This post is also available in:

What is online gambling channelization? How does it affect gamblers in the newly regulated Brazilian gambling market?

The concept of channelization, or channeling rate, refers to the proportion of domestic consumers gambling within the national licensing system. For several reasons – consumer protection, tax collection, and quality standards above all – the optimal channelization rate is considered above 80 percent.

In Brazil, the licensing system is still in its early stages, which means channelization will be an evolving process. It takes a while to get the puzzle right, as gaming regulations impose safety norms, technical standards, financial requirements, and much more. But it is easy to justify why legitimate gaming is safer and better controlled than offshore websites.

Last but not least, channeling targets need to take into account player needs. Gamblers need just enough regulation to be protected, but with excessive limitations to their gaming experience, many could be driven to unlicensed platforms.

We analyze all of the above aspects and explain how they apply to big emerging markets like Brazil.

Challenges to Gambling Channelization in Online Gambling – Lessons from Mature Markets

Undeniably, regulation aims to make gaming safer. Players outside the national system are not covered by protective measures and standards, and they are susceptible to fraud, scams and other cyber threats. The recent enactment of Law 14.790/23 – that set essential standards for physical, online, sports-themed, and other virtual games – marked a significant step towards establishing a regulated online gambling environment.

On the other hand, over-regulating can reduce channelization rates and that is something newly regulated markets, like Brazil, must be fully aware of. Countries with a long history of regulated gaming, like the United Kingdom and Sweden, have had more time to get the mix right and achieve the desirable channelization rate.

With approximately 22.5 million consumers (44% of the adult population), the UK has one of the most impressive channelization rates of 97.6% in online gambling. Several initiatives – like the pilot program “GamProtect”, which involves multi-operator data sharing to create a Single Customer View (SCV) of the UK gambling industry – have made a convincing impact.

A transparent industry instills trust and ultimately safeguards player interests. As for the balancing act of not “suffocating” the market with too many limitations, it lies in innovation when addressing the industry bottlenecks, says Andrew Rhodes, the CEO of the UK Gambling Commission. We can easily agree there is no better channel for pioneering consumer protection tools than digital platforms.

In Sweden, on the other hand, the latest annual reports show that the current average channelization rate for online gambling is 77% (in 2023, varying between verticals from lottery, at 91%, to online casinos at 72%). Market research agencies attribute this relatively low channelization rate to players seeking more variety or better odds, often advertised by unlicensed sites.

Despite the best of intentions, this is one of the side effects of strict regulatory environments. High taxation and restrictive policies, actually impacting consumer choice and their gaming journey, might lead consumers towards unlicensed operators.

In practical terms, what this means is that prior to the latest regulatory updates, players were able to get bonuses and cashback from casinos. Since 2023, players can only get one welcome bonus with licensed casinos and little else in terms of casino bonuses. With unlicensed operators, they still get various bonuses and cashback offers.

The spike in searches for “casino without Swedish license” illustrates this challenge best. High channelization rates cannot be achieved at the expense of player satisfaction.

Through severe bonus and spending limits, less competitive odds, and RTPs (returns to player), licensed gaming platforms can be put at a disadvantage compared to unregulated foreign ones, draining the market from legitimate economic activity and leaving consumers exposed.

Achieving the right balance is crucial for keeping players safe and satisfied within a regulated market. Given its nascent regulation, Brazil has a lot to learn from these scenarios where all stakeholder interests need to be considered.

Best-Case Scenario for Brazil (or a Simply Working One)

To avoid a false start in its recently regulated gaming sector, Brazil needs to fine-tune several crucial parameters:

- First and foremost, setting reasonable tax rates will convince investors to enter the market, and do it by Brazil’s rules.

- Secondly, it needs to legitimate and control a wide range of real-money gaming verticals, raising channelization volumes as a result.

- And lastly, authorities should impose standards and guidelines related to Responsible Gaming (RG) and consumer safety (i.e., financial, personal, etc.) but not venture too much into gameplay limits and user experience, which has often deterred players from over-regulated channels.

The Brazilian gambling market is estimated at US$ 10 billion (BRL 50 billion) total in pre-regulation volumes. It also boasts approximately 103 million players, stressing its potential as a global gaming power and catching the attention of businesses from around the world.

According to leading legal experts in gaming and betting regulatory compliance:

| The [cited] law is the best effort to regulate the industry achieved to date. It provides the general guidelines for what to expect in the ordinances [yet] to be issued by the Ministry of Finance. The challenge [in this version of the legal framework] is the requirement for 20% Brazilian ownership in operators applying for a federal license. Most foreign operators will need to incorporate a local holding company to obtain a license. Hopefully the Ministry of Finance will accept the two-tier corporate structure. Neil Montgomery | Montgomery Law Firm, São Paulo – Rio de Janeiro |

Based on lessons learned, Brazil should focus on ensuring its licensed gambling market remains attractive and competitive to retain and channel players toward legal offerings.

For that to happen, regulators need to consider both the consumer profiles and needs, as well as the gaming industry angle. It is crucial to analyze what has worked in other jurisdictions and translate it to the Brazilian reality.

More importantly, the experience of setting up comprehensive market regulations in other countries shows that it can be a time-consuming process. We fully expect legislators to have to adapt the current rules, standards, and guidelines yet again in the coming months and years.

Player Protection Beyond Political Mottos

Balancing all of the above variables is crucial but player protection and operator taxation are always central to the public debate.

The former, in real-money gaming contexts, involves responsible gambling above all. An RG policy focuses on ensuring users are playing for entertainment only, and providing support tools that enable such an attitude in practice.

Montgomery also points out that

| The Conar, Brazil’s non-governmental self-regulation advertising watchdog, has also laid down specific advertising guidelines for operators to follow responsible gambling principles. |

The most widely used RG tools include limits that can be set on deposits, bet amounts, or time sessions; temporary or permanent breaks from gaming; support lines and registers for problem gamblers; and, of course, fully prohibiting real-money games to minors.

Licensed providers are expected to collaborate with gambling support organizations and show their commitment to responsible gambling by enabling players to monitor their gaming habits.

| Now that operators have to register and apply for a Brazilian license, we will see a first wave of consumer claims from when they were based overseas. This is something that not all operators are considering, but should, because the impact on their balance sheet could be significant. Neil Montgomery |

On the other hand, academic studies have shown that excessive or ill-designed RG tools can potentially disturb recreational gamblers, channeling them to less protective operators. Still, RG policies (translated into settings and support materials) are the most meaningful way of protecting adult players and making sure gaming is a safe form of entertainment.

Decades of industry experience show that there is no more effective, user-friendly and pragmatic way of taking action on ethical concerns, regardless of political statements and judgemental public attitudes.

Data Safety

Along similar lines, higher channelization protects players from uncontrolled data collection. Sensitive data is always likely to be gathered by businesses, especially in our mobile-first day and age. Tech consultancy studies reveal just how much the gaming industry is exposed to cyber threats. More frequent and sophisticated with each year, these security breaches require a “multi-layered” approach which is often outlined in initial licensing requirements by gambling regulators (e.g., full compliance with the General Data Protection Law, LGDP).

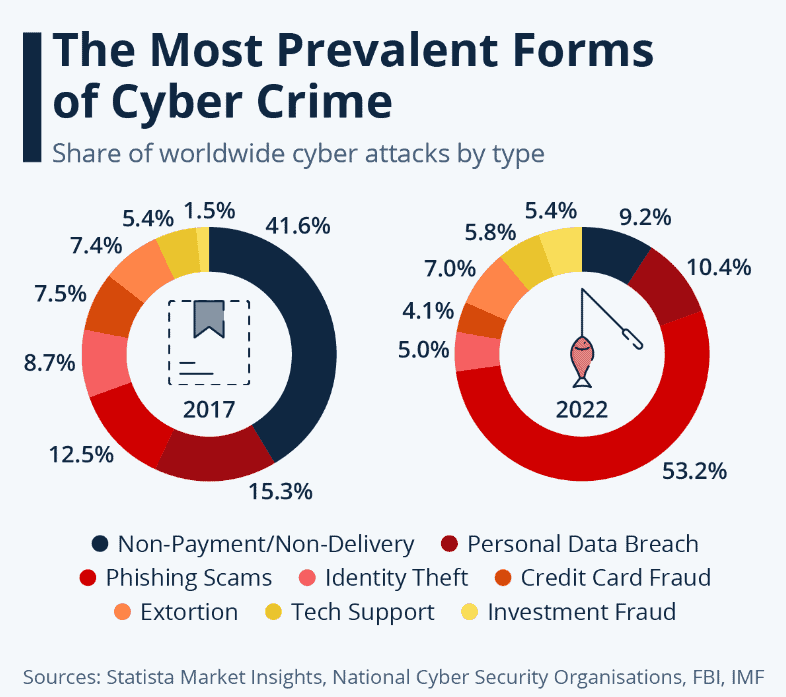

Statista figures also concur that – after cases of non-payment/non-delivery as the leading threat – personal data breaches are quite common for digital transactions. Low channelization to verified operators (and their vetted providers) leaves more players exposed to unsafe practices.

IP blocking and bank account tracking remain an inefficient “chasing game” with the myriad of offshore gaming sites. Non-licensed platforms will always be the majority out there and the Brazilian authorities’ goal should be to convince and channel domestic users to safe and legitimate alternatives.

In this scenario, Brazilian authorities are implementing adequate protections – including player identity verification requiring facial recognition, affirms Montgomery.

Taxation Is the Key

The ability to tax registered and licensed businesses is a big part of why regulating paid gaming was the right move for Brazil. Consumer channelization inevitably impacts tax proceeds in a very linear manner, where the goal is to keep a big part of the domestic market proceeds.

But getting the fiscal policy right is also important when trying to make the business environment attractive for legitimate iGaming companies. Setting tax rates too high will only make (or keep) businesses offshore. The domino effect will leave out much of the attractive online gaming offers outside Brazil’s regulated scope, compelling consumers to play elsewhere.

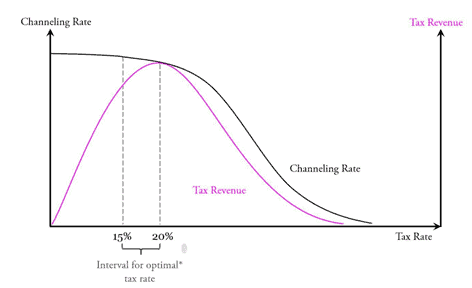

According to a study by Copenhagen Economics, the optimal tax rates for achieving both high channelization and high tax revenues are between 15-20% of the Gross Gaming Revenue (GGR), as seen in the graph below:

Tax rates below 15% would result in marginal increases in the channeling rate, at best, but at the expense of a substantial reduction in tax revenue. On the other hand, the tax rate should not exceed 20%, because at higher tax rates gambling operators become less competitive and consumers choose operators outside the system instead.

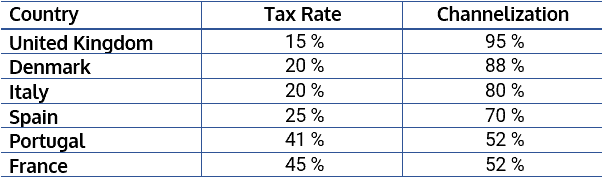

Comparing some of the jurisdictions with a history of regulated gambling, we see that tax rates above 20% bring channelization below the desired 80%, in some cases way lower. The table below shows how channelization is inversely proportional to taxation when the levy is higher than 15%.

In Brazil, the legislation has set the bar at 12% tax on GGR for gaming companies. (For players, the rate is 15% on winnings that exceed R$ 2,112 in a given year). The way law experts see it:

| The 15% income tax rate for players is not bad, if indeed the income tax exemption threshold is respected – but high rollers may see it as high and could turn to unlicensed sites. The annual calculation methodology on net winnings is [currently] vetoed but I hope that version prevails. As for operators, they will have to collect other federal and municipal taxes (besides the monthly progressive inspection fee) in addition to the 12% GGR tax. This can potentially make Brazil unattractive for some operators. Neil Montgomery |

In line with the above findings, this puts the Brazilian tax “burden” on the low end of the desired scenario. However, this is a reflection of internal politics and legislation processes and includes a profound evaluation of market needs, challenges, and realistic possibilities while setting that rate.

Put simply, it is part of the regulators’ strategy of getting everyone on board at this early stage of the licensing system. Quite possibly, tax rates might be raised in the near future, when legitimate competition has helped the market mature.

How Strict Is Too Strict?

The last point we need to make was already covered briefly above – over-regulation is often counterproductive. Excessively strict limits on licensed operations – e.g., limits to bonuses and promotions, low spending limits, and other arbitrary obligations – can make legitimate websites less attractive.

This was illustrated by the Swedish example but is also seen in Germany. In fact, the European Gambling and Betting Association (EGBA) emphasizes the error as a guiding principle for regulators: “[Too many] restrictions entail the risk of channeling the demand to unregulated offers and operators”.

Brazil’s operational setup is still a work in progress. In our view, the current framework is a good starting point for achieving high channelization, as it is not too strict and leaves much of the gameplay details to businesses and market self-regulation. It is still something to keep an eye on for future changes.

A Glimpse into The Future – Steps to High Channelization

To achieve high channeling rates, Brazil must adopt a multi-level strategy.

- Establishing a competitive and transparent licensing process that encourages operators to enter the regulated market is just the beginning;

- Adopting consumer protection measures, such as clear terms of use, deposit and loss limits, and self-exclusion options, is essential for building trust and encouraging players to choose licensed platforms;

- Rigorous enforcement against unlicensed operators is also crucial. It includes a series of tech-based interventions and policies, including cooperation with global actors. This is vital for maintaining the integrity of the regulated market;

Such an approach can pave the way for being successful in attaining higher channelization in iGaming. By learning from global best practices, and adapting them to its reality, Brazil can carve a path where consumers are protected, and tax revenues are satisfactory.

Arguably, Brazilian regulators, operators, and the public must work together. Building public awareness on the issue will go a long way toward convincing consumers to choose licensed gambling channels. But we can agree that it is in the best interest of all stakeholders to get it right and enable long-term market sustainability.