This post is also available in:

This study examines the awareness and knowledge of the sports betting market among actual Brazilian gamblers. The insights we present reflect their preferences, habits and overall understanding of a wide range of sports betting aspects from an end-user (bettor) perspective.

Main Takeaways

- High Engagement – all respondents are confirmed active sports bettors. As much as 50% bet every week, while 21% bet on a daily basis.

- Informed Bettors – 44% of bettors spend 30 minutes to 1 hour researching before placing bets, showing a commitment to informed decision-making.

- Diverse Interests – Beyond football (94%), significant numbers bet on basketball (28%) and esports (video game competitions, 29%).

- Financial Motivation – 59% are driven by potential financial gain, while 19% bet for the extra excitement when watching sports.

- Platform Preferences – Attractive bonuses (71%) and a user-friendly interface (59%) are crucial factors in rating betting platforms.

Methodology

Our sports betting research paper is based on primary data. An original survey was conducted among 642 adults in Brazil who actively engage in real-money games. All of them bet on sports, while ample shares also play online casino, the lottery and other popular gambling activities.

The responses to a series of questions focused on sports betting enable us to lay out a comprehensive overview of their betting habits and knowledge of key terms, concepts and approaches to sports gambling.

The results are analyzed to identify trends and patterns in their behavior and understanding of the sports betting landscape.

Online Gambling Participation

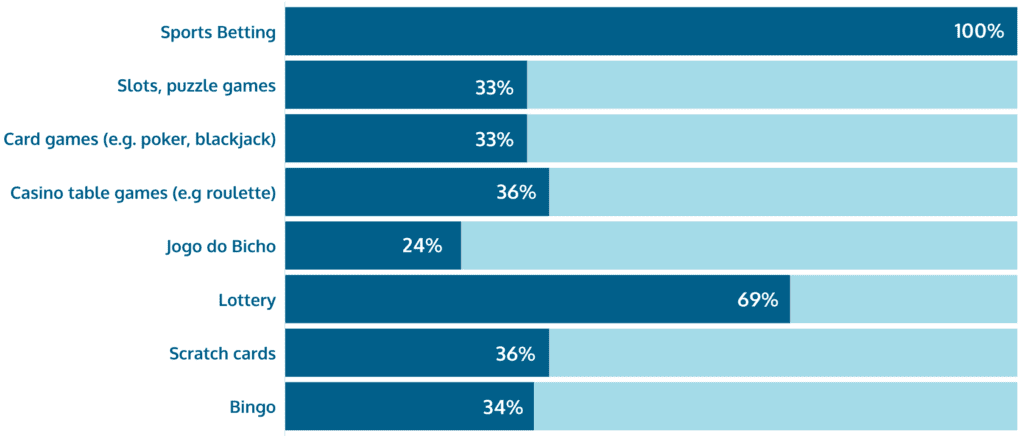

With a pre-filtering question on actual sports betting engagement (100%), we also asked respondents which other online real-money games they play. The frequency of other types of gaming is not considered further down this study.

Types of Online Gambling Activities

The survey revealed diverse interests in online gambling activities among Brazilians.

- Sports Betting – 100% confirmed their participation in sports betting. While a pre-selection was executed, the comparison to other iGaming verticals highlights the overwhelming popularity and acceptance of betting on sports in Brazil.

- Lottery – 69% also partake in lottery games (with the Mega-Sena a leading example), showcasing the still significant inclination towards more traditional forms of gambling.

- Casino Table Games – 36% play casino table games (e.g., roulette). We must emphasize, however, that complementary online casino participation increases these shares a great deal, with Slots and Card games (e.g., poker, blackjack) getting 33% each.

- Scratch Cards and Bingo attract 36% and 34% respectively, representing other “old-fashioned” gambling verticals that have been moving to online platforms.

Overall, respondents clearly demonstrate a varied interest in multiple forms of gambling. With a multiplicity index of 4.0 (choosing exactly 4 gaming segments per user), this reveals a broad and increasing engagement with online gaming platforms and gambling niches.

N.B. Further down the survey, when we discuss questions about specific sports or competitions (e.g., basketball, Olympics), the share of respondents per selection reflects only those who bet (or at least follow and consider betting) on that sport or competition actively.

That is why not all responses add up to 642 for every question, which is the total number of participants in our survey. Crucially, all shares are validated within the respective gaming verticals and the resulting analysis.

Frequency of Sports Betting

The frequency of sports betting among respondents varies, with a notable portion engaging regularly.

- Weekly – 50% bet on sports weekly, demonstrating consistent engagement yet maintaining its entertainment function through moderation.

- Daily – 21% place bets daily, indicating a high level of involvement for a significant subset.

Such betting frequency suggests a strong habitual engagement with sports betting among Brazilian gamers. Given the nation’s passion for sports (and particularly football), these are not unexpected levels, let alone unsound.

Nearly 30% of those considering themselves active sports bettors engage only occasionally or around major sports events.

Knowledge and Research in Sports Betting

Sports betting is considered a skill game by many of its practitioners because it involves research, analysis, and strategic decision-making, rather than relying solely on luck.

This mindset is supported by studies indicating the weight bettors place on expertise and knowledge in predicting outcomes. It has also been covered in our previous research, highlighting the recognition of sports betting as a skill-based activity, even by courts, in other emerging gaming markets.

This is why it is important to estimate the level of knowledge and experience sports betting fans in Brazil have or think they have.

Experience Level in Sports Betting

Respondents openly admit to different degrees of experience in sports betting. Essentially, a majority identifies itself as intermediate or advanced bettors.

- Intermediate – 49% consider themselves to have average experience and be reasonably well-prepared;

- Beginner – 29% identify as beginners, showing a substantial portion of new entrants to the market.

Just under a quarter consider themselves either Advanced 19% or even Professional 4%.

This indicates a mix of seasoned bettors and newcomers, reflecting an evolving betting community. Still, this is a very balanced view of their own know-how and experience.

Research Before Placing Bets

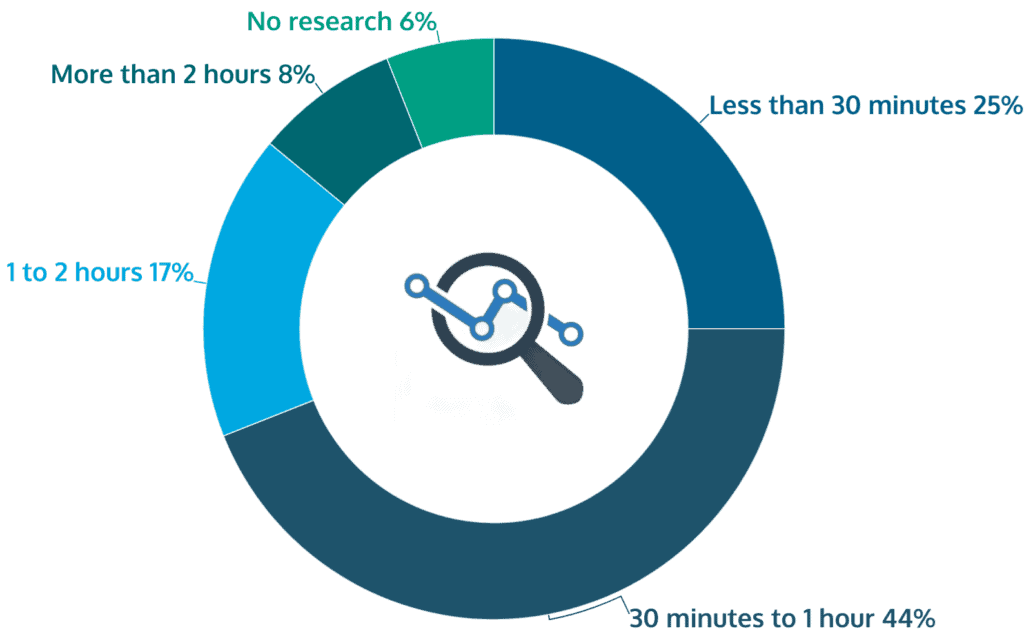

The time spent on research before placing bets is a crucial aspect of making an educated prediction.

- 30 minutes to 1 hour – 44% dedicate a sensible but not exaggerated amount of time to research, indicating a thorough approach to betting.

- 1 to 2 hours (17%); more than 2 hours (8%) – altogether 1 in 4 bettors spend more than an hour researching before placing a bet. These seriously passionate gamers practically coincide with those that consider themselves “advanced” or “professional” sports bettors (a combined 23%).

- Less than 30 minutes – 25% spend minimal time on research, suggesting reliance on basic knowledge. Yet, only 6% claim to do no research before placing bets, possibly relying on intuition, someone else’s tips or previous experience.

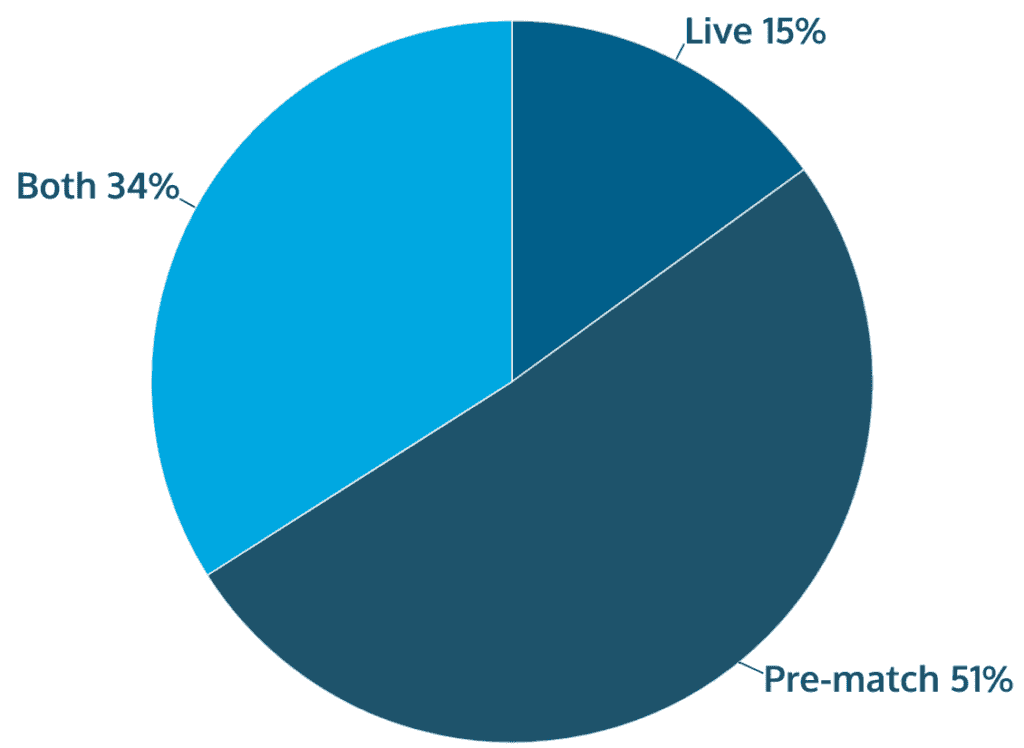

The commitment to research highlights the importance of informed decision-making among a significant portion of bettors. This is why it is not a surprise to see over half (51%) of all active bettors admit to preparing and placing their bets beforehand.

On the other hand, a combined half either bet in-game (15%) or use a mixture of the pre- and live-game bets (34%).

Understanding of Sports Betting Terms and Concepts

Awareness of basic terminology is crucial for effective participation in sports betting.

- Single Bets – 97% are familiar with single bets, showing widespread basic knowledge.

- Accumulators – 70% understand accumulators, indicating a growing awareness of more complex betting strategies.

- Live Betting (in-game) – as much as 82% know what it is at least (although less people use it, as we have seen above).

Given the early growth stage of the recently regulated Brazilian gambling market, the relatively high level of familiarity with fundamental betting terms shows a quickly learning betting community. What is more important, consumers appreciate the importance of placing “informed” sports bets, as seen above.

Knowledge of Betting Odds and Strategies

Understanding betting odds and more technical terms is a necessary step for a more strategic approach to sports betting.

- The Basics of Odds

47% assert to have a good or even perfect understanding of odds. This best-informed group is mirrored by another 46% who know how odds work but still have some doubts.

A comparatively marginal 7% admit to not understanding odds as a concept (or even having heard an explanation). For a gradually maturing market, these are realistic figures.

- Specific Gaming Terms

Terms Like Handicap, Over/Under and Moneyline are also gaining recognition in Brazil. More than a quarter (28%) are familiar with all these terms, while 51% know some of them.

N.B. Moneyline is a straight bet on the winner of a sports event; Handicap means adjusting the result/outcome via a virtual deficit or advantage, and then betting on that adjusted outcome; Under-over is a bet on a specific statistic being under or over a certain value (goals, cards, points, corners, etc.

- Early Cash-Out

The majority of respondents have experience with early withdrawal options. As much as 57% have already used in-game cash out of winnings or loss minimization.

Overall, the comprehension of these key concepts highlights the gradual sophistication of the betting community.

Sports Betting Information Sources

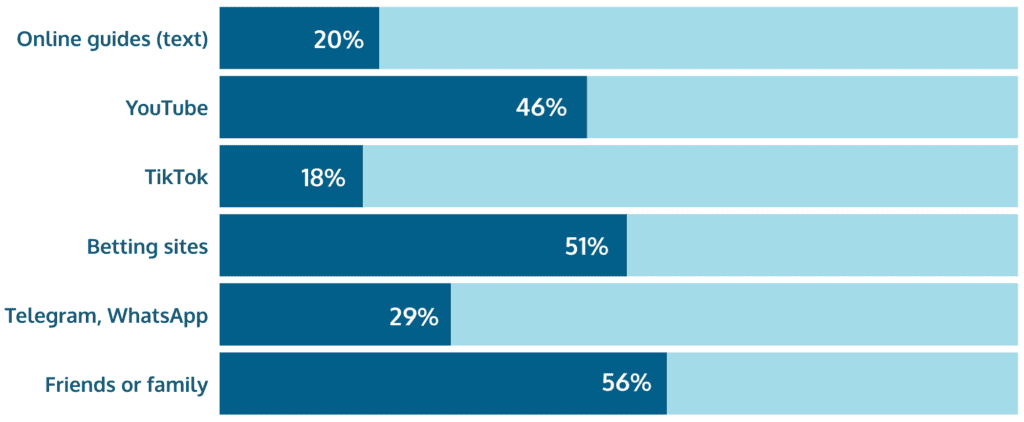

An interesting insight into the know-how of sports bettors comes from their sources and channels of acquiring information.

It is also interesting to distinguish these for players in the early stages of their gaming journey, as well as later on, when sports betting has become a routine.

Learning Experience

Awareness and learning about sports betting can come from a variety of sources for Brazilian gamers. Our survey highlights the different channels through which bettors gain their knowledge and skills.

- Friends or Family – 56% rely on peers or family members for betting knowledge, showcasing the importance of real-life social networks.

- Betting Sites – 51% learned to bet through betting sites, revealing the crucial role that gambling platforms have in educating users.

- YouTube Videos – 46% use YouTube videos to improve, reflecting the huge popularity of video content for learning.

- Telegram and WhatsApp Channels – 29% utilize messaging apps, pointing to the role of social media (SM) in information dissemination.

Among “others”, we note several mentions of “Instagram” and “alone, playing around”.

These statistics demonstrate that learning to bet is often a collaborative and multimedia experience, leveraging various online resources and personal networks.

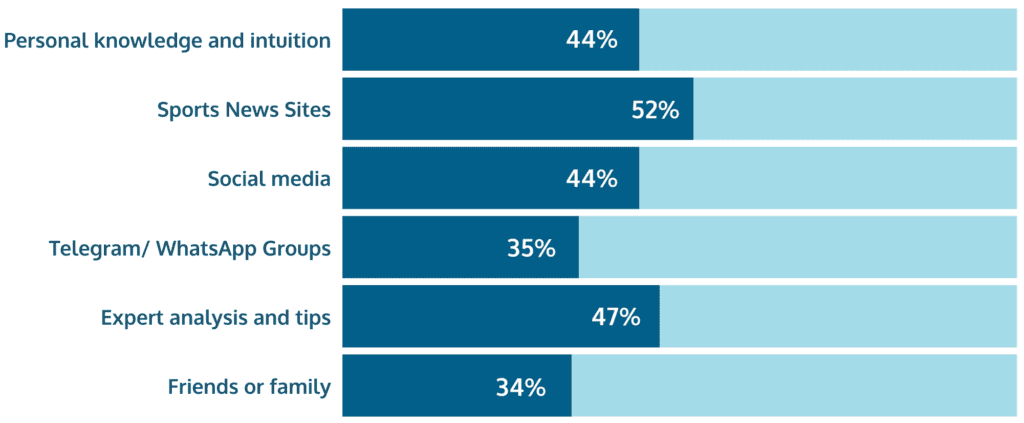

Ongoing Betting Decisions

Following the same logic, Brazilian bettors use a wide array of information sources to stay up to date before placing bets.

The survey results painted a largely expected comprehensive approach to gathering information related to sports betting which includes:

- Sports News Sites – 52% rely on sports news sites, building up on important general sports updates.

- Expert Analysis and Tips – 47% seek expert opinions. The second most important source shows the value placed on professional insights in a fast-paced market.

- Personal Knowledge and Intuition – 44% trust their own knowledge and intuition, highlighting the confidence bettors have in their own understanding of sports.

- Social Media – 44% use social media, indicating the influence of these platforms in providing timely updates and peer opinions.

- Telegram/WhatsApp Groups – 35% engage with messaging groups, pointing to the role of community and shared information.

The multiplicity index of 2.6 indicates that respondents typically check nearly three different sources before making their betting decisions.

These findings illustrate clearly that bettors blend various sources of information. They try to balance professional insights, personal knowledge and community input to make well-informed betting decisions.

Betting Preferences and Markets

If we take a step back and look at what drives sports bettors, we will get a better understanding of why and how Brazilians place their wagers.

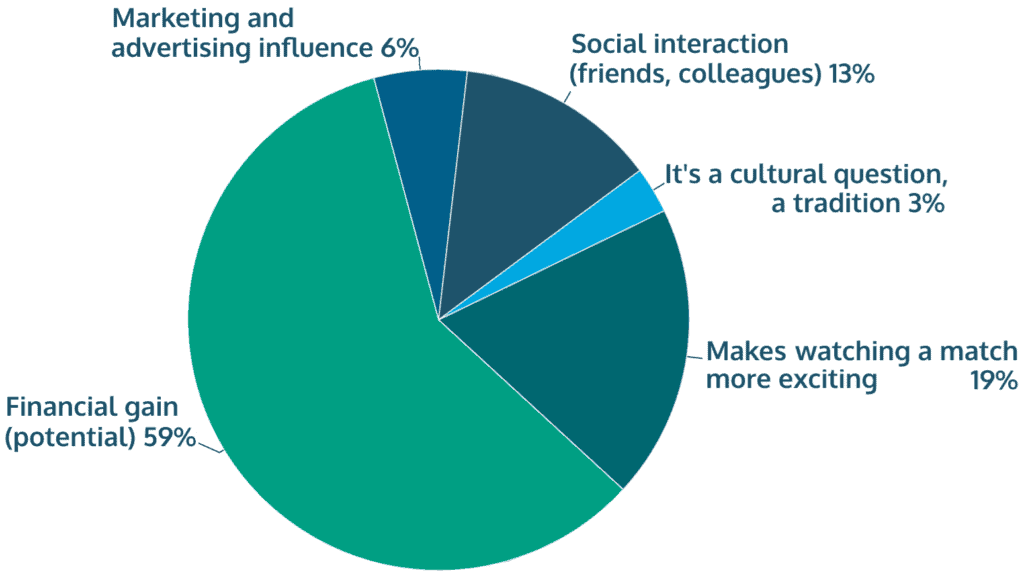

Motivations for Betting

The actual motivations for sports betting are slightly different from those behind gambling in general, particularly when it comes to the emotions generated by a real-world event taking place elsewhere.

- Financial Gain – the potential financial gain is still the primary driver for the majority of sports bettors – 59% cite it above anything else.

- Excitement – the passion for sports is sometimes never enough – 19% bet to enhance the excitement of watching sports, indicating the additional entertainment value of betting. Many also consume plenty of related video content, as well as replicating the experience into betting on virtual sports leagues.

- Social interaction – engaging with friends and colleagues is a leading motivation for 13%. That can easily be grouped with the perception of “tradition”, cited by another 3%.

These motivations reflect both the financial and recreational aspects of sports betting for Brazilian gamers.

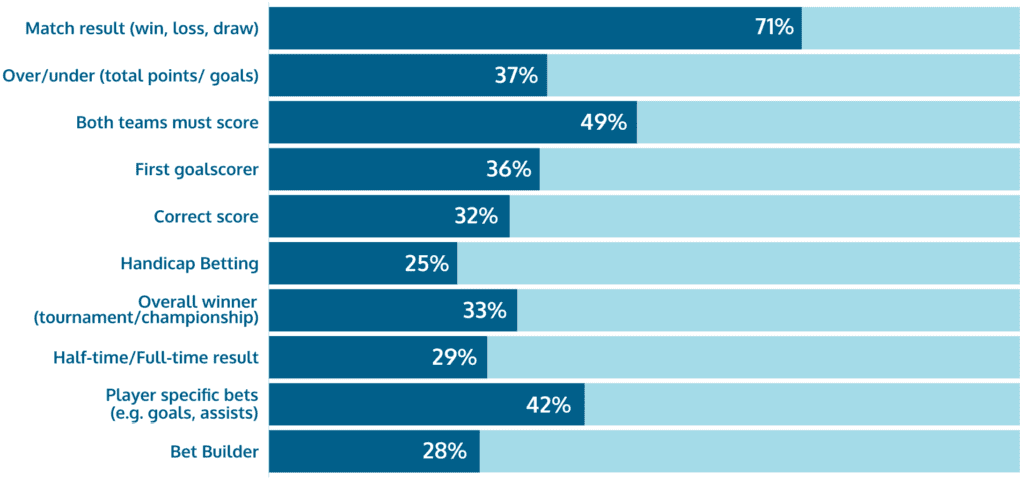

Types of Bets and Betting Markets Used

The variety of betting markets (i.e., betting categories, types of bets, in the technical sense of the term) placed on a regular basis reveals the diverse strategies employed by gamers.

Most people engage with straightforward match results – 71% prefer betting on single game results, indicating a more pragmatic approach to predictive betting.

Whether both teams score is the second most popular market, cited by 49%.

Player-Specific Bets (e.g., number of goals, assists) – 42% of gamers show substantial interest in detailed performance metrics. Although these are already somewhat more complicated to estimate, it shows that Brazilians know their stars and teams, and feel confident in predicting their performance.

The full range of betting markets used reveals the quest for diversification, deep interest in betting strategies and willingness to use one’s knowledge and intuition. A multiplicity index of 3.8 means that most users know and actively use nearly 4 different types of betting markets on a more or less regular basis.

Among “other” markets, gamers mention specific statistics available for betting like corners, shots and cards.

Knowledge Gaps Still Exist

When asked about which of the above betting markets they have never heard about, respondents seemed mostly confident about their knowledge. Despite that:

- Handicap Betting (for 26%) remains the most unfamiliar market.

- Bet Builders (known as accumulators) are unknown for 16%.

N.B. Bet builders are a collection of odds and selections from a single game, all compiled into one bet.

The relative complexity of handicaps and bet builders possibly contributes to the reported knowledge gap. Understanding the unfamiliarity with these concepts provides insight into areas where bettors might need more information or education.

Still, a multiplicity index of 1.8 indicates that, on average, less than two of the main types of betting markets are unknown to punters, confirming a high level of awareness overall. 40% of active sports bettors know every single betting market proposed in the survey.

Sports Betting Wins and Budget Planning

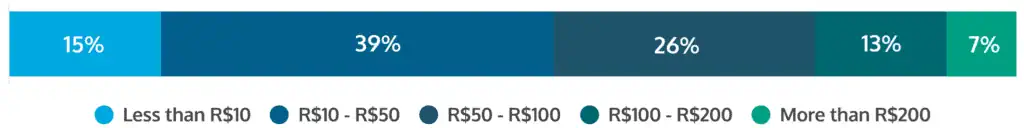

The main financial aspects of betting are budget allocation and the handling of winnings.

As far as the weekly budget is concerned, 39% bet between R$10 and R$50 weekly, showing a moderate spending pattern.

Overall, 4 out of 5 Brazilian gamblers (80%) spend up to 100 reais per week.

We also asked respondents if they reinvest their winnings immediately back into more real-money gaming. The overwhelming majority – 75% admit to reinvesting part of their winnings, indicating a strategy of leveraging current wins for future bets.

Just about equal shares either bet the entire amount again (12%) or withdraw it all (13%).

These financial behaviors reflect careful management and strategic reinvestment among Brazilian bettors, yet another sign of a responsible gaming culture.

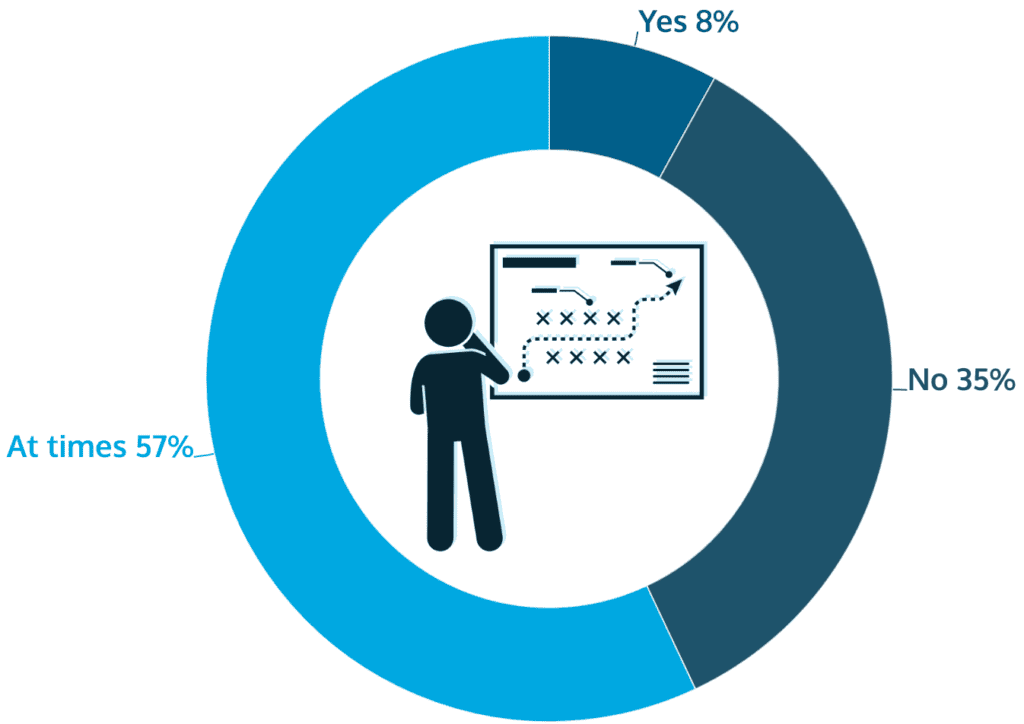

Strategies and Decision-Making

With growing knowledge and experience, bettors start to employ a wider range of strategies to try to increase their chances of success. Only one in three (35%) admits to not having a systematic action plan for that.

When asked to specify their strategies, sports bettors had a long list – from detailed historical and statistical analysis to relying on intuition and external advice. Besides attempting to impact winning odds, many aim their strategies at managing risks effectively.

The most common approaches included in open-ended responses are systematized below:

1. Historical Analysis:

Many punters focus on historical performance of teams and players. This includes analyzing:

- Team history and past performance (e.g., “Team history, players”, “Analyze the history and quality of the team”).

- History of meetings between teams or players (e.g., “History of encounters”).

- Recent trends (e.g., “Recent history of the teams in question”).

2. Statistical and Data-Driven Methods

A significant number of respondents rely on statistical data and analytical methods to make informed decisions. These include:

- Team performance metrics and game statistics (e.g., “League and game statistics and probability”).

- Specific game metrics like goals, cards, and other game events (e.g., “Look at the number of goals scored”, “Over/Under cards in the match”).

3. Research and Expert Consultation

Some punters emphasize the importance of research and seeking external opinions:

- Researching teams and championships before and during live games (e.g., “Study the teams and championships pre-live and follow them live”).

- Consulting with others and considering professional opinions (e.g., “Research and discuss with others”, “pay attention to what professionals say”).

4. Risk Management and Caution

Some responses reveal the more conservative approaches to betting

- Betting on favorites or teams with advantageous odds (e.g., “I go with the favorite”, “Identify more advantageous odds”).

- Limiting the number of bets and managing bet sizes (e.g., “do not play more than 5 times”, “I bet little”).

- Focusing on safer bets with higher chances of success (e.g., “Bet on the safest”, “Aiming for small winnings but with higher odds of success”).

5. Random Betting Patterns and Strategies

Various betting patterns and methods are mentioned that may or may not have their justification:

- Hedging bets by betting on both sides or using multiple bookmakers (e.g., “Bet on more than 1 bookmaker with doubled value on the opposite of the first”).

- Specific timing and sequence strategies (e.g., “Place bets at certain times”, “Double bet on loss”).

6. Intuition and Personal Insight

A number of punters rely on personal intuition and “gut feelings”:

- Making decisions based on intuition (e.g., “The intuition”, “Intuition, right most of the time”).

- Involving personal or family insights (e.g., “I ask for help from family members who know the players best”).

7. Mixed and Other Methods

A few respondents mentioned some unique approaches:

- Utilizing group opinions and past experiences (e.g., “Opinions in groups and also according to previous bets”).

- Specific focus on anomalies or perceived incorrect odds (e.g., “bet when I think the odds are incorrect, especially in esports”).

There is substantial research which points out that monitoring social media during games offers additional and very timely insights to sports bettors. In fact, even bookmakers track SM sentiment when updating their in-game odds, whenever possible.

Therefore, trusting the community knowledge and consolidated informal advice of the peers in the digital sports-betting tribe is always a valid and consistently used option for at least 5-6% of active bettors – something also confirmed by the survey.

Overall, the most commonly mentioned approach is “Statistical and Data-Driven Methods“, mentioned by 21% of those who shared their personal strategy. This is directly related to what others call “Historical Analysis” (17%). Therefore, the most substantial group of sports bettors like to make up their mind based on hard facts, statistics and performance data – or what we consider proper research.

To some extent, that is related to what “Studying the teams” via expert opinions (11%) has as a basis. Even when such a strategy involves somewhat unconventional methods – such as “observation” of the athletes’ pre- and live game performance; or what perceived “experts” in the art of sports betting might have to say – these betting decisions are also made on the basis of informal research.

One way or another, two thirds of Brazilian sports bettors have a preferred methodical approach, aiming to maximize success and manage risks effectively. Ultimately, this fits the narrative of the pursuit of financial gain as the main driver of sports betting.

Top Sports, Leagues and Competitions

So far, these detailed Brazilian sports betting insights provide the bigger picture – motivations and engagement, knowledge and experience, information sources, strategies and top betting markets.

In a more granular analysis, we will see how the most popular sports, competitions and athletes correspond to actual betting preferences.

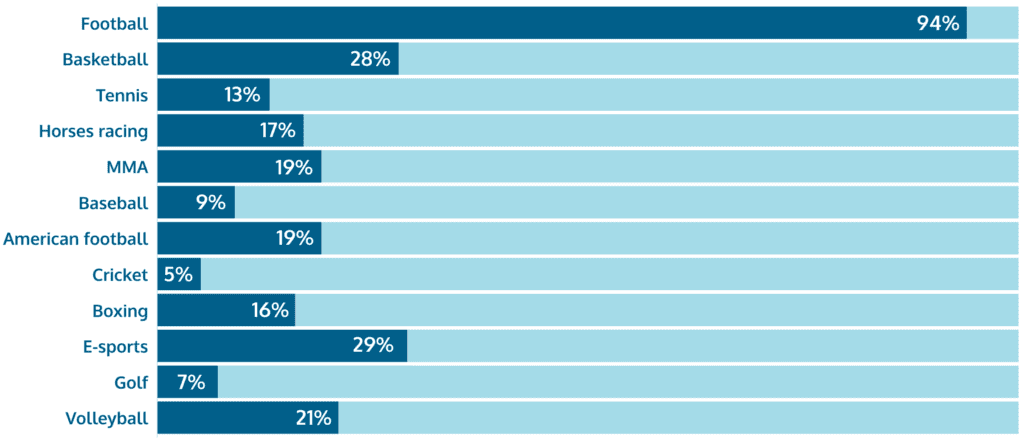

What Sports Do Brazilians Bet On?

- Football – 94% bet on football, confirming its dominance in the sports betting market.

- Basketball (28%) and volleyball (21%) also generate substantial interest, without coming anywhere near to the nation’s favorite.

While the strong following of football translates into various socio-cultural and entertainment expressions, real-money games are a particular segment. We see a growing interest in betting on other sports among Brazilian gamers. A multiplicity index of 2.8 means they follow actively and bet on around 3 different sports, not only football.

- Interestingly enough, esports (at 29%) are even more popular than any other sport besides football.

Naturally, esports are not athletic disciplines in the strict sense, and include a host of gaming options, communities and visual experiences. Yet their combined share is so consistent in Brazil that online gambling operators cannot afford to ignore the niche or provide insufficient or inadequate support.

Football Leagues and Competitions

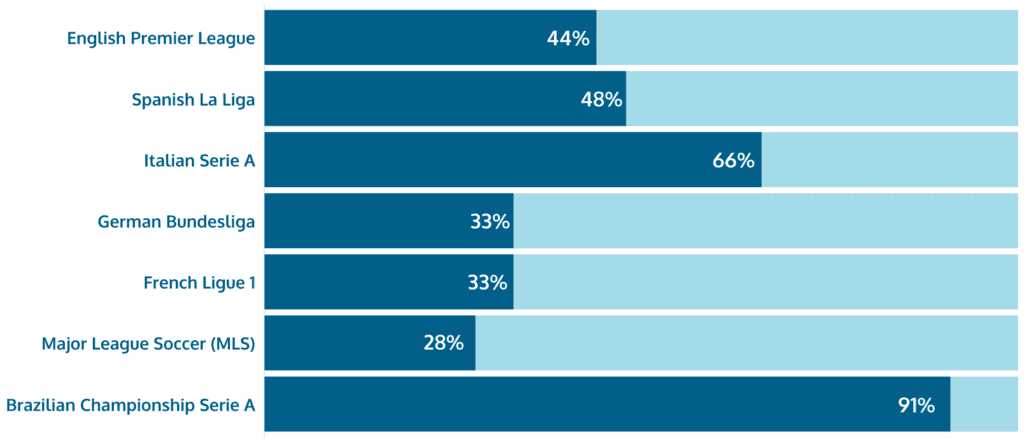

As football holds massive sway in Brazilian entertainment, we need to evaluate specific football leagues and competitions that will reveal more about the local betting habits.

As much as 91% bet on the Brazilian Serie A, reflecting national pride and interest. A logical leader, for more than 9 out of 10 bettors it is the top pick.

The Italian Serie A (66%) and Spanish La Liga (48%) have more following and betting activity compared to the world-renowned English Premier league (44%) – and way more than the Bundesliga, for example. This could be explained by linguistic and cultural proximity, family heritage or simply because of preferences for players they follow and know in those leagues.

Ultimately, an emphasis on both national and international leagues showcases a broad betting landscape. The multiplicity index reveals that, on average, Brazilians know and bet on almost 3 other leagues besides their top-tier national football competition.

National Football Competitions

Given the strong preference for domestic football, it is not surprising to see that the average bettor is active across at least two different league tiers in addition to the top-level football competition.

Behind the local Serie A (91%, see above), punters indicate the Brazilian Cup (74%), showing significant appeal of a national knockout format.

The Brazilian Serie B follows with 54%, not far ahead of the State Championships (49%). Even the lower Series C (25%) and D (20%), as well as the Futsal Championship (19%) draw a consumer base that is not irrelevant.

These findings underscore the deep engagement with national football at various levels. Fans follow, know and bet on their favorites and remain loyal regardless of competition level or type.

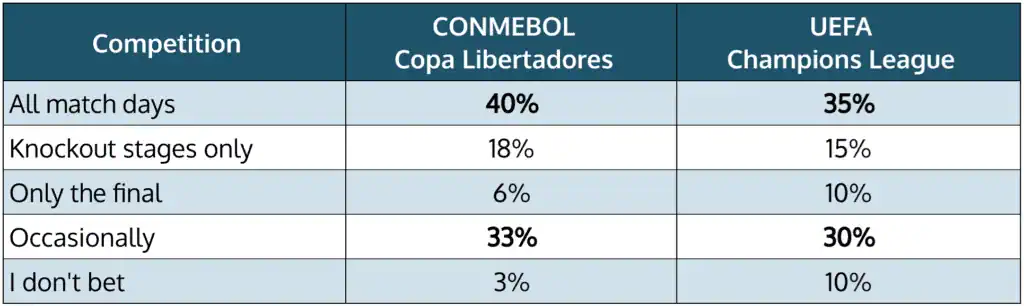

Engagement with Major Continental Club Football Competitions

The frequency of betting on major continental club football tournaments – e.g., the South American Libertadores Cup and the European Champions League – show that Brazilian bettors actively also follow the most prestigious club competitions.

More than a third of respondents bet on all match days – 40% for Copa Libertadores and 35% for the Champions League. This reveals consistent interest and high engagement throughout the tournaments.

Another third places bets occasionally, showcasing a preference for selective betting rather than consistently throughout the tournament. Logically, some become active only during the knockout and final stages only.

Basketball Betting

We move onto the second most engaging sports, basketball. This is where some more varied interests begin to emerge as well.

Among basketball fans:

- NBA – 92% bet on the National Basketball Association of the USA, highlighting its overwhelming popularity and global appeal.

- NBB – 46% engage with the Novo Basquete Brasil, the top-tier men’s basketball league. This shows noteworthy interest in domestic basketball.

Some bet on the EuroLeague, US College basketball or the Women’s NBA, adding up to 2.5 leagues on average per respondent.

Since the NBA is so popular, we also asked respondents to pick the teams they usually bet on.

The top 6 teams attract the majority of bets:

The Los Angeles Lakers lead the way, with 68%, followed by the Boston Celtics at 60%; The Golden State Warriors are also a popular choice (for 55% of bettors), while the Dallas Mavericks (48%), Denver Nuggets (46%) and Miami Heat (41%) are slightly behind.

This focus on high-profile teams reflects the bettors’ interest in historically successful franchises and recent top performers in the NBA. Indeed, the leading picks are:

- the all-time best – the Celtics and Lakers are record title holders with 18 and 17 titles each in the NBA;

- the Warriors have been a dominant force in the past decade (and 3rd overall historically), followed by the Mavericks (2024 finalists) and Nuggets (2023 champions).

Global Stars Have a Massive Pull

Historical favorites and recent top performers also tend to have more stars on their roster. In fact, active bettors were able to point out more than twice as many favorite basketball stars they bet on (5.3) compared to teams they might pick.

LeBron James still gets the most preferences (62%). He is followed by two other stars that may be considered veterans, having been on the big stage for more than a decade – Steph Curry (49%) and Kevin Durant (48%).

- All are multiple-time champions of the NBA (Curry and James with 4, Durant with 2).

- All top picks are regular NBA All-Star Game participants, and gold medalists at FIBA World Cup and Olympic Game basketball tournaments.

Other emerging stars (Luka Doncić, 36%; Jayson Tatum, 34%) and regular top performers (Nikola Jokic, 33%; Anthony Davis, 37%) also get regularly on the betting slip for at least a third of Brazilian gamblers.

Volleyball Betting

With due considerations (i.e., no comparisons to football), we’ve seen that more than 1 in 5 bettors (21%) are interested in volleyball, making it the third most popular sport in the country.

Among those, 87% bet on the Brazilian Volleyball Super league, answering a straightforward question on their engagement with this premier domestic volleyball competition.

Major International Sporting Events

Betting on major international sporting events was inevitably popular among respondents.

- Football – the FIFA World Cup (73%) and Copa America (66%) are the top events, showing a strong preference for football tournaments, especially with the participation of Brazilian and other South American national teams. These are followed by the UEFA European Championship (52%);

- Olympic Games – holding considerable appeal (35%), this global multi-sport event attract bettors interested in a variety of disciplines;

- the NBA Finals get 32%, confirming the status of basketball as the second most followed sport;

- Other global sporting events – Formula 1 (23%) and the Super Bowl (21%) also get a lot of attention, while tennis and cycling (e.g., Wimbledon and Tour de France both at 11%) are somewhat further down the list.

Only 5% of respondents do not bet on any major international sporting events and competitions. This clearly reflects the global nature of sports and betting interests among Brazilian gamers.

Betting on Olympic Events

With the confirmation that the Olympic Games are possibly the largest event outside of football tournaments for any Brazilian gamer, we take a closer look at the top Olympic sports people bet on.

Preferred Olympic Sports for Betting

Overall, 34.9% of participants admit to placing bets on the Olympics, following or planning to do so. Therefore, we proceed to evaluate their shares within that group.

Betting preferences for Olympic sports reveal some clear-cut interests.

- Team Sports above all – 77% prefer betting on team sports such as football, basketball, volleyball. Given the above context, this comes as no surprise. 21% prefer betting on individual sports, while an overlapping 18% are active in both niches.

- Football – at 70%, it is again the top sport during the Olympics, followed by Volleyball with 11%. All athletics events (combined) are picked by 5%, followed by basketball and swimming (4% each).

Understandably, no winter sports were mentioned explicitly by respondents.

Betting Preferences for Olympic Events

The types of bets placed on Olympic events also vary among respondents but follow a similar pragmatic philosophy.

- Direct Matchups or single Game Outcome – 58% attract the most interest, showing a preference for head-to-head outcomes.

- Event Winner – 56% prefer betting on the event winner, indicating a straightforward approach.

- The Medal Count is an important country comparison statistic, and that is a key betting market for 53% of those who bet on the Olympics.

- Performance metrics (i.e., under/over times, scores, etc) come next, still important for 39%.

These preferences reflect a desire for clear and direct betting outcomes, as anticipated.

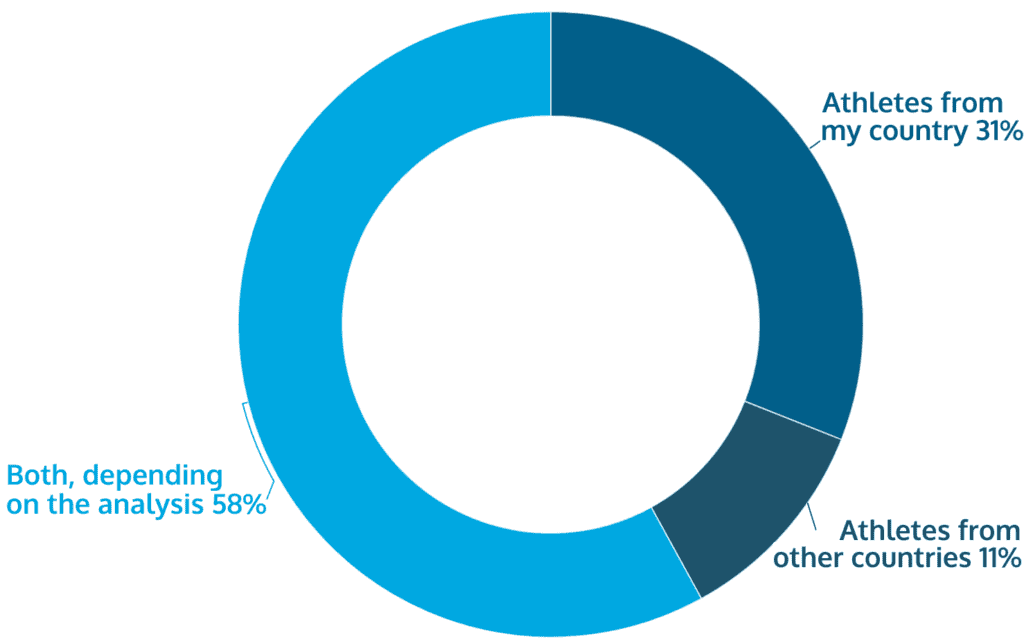

Do Brazilians Bet on Olympic Athletes Based on their Nation of Origin?

On the other hand, Brazilian bettors do now shy away from more complex analyses. This is evident from the fact that a clear majority do not bet on national representatives alone.

- 58% bet on athletes based on their analysis, a strategic approach that considers multiple factors way beyond national allegiance.

- 31% of respondents prefer betting on athletes from Brazil, reflecting a sense of national pride and support. However, that choice is possibly also based on a better knowledge of the athletes – recent form, tournament prospects or even relevant personal details.

While only 11% prefer betting on athletes from other countries, this simply adds to the perception that national loyalty plays a role but is not the dominant factor for most bettors during the Olympics.

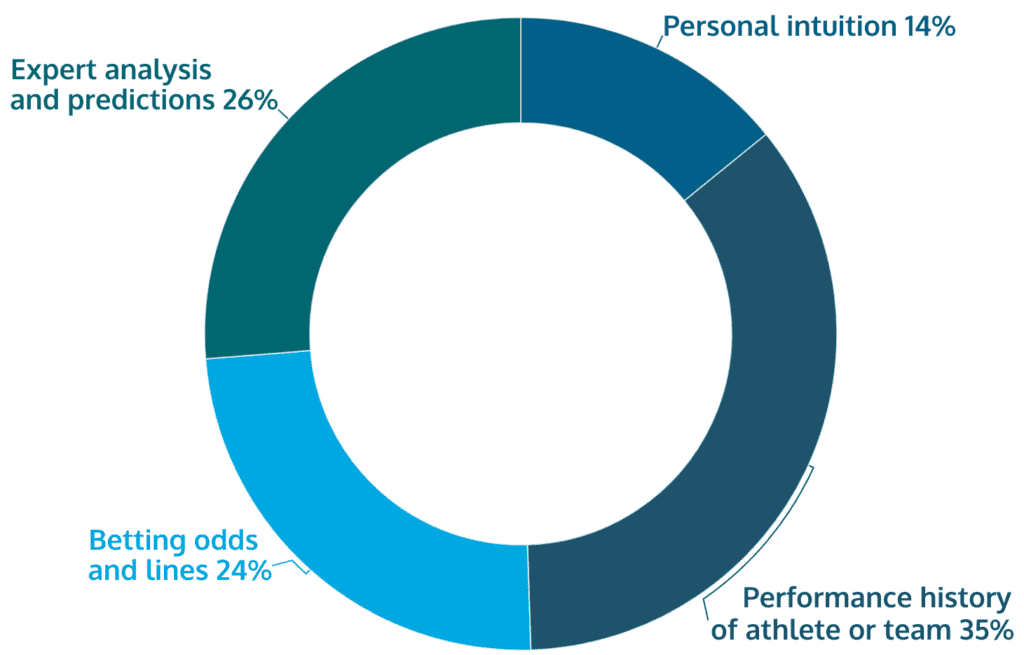

Influences on Olympic Betting Decisions

Bettors disclosed the major factors influencing their decisions for the Olympic events. Just like we had a detailed breakdown on the main strategies above, we split these into several main categories:

- Performance History – 35% consider the performance history of athletes or teams above anything else;

- Expert Analysis and Predictions – 26% rely on expert opinions and analyses; these analysts can be more or less formally recognized yet they certainly must have a strong following for those who bet on a particular sport;

- Betting Odds and Lines – yet another quarter (24%) base their decisions strictly (or mostly) on probability statistics for the matchup or competition.

Only 14% admit that they bet solely as a result of personal intuition or impression.

Overall, these preferences and decision factors stress the importance of informed decision-making for a growing number of Brazilian gamers – be that on the Olympics or any other competition.

Online Betting – Platform Expectations

Brand loyalty in sports betting is affected by multiple factors – from the quality of services received to the subjective perception of past gaming experiences (wins or losses, favorite team sponsorships, etc.).

What we need to find out is the factors which make gamblers rate platforms higher, what makes them change and how they discover their new favorite gaming site.

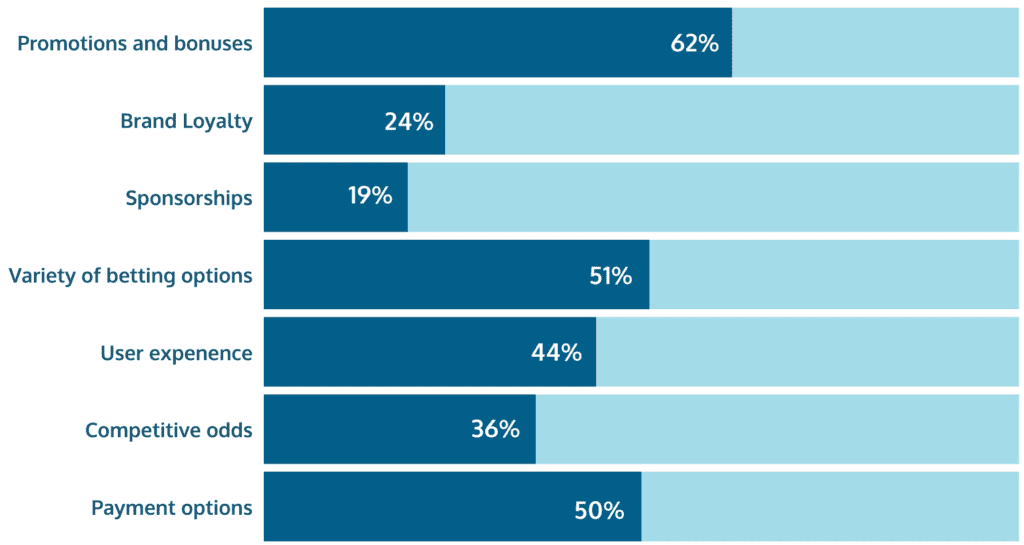

Key Factors in Choosing a Sports Betting Platform

When considering a new sports betting site, these are the leading factors behind Brazilian gamers’ choice:

- Attractive Bonuses and Promotions – 62% consider these of the highest importance, highlighting the appeal of welcome offers. These may not be possible much longer, according to recent legislative changes which aim to outlaw the distinction between new and existing players, giving an advantage to the former.

- Variety is also key, as both the number of betting options (51%) and payment options (50%) are cited among the top 3 decisive factors when choosing a betting site.

- The overall user experience (44%) comes next, something which is easily seen early on, even before signup, as well as evaluated through peer reviews.

Most people consider up to 3 elements when picking an actual operator. Only a few add (explicitly) factors like “reputation” and “data security.”

Brand Loyalty and Exploration

Some consumers are hard to convince. Still, based on their own experience and the prospects of a better rated alternative, many bettors switch their operator at different intervals. But just how often?

Overall, we see that as much as 46% try new betting sites only occasionally. This shows a fragile balance between commitment and exploration, yet leaning toward brand loyalty.

In support of the same conclusion, we see that 19% rarely or practically never switch their operator. Only 13% do so on a weekly basis.

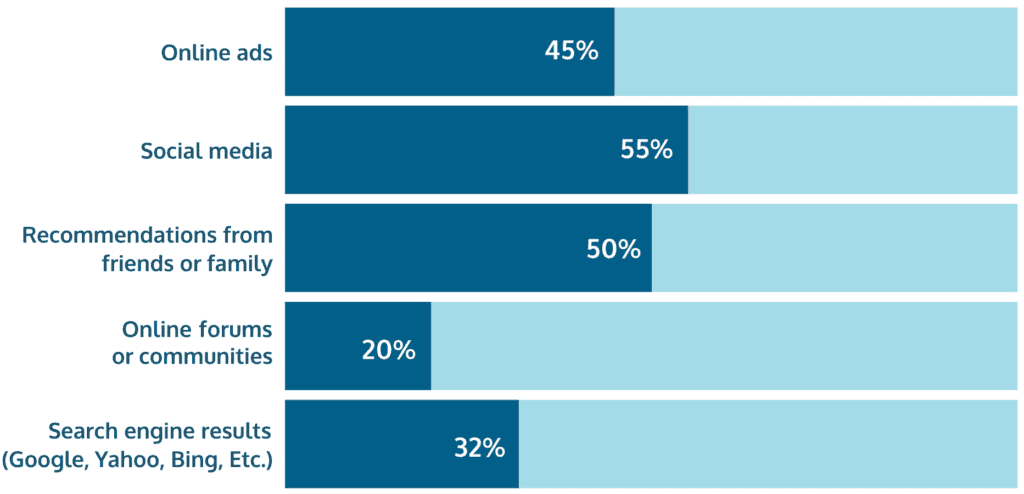

In terms of how players identify a new betting site, we see the emphatic role of digital marketing in today’s narrative about online entertainment.

- More than half (55%) discover new sites through social media.

- 45% come across online ads

- 32% discover new gambling sites via search engine results

- Forums or online communities are a factor for 20%

This indeed paints a comprehensive picture of how SEO and digital marketing generate massive traction in online entertainment discovery. Even open-ended answers mention “influencers” as information channels.

- Recommendations from friends or family have roughly the same weight (50%) as social media

These personal updates are shared, more or less requested, providing an often-decisive consideration when picking a sports betting site. However, they can only add the intangible dimension of informal advice, not corresponding to a generally recognized reputation.

With a multiplicity index of 2.0, most bettors turn to at least 2 of the above sources of information on gambling brands, relevant updates and new gaming options.

In the end, this dynamic between brand loyalty and exploration indicates an openness to new opportunities while maintaining trusted relationships with certain platforms.

What Makes Bettors Stay with an Operator?

Once again, attractive bonuses and promotions come on top for 71% of players, even more so when compared to those who are looking to switch. Evidently, regular incentives and promotions are highly appreciated and one of the strongest retention tools.

This is followed by an “easy to use interface” – crucial for 59%. With time, users value a smooth gaming experience, easy navigation and accessibility. Combined with graphics and design (26%) and mobile device compatibility (36%), this turns out to be a major factor for maintaining a lasting positive experience for existing customers.

Competitive odds come 3rd, picked by exactly 50% of respondents. They remain crucial and despite the rich market supply of bookmakers, possibly even a slight edge in odds may tempt users to consider an alternative (particularly if gamers notice that to be a regular shortcoming).

Among “other” answers we see people mention “honesty”, “instant withdrawals” and the presence of “casino games” on the platform as well.

Influence of Sponsored Platforms

The influence of sponsorships on betting platform choices is notable. Whether it’s choosing a new betting site or sticking with your current operator, sports enthusiasts are influenced by their favorite team’s affiliation.

- Fan of Sponsored Team – 57% choose betting platforms that sponsor their favorite teams, showing the immediate impact of such partnerships.

- No Influence – 43% are not influenced by sponsorships, indicating neutrality or a more “scientific” approach to betting as a data-based venture.

Engagement with Betting Content on Social Media

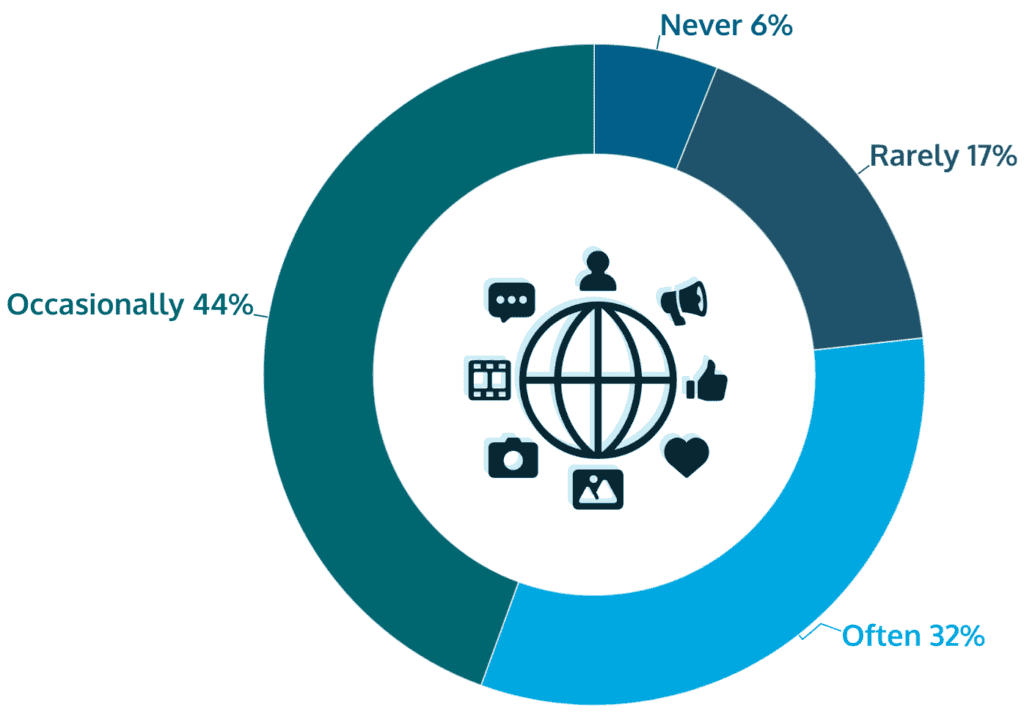

Engagement with betting content on virtual social networks and streaming platforms varies, as seen below.

Occasionally – 44% engage once in a while, indicating moderate interest for the majority.

Often – 32% engage frequently, showing a high level of interest for 1 in 3 bettors.

Less than a quarter of respondents do not follow or rarely engage with gaming content on social media (23% combined for “rarely” or “never”).

These responses stress, once again, the importance of digital content in the betting experience. Gaming communities create a strong sense of belonging, shaping betting trends, spreading strategies and advice.

In many cases, SM content and gaming channels provide the learning curve for less experienced gamers. For others, they can be a powerful prediction tool via crowd-sourced tips and strategies.

Main Trends in Brazilian Sports Betting

- High Engagement – The vast majority of respondents actively participate in sports betting, often supplementing with other forms of gambling.

- Informed Betting – A considerable portion of bettors invest time in research and employ statistical analysis and expert consultation.

- Diverse Betting Markets – Bettors engage with a wide range of betting markets, indicating sophisticated and varied betting strategies.

- Financial Motivation – The primary motivation for betting is potential financial gain, coupled with the added excitement of sports.

- Local and International Interests – There is a strong interest in both local and international sports and leagues, reflecting a broad betting landscape.

- Influence of Promotions – Bonuses and promotions significantly influence platform choices, highlighting the importance of gaming incentives in attracting bettors.

What We Learned

The sports betting market in Brazil is characterized by high engagement and a well-informed betting community.

Our survey respondents demonstrate diverse betting preferences and strategies, driven primarily by the potential for financial gain and the excitement of sports.

The sports betting landscape in Brazil reveals an evolving and maturing online gambling market. Sports bettors continuously seek to enhance their chances of success through informed decision-making and strategic approaches.

The way we see it, there has never been a stronger demand for quality information and insightful research on online gaming in Brazil.