This post is also available in:

Brazil is often seen as a dormant powerhouse in the gambling market. In the past few years, industry experts have pointed to signs of unlocking said potential, with changing attitudes and new regulations in sight.

While sports betting has already been (formally) legalized, further legislation is still debated upon. Authorities are considering opening up to most other forms of real-money gambling, including online and land-based casinos, as well as gaming cruise ships.

Demand for original content, localized platforms and dedicated customer service continues to rise. We already noted a similar macro trend in other big emerging gambling markets like India. Offshore companies are eager to get a chance to openly deliver more focused service to a user pool everyone strongly believes in.

Why We Chose Brazil‘s Gambling Market

Our team has a true passion for online gambling. Yet, despite our extensive professional experience, there is always a lot to learn and grow – by staying up to date with industry data, market trends, news and regulations.

We also have a commitment to industry transparency and fairness – the Brazilian market was chosen because of its marked advantages:

- Demographics: Brazil has a young, digitally savvy population interested in online gaming.

- Growth Potential: There’s significant untapped potential in the Brazilian gambling market.

- Evolving Regulations: Brazil’s iGaming regulations are changing, opening new opportunities.

- Gaming Culture: Brazil has a strong historical and cultural affinity for gaming.

- Economic Benefits: A well-regulated gambling industry could boost Brazil’s economy and all stakeholders working in the vertical.

This report aims to present a clear overview of the Brazilian gambling market – its current size and state, as well as its upcoming prospects.

An Overview – Size, Potential and Macro Trends

As the industry strives for legitimacy – meaning proper regulation, transparent funding and taxation, clear rules and incentives for gaming companies based in Brazil – market forces wait for no one. The country’s young and digitally savvy population has caused unprecedented growth in real-money gaming consumption.

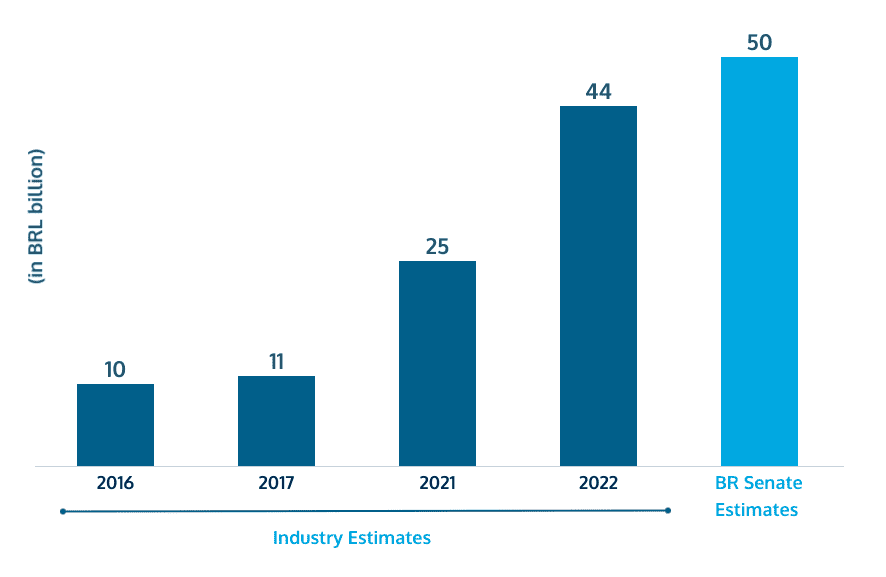

Based on a study conducted in 2016–2017, it is estimated that Brazil annually spends approximately BRL 2 billion on online casinos and bookmakers based abroad, potentially reaching BRL 10 billion. Academic sources translate that in BRL 3 billion in missed social contributions and taxes, potentially benefiting both the state and industry workers. In current figures, this amounts to a total market value of USD 2 billion, with a third of that contributing directly to the nation’s fiscal revenues.

Around that time, according to KPMG data in 2017, the Brazilian gambling market was estimated at around USD 2.2 billion, with approximately 60% (USD 1.3 billion) attributed to sports betting and 40% (USD 0.9 billion) to online casino, including popular games like poker and bingo. Notably, these figures excluded state lotteries and informal betting options, above all the national favorite “jogo do bicho.”

Four years later (in 2021), a survey by Globo became widely cited as a prominent insight into the Brazilian gambling market. Despite (or because of) the pandemic’s impact, sports betting alone had already reached BRL 7 billion (USD 1.25 billion) the year before, marking significant growth from BRL 2 billion in only a couple of years.

If the proportions between gaming genres referenced by KPMG are correct, the total market size at the time should be 3 to 4 times bigger – BRL 21-25 billion – when we include online casinos, lotteries and all other popular real-money games.

Local industry figures disagree with such estimates. The Brazilian Legal Gaming Institute (IJL) suggests that the numbers are even higher. In part, that is because prior to the legalization of sportsbooks, many survey participants were hesitant to disclose their gambling habits. The IJL reports that for every three gamblers in Brazil today, only one engages through legal channels. “Clandestine” gambling accounts for a staggering BRL 20 billion annually, compared to the official market’s BRL 14 billion.

Although these figures might have shifted in favor of legal online betting outlets since 2018, this would still amount to a market size of BRL 34 billion (back in 2017, according to the IJL).

Brazilian MPs spoke in the Chamber of Deputies (in 2021-2022) of roughly BRL 27 billion in illegal gambling and BRL 17 billion of legal gambling outlet turnover. This would make the market worth BRL 44 billion not so long ago.

And finally, there was a public Senate Bill No. 186/14 that addressed the legalization of various gambling channels, including “jogo do bicho,” video lottery, bingo, videobingo, casino, sports betting, and iGaming. Legislators cited studies that prove how, if not legalized, Brazil would potentially miss out on tax revenue of approximately BRL 15 billion.

To put this into perspective, the Senator that proposed the bill pointed out that the amount is five times greater than all revenues generated from taxing drinks, tobacco, cars, and fuels combined! More importantly, these figures value the total real-money gaming market at BRL 50 billion (or approximately USD 10 billion).

Although the above market estimates vary significantly – from BRL 10 to 50 billion (USD 2 to 10 billion) – it is likely that the actual market size falls towards the higher end of this range. Brazilian state lotteries alone reached a reported revenue of BRL 18.1 billion (almost USD 4 billion) in 2021, demonstrating steady growth of 8.2% even during the challenging years marked by the pandemic.

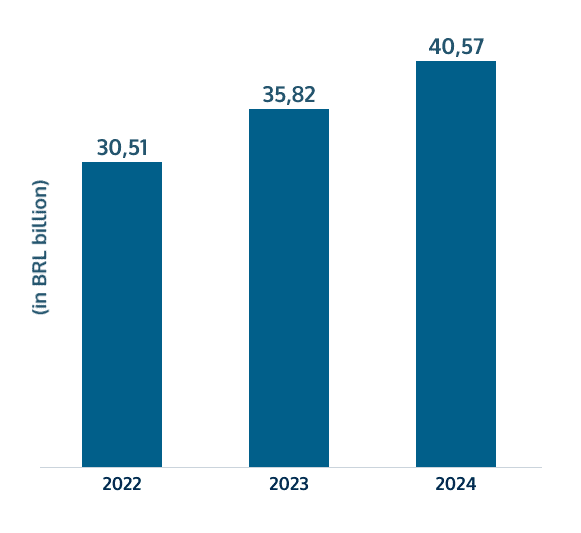

Furthermore, these figures may even underestimate the true market potential, particularly in the post-COVID era. The rapid digitization of society has transformed consumption patterns, resulting in a shift towards more virtual and mobile services, diversifying entertainment above all. Such trends have offset (and surpassed) any low-key expectations since the economic downturn of the mid-2010s. Predictably, a significant portion of the real-money gaming market is steadily transitioning to online platforms, and these are expected to become the dominant form in a few years’ time.

The Brazilian media and entertainment market also follows these macro trends. The national economy is the largest in South America and consistently ranked in the top 10 globally. It is also expected to prolong its current “vigorous employment growth”, with resulting positive impacts on disposable income and closely related demand for real-money online entertainment.

This enables the iGaming sector to invest in Brazil and become increasingly competitive. Its growing visibility is also the result of more and better online advertising and improved brand positioning.

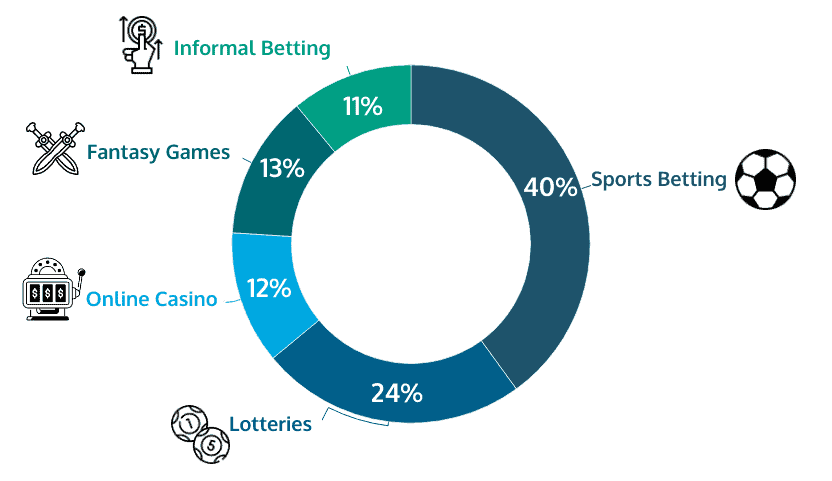

A large chunk of the promotional push goes towards sports betting, inevitably. However, a significant portion of Brazilians play the lottery (with some draws also available online), followed by fantasy games (free and paid) and online casino and online bingo. See more on these shares further down.

According to the Globo survey quoted above, online casinos are already half as popular as state lotteries. What is concerning, however, is that informal and unregulated gambling is practiced by nearly the same number of Brazilians as licensed online casinos. The so-called “low channelization” is a sign of a market that has not yet reached maturity and needs further attention by authorities and industry experts.

Brazilian Real-Money Player Pool and Basic Game Preferences

Recent industry surveys reveal that as much as 2/3 of Brazilian adults participated in real-money games at some point last year. That means approximately 106 million people (out of 160 million adults in the country) have a favorite paid game of chance or skill.

As for game preferences, an estimated 74 million engage in sports betting, while 46 million choose lottery or bingo. Even by conservative estimates (e.g., half of lottery players) there are still 23 million fans of online casino.

Clearly, the above user shares overlap as players are active across various game categories. More importantly, the gross figure is largely confirmed by other industry reports, placing Brazilian gamers at just under 103 million.

In line with earlier mentioned trends, real-money games have been increasingly internet-based. The same national surveys found that the overwhelming majority (86.43%) of sports bettors play online (through both websites and apps).

There are many types of sports bets – depending on athletic discipline above all but featuring numerous betting markets, systems and so much more. That brings them closer to skill gaming as well as to fantasy league competitions.

Lotteries are simpler and are defined by state and national guidelines and rules. Yet they are all about guessing a sequence of numbers.

The real-money gaming category that is the most diverse is (online) casino, without any doubt. Its fans are also among the most loyal – over three quarters play regularly (78%).

However, they are split between casino classics like roulette (78%), blackjack (66%) and video poker (61%); other table games (64%, e.g., baccarat); and quick-play genres like slots (63%) and crash games. Reportedly half of all players prefer live-dealer casino settings.

You can read more about game preferences in our comprehensive user profile study for the Brazilian market.

A Brief Recent Chronicle of Brazil’s Gambling Market

The history of real-money gambling in Brazil has been tumultuous, with various laws impacting its development. Lotteries and horse race betting have been the only consistently legal forms for decades.

Underground gambling emerged after near total bans of other forms in the 1940s. The Zico Act of 1993 partially liberalized bingo halls and slots but authorities backtracked a decade later.

Finally, in 2018, Federal Law 13.756 allowed sports and fixed-odds betting. Nevertheless, there is still no specific regulation for locally operating bookmakers and there are not even framework laws for other real-money games like casinos.

This compels reputable online gambling companies to operate under foreign licenses. In fact, among G20 countries, Brazil, Saudi Arabia, and Indonesia are the only three where gambling remains unregulated or prohibited.

Gaming Culture Boosts Industry Prospects

The gambling landscape in Brazil has gradually and inevitably evolved. In the imperial period, casinos served as meeting places for the aristocracy and the well-to-do. Games like roulette were true entertainment.

Brazil’s own “jogo do bicho“, the most popular betting game, has been played for over a century (since 1892 at least), becoming a misdemeanor only in 1941. To this day, more than 20 million Brazilians engage with it daily.

The state itself, through Caixa Econômica Federal, exploits numerous lotteries – Mega-sena, Lotofácil, Quina, Lotomania, Timemania, Dupla Sena, Loteca, Dia de Sorte Super Sete and others. All of these generate substantial revenues and have become a social custom for millions. Local authorities have also recognized the segment’s profitability and have shown increasing interest in launching their own real-money games.

The reality of Brazil’s solid gaming culture offers a long list of reasons to adopt a broad regulatory framework. It would set industry standards (for public and private actors), protect consumers, and allow only licensed operators to play a role in the market.

Since sports betting was formally legalized in 2018, the industry has experienced a boom in player interest and turnovers. Despite little further developments in terms of precise rules and licensing or incentives for gaming tech startups, sports betting has surfaced massively in popular culture and mass media.

In the Série A (the top-level football league), 19 out of 20 teams have sports betting houses as main sponsors. In total, there are over 400 betting websites operating in Brazil. Unfortunately for the nation’s treasury, both online casinos and sportsbooks, are based offshore, as we have seen above.

In the meantime, jogo do bicho bookies (known as “bicheiros”) have also started accepting bets on football matches. The Getulio Vargas Foundation (FGV) estimated losses of around BRL 30 billion in taxes alone. The risks that players take by trusting unlicensed operators are not even considered in most cases.

Given the evolving societal attitudes, market experts were hopeful that the upcoming government (now current) would introduce the much-awaited legislation. The Chamber of Deputies has confirmed the intent to regulate the entire real-money gaming industry, approving a law legalizing online gambling, horse racing, land-based casinos, bingo, and even “jogo do bicho.” It included:

- A regulatory body for oversight, licensing, and taxation

- Only licensed operators allowed to operate online

- Safe gaming measures such as age restrictions and bet limits

- Blacklists for illegal operators and abusive players

- Companies being required to fund Responsible Gambling campaigns and treatment programs

- Gambling revenues going to support social programs, education and healthcare.

Unfortunately, the Senate blocked the law but indicated the subject as needing further work.

Ultimately, regulating gambling is crucial to prevent revenue loss and control harmful aspects. A Portuguese study highlights the role of regulations in overseeing legitimate demand (known as “channelization” towards legal platforms), controlling illicit practices, and maximizing fiscal effects for the public good. Examples from the European Union illustrate how liberal regimes keep private operators in check and boost foreign investment.

What Drives Real-Money Gamers

According to the Globo survey, the majority of Brazilians (67%) see online gambling and betting as entertainment. It is a business opportunity for 43% and a sport in its own right for 38%.

The main drivers for sports betting are fun, income, and social connection. However, only 13% engage in it in order to interact with friends, and only 12% rely on it as a primary source of revenue.

Trust and positive experiences (54.2%) play a significant role in attracting new players. Recommendations of friends provide the necessary sense of security for 78%.

Next in importance are secure connection certificates (54%), positive reviews from specialized sites (49%), prominent partnerships (41%) and licensed operations (41%), showing that Brazilian players often dig into technical and legal aspects.

Surprisingly, media coverage and public visibility count somewhat less but are still key to new players. Whether a platform is supported by given clubs or athletes (36%), gets exposure on TV (28%), sports websites (27%), or outside mainstream media (21%) is convincing to quite a lot of Brazilians.

Recent industry surveys also confirm the primary drivers for real-money gaming in Brazil – the monetary factor on top with 54%, followed by excitement with 42%. More than a third (36%) agree that placing a wager enhances the event itself. As much as 41% of Brazilian adults perceive real-money gaming as a competition, while for 25% it is a hobby.

Among information sources related to sports betting (in particular), 56% of respondents rely on sports TV shows, 40% use social media groups, and 36% follow industry experts. About a third (32%) make use of specialized data and reports for their betting strategy, while 32% listen to friends and family, and 30% trust influencers.

Naturally, there are some aspects that dissuade people from wagering money on games of any kind. The biggest turnoff (47%) is the fear of losing money. With 25%, Brazilians have the highest levels of awareness and concern among all LATAM countries that gambling and sports betting might get addictive. Other reasons to avoid real-money games include the lack of game knowledge (18%) and the uncertainty of the potential winnings (15%).

App-Based Games vs Mobile Sites

Sports betting easily ranks above all other real-money games, partially because of the Brazilians’ love for football. Yet they also follow (and bet on) volleyball, basketball and American football, to name a few.

Sports betting is roughly twice as popular as online casinos. Lotteries come close second but they are often distributed offline and count little in terms of online traction.

Many casino operators offer downloadable apps but with the evolution of light and responsive platforms many players simply log onto the mobile site from their smartphone. This is particularly common among online casinos.

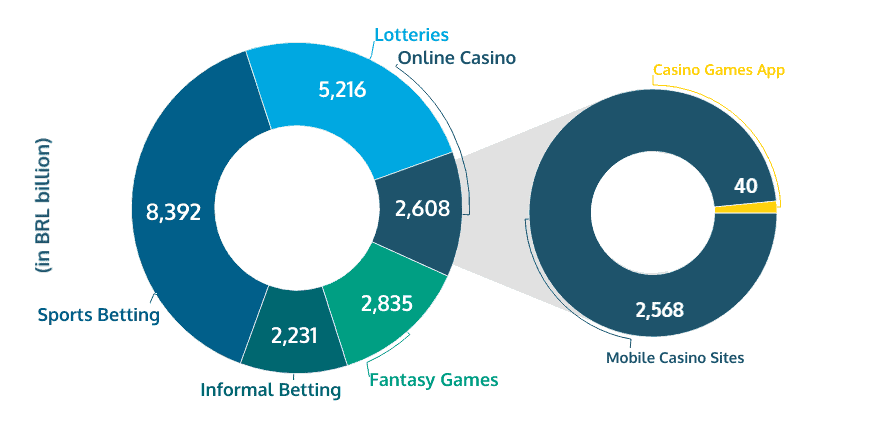

If we only look at online revenues generated by online casino game apps, these are infinitely less compared to the total market niche:

Statista values the mobile app market size for casino games at anywhere between USD 35 and 40 million at present. What is more, roughly half of the casino app revenues come from advertising, the rest is in-app spending. In total, this amounts to barely 1.53% of the online casino market value in Brazil, even by moderate industry and political estimates.

These figures are low exactly because of the nature of the mobile gaming platforms, with limited availability of app-based casino games (both classic and new-age). The only ones included are poker (34%), bingo (16%) and some stand-alone slot apps (10%).

Online casinos have largely shifted away from app-based distribution models. Multi-game apps are less frequent in the niche, unlike sports betting apps. Mobile-site based casinos are prevalent especially in unstructured markets (e.g., emerging and unregulated like Brazil or India). They fill the gap between the high churn rates and the sheer volume of demand for real-money games.

Put simply, users visit casino sites, play and move on. If they are satisfied, they come back but rarely seek to download multiple apps.

A Broader Digital Landscape

The growth of online entertainment in Brazil is driven mostly by the nation’s young and tech-savvy population. Only 10.3% of the population is aged 65 and above, while 82.3% is between 13 and 64 years, considered digitally active individuals interested in gaming and sports.

Moreover, Brazil has an 81% internet penetration rate, totaling 173 million users, and ranks 5th globally in total mobile connections with 206 million. This indicates a well-developed digital infrastructure and widespread access to digital services and communication.

In major metropolitan areas like São Paulo, Porto Alegre, Curitiba, Rio de Janeiro, and Belo Horizonte, 5G connectivity has seen full rollout. Higher average speeds in densely populated zones coincide with the residence of most mobile users – over 87% of Brazil’s population lives in urban areas.

Recent surveys indicate that 37% of Brazilian consumers use the internet for online gaming, while 25% prefer downloading games. Other sources suggest that up to 45% of online users engage in gaming activities regularly.

Industry studies targeting gaming fans found that up to three quarters (74.5%) confirm they play “frequently” and, as we saw above, mostly online.

Mobile industry reports focusing on Latin America emphasize the growth of Brazil in in-app spending (by 20% in 2022). Brazil tops the regional market with 10.6 billion app downloads and comes 4th globally for overall app adoption, behind China, India and the USA.

In such a dynamic tech-driven context, it is important to emphasize the enormous demand for native and original content that emerging economies generate. The gaming industry is wise to the fact that content which resonates well – culturally, generationally and socially – can unlock the market’s potential.

Development Prospects of the Brazilian iGaming Tech Industry

“Niche” competences like content localization, sound design, monetization, and gamification play key roles in creating engaging game-related content that attracts millions daily. New-age phenomena such as Virtual and Augmented Reality (VR/AR), open-source broadcasting and live game streaming are now commonplace entertainment.

To succeed in highly competitive globalized markets, the entire gaming vertical – developers, providers, operators, tech and marketing support – need to have favorable business conditions in Brazil.

The national game industry is indeed experiencing constant growth, with over 1,000 active studios (triple the amount in 2018) and more than 12,000 workers. In 2021, these surpassed USD 2.3 billion in revenues, with 57% coming from abroad. Success stories include the likes of Wildlife Studios, becoming the first Brazilian gaming unicorn (valued at USD 3 billion in 2020).

Inevitably, the industry faces challenges as well. Small independent companies struggle to emerge, relying mostly on internet stores such as Steam, Apple Store and Google Play for survival. Bureaucratic obstacles are also not uncommon.

Collaboration within industry bodies is one way to foster local growth and export opportunities. Most market experts agree, however, that Brazil’s gambling industry would benefit, above all, from a clearer legal framework and development incentives.

Well-defined long-term perspectives will attract investments and help establish iGaming as an important economic sector. While Brazil has made progress in legitimizing sports betting, the lack of laws covering online casinos and other online real-money games leaves an immense market unregulated and untapped.

Enhancing the Gambling Experience

Operators in Brazil need to look into improving the real-money gambling experience in terms of platform transparency and content localization, as well as by ensuring better overall user awareness.

Across the studies cited above we see the desire of players for faster payouts (53%) and updated game statistics (43%). Nearly half (44%) ask for more live games while those betting on sports believe that offering some technical analysis and post-event commentary would improve their experience (35%).

Localization remains a key factor – lower English proficiency compared to other globalized markets stresses the importance of native support and local context. Brazilians appreciate references to their culture, such as including Brazilian football teams and Carnival outfits in games.

Responsible Gaming to Safeguard Players and Industry Growth

Responsible Gaming (RG, also known as Safe Gambling) is also a pillar of any enjoyable real-money gaming experience. Ever since the sector’s regulation entered the public discourse, RG has been considered the key to meaningful legislation.

Earlier academic research (2010) indicates low rates of problem gambling among Brazilians (1.3%) and even lower for pathological gambling (1.0%). Risk factors include being young, male, unemployed or not pursuing further education, especially in metropolitan areas which have increased exposure to gambling opportunities. On the other hand, being active and feeling socially connected helps avoid problem gaming.

This is where authorities, operators and providers come into play – full industry transparency matters the most, as well as collaborations with RG advocates, support groups and treatment programs. Helping player awareness through an RG policy is just as important as integrity agreements with athletes, teams and consumer associations working to prevent match-fixing and game fraud.

A safe gaming environment protects players and promotes industry sustainability. A national RG strategy must underpin essential market dynamics and public priorities:

- Protect minors and vulnerable users

- Establish RG tools that empower players and ensure safe gaming

- Enhance industry transparency through verified providers (e.g., game mechanics, payments), licenses and audits by authorities and consumer groups.

We will dedicate a separate case study on the importance of Responsible Gaming policies and tools.

Conclusive Remarks

Our report establishes the significant potential and continuous growth of Brazil’s Gambling Market. Driven by a young and digitally engaged population, the gambling market simply exploded after the legalization of sports betting. Mobile platforms are highly popular among local gamers, with sports bets standing out, followed by online casinos and lotteries.

At this point, a comprehensive regulatory framework is crucial to ensure consumer protection, prevent revenue loss and promote responsible gambling practices. Secure and licensed operations can provide a safe and enjoyable gaming experience and help the industry attract and retain players.

This will also boost Brazil’s digital economy, creating employment opportunities and allowing game tech companies to exploit the local market before measuring up to global competition.