This post is also available in:

Mexico’s gambling market is dynamically evolving, positioning itself higher up in global industry rankings. Driven by a fervent passion for sports, especially football, and an expanding digital infrastructure, the country is witnessing a surge in online gambling and gaming. Still, challenges like outdated regulations and the unchecked dominance of offshore operators persist.

This study examines the vast potential of Mexico’s gambling market, underscored by a rich gaming history and a young, tech-savvy population. We will explain why and how the Central American nation is turning into a focal point for gambling industry stakeholders around the World.

Mexican Gambling Already on the Big Stage

The current size and unmistakable potential of the Mexican gambling market has made it pivotal to the strategies of many industry stakeholders. The sector’s transition to maturity in one of the world’s most exciting emerging markets has brought visibility to Mexican gaming customs, regulations and technological preparedness.

Already considered a real-money gaming hub for Latin America, Mexico’s offers formal licensing of consumer-oriented gaming services, even to foreign companies. This has led to a wide array of gambling options, especially in the sports betting segment.

Still, current regulations cater mostly towards traditional and land-based forms, urging some legislative modernization. The latter is also true for market oversight mechanisms and possibly a more flexible taxation structure.

Despite these limitations, the growth of online gambling platforms on a global level (and especially in the neighboring United States since sportsbook regulation in 2018) has significantly enriched the options and channels for Mexican gamers. The leading online gambling operators have dedicated an ES-MX version of their sites and have started exploring the nation’s gambling culture, consumption models and habits.

Industry associations summarize thus the Mexican gaming market’s strengths:

- License availability, practically unlimited.

- Broad range of real-money gaming product offering.

- Ability to advertise gambling services.

And challenges:

- Outdated laws primarily focused on physically-present gambling.

- Relatively high tax burden.

- Lack of market integrity measures.

Mexico Gambling Market: Size, Growth and Potential

Mexican gamer pool estimates and projected growth.

The Mexian gambling landscape’s significant evolution has often been hard to estimate precisely. Even back in 2016, however, some specialized financial outlets settled on a sizable figure for the online gambling market – USD 2 billion. However, according to the Association of Permit Holders and Game Providers (APJSAC), most of that amount (90%) was channeled towards offshore and unlicensed operators.

A year later (2017), the casino market as a whole was assessed to be worth as much as USD 10 billion. The online segment was still accounting for only USD 500 million of that, industry experts claim.

Mexican market consultancies estimate that in 2019 adult gamers in Mexico spent approximately USD 1.84 billion on paid games (over MXN 32 billion), notably surpassing the revenues of the national film industry.

Around that time, Mexican Government data valued the gambling industry at roughly USD 2.18 billion (MXN 36.5 bn). However, these estimates consider only domestic (based or registered) operators and supporting businesses. This makes it an apparent underestimation of the total spending of Mexican gamers. Real-money gaming has almost inevitably grown since 2019, especially in the post-Covid digital reality.

And this is exactly what we have seen in the past few years. In 2022, the Mexican real-money gaming market (USD 1.2 billion) was hot on the heels of Brazil (USD 1.3 bn) and well ahead of Chile and Colombia among its Latin American counterparts. What is more, Statista sources expect gaming revenues to continue growing by 13.1% throughout 2023, while some market research agencies expect those figures to be even higher – 19.69% on average until 2028.

While some of these reports agree on approximate figures, others diverge on the market scope for such revenue volumes. Total “gaming revenues” in Mexico are estimated at just under USD 1.9 bn for 2023 by prominent database platforms (reaching USD 2.66 bn in 2027) – just about the same amount we had seen for real-money games alone. On the other hand, the cited statistics cover a much wider range of gaming products and services – including console and PC games and well beyond real-money mobile and online games.

With that in mind, we do understand and define the subject matter of our study more narrowly. In terms of market segmentation, sports betting has emerged as the dominant segment in Mexican gambling, and that is even more the case in online platforms. It is driven by the nation’s passion for sports, especially football, in addition to the presence of numerous regulated betting channels.

Other real-money gaming segments – namely online poker, bingo, lottery and online casino – have also seen consistent growth. The online casino segment, in particular, has benefited from an abundant supply (and quality) of games and marked improvements in digital payments.

This allows us to distinguish more recent and, above all, more accurate industry figures. Based on 2023 data, the Mexican National Lottery alone has ticket sales for more than USD 1 billion (MXN 18 bn), paying out about half of that in prize money.

The sports betting segment has roughly twice the financial impact of lotto games – in 2022 it reached USD 2 billion. A significant boost to the industry was provided by the FIFA World Cup in Qatar and the limitless betting options that such a global football event offers to fans. Mexican media reports remind us of significantly lower figures before the pandemic – USD 600 mln – much closer to what we saw in 2017 reports.

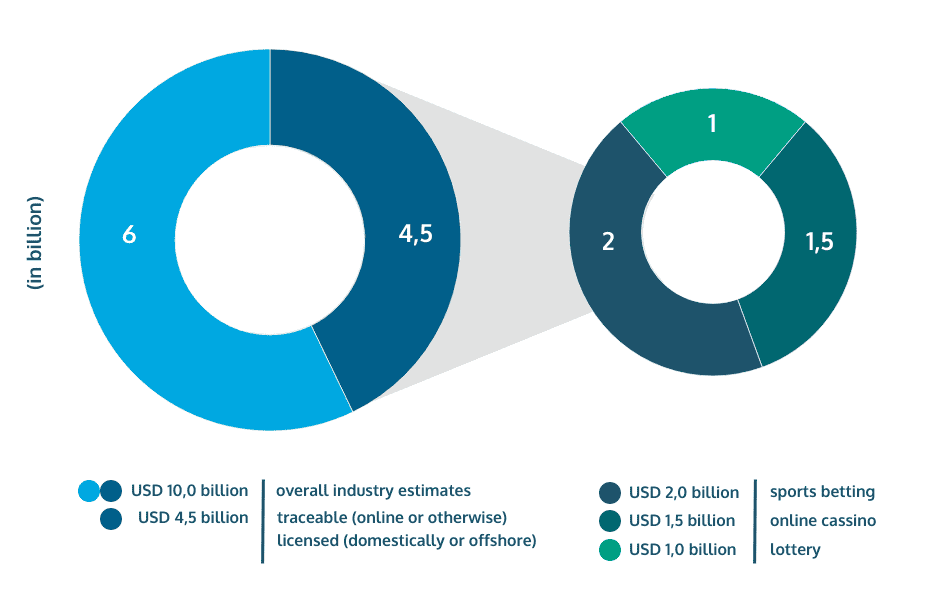

Thus, based on the data sources cited above, we are able to establish the market’s magnitude and potential. The entire real-money gaming scene in Mexico is worth around USD 10 billion, as per industry estimates and in line with its being a close behind the Brazilian gambling market which is reported at similar volumes.

Taking into account online platforms and licensed operators only – including lotto games and high-profile real-money gaming sites operating on the Mexican market – we see them reach just under half of that turnover. An estimated USD 4.5 billion is partitioned between sportsbook platforms, online casinos, lottery, bingo and other games of chance (see Game Types below).

Player Pool in the Mexican Gambling Market

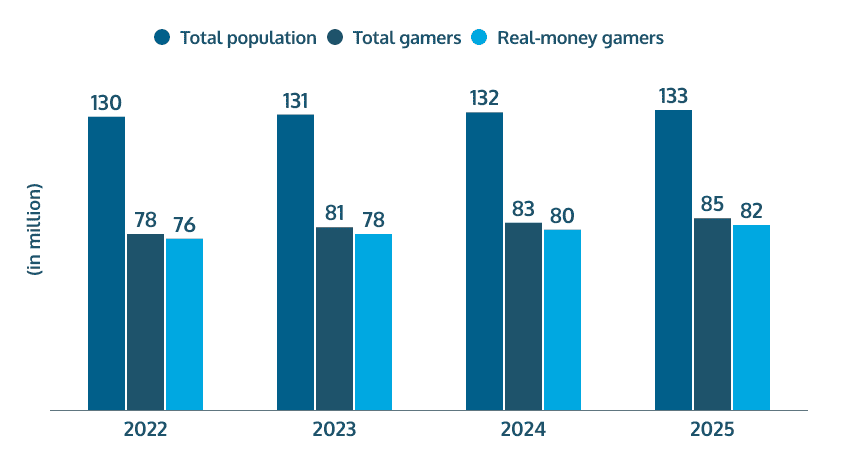

At present, Mexico has a population of approximately 130 million, according to Government sources. Combined with a highly urbanized population (81% and rising) and one of the youngest average demographics profiles globally (median age of under 30), this puts it firmly among the top 10 markets for digital entertainment.

These traits of the user pool are crucial in understanding Mexico’s importance for the online gaming and gambling industry. This is also evident from its ranking as the 4th most active country globally in terms of visits to casino websites. 2022 data by payment provider Nuvei reveals that Mexico recorded an impressive 3.6 million monthly visits to online casinos. However, these figures represent only website visits and do not reveal the total number of active players or actual gaming spending.

Some behavioral studies get us closer to estimating user volumes. Surveys from 2022 indicate that 65% of respondents have engaged in gambling activities within the past year. Out of the country’s roughly 90 million adults, that makes about 58.5 million Mexican real-money gamers.

Some experts, however, believe that the actual numbers are much higher. The Competitive Intelligence Unit (CIU), a research institute based in Mexico, reported back in 2019 that the country had 72.5 million gamers. By the end of 2021, this figure had risen to 76.7 million, corresponding to a 5.8% increase over two years (or 2.86% annually). The majority of players (59.7%) prefers mobile games.

Other sources agree on similar numbers – indeed, local reports go a step further, asserting that by 2022 Mexico already had more than 76 million players of games of chance. Not games of any kind or casual mobile players but actual real-money gamers. Contextual projections even anticipated a further 15% user growth in 2023. While such an increase is rather unrealistic, even if we observe growth rates similar to those of the general gamer population, Mexico could boast about 90 million real-money gamers by 2028. An impressive market by all iGaming and gambling industry accounts.

Most Popular Gambling Games in Mexico

In general gaming terms, the Federal Telecommunications Institute affirms that Mexicans would choose battle scenes first of all, followed by racing and sports (based on 2019 data). However, this survey included respondents as young as 7 years old (20% were under 18 years of age), with multiple responses possible. Naturally, this takes real-money games of any kind down the rankings.

In more narrowly focused studies, market experts estimated in 2022 that gambling activity is roughly split 60%–40% between sports betting on one hand and casino and other games of chance on the other. The latter macro segment includes the likes of “slots, blackjack, poker and various lotteries”.

Sports Betting Dominates

Most of the existing market studies agree that sports betting rates well above other gambling forms. Reportedly, 40% of Mexicans have placed bets on sporting events in the past year (e.g., football, horse racing). Many – 21.6% in overall player shares – engage among friends. As a rule, however, sportsbook activity is channeled mostly (73.13%) over the internet, be that via mobile apps or websites.

Lottery and Instant Games

Lottery draws and instant games of chance also hold a considerable share of the market. The latter study places the fans of such draws (e.g., Powerball, bingo) at 25.2% of Mexicans. Alternative sources show (overlapping) shares of 24% for lottery draws and 22% for instant games of luck.

Casino Games

Casino games are not far behind. The 2021 report (ibid) leaves 17% for casino games and other traditional gambling forms. Admittedly sports betting is still almost twice as popular as casino genres, yet the likes of online slots (17%) and card games (12%) also have a substantial fan base.

Industry bodies (the APJSAC) cited by financial media also distinguish two main macro segments among online operators – 60 percent going to sports and 40 percent to “traditional” games, among which blackjack, poker and the “maquinitas”, i.e., slots.

The combination of the above product offers and the global competition for the Mexican gamer market ensures a well-rounded and dynamic gaming environment.

Historical Perspective

Mexico’s gambling roots date back to ancient indigenous civilizations. The Olmec, Maya, and Aztec cultures all indulged in games with stakes and prizes. Novel forms of gambling were brought to the Americas by the Spanish conquistadors in the 16th-century.

The Royal General Lottery was established in 1771 as Mexico’s first formal gambling outlet. Complying with dominant Catholic beliefs and values, proceeds were most often directed towards socially beneficial or charitable causes.

The early 20th century (late Porfiriato era) saw Mexican gambling flourish with French-style casinos. After the Revolution, when the U.S. was banning gambling in the 1920s, Mexico legalized most forms, attracting plenty of related tourism.

This boom was short-lived, however, as President Lazaro Cardenas banned many gambling forms in 1935. Restrictions culminated in a Gaming Law which nearly outlawed all real-money games.

The landscape shifted in 1947 when President Miguel Alemán Valdé introduced the Federal Games and Draws Law (Reglamento de la Ley Federal de Juegos y Sorteos, RLFJS). It created a General Directorate of Games and Draws, opened up to the possibility of regulated gambling and standardized requirements across lotteries, sports betting, and casinos. And although some regulations vary across Mexican states, most remain pretty consistent when compared to those in the United States.

Modern Gambling Culture and Societal Trends in Mexico

Sports betting has firmly established its presence in present-day Mexico and has more media visibility than other local favorites like the lottery or slot games. In 2022, Fox Sports México launched “Money Line Show,” a program dedicated entirely to sports betting. The show’s hosts discuss betting options across various sports, while emphasizing responsible gaming.

Football can almost be considered a national obsession and it dominates the betting scene. Further back, we see American sports like baseball and the NFL. Horse and greyhound racing have their stronghold in Juarez, while Mexico City hosts the famous Hipódromo de las Américas.

Online casinos available in Mexico do follow global trends and gaming offers but they also put much emphasis on content localization. Cultural references to the Incas, piñatas or el Día de los Muertos are often seen in game themes and visual setup.

As noted above, slot games likely have the largest player base in the online casino segment. Card games (with blackjack and poker on top) and live casino games (e.g., roulette) are most frequently cited by gaming fans.

Such gambling “classics” continue to draw American tourists to Mexico to this day, especially from States where gambling is not allowed or well regulated. This also demonstrates differences in cultural perceptions and, for the most part, the progressive mindset of Mexican society on the topic. Interestingly enough, a 2022 report highlighted that 31% of the nation’s adults do not consider the lottery to be gambling.

The allure of gaming is also easily noticed among the younger generation. Children and teenagers allocate as much as 60% of their leisure time to games and visual content platforms like YouTube. Recognizing the profound influence of gaming, the government has been proactive in content regulation – game ratings have been enforced since 2021. The Secretariat of the Interior (SEGOB), which oversees game distribution, classifies games into age-specific categories, with the higher ratings (C and D) necessitating age verification.

Legal Status of Real-Money Gambling in Mexico

Mexico is often viewed as a pioneer in online casino and gambling legislation, especially when compared to most other American jurisdictions. Since the middle of the 20th century, Mexico has had established legal structures and dedicated governmental bodies responsible for licensing and overseeing the industry.

In a short yet structured manner, we can list the following regulatory milestones:

- 1947: The foundation of Mexico’s gambling regulation was laid with the Federal Gaming and Raffles Law (RLFJS). Oversight of this framework was entrusted to SEGOB.

- 2004: The original gambling Law, which had remained static for decades, underwent significant revisions. These changes expanded the law’s scope to include online gambling, mandating all online operators to secure a license from the Mexican government.

- 2007: The Federal Gaming and Raffles Law was further broadened to include online sports betting, permitting Mexicans to wager on sports events online through licensed operators.

- 2012: The government introduced two IT-related standards for gambling: NMX-I-287-1-NYCE-2012 for providers and NMX-I-287-2-NYCE-2012 for operators. These standards aimed to ensure fairness, security, and proper operation of interactive gambling systems accessed online.

- 2014: A significant overhaul of the RLFJS was approved by Mexico’s lower legislative chamber. However, the Senate sought a more comprehensive analysis, leading to delays in finalizing the regulation. This indecision has been estimated to cost the government substantial gambling tax revenues. Later that same year, reforms to the telecommunications law were passed, compelling internet service providers to block unauthorized online gambling sites.

Available Gambling Licenses in Mexico

As things stand, there are no limitations on the number of land-based or online licenses that can be issued. These can be valid for up to 25 years, with the possibility of extending them for additional 15-year periods.

Licenses are exclusively granted to Mexican commercial entities (based or registered) compliant with national laws. Just like land-based operators, online agents must also obtain a license from SEGOB. However, B2B providers are exempt from this requirement.

There are four kinds of real-money operator licenses in Mexico:

- Horse and greyhound Racetracks, with contextual betting;

- Fronton arenas for jai alai (a.k.a. pelota);

- Remote betting centers (i.e., sportsbooks) – Licenses for any kind of establishment facilitating remote sports betting;

- Betting centers or “rooms for drawing numbers” – This category encompasses land-based casinos, covering live gaming, slot machines, and online gaming activities.

Consumer Protection

The RLFJS and its numerous updates institute a framework for safeguarding customers of the gambling industry. Key provisions include:

- Age Restrictions: Naturally, real-money gaming is strictly off-limits for minors.

- Grievance Redressal: Users can file complaints directly with the SEGOB – e.g., for prizes unpaid and other unfair practices;

- Advertising: All gambling-related advertisement requires SEGOB’s prior approval; Licensed establishments are barred from explicitly promoting bet types; All promotional content must be accurate to avoid consumer confusion;

- Responsible gaming: all industry messages should emphasize the protection of minors and the importance of responsible gambling.

Current State and Effect of Regulations

While the initial Gaming Act has been greatly and meaningfully expanded – especially in its restrictive sense – current regulations still exhibit gaps, particularly related to the online gaming segment. The laws lack comprehensive descriptions and requirements for online activities, leaving much to the SEGOB’s discretion.

Consequently, Mexicans often turn to foreign online gambling sites. These operators tend to adhere to local laws and have a dedicated market offer but, being foreign-based entities, they cannot directly obtain Mexican licenses. This regulatory void has led to approximately 60% of online casinos operating outside national control. Another important industry body, the AIEJA, has highlighted this concern, urging the government to modernize the RLFJS, especially given the unchecked operations of over 100 unlicensed companies in the country.

Technological Overview – Infrastructure, Communications, Banking

It has been barely two decades, since 2004, that foreign companies have been able to distribute, and sell games within Mexican borders. As it might be expected, this move led to a surge in the gaming sector, with global gaming companies raising the levels of quality and competition on the market. Mexican players have often shown a preference for foreign titles, drawn by their engaging gameplay, superior graphics, and compelling narratives.

However, the online gaming landscape also faces significant challenges. Despite widespread internet access, banking penetration remains low. Fernanda Sainz of Caliente Interactive (one of the gaming giants present in Mexico) highlighted that less than half of the internet users possess a bank card, which is crucial for online gaming transactions.

Transaction rejections are not uncommon also because of the limited telecommunications infrastructure, especially in rural areas, which leads to transaction latency. Experts claim that the relatively high fraud rates are also attributable to these issues.

A broader look at the Mexican digital landscape reveals that only 22% of internet users make online purchases, while a mere 17.6% engage in online banking operations. The problem is further compounded by the fact that nearly 56% of Mexicans are involved in informal economic activities, as reported by the National Institute of Statistics and Geography in March 2022.

To gain trustworthiness, the online gaming sector needs to achieve higher degrees of transparency. That entails both banking traceability – to verify player profiles and the legitimacy of funds as well as a coordinated action against illegal betting platforms. The industry needs a marketing strategy and the authorities’ support against unlicensed real-money gaming operators.

Yet, Mexico is still the region’s second largest smartphone market. In terms of digital maturity, McKinsey ranked it 55th out of 151 countries in 2018. The Mexican Internet Association reported in late 2021 that the nation boasted 89.5 million internet users, accounting for 75.7% of its population aged 6 and above.

Unfortunately, a disparity still exists between urban and rural areas, with 77% of urban dwellers having internet access compared to a mere 48% in rural regions. In the past few years, however, recognizing the need for enhanced digital connectivity, the government initiated the “Internet para Todos” program, focusing on expanding internet access to rural and underserved communities.

Analyzing the competition in the telecommunications’ landscape, we see the Herfindahl-Hirschman Index (IHH) – a market competition index – rate Mexico in mid- to upper-4000 points (4,270 in year-end 2022). Such a score indicates a high market concentration and limited competition in the mobile market.

The dominant presence of América Móvil underscores the need for regulatory interventions to bolster competition and ensure a level playing field for all market participants. This would be crucial for the digital entertainment macro segment – which heavily relies on mobile access – and the online gaming industry in particular.

Mexico’s Local Gaming Industry

Mexico’s own gaming industry has witnessed significant growth in the past two decades due to the revival of the public and regulatory debate. The ascent of domestic giants like Caliente, CIE and Televisa, along with the competition of international agents such as the Spanish CODERE brought the real-money license holders to over 300 in 2013.

The same sources give a slightly inflated overall valuation to the industry, citing USD 16 billion as early as 2010, possibly including related and supporting sectors and services. Market analysts emphasize that real-money gaming in Mexico employs directly more than 40,000 people and indirectly up to 120,000, contributing 3.7% to the nation’s GDP.

The Mexican Government reports industry estimates that are quite different – just under 10,000 workers directly employed by the gambling industry, predominantly female (60.1%), mostly middle-aged. These figures also result in different market valuations and, as we have seen above, the more realistic estimates lie in the middle.

Out of the 5,524 economic units in 2022, authorities point out that the largest share of gross production and gaming businesses is based in Ciudad de México, standing well above other territories and states. Nuevo León follows with a third of the Capital output, followed by the likes of Yucatán and Jalisco. Perhaps surprisingly, Federal sources cite only USD 2.32 million of foreign direct investment on an annual basis.

Most of the challenges are related to high procedural and licensing costs. Industry stakeholders have repeatedly raised concerns about the high taxation rates imposed on gross gaming revenue (GGR). A 30% GGR is in force, without accounting for levies on player winnings, both state and federal. In addition, a 16% digital services tax was introduced in 2020.

The demanding regulatory and business environment is seen in the dynamic industry changes over the years. In 2013, Mexico had 27 gaming permit holders under two main associations: APJSAC and AIEJA. These entities held a total of 561 casino permits, but only 306 were active.

Sectoral associations saw the market’s liberalization as an opportunity to increase the number of venues yet they slowly declined (291 in 2015). Still, by 2017 most active land-based operators were nevertheless optimistic. Miguel Ángel Ochoa of the AIEJA noted that Mexico’s casino market position had dropped in the preceding few years due to stricter regulations but that was not necessarily a bad thing. Compared to more mature markets like Argentina, these measures were “needed” and the time to expand again had come.

Today, the country has around 200 physical gambling venues. Upscale ones are part of resorts catering to tourists, while there are a number of smaller gambling halls offering slot machines and more limited amenities. A typical Mexican bingo hall or slots venue would have about 200 to 300 machines. At this point, locally registered operators – particularly sportsbook and those with physical outlets – tend to see the market as having high channelization rates.

However, from the point of view of the Mexican regulator that is not quite true. Offshore sites, operating without local licenses, dominate the online gambling scene. They rake in as much as 90% of the market profits.

Global gaming companies are also the ones that react faster to market changes and fresh gaming trends. Esports, for example, a segment on the rise around the World, has seen international companies host events and tournaments around Mexico, while some universities offer eSports-based scholarships in partnership with global gaming giants.

Online Gambling in Mexico – Prospects and Expectations

With a sizable and youthful market pool, it is easy to appreciate why Mexico is rated highly for its potential by iGaming stakeholders, even more so than its current performance. Thriving on the nation’s sports enthusiasm and growing digital maturity, Mexico is gaining global traction among its emerging market peers.

The industry also faces inevitable hurdles, namely outdated laws and unregulated offshore competition. Emphasizing that a well-regulated environment is vital for maintaining ethical standards and ensuring a competitive edge through technological upgrades. Operators willing to perform well in Mexico need to deliver top quality gaming experiences and adopt smart marketing strategies. They also need to take into account the demand for content rooted in the local culture.

Ultimately, the industry’s success hinges on a mix of clear regulations, tech innovation, and market transparency. Sooner rather than later, however, Mexico will climb rankings and position itself as a market to be reckoned with in the global iGaming scene.