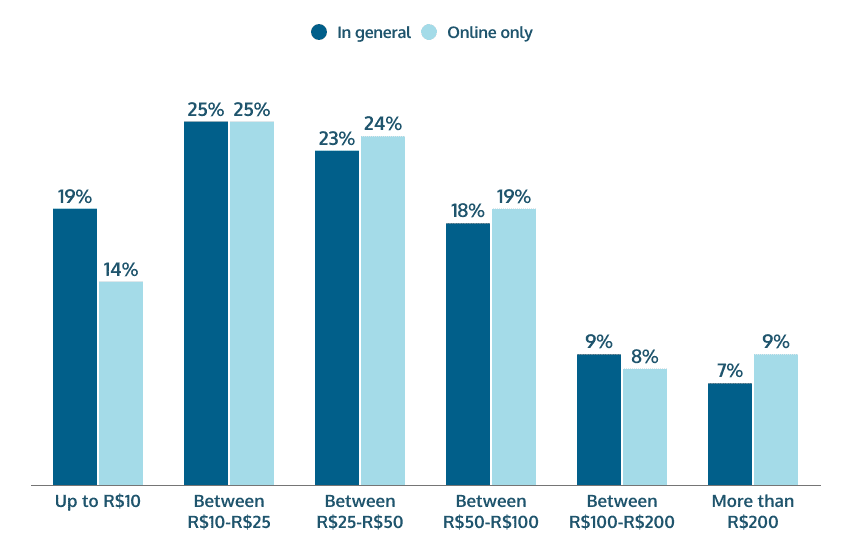

When asked about the monetary amounts they typically spend on real-money games each month, players gave the following feedback:

If we consider both online and offline gaming, around two thirds of players (67%) spend less than or up to BRL 50 per month. That is about USD 10 monthly, emphasizing the entertainment nature of real-money gaming for most users. A fifth (19%) even spend under BRL 10, while only 7% admit to spending more than BRL 200 on a monthly basis.

Considering the unstoppable growth of online platforms, a big part of the survey was focused on the impact those had on players’ mindset and experience. Yet, the picture changes only slightly if we consider online gaming spending alone – 63% spend below BRL 50 and only 9% spend above BRL 200.

Still, the shares are in favor of a marginally higher spending for online players compared to more traditional real-money gamers (e.g., lottery, office pools or even jogo do bicho).

Statista reports from 2022 indicate levels of engagement for online gamers that are comparable to the overall playing frequency observed in our survey:

- almost half of (48%) play occasionally (1-3 times per week) while nearly one-fifth are “light” users (18%), betting even less than that;

- 18% of active users played daily; 16% do it somewhat less (4-6 times a week);

When it comes to their budget, a related report estimated that around 61% of Brazilian online gamblers spend on average less than 100 Brazilian reals a month (~ USD 20). A year and a half later, our questionnaire indicates that threshold for 82% of online gamers, while the daily play sessions have decreased.

Even if we don’t consider this as a lasting trend and accept that the numbers are somewhere in between over a longer test period, it is also probably true that the majority of online gamers engage less often and with less money. Only a marginal share can be considered hard-core both in terms of frequency (8% with daily sessions) and amounts spent (9% commit more than USD 10 on a weekly basis).

As per KTO Group data, most gamers indeed have a preference for playing with small amounts but regularly. The majority appreciates higher return odds at the cost of winning opportunities with greater volatility. Even when taking a risk with a certain betting strategy, players tend to prefer high RTP genres like crash games, blackjack, roulette, and slots.

- 2021 studies define 55% of players as moderate gamblers that value bet security but are willing to take risks on occasion;

- 33% are qualified as risk-averse, while

- 12% take risks more “aggressively” in the pursuit of bigger profits.

All of the above findings are arguably similar. In general, they exclude outliers (i.e., extremes for most indicators) and in many cases they underestimate the need for more precision, simply assigning gaming habits to younger consumers than what actual market dynamics suggest. Nevertheless, we need to match our player profiles to what the industry has been working in terms of publicly available market data.

What Is the Public Perception of the Average Brazilian Gambler?

The gambling industry has seen barely a few dedicated studies in Brazil for the past decade. Limited research output has hampered the industry understanding of the market, mostly sitting back and absorbing the market growth.

However, with the increased relevance of online gaming and the fierce competition between various digital entertainment channels, the need for better player outreach has become essential for all reputable stakeholders.

By and large, the gamer profile outlined by our survey is corroborated by earlier attempts to describe the traits of the average domestic player:

- Likely to be under 34 years old, increasingly female, especially in a wider mobile gaming context (e.g., paid casual and social casino games);

- Statistically likely to be from states like São Paulo, Rio de Janeiro or Rio Grande do Sul;

- Engaging most often in sports betting or lottery games;

- Playing for entertainment rather than expecting a return;

- Predominantly using mobile devices, pushing the industry to improve accessibility.

- Broadly aware of regulatory gaps and expecting some improvement by authorities.

The typical Brazilian real-money gamer is without a doubt young, tech-savvy and exposed to a wide variety of games and genres. Globo claims it would be a male user between 25 and 35. Pesquisa Games Brasil agrees that over half of gamers are under 34 years of age, with a substantial part (27.6%) belonging to the upper-middle class. The percentage of gamers in what could be defined as working and lower classes was estimated at 49.7%. PGB also affirms that 40.8% of mobile gamers play every day while for PC gamers this share is less than half 19.6%, and for console gamers even lower, 15%.

Newzoo also places the majority of Brazilian gamers at under 34. In addition, over half reportedly watch gaming content (a quarter alone opting for eSports). If we extend real-money gaming to all player profiles that make in-game purchases, we see that rise to 83% (yet that is not our subject vertical in a stricter sense). As much as 42.2% of players affirm that during the Covid pandemic they spent more on games overall.

Indisputably, today’s Brazil has a burgeoning gaming culture and the continuous user pool expansion stresses the importance of providing market stability and establishing responsible industry practices.

Key drivers for the sector’s evolution include overall development metrics such as disposable income, education and socio-economic standing. These influence player engagement and channelization towards modern iGaming platforms. That is also why, besides the top 3 states mentioned earlier, we see plenty of online traction from the likes of Minas Gerais, Santa Catarina and Paraná. (The Federal District simply does not have the population to stand out on a national level).

Other factors include media exposure, accessible technology and, of course, more clarity on market regulation. Industry experts highlight the potential of social casino games, hybrid genres and innovative monetization models that enable segment crossovers and aid the adoption of licensed real-money entertainment.

This is particularly the case of new-age games like crash-style or game-show titles, as well as any with transparently high RTP and immersive AV/RV features.

Ultimately, proper channelization is essential to ensure users gradually abandon informal or unlicensed options, regardless of game types.

A Snapshot of Brazil’s Gaming Boom

In our own comprehensive overview of Brazil’s gambling market, we’ve seen that Brazilian players spend close to BRL 50 billion (~ USD 10 billion) annually. In 2021, Brazilian state lotteries alone generated estimated revenues of BRL 18.1 billion (nearly USD 4 billion). Such figures rank Brazil as the 5th largest gambling market globally, with over 100 million players and in the top 10 as an estimated total value.

Established channels include land-based locations, online platforms – mostly offshore – and illegal gambling outlets. The industry growth is mostly fueled by an expanding middle class and a genuine passion for gaming.

- Approximately 106 million people (out of 160 million adults in Brazil at present) have a favorite paid game of chance or skill.

- An estimated 74 million engage in sports betting, while 46 million choose lottery or bingo, while 23 million are fans of online casino.

When we combine macro-genre statistics for the entire gaming scene, we see a total of 278% active users, meaning that those who play for money have nearly 3 preferred game types on average. That is quite close to what we saw in the latest survey. Some players stick to one or two games, others try multiple categories and outlets. But public statistics only validate further our field study.

Online casino remains the most diverse segment in terms of game types and engagement opportunities. Casino fans are split between classics like roulette (78%), blackjack (66%), video poker (61%), table games (64%, e.g., baccarat) and quick-play genres like slots (63%) and crash games (over 60%).

The latter two genres see an increasingly dynamic turnover of titles and even provider popularity, albeit following the same game mechanics and “provably fair” technology. A hit online slot or mobile crash game may explode among gaming communities and become the trendiest title for weeks or even months, only to be surpassed by a new player favorite for no apparent reason. However, these are the genres that usually generate the most gaming rounds and consistently draw about two-thirds of active players.

Further Drivers of Gambling in Brazil

Post-pandemic consumption habits have led many users to opt for easily accessible digital and mobile entertainment. Gaming trends evolve dynamically, with novel gaming genres emerging and shaping a new gaming culture across generations.

Two apparently diverging trends manage to respond to the tastes of most online casino players. The simplicity and quick gameplay of online slots is what makes them popular. On the other hand, live dealer games are also favored by roughly half of the players as they offer more immersive and realistic experiences.

All studies agree, however, that the majority of Brazilians embrace online gambling and betting as an entertaining pastime:

- 67% see it as entertainment, 43% as a “business” opportunity (43%) and 38% as a kind of sport.

- Motivations cited include fun, income and social connection. More than half of real-money players (53.85%) are drawn by the desire to win money, while for 42.25% the excitement of sports bets is decisive. Placing a bet increases the interest in watching the game itself for 36.07% of fans.

- Only a small percentage use it for social interaction (13%) or as primary income source (12%).

When they consider new sign-ups, Brazilians are influenced by:

- Recommendations from friends above all (78%), followed by other testimonies of trust and reportedly positive experiences (54.2%)

- Verifiable certificates (54%) including secure connections, positive site reviews (49%), prominent partnerships (41%), and licensed operations (41%).

- Media coverage also matters, as endorsements by clubs or athletes (36%), TV exposure (28%), sports website coverage (27%), and presence outside mainstream media (21%) impacting player decisions considerably.

The fear of losing money discourages potential players the most (47%). However, Brazilians exhibit the highest levels of risk awareness and responsible gaming concerns of all the LATAM markets (25%).

This kind of mindset – or a cultural trait, more likely – ensures that Brazilians in general know that the chances of consistently winning significant amounts are limited. Preconditions change, albeit only slightly, if users dedicate time to studying certain games and their odds.

Some users exploit the possibilities of engaging full-time in gaming, sports betting or even becoming professional players. Poker tournament participants emphasize the importance of concentration, study, and hard work and some of them even manage to support themselves and their families with such earnings. However, these cases are unique, if not one in a million.

It is crucial for players to evaluate their resources, time and budget well, as well as psychological dispositions that could interfere with responsible gaming. The latter brings us to some indispensable features of mature gaming markets.

Consumer Safety and Industry Stability

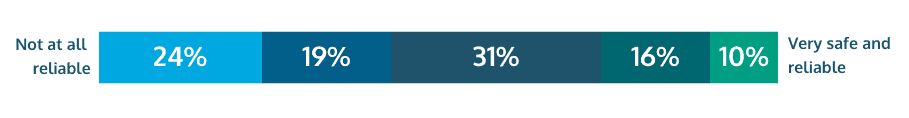

Survey respondents were also asked about their perceptions of the safety and security of known online real-money gaming options. Answers were graded on a 5-point scale from “not at all reliable” to “very safe and reliable”.

While most adult players rate the online gambling scene in Brazil as somewhere in the middle (74% for scores 1-3 combined), few think it is completely safe and secure. Evidently, there is still much to be done on behalf of all iGaming stakeholders in order for the segment to be considered highly trustworthy.

When asked how familiar they are with the current Brazilian gambling laws and regulations, players turned out even more emphatically unsure.

On a scale ranging from “no knowledge” to “very familiar”, about half of respondents are almost completely unfamiliar with the matter (49% combined for scores 1-2). Those with above-average knowledge on the topic are less than 1/4 (23% combined for scores 4-5).

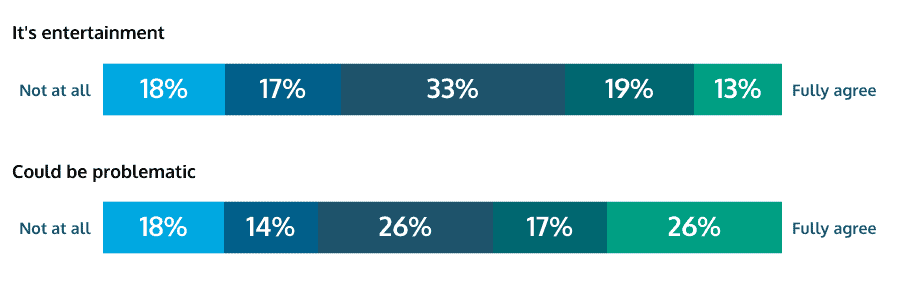

However, there were comforting responses to the question whether they agree that gambling is a form of entertainment – evaluated on a scale ranging from “not at all” to “fully agree”.

Most people concur that real-money games (should) serve an entertainment purpose – only a third (35%) opted for levels 1-2, disagreeing strongly or at least in principle.

More importantly, those who are aware that gambling can be potentially problematic – whether personally and/or socially – are even more than two thirds (68% for levels 3-5). Only 32% cannot foresee any potential problems arising for them of other players.

The Brazilian Senate has repeatedly discussed the political and social implications of legalizing various forms of gambling, particularly online games, casinos, bingos, even the “jogo do bicho”. Most legislators agree something needs to be done but are not sure how. Authorities and the general public are aware that in the absence of pragmatic steps player protection is not ensured and the quality of unlicensed operators is quite low. What is even more politically relevant, the economic spillovers remain abroad.

Responsible Gaming and Player Protection

We also asked Brazilians about possible experiences related to fraud or addiction. Only 12% reported any knowledge of such issues – either personally or in connection to someone they know. This is still a considerable rate but for a market that is not fully and properly regulated it is not unexpected.

On that note, 9% confirmed they have at one point been in some kind of support or counseling program. This is a commendable rate but is anticipated in a way, given the high awareness levels of Brazilians (see above) about the nature of real-money games and any potentially sensitive personal and financial aspects.

Responsible gaming (RG) is a critical aspect of the gaming industry. A coordinated national approach would involve a range of policies and requirements for all gambling stakeholders and ensure they respect the highest standards of quality and safe user experience. RG has proven effects in protecting players from potentially negative consequences. The Brazilian government seems to be working on developing and implementing such policies that create a safe and fair gaming environment.

How Players Shape the Gambling Market

Our analysis of primary survey data and previously published market studies have helped us establish a conclusive player profile for Brazilian real-money gamers. They are most likely to (be):

- in their upper 30s

- middle class, regularly employed

- well-educated

- live in a state capital or its metropolitan surroundings

- gender is unimportant

- play 2 or more games – the lottery, some sports betting, occasionally online casino games like slots or poker

- spend between 10 and 50 reals per month on games

- play half an hour daily

- have little knowledge about current regulations but grown up with the consciousness of responsible gaming

Just like us, other industry observers have also celebrated the rapid evolution of the Brazilian gaming market. Its future potential remains significant but requires a comprehensive understanding of player traits and needs, , as well as a commitment to responsible gaming practices.

Our study manages to outline a very specific and detailed player profile, including preferences, motivators and self-awareness within the complexity of real-money gaming in modern Brazil. Such evaluations contribute to improve market transparency and can be used by public and private stakeholders to address consumer concerns and optimize the regulatory framework.