This post is also available in:

The Peru gambling market is one of the few in South America that is fully regulated. It took legislators and gaming companies over four decades to take the industry to where it is now. It is safe to say that, today, real-money games enjoy the recognition of a considerable share of Peruvian adults, with both land-based casinos and online betting as popular options.

Our study provides a detailed review of the figures and socio-economic trends that distinguish the gambling market in Peru. We also take a look at the history and evolution of active regulations, as well as some of the main traits of real-money players in the country.

Peru’s Current Gambling Market Scope and Growth Projections

The gambling sector in Peru has seen decades of legitimate economic operations, mostly through classic verticals like lottery draws and slot machine parlors. Online gaming had modest shares until the mid-2010s when rising internet penetration started having an impact.

That particular trend saw a boost after the COVID-19 pandemic, as the entire online entertainment macro sector experienced beneficial transformation. Online gambling is further driven by mass technology adoption and finally a fresh regulatory framework (see below).

Estimates of market size and industry developments include both online and land-based gambling channels. We take a look at available data for separate macro segments, namely online casinos and sports betting, as well as in-person gambling options like slots, lotteries and casino facilities.

Traditional Games of Chance

Lotteries, along with related and derivative real-money games like bingo, scratch cards and keno, are well-known traditional gambling formats in Peru. The nationally prominent “La Tinka S.A.” stands out among lottery operators, with products like Gana Diario, Kábala, Raspaditas and Kinelo in addition to the top household name La Tinka. (The parent company also runs sports betting under the Te Apuesta and Ganagol brands, as well as “quick-play” games through its Casino, RaspaYá! and Deportes virtuales).

The nostalgic appeal of old-fashioned lottery games still draws millions in Peru, even if it is less pronounced in younger generations. There are at least ten additional licensed companies administering lottery draws with national coverage.

University studies show that around the turn of the century (1999-2000), Peruvians were spending approximately USD 50 million on lottery tickets and around USD 100 million on casino and slot games each year. Fast-forward two decades – industry figures reveal that by 2019 La Tinka ticket sales had grown to USD 314 million, dropping to USD 256.7 million in the first pandemic-affected year.

Land-based (Offline) Gambling Sector

As of 2020 Government reports, the offline gambling sector in Peru had an estimated 327 active operators. The overwhelming majority – three quarters – were concentrated in and around the capital Lima.

Even more detailed industry figures are cited – real-money games were available across 744 gaming venues (accommodating 83,826 slot machines and 256 tables). Right before the pandemic, these were reportedly employing 87,000 people directly and another 25,000 indirectly. Gaming industry publications indicate annual turnovers of about PEN 3.711 billion (roughly USD 1 billion). Tax revenues alone were exceeding PEN 500 million (USD 135 million).

Peruvian authorities (and industry associations) traditionally consider in-person gambling facilities separately from online gaming platforms. Interestingly enough, when public consultations were held with industry stakeholders prior to the recent regulatory shift, only 29 online operators were identified as based in Peru.

Peru’s Online Gambling Sector

The rise to prominence of online gambling options is unmistakable across Latin America, and Peru makes no exception to that trend. A broad spectrum of options is currently available, mirroring post-pandemic realities elsewhere. In addition to the above number of domestic iGaming operators (29), authorities counted another 86 active in Peru despite being based offshore.

Online sports betting has been the biggest driving force behind this expansion. Football in particular has captured roughly 90% of that vertical, followed by basketball and eSports.

Fintech solutions (including cryptocurrency payments) and technological innovations have rendered the Peruvian online gambling scene safer, more transparent and more “global”, in various ways.

Conservative estimates project 2024 online sports betting market volumes around USD 169 million, while total online operations are cited at USD 315 million (and growing at 6.4% annually at least until 2028).

The Ministry of Foreign Trade and Tourism (Mincetur), traditionally overlooking the sector, disagrees with such figures. Early 2022 estimates placed the online betting market at around USD 1 billion in 2022 (PEN 3.8 billion). Post-World Cup figures showed that the actual turnover was about 20% higher, boosted by the global sports forum – around PEN 4.5 billion (USD 1.2 billion).

In the end, the latter figures seem to be the new norm. Academic studies point out that 2020 online gambling turnover also reached PEN 4.5 billion at a rate of 150,000 average daily bets. Evidently, the Peruvian online gambling market has been rapidly fulfilling its potential, partly because of the digital transition and partly because of the new outlook on regulation.

Mincetur officials confirmed that the main goal of recent legislative efforts was to license and tax foreign online gaming operators under the same conditions as national platforms. In fact, Peru was the third country in South America to openly and comprehensively regulate iGaming, behind Colombia and Argentina (albeit in 3 provinces only including Buenos Aires). Brazil joined its Western neighbors in December 2023 to become a regulated gambling market.

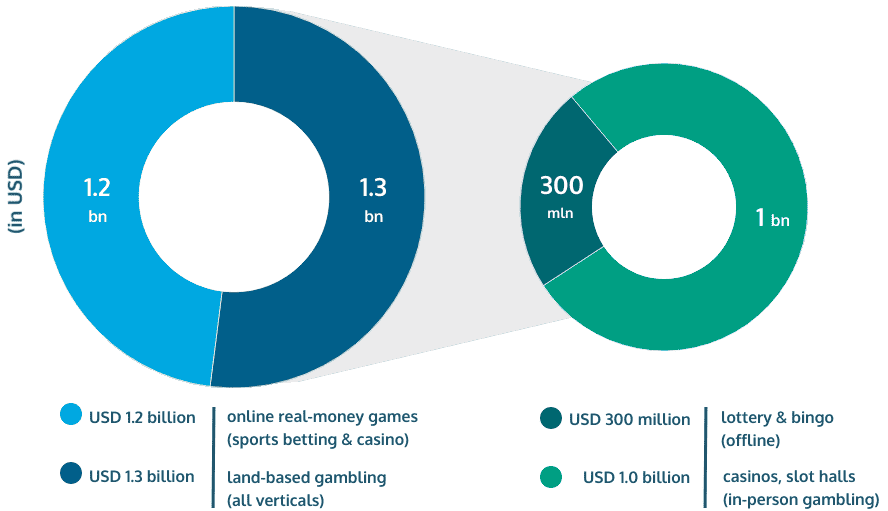

Total Peru Gambling Market Size

Ultimately, a comprehensive market figure emerges:

- If we consider iGaming operators, the majority offer both sports betting and casino games under the same website. Even if this is a cautious (and momentaneous) estimate, we can safely concur on the USD 1.2 billion mentioned above.

- To that amount, we need to add USD 1 billion from land-based casinos and in-person gambling facilities.

- Due to the enduring popularity of traditional gambling forms – lottery and bingo, above all – the roughly USD 300 million from 2019 also seems a reasonable annual turnover. Although less than half compared to casino revenues (a ratio we saw reported around 2000), it reflects current dynamics and we would expect them to lose market shares in relation to fast-play or immersive iGaming verticals.

Altogether, this takes the total market size to around USD 2.5 billion. This amount includes practically all real-money gaming verticals and reflects the sector’s imposing current stature. But it also gives us an idea of its impressive potential for further expansion in light of the fact that these are pre-regulation figures.

The Evolution of Gambling Regulation in Peru

The new regulatory framework entered into force in February 2024, transforming the gaming landscape profoundly. The big difference has been the clear shift of focus to online gaming verticals, with sports betting as the poster segment.

The latest gambling laws mandate operators to conform to updated technical standards and certification requirements. Crucially, it allows existing operators to seek authorization without ceasing their operations, while new entrants must obtain regulatory approval before commencing activities.

Operators need to appoint a local legal representative responsible for managing administrative, legal and technical procedures to secure approval. More importantly, a short transition phase should lead to a technically and ethically compliant online gaming market in Peru.

The Role of the DGJCMT

The Directorate General of Casino Games and Slot Machines (DGJCMT) is an important executive body within the Mincetur. It is the authority that oversees licensing, compliance and enforcement of gambling industry regulations. This authority is instrumental in monitoring the market, ensuring adherence to legal standards, and fostering a safe gambling environment.

As per declared priorities of Peruvian legislators, the DGJCMT currently has three main objectives:

- Ensuring player protection (e.g., consumer support and risk mitigation policies)

- Raising the gaming quality (e.g., welcoming innovation);

- Implementing regulations (e.g., legal and tech standards for safety and transparency).

Such an approach is seen as the only way to provide a sustainable future for a market set for inevitable growth.

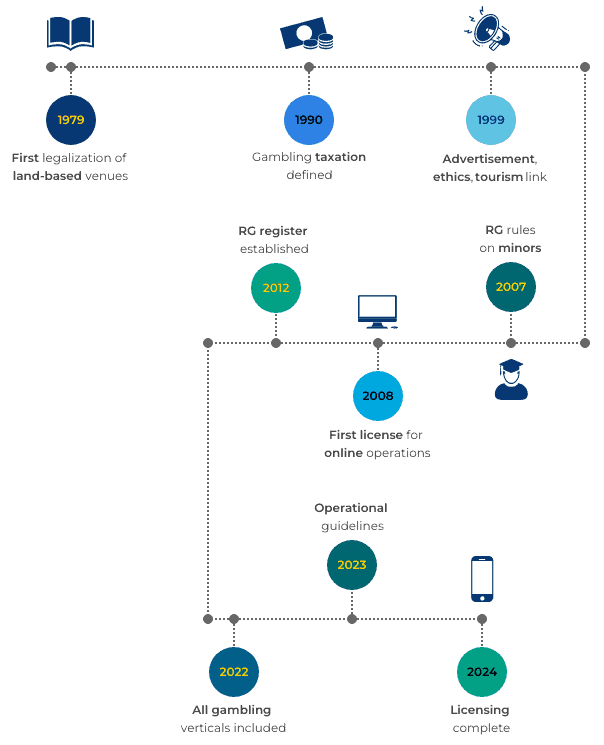

Brief History of Peruvian Gaming Laws

Peru’s gaming regulation journey began in 1979 (with Decree-Law No. 22515 aimed at legalizing land-based gambling establishments). The move provided the impulse for a wave of casinos nationwide. Local and international investors joined the gaming market, many tapping into the potential of gambling tourism.

Over the years since then, the DGJCMT and Mincetur have tried to update and adapt the legal framework to global trends and market demands. Some of the regulatory milestones include the Legislative Decree No. 608 of 1990 (on taxation formulas for gambling operations), and the Law No. 27153 (on ethical and promotional guidelines for gaming establishments, while preserving tourism potential) amended by Law No. 27796 in 1999.

Online real-money gaming was only considered for regulation nearly a decade later, with the spread of and growing access to the internet. The first license for online casino operations was issued in 2008.

Significant changes related to responsible gaming (RG) policy were made in 2007 and 2012, laying the groundwork for modern iGaming regulation.

In fact, Peru had never (explicitly) forbidden online casinos operating on the market. The rationale has always been that if offshore platforms were to meet standards set by authorities for domestic operators, they would be eligible for valid gambling licenses.

The largely permissive approach has seen the market entry of numerous brands (at least 115, see above), with some globally prominent names active in the country for years.

Current State of Peru’s Gambling Regulations

In response to growing demand and continuous expansion of the market, Peru took concrete steps to ensure effective taxation of gaming operations. The need to maximize public benefits was the starting point of seeking better gambling regulations.

With the passing of Law N° 31557 and its amendment, Law N° 31806 in 2022, most gambling verticals were included under a comprehensive legal framework. In 2023, the Supreme Decree N° 005-2023 provided the enactment of these laws through detailed operational guidelines for online sports betting and a range of real-money gaming services.

The ordinance (i.e., specific regulations) stipulates that online casino operators need to have a valid gambling license from the DGJCMT to be able to provide iGaming services legally. The rules also list means, channels and standards for obtaining and maintaining legitimate operations.

The licensing process was initiated in mid-February of 2024 and remained open for a month. The initial emphasis was on short-term compliance, with penalties for non-adherence ranging from fines (i.e., up to USD 260,000) to permanent market exclusion.

Foreseen Effects in Peru’s Gambling Market

As already emphasized, the main concern of Peruvian authorities was ensuring a level playing field between domestic and foreign operators, mainly in terms of taxation. That aspect is pivotal and the 12% taxes on net profits enter into force starting April 2024 for all companies that manage to obtain a license.

The anticipated outcomes are seen as decisively positive and often widely publicized by the Mincetur – increased government revenue, enhanced consumer protection through responsible gaming measures, and economic growth via legitimate job creation and an influx of investments. Without a doubt, a transparent approach which includes awareness-raising campaigns is the preferable way to go about implementing such sensitive legislation.

Authorities have also formally committed short-term redistribution of gambling tax revenues (of around USD 44 million) for public services related to tourism, sports, and mental health initiatives. Longer-term plans include more support for education, healthcare and social programs.

For gaming industry stakeholders, the true value in such regulations is the opportunity to invest and operate legitimately and sustainably, with a comfortable planning horizon. Crucially, the recent updates to the regulatory framework include a diverse array of real-money gaming verticals, channels and operation models.

More specifically, despite the public emphasis (and media focus) on sports betting platforms, the recent regulatory debate has always included online casino games. Virtual gaming options have been indicated as including games which are outside the scope of physical gambling facilities. A broader range of online gaming experience is projected to halt the outflow of economic activity to offshore websites and possibly attract additional foreign consumers.

Lastly, the dedication of more efforts, standards and funds toward societal benefits is not a burden for the sector. Quite the contrary, the responsible gaming paradigm has been proven to help drive markets to full maturity and produce sustainable benefits for both businesses and consumers.

Gambling Culture in Peru – Approval within Ethical Boundaries

The formal recognition of the entire gambling spectrum marks a conscious move toward bridging a gap between legal reality and market demand. Thus, Peruvian legislators acknowledge what already exists within the country in terms of gaming culture and real-life consumer practices.

The challenge is to conciliate the maximization of public economic gains (tax and employment) with the intangible benefits of ethical gaming practices.

Societal Insights

University research on casinos in Peru shines more light on the nation’s perception of gambling. Analyzing habits, financial commitments and wider public assessment of the segment, the study focuses particularly on “exclusive” gaming halls.

The findings outline a somewhat negative reception of real-money gaming, especially in such contexts and toward potential high-level clients. That kind of feedback persisted mainly because of certain public expectations related to ethical values and corporate responsibility. Concrete concerns listed money laundering, unethical operator practices and gaming risk (i.e., problem gaming or addiction potential).

On the other hand, most of the conclusions underline the potential for improvement within the gaming industry. Recommendations included public image improvement and prioritization of ethical practices and service quality. Such strategies would suggest that by addressing these concerns – often ideological but largely amendable through Responsible Gaming tools, industry standards and policies – the sector has always been expected to fulfil its potential for legitimate growth.

In this sense, industry associations like SONAJA (National Society of Games of Chance) and APADELA (Peruvian Sports Betting Association) have always taken a proactive stance. They have welcomed more sector transparency, expressed willingness to adapt to new legislations and sought effective communication with regulators and the public at large.

Player Pool, Profile and Preferences in Peru’s Gambling Market

The market growth and maturity which come with regulatory stability are also expected to diversify the player base, reaching out to new demographics and social circles. Market studies estimate the average revenue per user (ARPU) at an annual USD 502.20 for Peruvian online gamblers in 2024.

Market penetration is projected much more conservatively by the same source, at barely 750 thousand players by 2028. The multiple official sources that cited earlier on total market size should enable us to provide a more precise estimate of the player pool.

If the roughly USD 500 assesses truthfully the annual spending of real-money gamers in Peru, then the USD 2.5 billion turnover is likely generated by around 5 million players. Out of around 24 million adults in Peru in 2023, that takes market penetration slightly above 20% – a number sensible enough, even without accounting for the optimistic growth trajectory for iGaming in the coming years.

Demographics, Gaming Habits and Regional Trends

The complementarity between online and land-based gaming establishments covers a wide scope of demographics, socio-economic profiles and regional adoption levels.

Still, industry surveys have managed to uncover some general traits of the typical gambler in Peru. Highlights include:

- 21% of Peruvian adults engaged in some form of gambling in 2021 – confirming our estimates above.

There was a somewhat higher propensity to gamble in provinces (23%) compared to the capital Lima (20%). Perhaps unsurprisingly, digital betting options were preferred in Lima while physical gambling locations were favored in other provinces. Lima residents also focused their expectations on security and ease of payment while elsewhere users evoked customer service and potential winnings as leading motivators.

- The demographic profile indicates a male dominance (70%)

- The 25-to-40 age bracket makes up 56% out of the total player pool.

- In terms of gaming choices, football bets clearly have the biggest share. However, there is unmistakable growth in casino games and novel genres like eSports, especially among younger Peruvians.

To get more insights into spending habits, we need to refer again to the study done by graduate researchers at the Pontifical Catholic University of Peru seen earlier, albeit done in land-based contexts.

- Players usually allocate 1 to 3 hours when they visit casinos.

- In terms of spending, most Peruvians are cautious gamers – 47% indicate they spend under PEN 100 (~USD 25), while 41% are willing to spend between PEN 100 and 300, a more dedicated but still moderate spending pattern for an in-person gambling experience. Only 2% would spend more than PEN 500 during a day’s gaming session.

Economic Development and Collateral Factors

Over the past two decades, Peru has achieved remarkable economic growth, significantly reducing poverty levels and transitioning into a middle-income economy. Per capita income rose to over USD 7000 in 2022 from only USD 2000 twenty years earlier.

For the purposes of our analysis, beyond macroeconomic indicators, these figures mean that adult Peruvians have recently enjoyed greater amounts of disposable income. Proportionally, that also means more funds available for discretionary spending such as entertainment, including paid gaming.

The scope of the booming gambling market is seen from the turnover estimates and tax revenue projections (above). Even more clearly, it is evident from reports on the growth of the player pool. Academic sources cite 2 million online bettors in 2019, rising sharply to 5 million in 2020 and up to 6 million in 2021.

These figures check out with our own assessments (around 5 million), even if the big picture is a little more complex to describe. Many of these gamers have probably transitioned from offline and in-person games – partly due to the pandemic period and lastingly because of constantly rising adoption of technology (i.e., affordable mobiles and better internet access).

Inevitably, a further boost has been given by the incoming gambling regulation. More market transparency and expected player protection can only have beneficial impacts on the industry.

Big sporting events provide extra incentives for casual Peruvian bettors. Yet, the total gamer pool always tends to stay at higher levels rather than come down afterwards.

Peru’s Technology and Digital Infrastructure

The largely predictable digital transition can also be tracked down via public statistics. Currently, around 25 million Peruvians have internet access, which translates in roughly a 75% penetration rate. Going back to 2010, when barely a third of the population had internet access, we can see the remarkable progress made.

Social media usage is approximately at the same level, while mobile connections have gone above 40 million, surpassing total population figures (117.1% penetration).

Still, the digital divide persists for around 9 million people who remain offline across the nation. Improvements in digital infrastructure are crucial for social and economic growth. Even more, they impact online gaming directly and decisively – technological adoption rates provide the foundation for innovation and market expansion.

E-Banking and Financial Inclusion in Peru

Mainstream payment methods like credit cards and bank transfers are reminiscent of a more traditional transaction landscape. Their lasting popularity underscores the demand for familiar and secure payment methods.

Big steps to eliminate unbanked adults have been taken as recently as 2020. Then-President Vizcarra promoted an initiative to open digital deposit accounts at the National Bank for all citizens lacking one. The move was both a response to remote payment needs in a pandemic context, as much as a milestone in financial inclusion.

Higher banking rates also have significant direct benefits for sectors like digital entertainment and iGaming in particular. eBanking enhances payment options and expands market accessibility, ultimately fostering growth across various consumer segments.

Looking at the other end of the development spectrum, the Peruvian fintech market has consistently responded to global trends. A prominent payment solution is PagoEfectivo (founded in 2009 and currently owned by PaySafe) which offers payments through reference codes for both online and offline clearance. It has been adopted by the majority of banks and over 140,000 points of sale.

The Electronic Clearing House of Peru (CCE) has also analyzed the efficiency of systems like Pix and the impact it has had on the entire Latin American market. As a result, the CCE has elaborated plans to launch its own instant payment clearance system.

In any case, the CCE has already performed a series of upgrades to its real-time payment systems, enabling fintech solutions to nurture greater financial inclusion. As per CCE data, Peru is home to at least 120 fintech startups, while private consultancies estimate them at 171 in 2021.

Embracing the iGaming Future

The present state of Peru’s gambling market is a testament to the nation’s commitment to efficient regulation and constant innovation. Gradually but surely, the real-money gaming sector has been maturing. The latest legislation accommodates both traditional venues and the thriving iGaming scene.

Our analysis has revealed the multiple nuances of the Peruvian gambling market’s economic and social implications. Already at impressive volumes, the sector needs the right blend of proper regulation, technological innovation and financial inclusion.

More importantly, the key to sustainable support from the very consumer pool lies in greater industry transparency and a responsible approach to player protection. Judging by the recent developments, Peru has made a series of smart moves, mostly in the right direction.