This post is also available in:

The gambling industry in Brazil seems to have passed a pivotal juncture. The undeniable interest of Brazilian adults for real-money games has led to public debate and, finally, a set of dedicated laws.

This study makes use of recent survey data and reveals the attitudes of actual gamblers towards gambling regulations. We also analyze said legislative framework and provide iGaming stakeholders with actionable insights into the sector’s future.

Background and Context

The real-money gaming market in Brazil has always had the challenge to reconcile the complexity of socio-cultural factors with the reality of market demand. And as things stand, the nation still has imperfect gambling legislation – fragmented and incomplete, put simply.

While land-based (and cruise-ship) casinos remain prohibited, in June, the Senate’s Justice and Citizenship Committee (CCJ) approved Bill 2.234/2022, which aims to regulate land-based casinos, bingo halls and horse race betting. The bill should be voted on after the municipal elections, which end on October 27.

December 2023 saw the enactment of the crucial Law 14.790/23 which set the stage for regulated fixed-odds betting. The Act defines a wide range of real-money gaming segments and provides essential standards for physical, online, sports-themed and other virtual games.

According to the 2023 law, bettors must pay 15% income tax on their annual net winnings, while operators are responsible for paying both the winnings and the income tax applied to them.

Regarding the detection of fraud and gambling problems, Serpro – the Federal Data Processing Service – developed Sigap, the Betting Management System, under the command of the Ministry of Finance in July 2024. In addition to regulating and monitoring the betting market in real time, Sigap helps to cross-reference data to analyze bettors’ behavior and identify possible cases of pathology or debt. The system collects data provided by companies on bets made on sports and online games, according to the format established by the Ministry of Finance. The Ministry of Sports also uses Sigap to monitor sports bets suspected of manipulation.

In terms of payment methods, limits are now applied to sports betting transactions via Pix (as instant payments) and debit cards. Credit cards and bank slips have been excluded to reduce the risk of over-indebtedness and combat money laundering.

Also in accordance with Law 2023, the National Advertising Self-Regulation Council (Conar) has established rules for betting advertising in Brazil. The guidelines emphasize transparency, child protection and responsible gambling. Consequently, advertisements must include age restrictions, clear labeling and avoid misleading claims about winnings or linking gambling to success. Warnings such as “play responsibly” are also required.

Published on October 1, 2024, the list of licensed casino and sports betting companies includes 96 operators nationwide and 18 authorized to operate at state level. On the 11th of the same month, at the initiative of the Ministry of Finance, the National Telecommunications Agency (ANATEL) began blocking 2,027 betting sites that were operating illegally in the country.

Further down, we will come back to the coverage and effects of these gambling regulations. First and foremost, however, we need to understand how these developments have been received and digested by the very gaming customers and public at large.

The Players’ Viewpoint – Moving in the Right Direction

In February 2024 we conducted a field survey among 627 adult Brazilian real-money players. Essentially, the results reveal a significant engagement with the topic among gaming consumers. Upon further segmentation, the data shows a more nuanced understanding of and active interaction with this kind of entertainment. Most importantly, the questionnaire reveals a keen interest in the legal landscape, both for its impact on end-user options and the public interest.

Sentiment on Brazil’s Gambling Regulation

The survey is built upon the very idea of the need and projected effectiveness of gambling regulations as they have been adopted at this stage.

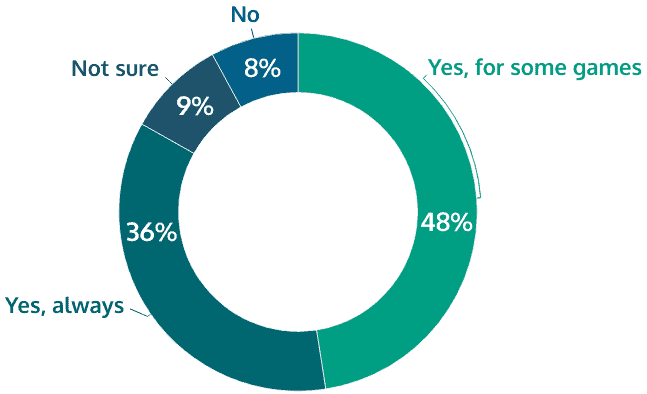

When asked if they consider it a good idea to have online gambling operators acquire a Brazilian license, respondents were quite clear.

A combined 84% favor licensing for online gambling, showcasing the broad support for regulated gaming.

As for the steps taken in that direction, players seem to approve of the direction at least.

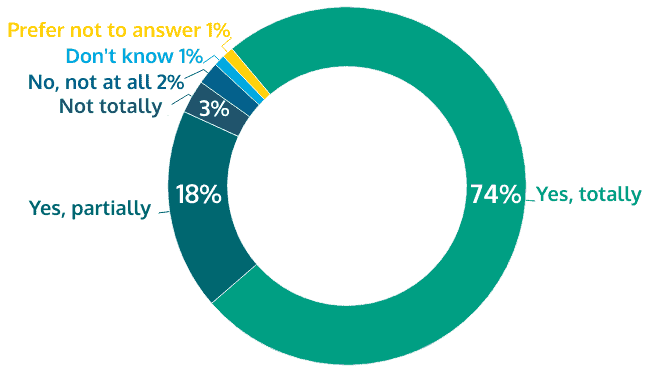

The demand for gambling regulation in Brazil is unequivocal. A staggering 92% advocate for clear online gaming laws, emphasizing the public expectations on market transparency and safety.

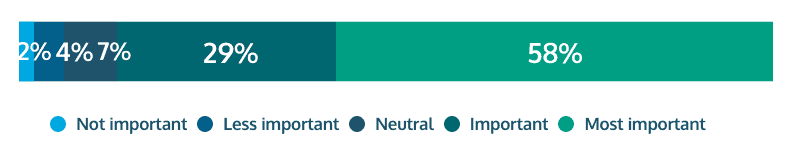

An overwhelming 87% regard company registration, licensing and taxation as important. The logic that regulation is instrumental for effective taxation – and therefore wider public benefits – underlines the acceptance of governmental oversight of the market and its integrity.

General Public Awareness on Gambling Regulation in Brazil

This brings us to assessments on the overall level of knowledge among Brazilians, when it comes to gambling laws.

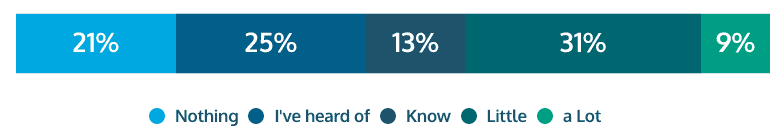

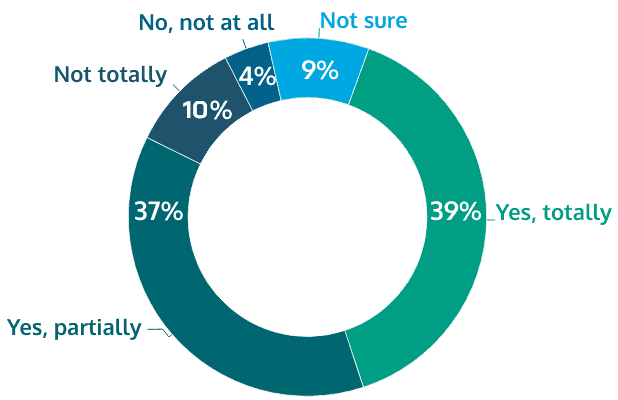

Evidently, the demand and acceptance of gambling regulations do not quite equate to actual familiarity. The limited law awareness is seen from the 53% admitting to moderate or ample knowledge on the issue.

Such levels are probably expected and “physiological”, given the early adoption stages of a comprehensive gaming regulation in Brazil. Yet, they still indicate a certain need for enhanced education of the public and consumer awareness campaigns.

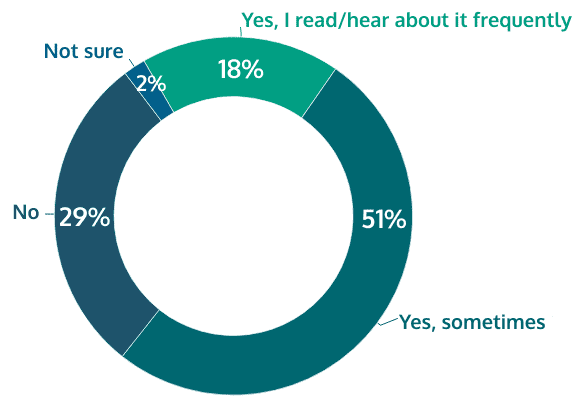

Along the same lines, real-money players were asked whether they usually follow any regulatory updates.

The high engagement levels – 69% follow gaming regulation news, ranging from occasionally to frequently – confirm the sense of concern (or at least curiosity) about where the sector is heading.

Economic and Social Implications of Regulation

Clearly, the surveyed gamers view the new regulatory measures as a positive turn of events, even better if they are more stringent. Above all, these laws and rules need to be decisive in providing a safe and fair gaming market, protecting players’ interests.

Most adult consumers also know that gaming regulations need to enable the prevention of negative social impacts. (Explicit questions related to gaming risks are presented below).

Inevitably, it is also important to evaluate the consequences that a legalized gambling sector will have on politically important domains like the public finances. In mature and well-regulated markets (e.g., Europe or, more recently, the U.S.), the economic benefits of regulated gambling are widely recognized.

Financial and Job Creation Potential

The economic and social implications of the new gaming regulations are profound. The hopes are that the iGaming industry stands to contribute significantly to tax revenues and employment opportunities.

Although official estimates (used by legislators when drawing the bills) are hard to come by, Federal Senators cited figures of around BRL 10 billion annually, in addition to BRL 3-4 billion every five years for licensing fees. That makes up around USD 2.2 billion in annual tax revenues, excluding economic spillovers from supporting business activity.

Moreover, taxation on player winnings is also not accounted for. That should practically double the projected levies, since most licensed games have a return-to-player ratio (RTP) between 90% and 98% of the sums played and the lucky winners will be taxed at 15% (compared to operators, at 12%).

Altogether, Brazil can expect tax proceeds of around USD 4.5 billion every year, as well as plenty of employment opportunities in the iGaming sector.

Most respondents showed adequate understanding of such economic potential.

Recognizing the expected economic contribution of the iGaming industry, a combined 76% believe that it can boost Brazil’s finances and provide employment opportunities.

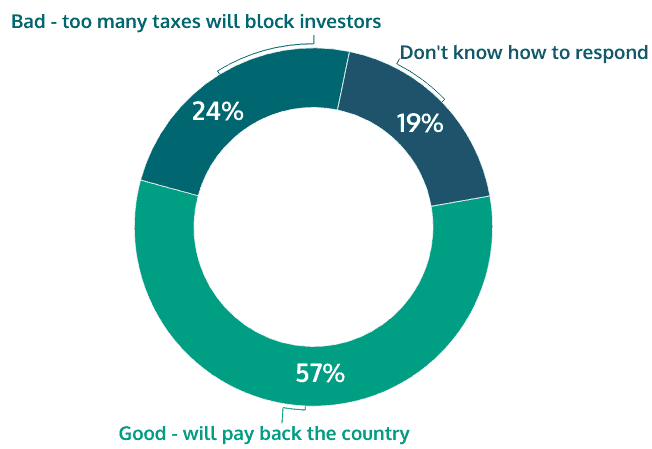

Taxation levels, on the other hand, reveal more nuanced prospects, and the respondents seem to appreciate that as well.

When asked about the impact of taxation levels, 57% consider higher gaming taxes positively. In the opinion of the majority, this is a means for companies to contribute more to national welfare.

Interestingly enough, this view is even more emphatically supported by higher-income households (62% for A and B classes combined), as well as those residing in State Capitals (63%).

Still, nearly a quarter (24%) fear that increasing taxes to excessive levels might deter investments. Effectively, such a scenario might see iGaming businesses (i.e., websites) remain unlicensed or simply registered offshore.

Consumer Protection and Safety

The survey responses rightly highlight the fundamental role of proper regulation in combating risky gambling behavior and ensuring game integrity. There is a strong consensus on the importance of setting requirements and mechanisms that can safeguard consumer interests.

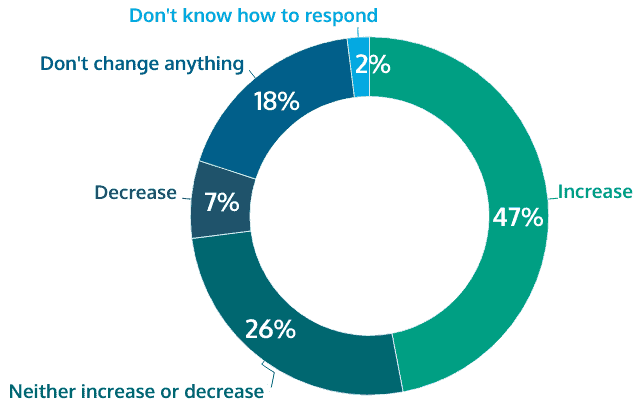

Concerns about problem gaming and addiction risks persist among many respondents, regardless of regulation. As much as 47% even see legalization as “inviting” more risks, potentially increasing problem gaming.

Still, that is less than half, while 26% see regulation as having neutral impact in this regard. Possibly not being familiar enough with the new rules, gamers still indicate diverse scenarios and impacts of legalization. For 18% it would not change anything in terms of risk factors, while 7% agree it would decrease them.

Brazilian players are much more univocal when asked about prospects of match fixing and money laundering, undesirable phenomena often attributed to unregulated gambling.

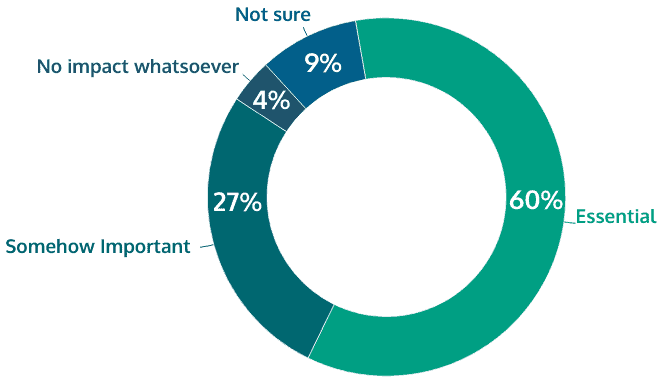

For 60% this is an essential and appropriate step, and as many as 87% claim it has certain importance in making the market more transparent.

iGaming Safety and Information Security Awareness

The latter aspect leads us to further (and related) consumer protection impacts. For a long time, the absence of a structured gaming regulation has been a bigger issue. Lately, the debate around sensitive personal and financial effects uncovered some real-world problems which may have otherwise remained neglected.

Topics like online scams and cybersecurity threats raise concerns about data privacy and the vulnerability of players engaging with unlicensed providers.

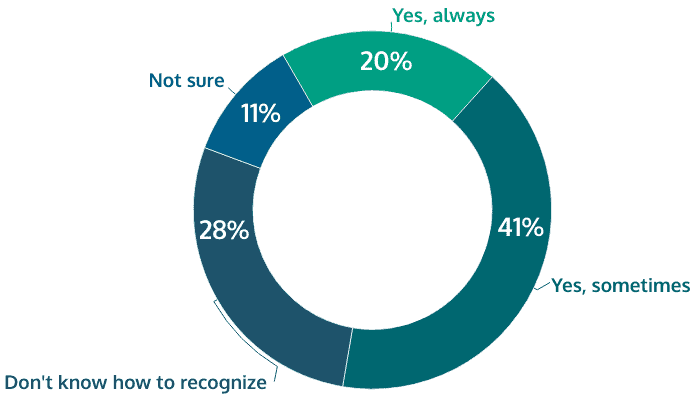

When asked about their ability to recognize safe gaming sites – or spot a fraudulent or potentially dangerous one – 61% claim to be able to do that sometimes or always (20%). This may seem a satisfactory level, overall, yet only one in five are certain in their abilities and knowledge about this. And nearly twice as much lack the confidence or skill to spot online gaming scams. The outcome of this question clearly shows the need for increased digital literacy on secure online gambling practices.

A closely related set of skills is the one required to protect personal information.

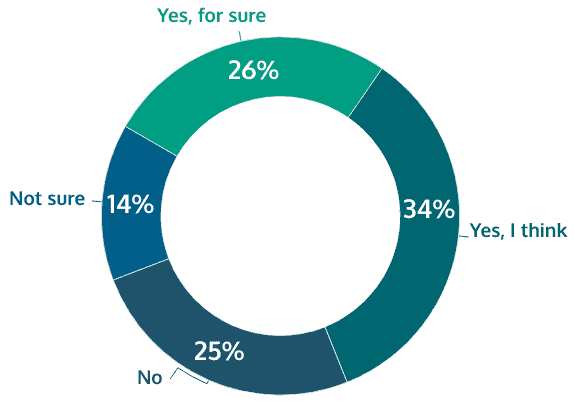

Much like with website reliability, we also observed a divisive stance on the respondents’ ability to keep their personal information safe in real-money gaming contexts. Similarly, a consistent majority think they know or are certain they know what to do (60% combined) but only one in four are absolutely sure (26%).

Online Casino vs. Sports Betting. Nuances in Regulation Demand

The profiles of survey respondents confirmed much of what we already know about the Brazilian gambler.

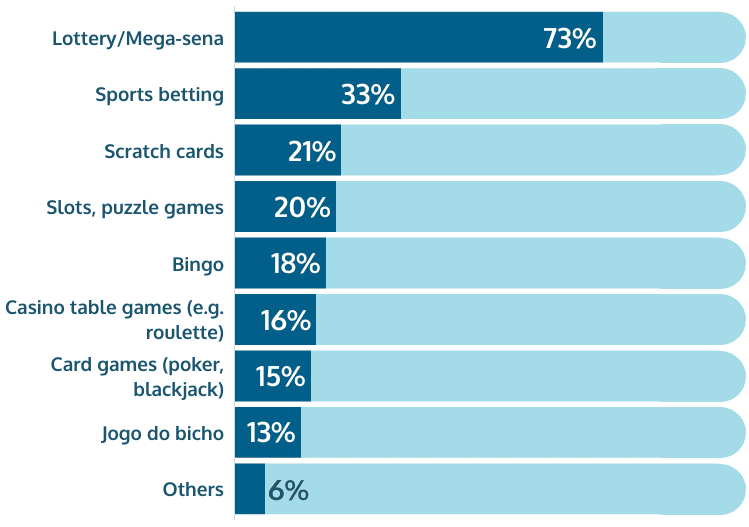

If we combine all game verticals, we have a “multiplicity index” of 2.2, meaning that people play more than 2 games, on average.

Lottery players top the list, in all studies. Sports bettors are the second most important group but a rapidly growing one.

However, the aggregate shares for all casino-type games – combining slots, crash games, casino table games and card games like poker and blackjack – show us that online casinos also attract over a third of all active players – nearly 35%.

Online casino is often played besides other real-money games (hence the 2.2 multiplicity). Many casino games are widely known, with some considered timeless classics like roulette, slots or blackjack. That is why they have awareness and activity levels comparable to the more “visible” gaming verticals, i.e., sports betting.

On the other hand, the online casino niche also presents certain differences in public perception and player awareness of effective regulations. While lottery, for example, has been legal and regulated for much longer across a number of Brazilian states, that has not been the case of online casino games and even sports bets.

A comparative analysis of responses by casino players and sports bettors reveals variations in preferences for licensing and regulatory awareness. Both segments show high approval for regulation but varying levels of safety recognition and legal knowledge.

In relation to their ability to recognize safe and legitimate websites, online casino players reach combined levels of “sometimes” and “always” of 58%. This is slightly lower than the rest of the respondents, showing certain difficulties in recognizing licensed and trustworthy casino operators.

Sports betting fans, on the other hand, reach 75% in claiming such abilities. This is much higher than both online casinos and other “traditional” real-money games like lottery, bingo, scratch cards, wherever they have an online version that is. We can attribute this to massive advertisement campaigns in Brazil, along with the operators’ association with top-tier football teams and mainstream events.

On the very idea of having a Brazilian license, online casino players show 88% of combined approval (48% agree on licenses for “some games”, 40% for “all game types”).

Sports bettors think in a similar manner, reaching 89% combined approval. More importantly, both segments rate the idea higher than fans of traditional real-money games (ranging between 80% and 84%). This stresses the modern gamers’ desire for more clarity and a conclusive gambling regulation in Brazil.

The high approval ratings also reveal something which is the very idea of a well-regulated market – the huge potential for high channelization rates, compared to playing only on offshore gaming websites, holds a series of long-term benefits for the Brazilian market.

And last but not least, on the question of legal knowledge, online casino players showed a combined 60% between “something” and “a lot”. Sports bettors are even better informed, at 68%.

Both gamer pools rated higher than average levels (53%), showing keen interest in getting more clarity on their vertical and the regulation of gaming services in Brazil. Sports regulation, obviously, is better communicated and more advanced in its adoption by users.

Latest Regulatory Framework

As we mentioned above, the most recent major legal update goes back to the closing weeks of 2023. The current real-money gaming act legalizes formally several gaming verticals and amends related legislation from 1971 and 2018.

The Law 14.790/23 is, indeed, a significant step in regulating gambling in Brazil. It aims to ensure safety, fairness and responsible gaming, while also contributing to the country’s social and economic objectives.

It provides guidelines for licensing, operational standards and tax rules for gambling operations in Brazil.

Brazil Gambling License Terms

- 5 years – the license duration for online casino and sports betting operators that receive approval;

- BRL 30 million (~USD 6 million) – the fee for online gambling permits, owed once per licensing cycle;

- 3 brands – the limit for trademark platforms (websites or apps) under one license;

- 31 December 2024 – the cutoff date for compliance. Penalties for non-legitimate online gambling operations apply from 1 January, 2025.

In addition, the law currently sets the following requirements:

- Operational guidelines and integrity measures– fixed-odds betting operations are contingent on the approved companies’ adherence to policies, procedures, and internal controls. These include customer service and complaints handling, anti-money laundering, counter-terrorism financing, responsible gaming, prevention of pathological gaming disorders, betting integrity and prevention of result manipulation and other frauds. Naturally, gambling is prohibited for minors and individuals who could influence game outcomes.

- Taxation as the core of regulation – the law introduces clear online gambling tax rules for Brazilian companies and players. iGaming operators are charged 12% on top of other standard corporate taxes, while a 15% flat income tax is foreseen for player winnings. Taxation is explicitly extended to fantasy-style games and virtual events with uncertain outcomes.

Collected tax revenues are distributed across various sectors including education, public security, sports, social security, tourism, and health (for prevention and mitigation of possible negative effects arising from problem gaming). Even unclaimed prize money is foreseen to go to student funds and civil defense programs.

This all-round approach dictates rules for operation, services and standards in a structured manner. If anything is missing, that could possibly be traced to insufficient provisions for monitoring bodies but those may be defined as the sector evolves. And often come in the form of self-regulation associations.

Most importantly, the big difference from previous legislation attempts is in its widened scope – the regulation applies to both online and physical gambling (although not all kinds), as well as both real-life and virtual events.

Advertising Guidelines

The 2023 gaming law also advances the state of regulation on gaming advertisements. In that context, key provisions include:

- Guidelines for communication, advertising and marketing, essentially promoting self-regulation;

- Mandatory inclusion of warnings about the risks of advertised activities;

- Prohibition of misleading advertisement, promoting unlicensed brands or false benefits;

- Explicit prohibition of targeting minors (e.g., marketing in schools) and obligations of proper age-group labeling.

A few months earlier, the Chamber of Deputies at the Brazilian Congress approved the Bill 3915/23 which targets mostly unfair online advertising. More precisely, the law addresses social media channels and figures (i.e., influencers) and prohibits them from promoting unregulated gambling.

At the time, the scope of gaming regulation was not clear or predictable, therefore promotional limits were meant for anything outside the likes of sports bets and lotteries. At the time of writing, these restrictions are intended for promotions of gaming platforms that are unable to obtain Brazilian licenses.

The law was actually passed because of the significant impact social media has on direct promotional messages, reaching millions of followers. And, consequently, with the goal of limiting the risks of unfair online marketing on people’s mental and financial well-being.

While the proposed measures still need further approval (by the Senate) and enactment (by the Executive branch), they would mandate influencers to:

- Ensure their content does not encourage or refer to unregulated gambling;

- Inform their audience about potential risks and consequences;

- Clearly communicate the commercial nature of the publications;

- Include information identifying the company or individual sponsoring the content;

- Ensure the content does not reach minors;

Non-compliance by influencers would incur penalties, fines, warnings or suspensions, depending on the severity of the case.

Similar (but stricter) sanctions are foreseen for companies which must disclose a list of public figures and online personalities they work with. All contracts must be formalized and define both the scope of promotional activities and the parties’ obligation to act in good faith.

Some state-level legislation initiatives are also worth noting. This is particularly the case of the Maranhão Law Against Gambling Promotion. Sanctioned in October 2023, it prohibits the promotion of the online slot game “Fortune Tiger” (known as “jogo do tigre“, among other nicknames) by influencers. The law gained national prominence as a pioneering move in response to numerous cases of misleading promotional campaigns on social media.

Topical Cybersecurity Regulation

Around the time sports betting was (broadly) legalized in 2018, Brazil began taking first steps toward protecting data privacy on the Internet. The General Data Protection Law (LGPD) finally entered into force in mid-2020, mirroring most of the good practices found in the EU’s GDPR.

However, in the absence of concrete prospects of licensing gaming companies at that point, players remained susceptible to shady websites, unlicensed games and sub-par personal data handling.

The current gaming law (14.790/23) has certain provisions on complaints handling and customer service requirements, but little specifically on personal data protection and cybersecurity risks.

Thus, the leading dispositions on personal data and cyber protection remain within the Brazilian LGPD. We fully expect, however, that guidelines and requirements for iGaming operators will become more detailed and concrete in that direction. That is, whenever the designated licensing authorities accumulate more experience with sensitive topics like personal data protection in the context of real-money gaming.

Socio-cultural dynamics

When considering the consequences of regulations on gaming demand, we also need to investigate who is responsible for shaping these gaming regulations.

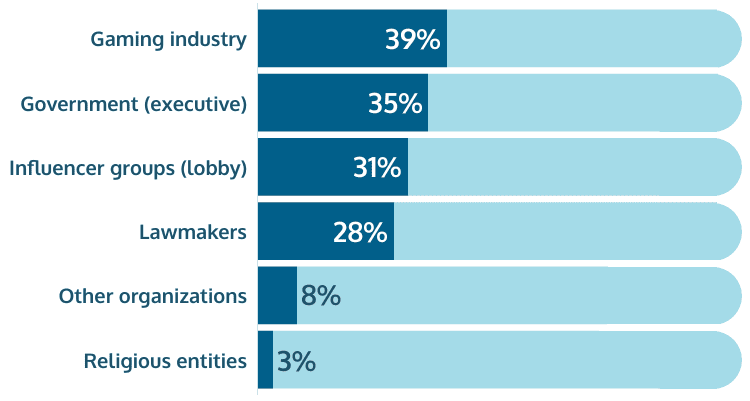

The largest share of respondents (39%) thinks that the gaming industry has the biggest role in shaping gambling policy and laws – bigger indeed than the Government (35%).

Perhaps not surprisingly, lobbies and other pressure groups come next (31%), ahead of lawmakers themselves (28%).

In this context, however, we need to consider some socio-cultural factors that impact the drive for gambling regulation – be those public or largely unspoken.

For a long time, it has been difficult to conciliate different opinions by Brazilian authorities and civil society actors.

- Regulation advocates have always pointed to substantial and legitimate revenues and economic spillovers, besides improvements in consumer protection.

- Critics have often expressed concerns about the potential for increased gambling risks and related social problems.

In Brazil, however, the “religious” factor is bigger than it appears on the surface – and it is probably underestimated in the survey response as well. Religious entities consider all betting forms a “sin”, citing the known risks.

Republican legislators have been slowing down regulation efforts since 2018. They are notably from the group called “the religious bench” but, in truth, the entire conservative party is heavily influenced by the Universal Church of the Kingdom of God.

Ultimately, motivations are found in what religious figures see as competing channelization of funds – from temple offerings into real-money games. This may not seem like a strong enough justification, yet we need to consider the extremely limited disposal income of millions of Brazilians on the outskirts of large cities.

Historical Context and Evolution of iGaming Regulation

The transition from a historically restrictive stance on gambling to embracing a regulated online gambling market in Brazil marks a significant shift. These developments reflect changing societal attitudes and the recognition of the economic benefits of a regulated gambling industry.

The government’s efforts to put order in the sector reflect a commitment to creating a secure and fair gaming environment. More practically, the latest regulations aim to balance economic incentives with protective measures for players.

Regulation Landmarks for Brazilian iGaming

- In 2018 the Federal Law 13.756 legalized fixed-quota bets (essentially sports betting), where games would have preset winning coefficients. No further rules or taxation dispositions were provided at the time.

- In mid-2023, returning President Luiz Inacio Lula da Silva issued an executive order to tax sports betting at 18% on “Gross Gaming Revenues” (GGR)

- Regulation efforts culminated in December 2023 when the President sanctioned the law regulating real-money games, establishing a more sensible legal framework for both physical and online gambling operations.

- The focus is currently on taxation and licensing revenues, as well as their redistribution among sports, youth and social programs.

Future Outlook

The iGaming sector in Brazil is destined for consistent growth in the next few years – driven by technological advancements and increasing player engagement. The biggest factor in that sense, however, is the newly found regulatory clarity.

The industry’s prospects will be shaped by the effectiveness of the adopted guidelines and efficiency of control mechanisms and self-regulation efforts. Ongoing adjustments to regulations will also be crucial in ensuring a balanced and responsible gaming ecosystem.

Implications for the iGaming Industry

The gaming laws enacted on a federal level aim to balance the economic benefits of the Brazilian gambling industry with the need for consumer protection and safe gaming practices.

As things stand, authorities channel most of their efforts to taxation and financial control. The key to sustainable growth, in that context, is whether the adopted fiscal policy will maximize public benefits while not stifling market growth.

More regulation and transparency also mean less opportunities for money laundering and match fixing but more chances for high-profile gaming partnerships with sports clubs, events and national awareness campaigns.

The debate must clearly shift outside the financial effects as well, and our survey helps gaming stakeholders see what is beyond that – public opinion on safety, efficiency and social effects should become the pivotal factors in improving gambling regulations. The impacts of fair marketing and product transparency might be harder to measure and regulate, given the fast pace of market evolution, yet there are good practices from mature markets that can be taken as reference.

One thing is certain – having an open discussion and setting up a wide-scope regulatory framework has been a huge step in the right direction for Brazil.