Brazil’s expansive market has become a headline subject in iGaming. It is now a legitimate playing field and industry stakeholders seek to understand and estimate which gaming operators command the most attention among local users.

Our study centers on the concept of “Share of Voice” (SoV), analyzing brand visibility and market shares among online casino websites active in Brazil. While there are literally thousands of online platforms which offer both casino games and sports betting, we will focus our study on the 20 most prominent ones available in the biggest regulated market globally.

We also take an analytic look at consumer preferences and brand loyalty, spotlighting the brands and gaming verticals that engage the Brazilian audience most effectively. Our team meticulously examines direct survey feedback, topical online traction and branded search data.

Consistent monitoring is key to a balanced interpretation of these results. This research is meant as an ongoing and revolving effort, tracking monthly volumes and aiming to pinpoint the standout iGaming operators and real-money verticals as chosen by Brazilian players.

We will measure and report on market trends and SoV changes every 3 months in this space.

What Is a Share of Voice?

“Share of Voice” is a pivotal metric in the iGaming industry. In simple terms, it offers a comprehensive view of a brand’s market presence relative to its competitors.

As a concept, SoV does not estimate market shares based on actual subscribers or active players. Yet, SoV goes deeper, assessing a brand’s visibility and dominance in industry conversations across various online marketing channels.

As a combined metric, it encapsulates everything from the volume of brand mentions to the extent of digital marketing efforts, including social media engagement, website traffic, and keyword prominence in iGaming-related searches.

Although SoV is affected by paid advertising, it also extends beyond that. It encompasses the entire spectrum of a brand’s digital footprint, including organic reach and the impact of content marketing strategies.

In our research, we apply the SoV concept for gaming verticals such as sports betting, lottery and online casino (along with corresponding sub-categories like slots or card games). This approach provides us with a contextual understanding of how various real-money gaming segments resonate within the market.

Explaining Our Methodology

As a starting point, our Share of Voice study benefits from a comprehensive survey, which we conducted following a coherent and well-structured approach. The field study collected data from a diverse demographic of 500 Brazilian adults, ensuring a representative sample of the target audience.

- Original survey of Brazilian adult gamers

Our survey benefits from a demographic segmentation (age, gender, socio-economic class, education level and occupation). What we present below, however, focuses on brand recognition and its impact on gaming habits, including factors that influence such choices and discovery channels for new platforms.

These findings are subsequently enriched with third-party data. Given our experience in SEO and lead generation, we focused our tracking efforts on relevant keywords divided between branded and generic searches. Generic searches focus on the casino vertical and specific game categories based on monthly search volumes.

- Keyword tracking – casino vertical only, by main game categories

The primary tool we used to measure the Share of Voice was Wincher.com. We tracked the selected indicators over three months, an ample timeframe which ensures illustrative and balanced data samples.

- Volume of branded searches

One of the most relevant ways of ranking the brands is the intensity of direct branded lookups coming from Brazilian IPs. We break down monthly averages for branded queries through Mangools.com.

- Brand interest trends on Google

Although much less concrete in its figures, Google Trends provides a very relevant overview of the amount and intensity of online demand for a brand.

- Organic traffic estimates

We monitor and list the amount of organic traffic that these 20 brands receive from Brazil. To ensure a more balanced and representative estimate of their online traction, we perform this task via Ahrefs.com and Semrush.com, two of the leading digital marketing platforms.

- Social Media followers – Instagram, X and Facebook

Given the impact of social networks and their ability to deliver marketing messages, compiling a ranking of iGaming brands’ presence on social media (SM) is a valid and objective criterion to judge their digital success.

There are some objective criteria when evaluating the visibility of a brand on the domestic market. First and foremost, branded searches have the highest relevance. We measure them both in terms of trending volumes as well as direct brand name queries.

Secondly, big-data measurements weigh much more than anonymous survey answers, often based on personal preferences and possibly extemporaneous. Therefore, we consider mid- and long-term traffic data, track several months at a time for Share of Voice and search volumes.

And naturally, these digital indicators cannot estimate subjective factors like reputation, visibility and word-of-mouth impact of brands that often have ample off-line presence – billboards, TV and radio ads, sports team and event sponsorships, ambassadors and influential publicity figures, and much more.

Ultimately, we designed a Weighted Points System which sees every indicator in the above list transformed into points – from 20 (assigned to the respective leader in a given segmentation) down to 0, when the bottom position has marginal or non-existent presence.

For every ranking and every indicator, we proceed systematically by assigning points via the following formula:

| ShareBrandX / ShareLeader x 20 pts = BrandX pts |

The resulting points are rounded off to the nearest whole integer.

This methodology ensures that the brands receive the weighted importance of their visibility, instead of assigning a simple algebraic scale-down by a single point for every position in the list.

In pragmatic terms, we take inspiration from the approach adopted by Google Trends which assigns the peak value at 100 and calculates the weighted curve based on that volume. Our weighted points system scales the comparison curve down from 20.

Operator Share of Voice and Brand Loyalty

Besides weighted estimates of the share of voice of online gaming operators, our study sheds light on player behavior and brand loyalty. A detailed look at game preferences, frequency of play and trust in specific brands also helps understand the factors influencing players’ choices when it comes to choosing or changing a gaming platform.

Multiple elements may affect these choices, such as website design, mobile app availability, and recommendations from friends. These insights are crucial in understanding the dynamics of brand loyalty and player engagement in the Brazilian iGaming market.

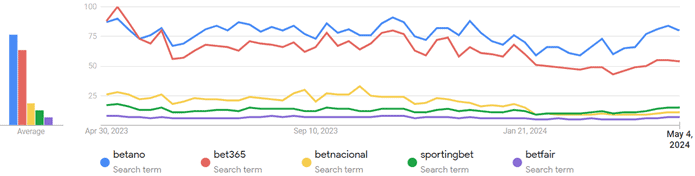

Tracking Popularity on Google Trends

With the above approach in mind, we will start by illustrating the ranking of iGaming operators as they are detected by Google Trends. The graph below shows an estimation of search activity (interest) in the past year, tracked in search terms and not “gaming brands” per se, as recognized by Google Trends.

As of May 4, we see the following relative interest in brand-match search queries, compared to the highest possible demand in Brazil in the past 12 months:

| Search Term | Interest via Google Trends | Weighted points assigned to brand |

|---|---|---|

| betano | 80 | 20 |

| bet365 | 54 | 14 |

| sportingbet | 15 | 4 |

| betnacional | 11 | 3 |

| betfair | 7 | 2 |

| pixbet | 5 | 1 |

| novibet | 5 | 1 |

| kto | 3 | 1 |

| parimatch | 1 | 0 |

| galera bet | 1 | 0 |

| betsul | < 1 | 0 |

| betway | < 1 | 0 |

| esportesdasorte | < 1 | 0 |

| leovegas | < 1 | 0 |

| pokerstars | < 1 | 0 |

| mrjack | < 1 | 0 |

| betsson | < 1 | 0 |

| stake.com | < 1 | 0 |

| estrelabet | < 1 | 0 |

| f12.bet | < 1 | 0 |

As the curve suggests, the peak trending intensity levels are set by bet365 nearly a year ago.

We see that Betano is gradually widening the gap at the top compared to bet365, after having taken over soon after those peaks.

Sportingbet has gained a slight advantage over Betnacional in early 2024.

The rest of the iGaming brands in Brazil are considerably less trending in search volumes, compared to the leaders. Exactly half of the chosen 20 operators show search demands of less than 1 percent compared to the peaks shown by bet365.

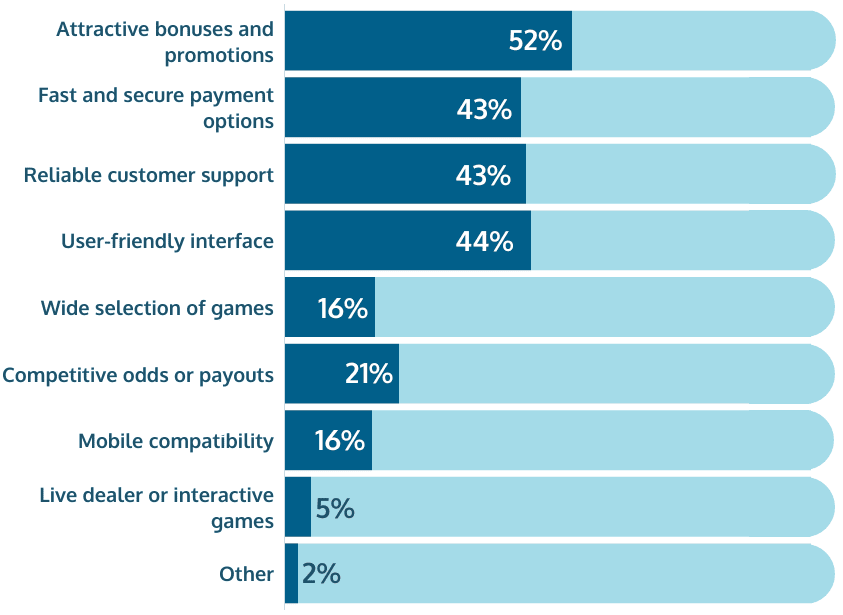

Key Factors for Choosing a Brand

To appreciate what shapes these preferences, we also need to know what Brazilian players deem as most important when choosing an iGaming operator. Based on our survey, we see the following selection:

Attractive bonuses and promotions were cited at the forefront of the deciding factors for Brazilian iGaming enthusiasts, over half of respondents (51.7%) emphasizing their importance.

User-friendly interface comes next, regarded as decisive by 44.4% of the survey participants. Obviously, players care about the product and the platform above all – a seamless and intuitive user experience attracts and retains players.

Reliable customer support follows closely, valued by 43.4% of respondents, reminding that efficient and responsive support systems are crucial for player satisfaction. Almost equally significant, we see fast and secure payment options, rated crucial by 42.5% of gamers.

Additionally, although not as paramount as the above factors, we see competitive odds and payouts (in terms of Return-to-Player percentages, RTP) at 20.5%. Still relevant but not critical, users rate the number of games available (16.2%) and mobile device compatibility (still an issue for 15.6%).

Perhaps surprisingly, the support for “live dealer games” – i.e., immersive and interactive real-money genres – holds less sway in the decision-making process (4.6%). This demonstrates that such features, while innovative and engaging, do not have a primary influence on the choice of an iGaming brand among Brazilian players.

Earlier responses which generate the SoV ranking of operators are likely unaffected by the list of impact factors we just presented. SoV presence is usually based on paid advertising, online and offline visibility, straightforward fame or notoriety, as well as recent gaming experiences. However, these elements all weigh in when ultimately making a decision to play on a given platform.

Most Engaging Gaming Verticals

As a next step in our evaluation of generic market shares, we need to analyze the verticals that have the biggest pull among Brazilian real-money gamers.

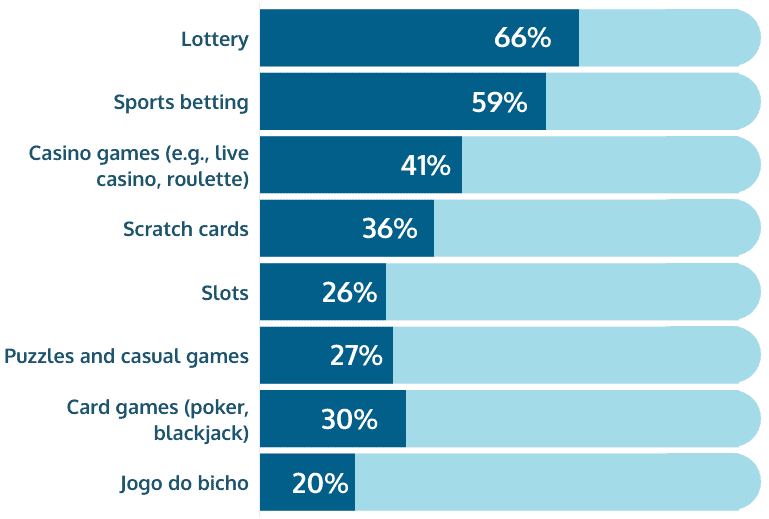

The most popular games among respondents were lotteries (65.6%) and sports betting (58.7%), followed by casino games (41.3%).

These do not come as a surprise, as we have already seen comparative market shares that put them in a similar order. Casino audiences are also the most diverse, encompassing roulette players but also fans of slots games (25.8%) and card classics like poker and blackjack (30%) as well.

We also notice a considerable share of games (27.3%) that are considered casual by nature but that can also be structured as real-money contests and random prize gaming sessions.

The sizable shares of scratch-card games (35.6%) are often considered in industry analyses under the lottery family of random draws.

The classic (and unregulated) game of “jogo do bicho” continues drawing interest by nearly a fifth (19.5%) of all adult real-money gamers in Brazil. Still, that shows a decrease from last year’s survey figures, showing better channelization to legal options post-regulation.

Exploring Online Casino Search Trends and Generic Game Popularity

Despite football being the undisputed king of all athletic disciplines when it comes to wagering, the sports scene is a complex universe in its own right. When aggregating sports betting performance of iGaming brands, their Share of Voice will be reflected in indicators like overall traffic projections and brand mentions, presented further down.

When it comes to the other macro vertical in the real-money gaming industry – online casino – we have set out to identify and track 3-month average monthly search volumes of major keywords typical for that vertical. These represent the demand for casino gaming products.

As previously seen, Brazilian casino fans are split between slots and crash games as quick-play options on one hand, as well as live casino games like roulette and blackjack on the other. And we expect these to get the most mentions and search demand.

However, an operator’s online visibility is closely linked to their SEO performance. Achieving top rankings in search engines for popular casino-related keywords is a challenging feat, requiring dedicated on-page and off-page SEO efforts. Established operators with a rich history of optimized content would rank higher in the SERP compared to newer competitors or those with minimal optimization efforts for our focus keywords.

Put simply, we expect to see older websites (i.e., established operators) with a high volume of optimised content to show up more often on top of search results with the biggest volumes, more so than newer competitors and websites with little or no optimisation towards our focus keywords.

Below, you can see the estimates given by Mangools.com, in the first week of May 2024, for the average monthly keyword demand in online casino terms.

| Keyword | Avg. Monthly Search Volume |

|---|---|

| cassino | 122,000 |

| cassino online | 49,500 |

| jogos de cassino | 11,000 |

| jogos cassino | 9,000 |

| jogar cassino | 8,100 |

| melhor cassino online | 8,100 |

| jogar cassino online | 2,900 |

| cassino online brasil | 1,000 |

| Keyword | Avg. Monthly Search Volume |

|---|---|

| roleta | 301,000 |

| roleta online | 90,500 |

| jogo da roleta | 6,600 |

| roleta cassino | 4,400 |

| roleta brasileira | 4,400 |

| roleta cassino | 4,400 |

| jogo roleta | 2,900 |

| roleta ao vivo | 1,000 |

| Keyword | Avg. Monthly Search Volume |

|---|---|

| slot pg soft | 183,000 |

| slots | 82,200 |

| caça níqueis | 22,000 |

| slots win | 16,400 |

| lucky slots | 11,000 |

| jogos caça níqueis | 4,000 |

| jogo de slots | 4,000 |

| slots cassino | 1,600 |

The data reveals that generic, short-tail keywords such as “cassino”, “roleta” and “slots” – along with some variations – generate the highest search volumes. This underscores the importance of focusing on basic queries – as much as on branded keywords, if not more – to achieve and maintain consistent online visibility.

On the other hand, specific game searches are more prevalent than undefined game terms, as evidenced by the relatively low search volume for “jogos de cassino” (11,000 searches) compared to “roleta” and “slot” variations.

The only exception to the outlined search intent is the volume of queries for PG Soft games. The Fortune slot series simply exploded in Brazil in mid-2023, with cascading effects on the gaming industry, even inducing dedicated consumer protection legislation.

These figures show that hugely popular slot games need a different positioning approach. Slot-related queries are much more fragmented, reflecting the popularity of single game titles (and even game studios) which combine to outrank generic slot queries.

It also must be noted that all casino-related searches have slightly declined since Q3 and Q4 of 2023. Yet, they are still over 120% higher than the levels registered a year ago. Combined queries for keywords related to “cassino” and “roleta” surpass 600 thousand monthly hits.

Overall Share of Voice Based on Generic Casino-Related Queries

Our breakdown of SoV rankings for various iGaming operators in Brazil takes into account a list of generic queries. These cover essential game categories – namely slots and roulette, in addition to general casino terms – altogether 32 generic keywords tracked over 3-month cycles.

| Brand | Overall SoV % | Pts | Cassino SoV % | Pts | Roleta SoV % | Pts | Slots SoV % | Pts |

|---|---|---|---|---|---|---|---|---|

| Betano | 1.49 | 3 | 4.56 | 4 | 0.80 | 3 | 0.52 | 1 |

| bet365 | 0.10 | 0 | n/a | 0 | n/a | 0 | 0.71 | 1 |

| Sportingbet | 1.53 | 3 | 3.09 | 3 | 0.03 | 0 | 0.15 | 0 |

| Betnacional | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Betfair | 10.64 | 20 | 21.21 | 20 | 4.57 | 19 | 6.72 | 8 |

| Pixbet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Novibet | 1.68 | 3 | 3.84 | 4 | 0.98 | 4 | 2.33 | 3 |

| KTO | 8.06 | 15 | 11.57 | 11 | 3.02 | 12 | 16.9 | 20 |

| Parimatch | 4.41 | 8 | 2.43 | 2 | 0.17 | 1 | 14.5 | 17 |

| Galera bet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Betsul | 0.47 | 1 | 0.99 | 1 | 0.75 | 3 | n/a | 0 |

| Betway | 6.65 | 13 | 12.49 | 12 | 3.15 | 13 | 4.21 | 5 |

| Esportes da Sorte | 0.21 | 0 | 0.43 | 0 | n/a | 0 | n/a | 0 |

| Leovegas | 0.62 | 1 | 0.95 | 1 | 0.44 | 2 | 0.52 | 1 |

| Pokerstars | 6.16 | 12 | 2.26 | 2 | 4.91 | 20 | 7.23 | 9 |

| Mr Jack | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Betsson | 1.25 | 2 | 4.05 | 4 | 0.28 | 1 | n/a | 0 |

| Stake.com | 0.05 | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Estrelabet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| F12.bet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

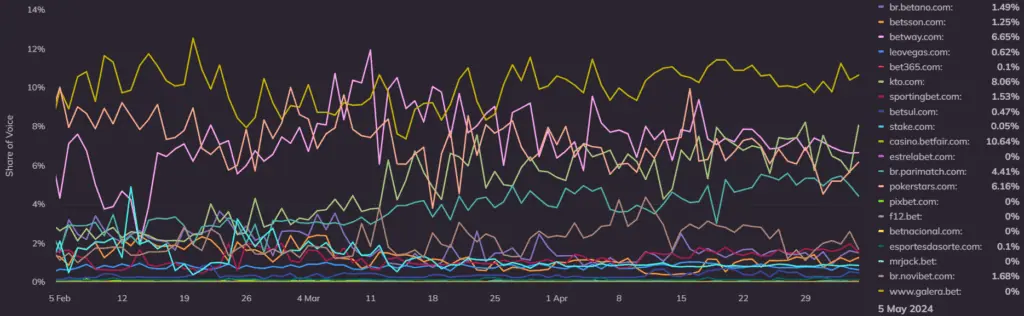

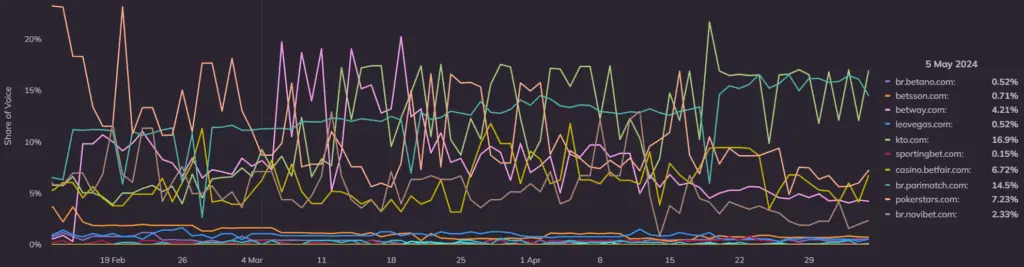

As of 5 May 2024, we have the following shares (and graphs) on Wincher, when we consider the all indicators in a single report.

The image above, taken from Wincher.com, includes all 20 operators we tracked, with compound SoV shares for all keywords that we monitor. (N.B. The screenshots below – for casino, roulette and slots – exclude those brands which show 0%).

In early May, Betfair (10.64%) stands out among operators active in Brazil, based on all query terms included. It has recently taken over the first position from Betway, still holding a stably high market SoV (6.65%).

The biggest surprise probably comes from KTO (8.06%), which has experienced meteoric rise since the start of the year, becoming a top contender and even taking the second spot at the time of writing.

Pokerstars (6.16%) has not been that far behind in the past trimester, showing less volatility than the platforms preceding it. Parimatch (4.41%) closes out the top 5. The rest arrive at a more noticeable distance from the leaders.

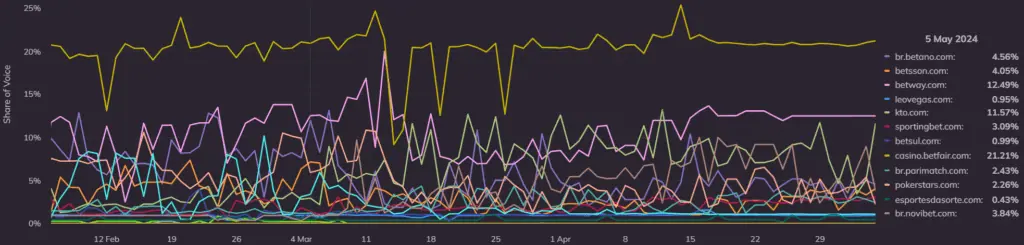

Share of Voice in Casino Specific Queries

For casino-related searches, yet another broad query, we can see Betfair (21.67%) lead the pack among Brazil’s operators. Betway (12.49%) is somewhat behind. KTO, again, comes in strong at 3rd position (1.57%). We saw these three also rank higher in our field survey of brand recognition, behind only Betano and Bet365. The underperformance of the latter two in online environments is evidently compensated by land-based promotions. As explained earlier, Bet365 does not have a noticeable online presence for casino-related terms, partly due to JavaScript-based SEO and content rendering.

Betano (4.56%), Betsson (4.05%) and Novibet (3.84%) rate comparably well, albeit at some distance from the leaders.

Share of Voice in Roulette Queries

Looking at roulette-related queries, we see SoV competitor shares closer to one another. Pokerstars (4.91%) precedes Betfair (4.57%) by a slight margin, taking over the top spot after a period of volatile performance in February and March. Betway (3.15%) and KTO (3.02%) are not far behind.

Besides being a casino classic, online roulette remains one of the most sought-after gaming products on a global level, particularly in its live casino version. Constantly high (and rising) levels of online demand make it a difficult vertical to compete for, and that is why we are not surprised to see the leading operators rank so closely to each other.

The roulette keywords we track place prominent platforms like Betano and Betsul around and below shares of 1 percent, coming even behind younger brands like Novibet.

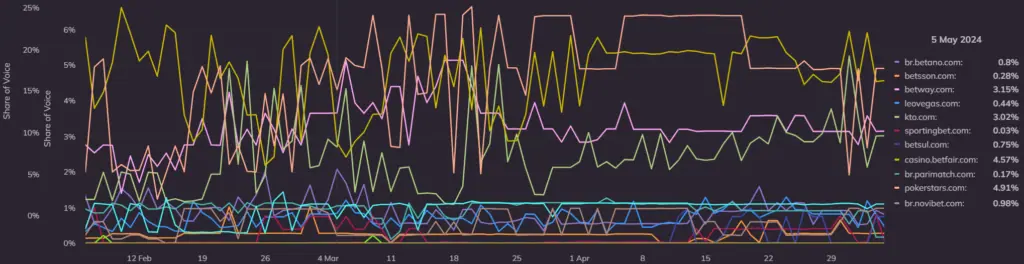

Share of Voice in Slot Queries

Slot-related queries divide the competitors in 3 groups. Here, KTO is ahead of every other operator, with 16.9%, competing with Parimatch (14. 5%) for the top spot.

Pokerstars (7.23%) and Betfair (6.72%) have just about half the impact of the top slot competitors, still almost never falling out of the top 5, rounded off by Betway (4.21%).

The online slots niche is possibly one of the most dynamic segments in real-money gaming. Tens of thousands of games are already on the market and hundreds come out each week. Being able to maintain high levels of online visibility and market recognition requires coordinated efforts in SEO, product delivery and superior player support.

It’s important to keep in mind that slot-related queries in Brazil include both “slot” and “caça niqueis” keywords. This is the only keyword category that uses both the English and Brazilian terminology for the game, so operators with SEO efforts in both will have a clear advantage here.

Moreover, effective SEO depends on precise targeting of specific titles and providers, as noted above. Operators also face daily challenges with social media trends and naming customs (nicknames for games and characters).

Evaluating Brand Awareness via Monthly Search Volumes

In our quest to weigh brand recognition among iGaming operators in Brazil, we analyzed brand-specific online queries for some of the leading gaming platforms. The ranking below encompasses some of the most recognized brands locally, providing a snapshot of their market presence.

It’s important to keep in mind that the total figures do not mean unique users; they include recurring searches by the same users finding the page through Google Brazil.

We indicate only the volume of exact branded queries, excluding misspellings or potentially related keyword combinations.

| Brand | Monthly Searches | Pts |

|---|---|---|

| Betano | 37,200,000 | 20 |

| bet365 | 30,400,000 | 16 |

| Sportingbet | 6,800,000 | 4 |

| Betnacional | 9,140,000 | 5 |

| Betfair | 2,490,000 | 1 |

| Pixbet | 6,800,000 | 4 |

| Novibet | 2,030,000 | 1 |

| KTO | 2,240,000 | 1 |

| Parimatch | 673,000 | 0 |

| Galera bet | 823,000 | 0 |

| Betsul | 201,000 | 0 |

| Betway | 246,000 | 0 |

| Esportes da Sorte | 165,000 | 0 |

| Leovegas | 82,200 | 0 |

| Pokerstars | 82,200 | 0 |

| Mr Jack | 911,000 | 1 |

| Betsson | 74,000 | 0 |

| Stake.com | 6,000 | 0 |

| Estrelabet | 223,000 | 0 |

| F12.bet | 368,000 | 0 |

Betano emerges as the most searched brand in Brazil, with over 37 million monthly searches, closely followed by Bet365 with more than 30 million specific brand queries.

The middle-tier operators include Betnacional (9.14 million), Pixbet and Sportingbet (both estimated at 6.8 million). The top 5 is completed by Betfair (2.49 mln) and KTO (2.24 million), with Novibet (2.04) closely following. These search volumes still indicate a strong market presence of the leading six operators in Brazil.

While brands like Bet365, and Betfair have been around for quite some time, it’s impressive that relatively young brands rate quite well, e.g., KTO and Novibet grabbing leading positions. What is even more important is that many brands outside the top 2 have been adding visibility faster than the leaders in the past few months since we started tracking their Share of Voice.

Most of the operator brands operlap with the responses received in our survey, as well as the ones tracked for online SoV in Wincher (see data below). This allows us to combine these sources and rank the top 20 real-money gaming brands in Brazil.

Monthly Traffic Estimates

An important part of our study is the monitoring of the estimated monthly organic traffic that these competitors receive from Brazil (only). We utilize proven and trusted SEO analytic tools provided by Ahrefs and Semrush.

| Brand | Monthly Organic Traffic (via Ahrefs) | Monthly Organic Traffic (via Semrush) | Average traffic (estimate) | Pts |

|---|---|---|---|---|

| Betano | 3,800,000 | 32,500,000 | 18,150,000 | 15 |

| bet365 | 33,600,000 | 13,600,000 | 23,600,000 | 20 |

| Sportingbet | 5,400,000 | 6,700,000 | 6,050,000 | 5 |

| Betnacional | 10,300,000 | 8,100,000 | 9,200,000 | 8 |

| Betfair | 3,700,000 | 3,300,000 | 3,500,000 | 3 |

| Pixbet | 2,900,000 | 5,700,000 | 4,300,000 | 4 |

| Novibet | 4,600,000 | 930,500 | 2,765,250 | 2 |

| KTO | 2,700,000 | 1,900,000 | 2,300,000 | 2 |

| Parimatch | 544,000 | 417,000 | 480,500 | 0 |

| Galera bet | 261,300 | 394,000 | 327,650 | 0 |

| Betsul | 390,400 | 281,300 | 335,850 | 0 |

| Betway | 779,400 | 494,000 | 636,700 | 1 |

| Esportes da Sorte | 2,700,000 | 10,600,000 | 6,650,000 | 6 |

| Leovegas | 233,800 | 100,500 | 167,150 | 0 |

| Pokerstars | 214,900 | 457,100 | 336,000 | 0 |

| Mr Jack | 858,100 | 1,400,000 | 1,129,050 | 1 |

| Betsson | 299,000 | 144,100 | 221,550 | 0 |

| Stake.com | 46,300 | 308,400 | 177,350 | 0 |

| Estrelabet | 4,100,000 | 2,950,000 | 3,525,000 | 3 |

| F12.bet | 993,900 | 1,900,000 | 1,446,950 | 1 |

Since the estimates for organic traffic differ greatly in some cases, we consider the mean (average) value when ranking the website traffic and, consequently, assigning the weighted points for that indicator.

Bandwagon Effect Implications

The bandwagon effect is a phenomenon where individuals tend to align with popular choices. This is especially common in the absence of in-depth expertise and plays a significant role in brand recognition.

In the iGaming sector, such behavior would suggest that the most recognizable operators, or those perceived as leaders, are more likely to be chosen by consumers. However, it’s interesting to note that while some operators may be more recognizable in reality, they might not always be the top choices or at least not by such a wide margin.

Why Do Players Switch? Frequency and Motivations for Choosing a New Online Casino or Sportsbook

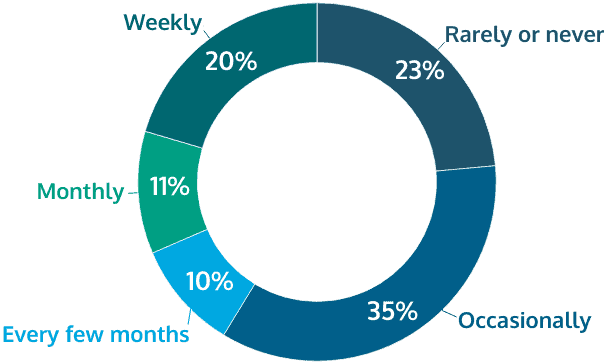

Our survey also reveals the consistency and loyalty of player engagement with leading iGaming operators. The largest share of respondents (35.5%) occasionally switches between different iGaming operators, suggesting a tendency to explore various options. On the other hand, almost a quarter (23.4%) rarely or never switch, indicating a significant level of brand loyalty among a segment of users.

A smaller yet still significant portion of players switch operators at regular intervals – 11% do so monthly, and 20.3% weekly. This highlights a group actively seeking new gaming experiences and promotions.

Discovery Channels for New Gaming Platforms

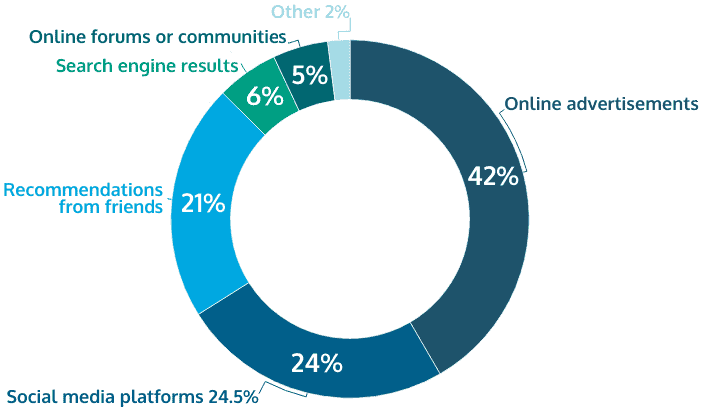

When it comes to discovering new iGaming sites or apps, online advertisements are the primary method for 41.7% of respondents. This underscores the effectiveness of digital marketing strategies in the industry.

Social media platforms also play a pivotal role, being the chosen source for 24.5% of gamers in finding new games. The relatively high impact of personal recommendations (21.4%) is also expected in many ways.

Online forums and communities (5%) along with search engine results (5.6%), though less prevalent, are still notable means for discovering new gaming opportunities.

The propensity for occasional switching among operators suggests a market driven by curiosity and the pursuit of better offers or experiences. In turn, these trends confirm the significant impact of online advertising and social media in discovering new gaming opportunities.

Reasons for Switching – Non-Gaming Factors and Desired Improvements

As we noticed, there are a number of factors that influence the choice of an iGaming platform, many of which lay outside of those directly related to one’s gaming experience.

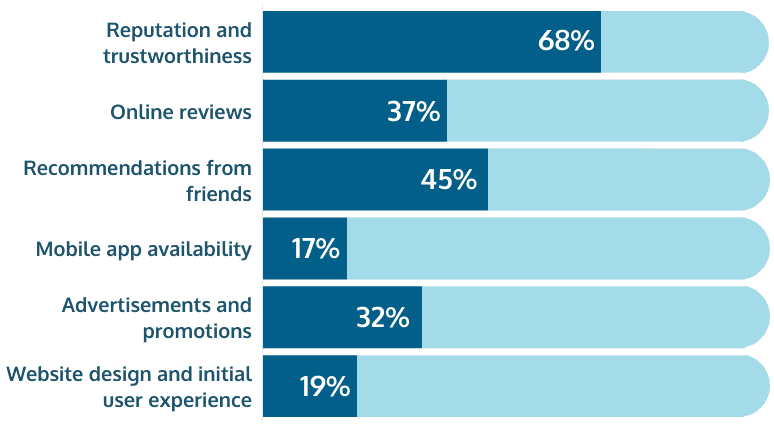

Reputation and reliability are the most influential non-gaming factors, with 67.8% of respondents prioritizing these. In other words, trust and credibility in the iGaming industry goes a long way, for most users.

Recommendations from friends (45.2%), online reviews (37%), and the design of the site (18.9%) also play significant roles in influencing user choices. The availability of mobile applications is still an issue for 16.8% of respondents, despite most games and platforms having quite optimized mobile browser versions.

Even when some key features do not represent a decisive factor (or a deal-breaker) for gamers, many are eager to see improvements in certain areas.

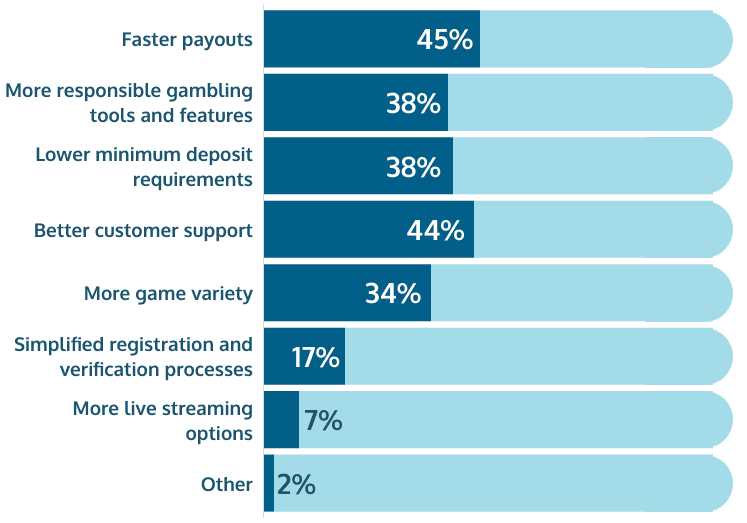

The most desired improvement was faster payments (44.6%), followed closely by better customer support (44.4%). These aspects are naturally related to what we were reminded above – the need for fast and convenient financial transactions and quick resolution of potential problems. Both of these can get in the way of a smooth gaming experience.

Hovering around 38%, therefore still quite relevant, we see a demand for more responsible gaming tools and lower deposit requirements. Although somewhat contrasting, these expectations mean that the Brazilian public is getting a better grasp of RG tools and is showing an improved ability to manage their spending patterns.

Perhaps surprisingly, we see the demand for more game variety further down the players’ priorities (34.4%).

Gaming Brand Followers on Major Social Media Networks in Brazil

Last but not least, our analysis needs to factor in the importance of Social Media followers in Brazil. The table below shows the adherence of users to these channels. Again, we only consider dedicated Brazilian accounts for the iGaming brands in the study.

| Brand | Instagram followers | X followers | Facebook followers | Total | Pts |

|---|---|---|---|---|---|

| Betano | 401,000 | 63,000 | 67,000 | 531,000 | 6 |

| bet365 | 80,600 | n/a | 5,300 | 85,900 | 1 |

| Sportingbet | 164,000 | 7,500 | 266,000 | 437,500 | 5 |

| Betnacional | 131,300 | 7,900 | 5,400 | 144,600 | 1 |

| Betfair | 155,000 | 135,500 | 8,900 | 299,400 | 3 |

| Pixbet | 839,000 | 28,900 | 9,400 | 877,300 | 9 |

| Novibet | 23,900 | 2,000 | 1,100 | 27,000 | 0 |

| KTO | 180,000 | 32,100 | n/a | 212,100 | 2 |

| Parimatch | 44,100 | 16,700 | n/a | 60,800 | 1 |

| Galera bet | 102,000 | 4,300 | 1,900 | 108,200 | 1 |

| Betsul | 38,500 | 4,100 | n/a | 42,600 | 0 |

| Betway | 14,600 | 37,900 | 4,000 | 56,500 | 1 |

| Esportes da Sorte | 1,900,000 | 25,600 | 4,700 | 1,930,300 | 20 |

| Leovegas | 5,500 | 2,400 | n/a | 7,900 | 0 |

| Pokerstars | 20,300 | 54,400 | n/a | 74,700 | 1 |

| Mr Jack | 87,000 | 7,000 | 2,300 | 96,300 | 1 |

| Betsson | 20,200 | 4,100 | 42,000 | 66,300 | 1 |

| Stake.com | 38,200 | 800 | n/a | 39,000 | 0 |

| Estrelabet | 1,900 | 22,900 | 15,000 | 39,800 | 0 |

| F12.bet | 679,000 | 6,500 | 2,500 | 688,000 | 7 |

Unsurprisingly, Instagram is the most popular Social Media platform where iGaming operators create and maintain an account. Twitter, despite not being the biggest SM network, is still quite mobile friendly which explains why iGaming profiles there outperform Facebook.

Facebook is still big in Brazil but not so much for gaming, especially if we think about mobile games and modern real-money entertainment at the palm of one’s hand. Despite that, we consider the followers in a cumulative count, even if many of these might be overlapping and registered across more than one Social Media platform.

Final Evaluation on iGaming Operator “Share of Voice” Rankings in Brazil

| Brand | Final Score | Google Trends | Overall SoV | Cassino SoV | Roleta SoV | Slots SoV | Brand Search | Mo. Traffic | SM Follow |

|---|---|---|---|---|---|---|---|---|---|

| Betano | 72 | 20 | 3 | 4 | 3 | 1 | 20 | 2 | 6 |

| bet365 | 52 | 14 | 0 | 0 | 0 | 1 | 16 | 20 | 1 |

| Sportingbet | 24 | 4 | 3 | 3 | 0 | 0 | 4 | 3 | 5 |

| Betnacional | 17 | 3 | 0 | 0 | 0 | 0 | 5 | 6 | 1 |

| Betfair | 76 | 2 | 20 | 20 | 19 | 8 | 1 | 2 | 3 |

| Pixbet | 18 | 1 | 0 | 0 | 0 | 0 | 4 | 2 | 9 |

| Novibet | 18 | 1 | 3 | 4 | 4 | 3 | 1 | 3 | 0 |

| KTO | 64 | 1 | 15 | 11 | 12 | 20 | 1 | 2 | 2 |

| Parimatch | 29 | 0 | 8 | 2 | 1 | 17 | 0 | 0 | 1 |

| Galera bet | > 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Betsul | 5 | 0 | 1 | 1 | 3 | 0 | 0 | 0 | 0 |

| Betway | 45 | 0 | 13 | 12 | 13 | 5 | 0 | 1 | 1 |

| Esportes da Sorte | 26 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 20 |

| LeoVegas | 5 | 0 | 1 | 1 | 2 | 1 | 0 | 0 | 0 |

| Pokerstars | 44 | 0 | 12 | 2 | 20 | 9 | 0 | 0 | 1 |

| Mr Jack | 3 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 |

| Betsson | 8 | 0 | 2 | 4 | 1 | 0 | 0 | 0 | 1 |

| Stake.com | < 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Estrelabet | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 |

| F12.bet | 8 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 7 |

The table above contains the combined rankings of the iGaming operators in Brazil, showing the separate categories side by side. Based on the above methodology, we can see how these brands rate against one another.

However, the way our points system ranks them, we do not perceive an estimation of the market shares and online Share of Voice of these gambling brands in their most pragmatic expression – percentages.

With the due conditional provisions, we can provide a solution based on the average monthly estimated traffic (see above). The latter adds up to 82.3 million organic visits for all brands in our study. Earlier ENV Media research had shown that – out of just about 100 million adult real-money gamers in Brazil – most play “occasionally throughout the year” or approximately “once a month”.

Such levels of real-money gaming frequency combine for 61%, taking the median value reasonably close to “once a month”. This would see the resulting gaming activity correspond closely with the concept of unique monthly visitors.

Therefore, it is reasonable to accept that the above top 20 operators – their online traffic, visibility and weighted points as assigned in our study – cover a comparable total combined share of the market, 82.3%.

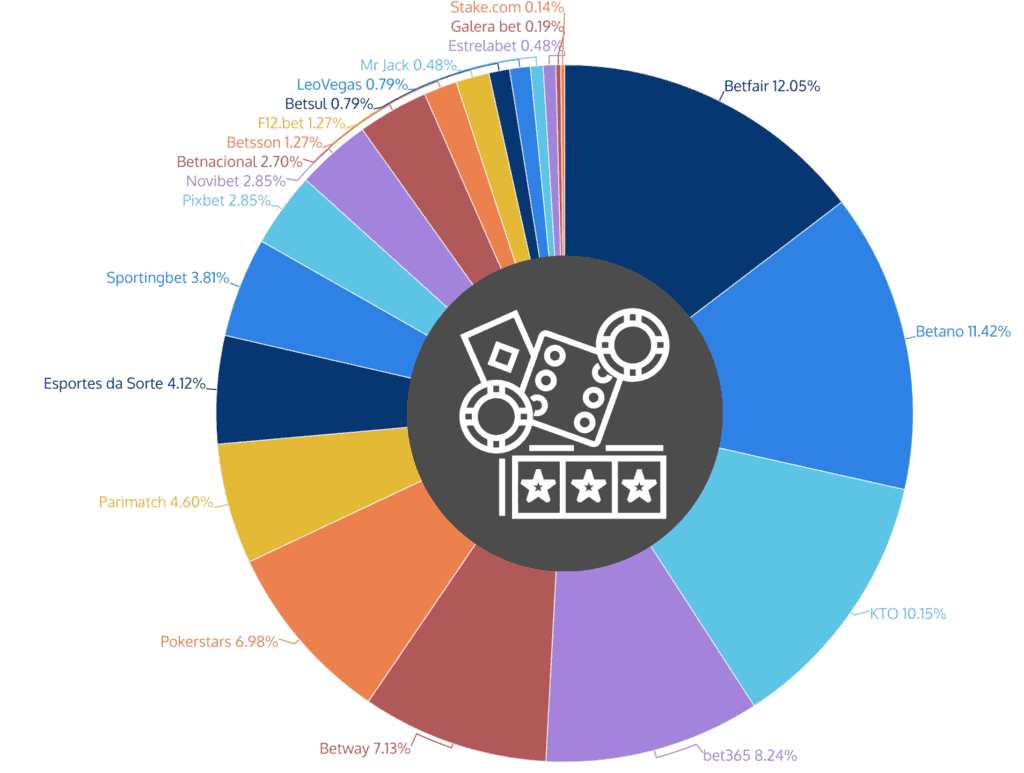

Our systematic approach leads us to conclude that the Share of Voice of the top 20 iGaming operators in Brazil is reasonably well represented (in market share percentages) by the table below:

| iGaming Brand | Online Share of Voice on the Brazilian Market |

|---|---|

| Betfair | 12.05% |

| Betano | 11.42% |

| KTO | 10.15% |

| bet365 | 8.24% |

| Betway | 7.13% |

| Pokerstars | 6.98% |

| Parimatch | 4.60% |

| Esportes da Sorte | 4.12% |

| Sportingbet | 3.81% |

| Pixbet | 2.85% |

| Novibet | 2.85% |

| Betnacional | 2.70% |

| Betsson | 1.27% |

| F12.bet | 1.27% |

| Betsul | 0.79% |

| LeoVegas | 0.79% |

| Mr Jack | 0.48% |

| Estrelabet | 0.48% |

| Galera bet | 0.19% |

| Stake.com | 0.14% |

N.B. This methodology naturally excludes users who play across multiple platforms, creating overlapping market shares.

Ultimately, standout operators like Betano, Betfair and KTO confirm their dominant performance in terms of Share of Voice (SoV) and overall digital market presence. Based on our weighted points system, we can objectively assess the top 20 online gaming operators in Brazil in terms of their online traction – especially relative to their competitors – and effectively highlight their strengths and weaknesses.

The popularity of leading iGaming verticals like sports betting, lotteries and casino games (particularly online slots and live roulette) highlights the defining role of these games in the digital gambling landscape of Brazil.

In the end, our findings illustrate the profound impact of targeted SEO strategies. Operators with optimized content and superior digital marketing practices rank higher in search engine results and enjoy enhanced visibility and organic traffic. Finely-tuned SEO operations are indispensable for achieving a competitive edge in the iGaming industry as they translate directly into greater market penetration and player engagement.