This post is also available in:

The analyses in this Share of Voice (SoV) study are conducted considering the three months prior to July 2024. The results presented below make up and justify the ranking of the top 20 gambling operators in Brazil.

Total operator scores reflect online SoV visibility for casino-related keywords as detected by SEO tools, as well as branded searches, social media presence and estimated organic traffic, in addition to original survey responses.

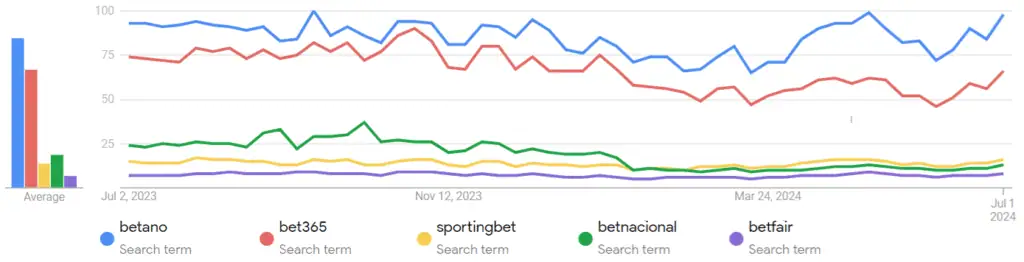

Tracking Popularity on Google Trends

With the above approach in mind, we will start by illustrating the ranking of iGaming operators as they are detected by Google Trends. The graph below shows an estimation of search activity (interest) in the past year, tracked in search terms and not “gaming brands” per se, as recognized by Google Trends.

As of 1 July 2024, we see the following relative interest in brand-match search queries, compared to the highest possible demand in Brazil in the past 12 months:

| Search Term | Interest via Google Trends | Weighted points assigned to brand |

|---|---|---|

| betano | 98 | 20 |

| bet365 | 66 | 13 |

| sportingbet | 16 | 3 |

| betnacional | 13 | 3 |

| estrelabet | 13 | 3 |

| betfair | 8 | 2 |

| pixbet | 5 | 1 |

| novibet | 5 | 1 |

| kto | 3 | 1 |

| parimatch | 2 | 0 |

| galera bet | 2 | 0 |

| betsul | 1 | 0 |

| betway | 1 | 0 |

| esportes da sorte | 1 | 0 |

| leovegas | < 1 | 0 |

| pokerstars | < 1 | 0 |

| mrjack | < 1 | 0 |

| betsson | < 1 | 0 |

| stake | < 1 | 0 |

| f12 | < 1 | 0 |

Compared to the previous quarter, Betano is again on top. Moreover, it is the trend setter in terms of peak search interest in the past year, and it keeps gradually widening the gap.

Bet365, still second, had its maximum search demand in early 2023 but still maintains consistent brand interest according to Google Trends.

Six more brands manage to get weighted points – Sportingbet, Estrelabet, Betnacional, Betfair, Pixbet, Novibet and KTO – occupying practically the same positions as in the last report. The rest register marginal interest, weighing at less than 1/20 of the leader.

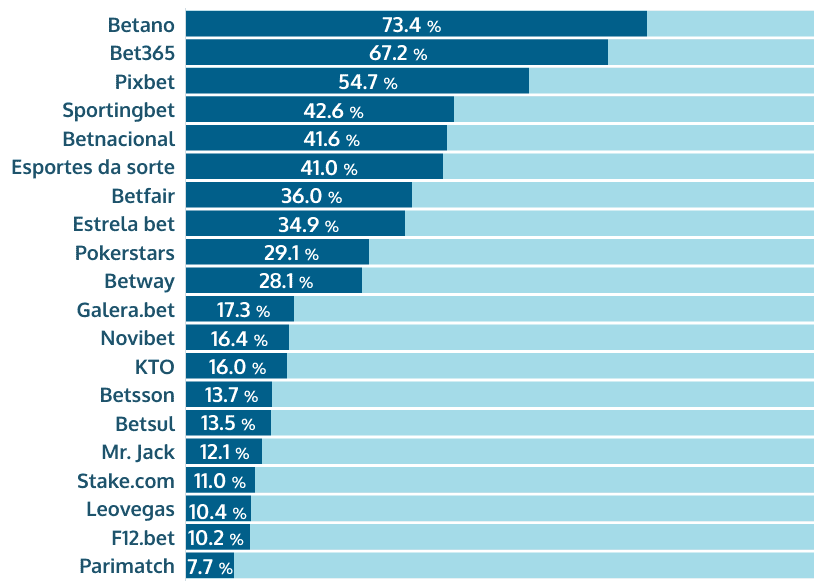

Gambling Brand Recognition and Trust

An important variable we need to take a look at is just how well recognized and trusted these online casino and sports betting brands are in Brazil. While based on subjective perception, the ranking below is based on a survey of actual active adult gamblers. We asked them which of the following brands they knew and trusted.

The top 20 standout online gambling websites in Brazil, based on survey responses, were identified in the following order:

Compared to earlier Share of Voice reports, we amplified and updated the survey to include the 20 leading gambling brands in Brazil.

To avoid biased replies (response tiredness or overlooking, i.e., temptation to pick early and move ahead), brands appeared in a randomized order to respondents.

We see that the leaders – Betano and bet365 – are more or less confirmed. Pixbet overtakes Sportingbet and Betnacional and takes position 3. Esportes da Sorte also receives much higher recognition, outranking Betfair. Others that climb the table early on include Betway, Estrela bet and Pokerstars.

This survey selection and resulting ranking attributed additional weighted points to the top 20 gambling brands, which were then added to the final calculation.

| Brand | Recognition and Trust (via survey) | Weighted points assigned to brand |

|---|---|---|

| Betano | 73.4% | 20 |

| Bet365 | 67.2% | 18 |

| Pixbet | 54.7% | 15 |

| Sportingbet | 42.6% | 12 |

| Betnacional | 41.6% | 11 |

| Esportes da sorte | 41.0% | 11 |

| Betfair | 36.0% | 10 |

| Estrela bet | 34.9% | 10 |

| Pokerstars | 29.1% | 8 |

| Betway | 28.1% | 8 |

| Galera.bet | 17.3% | 5 |

| Novibet | 16.4% | 4 |

| KTO | 16.0% | 4 |

| Betsson | 13.7% | 4 |

| Betsul | 13.5% | 4 |

| Mr. Jack | 12.1% | 3 |

| Stake.com | 11.0% | 3 |

| Leovegas | 10.4% | 3 |

| F12.bet | 10.2% | 3 |

| Parimatch | 7.7% | 2 |

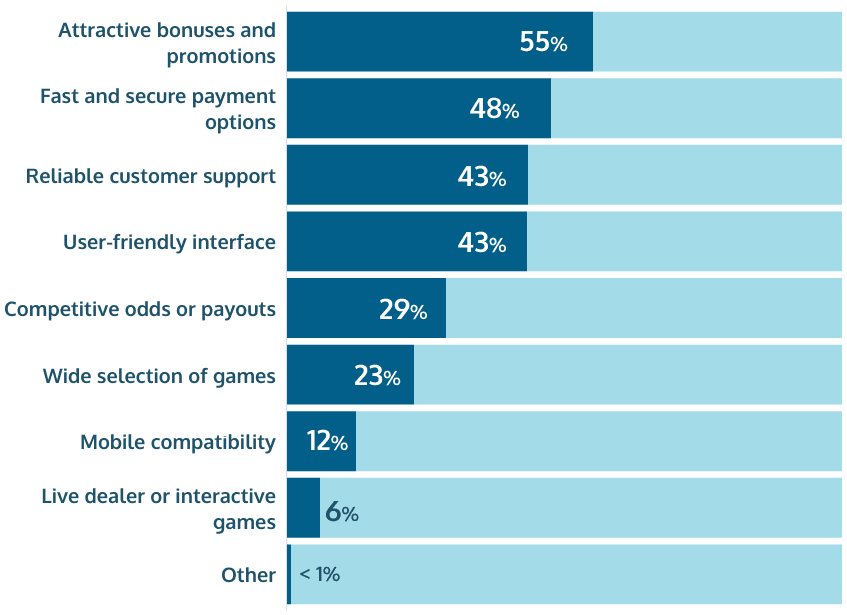

Key Factors for Choosing a Brand

To appreciate what shapes player preferences, we also asked Brazilian players what is most important to them when choosing an online gambling operator. Based on our survey, we saw the following selection:

Attractive bonuses and promotions were, again, at the forefront of the deciding factors for Brazilian iGaming enthusiasts, over half of respondents (55.1%) emphasizing their importance.

Fast and secure payment options moved to second position among decisive factors, picked by 47.6% of gamers. User-friendly interface and reliable customer support kept their shares from the previous quarter, cited by 43.5% and 43.2% respectively.

A seamless, intuitive and well-serviced platform is obviously crucial to players, and these factors ultimately retain consumers. However, the perception of elevated odds, game returns and high potential payouts attracts players above anything else. “Competitive odds and payouts” has risen from just over 20% to 28.7%.

The ample selection of games also rises in absolute shares, chosen by 22.9%, yet falls behind odds and payouts. Mobile device compatibility also becomes less of an issue nowadays and is mentioned by only 12.5% of gamers.

The availability of live dealer games is still at the bottom of the above selection (with 6.0%), yet it rises slightly as a factor from an earlier 4.6%. While immersive and interactive live casino games prove engaging and highly sought after by Brazilian audiences, they are not the main reason why players turn to a given brand.

Earlier responses we saw on brand recognition and trust are affected by the list of impact factors we just presented. However, SoV presence is strongly shaped by the likes of paid advertising, online and offline visibility, straightforward fame or notoriety, as well as any recent gaming experiences.

Most Engaging Gaming Verticals

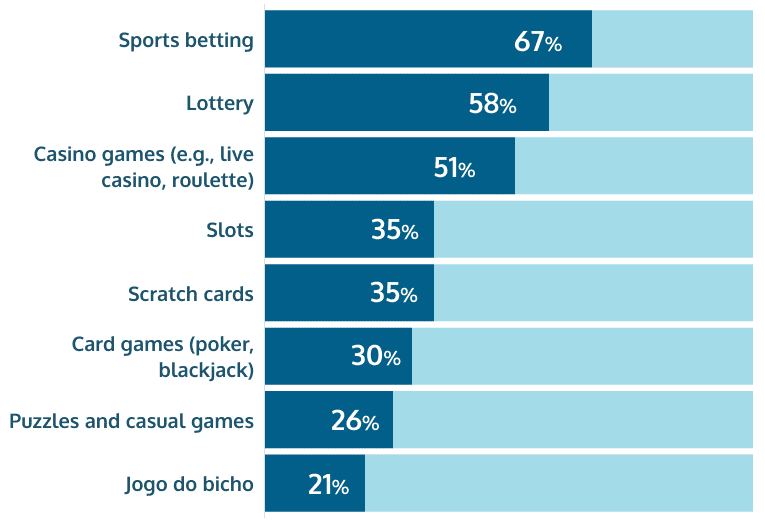

As a next step in our evaluation of generic market shares, we need to analyze the verticals that have the biggest pull among Brazilian real-money gamers.

The biggest change from our previous report is seen in the new leader among gambling verticals – sports betting is picked by over two-thirds (66.9%), replacing lottery (58.2%) at the top.

The fact that the gambling sector is now legal possibly makes more adult respondents admit to taking part in it. Still, it is remarkable that a traditional form of real-money gaming such as the public lotteries are being overtaken by more dynamic and modern gambling products.

With that in mind, it is not surprising to see over half of all adult players identify themselves as casino fans (51.1%), while 35% explicitly point out online slots as their game of choice. Both options receive around 10% more responses compared to our previous survey.

Scratch cards (35%), card games (30%) and various casual paid games (26%) keep their shares mostly constant, as does another traditional Brazilian pastime – jogo do bicho – voted by 21%.

Exploring Online Casino Search Trends and Generic Game Popularity

Despite football being the undisputed king of all athletic disciplines when it comes to wagering, the sports scene is a complex universe in its own right. When aggregating sports betting performance of iGaming brands, their Share of Voice will be reflected in indicators like overall traffic projections and brand mentions, presented further down.

When it comes to the other macro vertical in the real-money gaming industry – online casino – we have set out to identify and track 3-month average monthly search volumes of major keywords typical for that vertical. These represent the demand for casino gaming products.

As previously seen, Brazilian casino fans are split between slots and crash games as quick-play options on one hand, as well as live casino games like roulette and blackjack on the other. And we expect these to get the most mentions and search demand.

However, an operator’s online visibility is closely linked to their SEO performance. Achieving top rankings in search engines for popular casino-related keywords is a challenging feat, requiring dedicated on-page and off-page SEO efforts. Established operators with a rich history of optimized content would rank higher in the SERP compared to newer competitors or those with minimal optimization efforts for our focus keywords.

Put simply, we expect to see older websites (i.e., established operators) with a high volume of optimized content to show up more often on top of search results with the biggest volumes, more so than newer competitors and websites with little or no optimization towards our focus keywords.

Below, you can see the estimates given by Mangools.com, as of the first week of July, for the average monthly keyword demand in Brazil for the following online casino terms in the second Quarter of 2024.

| Keyword | Avg. Search Volume |

|---|---|

| cassino | 135,000 |

| cassino online | 49,500 |

| jogos de cassino | 12,100 |

| jogos cassino | 12,100 |

| jogar cassino | 12,100 |

| jogar cassino online | 3,600 |

| cassino online brasil | 1,000 |

| cassino online dinheiro real | 590 |

| Keyword | Avg. Search Volume |

|---|---|

| roleta | 334,000 |

| roleta online | 100,000 |

| jogo da roleta | 6,600 |

| roleta cassino | 4,400 |

| roleta brasileira | 3,600 |

| jogo roleta | 2,900 |

| roleta de cassino | 1,300 |

| roleta ao vivo | 1,000 |

| Keyword | Avg. Search Volume |

|---|---|

| slot pg soft | 97,700 |

| slots | 90,500 |

| caça níqueis | 22,000 |

| jogo slots | 6,600 |

| slot casino | 6,000 |

| slots casino | 6,000 |

| jogo de slots | 4,400 |

| jogos caça níqueis | 4,000 |

We see stable volumes for most keywords we tracked, with some noteworthy growth for terms like “cassino” and “jogar cassino”, “roleta” and “roleta online”, as well as “slots”.

The data also suggests that generic, short-tail keywords such as “cassino”, “roleta” and “slots” – along with some variations – generate the highest search volumes. This underscores the importance of focusing on basic queries – as much as on branded keywords, if not more – to achieve and maintain consistent online visibility.

On the other hand, specific game searches are more prevalent than undefined game terms, as evidenced by the relatively low search volume for “jogos de cassino” compared to “roleta” and “slot” variations.

The only exception to the outlined search intent is the volume of queries for PG Soft games. The Fortune slot series simply exploded in Brazil in mid-2023, with cascading effects on the gaming industry to this day, even inducing dedicated consumer protection legislation on advertising standards. Even so, “slot pg soft” queries are nearly half the volume compared to the previous quarter.

These figures show that hugely popular slot games need specific positioning in digital marketing. Slot-related queries are much more fragmented, reflecting the popularity of single game titles (and even game studios) which combine to outrank generic slot queries.

Overall Share of Voice Based on Generic Casino-Related Queries

Our breakdown of SoV rankings for various iGaming operators in Brazil takes into account the above list of generic queries. These cover essential game categories – namely slots, roulette and blackjack, in addition to general casino terms – altogether 40 generic keywords tracked over 3-month cycles.

| Brand | Overall SoV % | Pts | Casino SoV % | Pts | Roulette SoV % | Pts | Slots SoV % | Pts |

|---|---|---|---|---|---|---|---|---|

| Betano | 1.49 | 3 | 4.56 | 4 | 0.80 | 3 | 0.52 | 1 |

| bet365 | 0.10 | 0 | n/a | 0 | n/a | 0 | 0.71 | 1 |

| Sportingbet | 1.53 | 3 | 3.09 | 3 | 0.03 | 0 | 0.15 | 0 |

| Betnacional | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Betfair | 10.64 | 20 | 21.21 | 20 | 4.57 | 19 | 6.72 | 8 |

| Pixbet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Novibet | 1.68 | 3 | 3.84 | 4 | 0.98 | 4 | 2.33 | 3 |

| KTO | 8.06 | 15 | 11.57 | 11 | 3.02 | 12 | 16.9 | 20 |

| Parimatch | 4.41 | 8 | 2.43 | 2 | 0.17 | 1 | 14.5 | 17 |

| Galera bet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Betsul | 0.47 | 1 | 0.99 | 1 | 0.75 | 3 | n/a | 0 |

| Betway | 6.65 | 13 | 12.49 | 12 | 3.15 | 13 | 4.21 | 5 |

| Esportes da Sorte | 0.21 | 0 | 0.43 | 0 | n/a | 0 | n/a | 0 |

| Leovegas | 0.62 | 1 | 0.95 | 1 | 0.44 | 2 | 0.52 | 1 |

| Pokerstars | 6.16 | 12 | 2.26 | 2 | 4.91 | 20 | 7.23 | 9 |

| Mr Jack | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Betsson | 1.25 | 2 | 4.05 | 4 | 0.28 | 1 | n/a | 0 |

| Stake.com | 0.05 | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| Estrelabet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

| F12.bet | n/a | 0 | n/a | 0 | n/a | 0 | n/a | 0 |

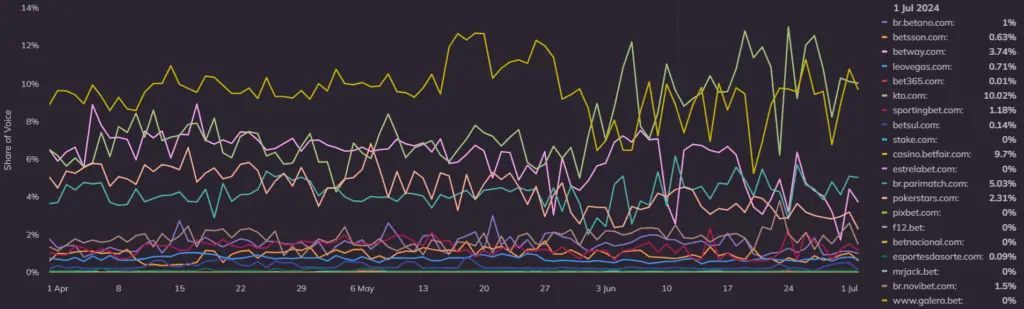

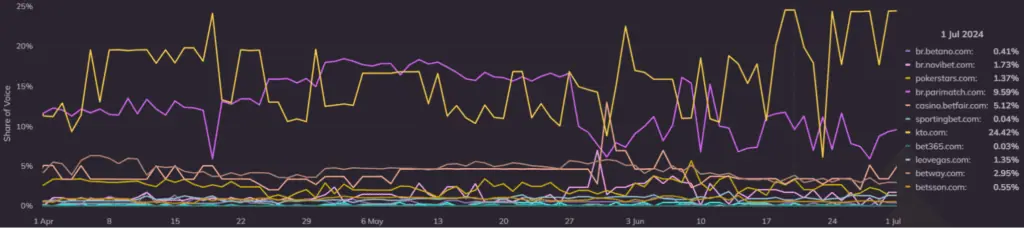

As of 1 July 2024, we have the following shares (and graphs) on Wincher, when we consider all indicators in a single report.

The graphical representation above, taken from Wincher.com, includes all 20 operators we tracked, with compound SoV shares for all keywords that we monitor. (N.B. The screenshots below – for casino, roulette and slots – exclude those brands which show 0% SoV for that niche).

In the first week of July, KTO (10.02%) stands on top of other online gambling operators in Brazil, based on all query terms included. It has experienced consistent rise throughout 2024, coming out on top in June for the first time. Betfair is still closely contesting the first position (9.7%), maintaining and improving its overall SoV in the quarter under study. The top 2 come at a considerable distance from all other competitors.

Parimatch (5.03%) also continues improving and comes up into third position. Betway (3.74%) keeps gradually declining, yet makes it into the top 5, along with Pokerstars (2.31%).

Worth pointing out is the fact that many of the underperforming brands in online environments make up their market shares with land-based promotions and coverage. Others post lower than expected metrics because of a JavaScript-based SEO and content rendering – with bet365 a prominent example.

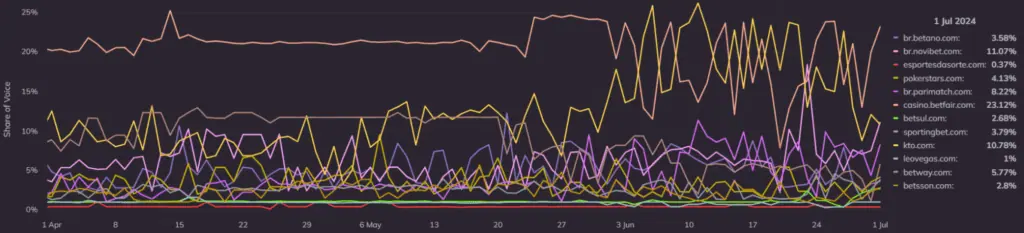

Share of Voice in Casino Specific Queries

For casino-related searches, yet another broad query, we can see Betfair (23.12%) still come well ahead of its competitors. Novibet posts the biggest growth – in absolute shares and relative position – rising constantly in the past three months to occupy second position with 11.07%. KTO maintains a stable performance (10.78%), closely behind Novibet and often even fighting for the top spot in June with Betfair.

Parimatch is another brand that has seen solid growth in casino-specific SoV (8.22%), while another global giant, Betway, closes out the top five (5.77%).

Among the “losers” in the quarter we need to mention Betano and Betsson, dropping down below 4% and 3% SoV respectively.

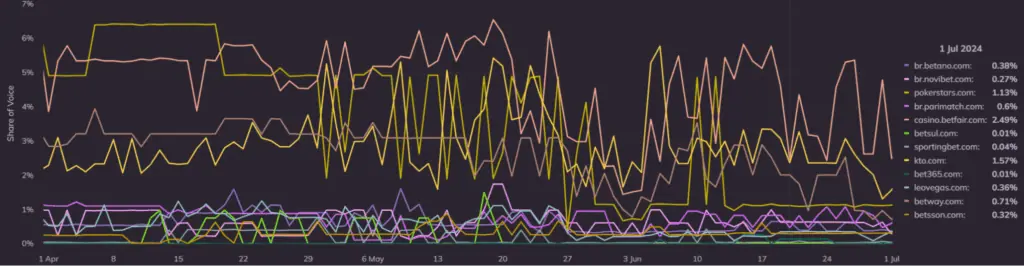

Share of Voice in Roulette Queries

Looking at roulette-related queries, we see SoV competitor shares closer to one another. It appears increasingly hard for most brands to have an impact and break through in terms of online visibility for roulette searches, as almost all operators drop shares in absolute terms.

Betfair retakes the top spot, yet dropping from 4.57% previously to the actual 2.49%. KTO follows, dropping to 1.57% (from an earlier 3%) but improving by one position. The leader in the last report, Pokerstars, loses the most in absolute roulette-SoV (1.13% from nearly 5% in past estimates) but still makes the top 3.

All other competitor brands report below 1% in online roulette SoV presence, and all come quite close to each other.

Besides being a casino classic, online roulette remains one of the most sought-after gaming products on a global level, particularly in its live casino version. High levels of online demand make it a difficult vertical to compete for, and that is why we are not surprised to see almost all online gambling operators rank so closely to each other.

Share of Voice in Slot Queries

When it comes to slot-related queries, we have one undisputed leader toward the end of Q2. KTO posts a remarkable 24.42% in slot SoV, and is well ahead of its closest competitor, Parimatch (9.59%). Our previous report also saw KTO come out on top, yet Parimatch was much closer.

Betfair takes back the third position (5.12%), partly because Pokerstars posts the biggest drop among the leaders (1.37% down from 7.23% in our previous report) and comes in seventh. Betway also drops somewhat to 2.95% but moves up a spot to 4th, while Novibet confirms its good quarterly performance, roundinging off the top 5 (also up 1 position).

The online slots niche is possibly one of the most dynamic segments in real-money gaming. Tens of thousands of games are already on the market and hundreds come out each week. Being able to maintain high levels of online visibility and market recognition requires coordinated efforts in SEO, product delivery and superior player support.

It’s important to keep in mind that slot-related queries in Brazil include both “slot” and “caça niqueis” keywords. This is the only keyword category that uses both the English and Brazilian terminology for the game, so operators with SEO efforts in both will have a clear advantage here.

Moreover, effective SEO depends on precise targeting of specific titles and providers, as noted above. Operators also face daily challenges with social media trends and naming customs (nicknames for games and characters).

Evaluating Brand Awareness via Monthly Search Volumes

In our quest to weigh brand recognition among iGaming operators in Brazil, we analyzed brand-specific online queries for some of the leading gaming platforms. The ranking below encompasses some of the most recognized brands locally, providing a snapshot of their market presence.

It’s important to keep in mind that the total figures do not mean unique users; they include recurring searches by the same users finding the page through Google Brazil (as estimated by Mangools).

We indicate only the volume of exact branded queries, excluding misspellings or potentially related keyword combinations.

| Brand | Monthly Searches | Pts |

|---|---|---|

| Betano | 45,500,000 | 20 |

| bet365 | 30,400,000 | 13 |

| Sportingbet | 9,140,000 | 4 |

| Betnacional | 11,100,000 | 5 |

| Betfair | 3,040,000 | 1 |

| Pixbet | 3,350,000 | 1 |

| Novibet | 2,740,000 | 1 |

| KTO | 2,490,000 | 1 |

| Parimatch | 823,000 | 0 |

| Galera bet | 673,000 | 0 |

| Betsul | 223,000 | 0 |

| Betway | 201,000 | 0 |

| Esportes da Sorte | 1,220,000 | 1 |

| Leovegas | 67,200 | 0 |

| Pokerstars | 74,000 | 0 |

| Mr Jack | 1,000,000 | 0 |

| Betsson | 74,000 | 0 |

| Stake | 450,000 | 0 |

| Estrelabet | 5,700,000 | 3 |

| F12 | 409,000 | 0 |

Betano emerges once again as the most searched brand in Brazil, with over 45 million monthly searches. It even widens the gap to bet365, which nevertheless gets over 30 million specific brand queries each month from Brazil.

What we can consider middle-tier operators – Sportingbet (9.1 mln), Betnacional (11.1 mln), Estrelabet (5.7 mln), Betfair (3 mln), Pixbet (3.4 mln), Novibet (2.7 mln) and KTO (2.5 mln) mostly keep or improve their brand search attractiveness.

In terms of direct brand searches, the biggest gainers for Q2 of 2024 are Betano (+22% growth), Sportingbet (+22%), Betnacional (+21%), Novibet (+35%) and Stake (+50%).

The biggest losers for the period appear to be Pixbet (–51%) and Galera (–18%).

Casinos’ Monthly Traffic Estimates

An important part of our study is the monitoring of the estimated monthly organic traffic that these competitors receive from Brazil (only). We utilize proven and trusted SEO analytic tools provided by Ahrefs and Semrush.

| Brand | Monthly Organic Traffic (via Ahrefs) | Monthly Organic Traffic (via Semrush) | Average traffic (est.) | Pts |

|---|---|---|---|---|

| Betano | 6,900,000 | 11,900,000 | 9,400,000 | 8 |

| bet365 | 29,700,000 | 16,200,000 | 22,950,000 | 20 |

| Sportingbet | 4,600,000 | 3,900,000 | 4,250,000 | 4 |

| Betnacional | 5,100,000 | 6,700,000 | 5,900,000 | 5 |

| Betfair | 2,900,000 | 2,600,000 | 2,750,000 | 2 |

| Pixbet | 2,200,000 | 4,000,000 | 3,100,000 | 3 |

| Novibet | 965,000 | 773,100 | 869,050 | 1 |

| KTO | 2,900,000 | 1,900,000 | 2,400,000 | 2 |

| Parimatch | 411,300 | 360,000 | 385,650 | 0 |

| Galera bet | 257,700 | 2,700,000 | 1,478,850 | 1 |

| Betsul | 314,300 | 120,000 | 217,150 | 0 |

| Betway | 553,500 | 590,500 | 572,000 | 0 |

| Esportes da Sorte | 1,500,000 | 19,800,000 | 10,650,000 | 9 |

| Leovegas | 130,400 | 84,800 | 107,600 | 0 |

| Pokerstars | 181,800 | 326,900 | 254,350 | 0 |

| Mr Jack | 620,000 | 1,150,000 | 885,000 | 1 |

| Betsson | 180,300 | 158,600 | 169,450 | 0 |

| Stake.com | 53,300 | 304,100 | 178,700 | 0 |

| Estrelabet | 1,500,000 | 2,900,000 | 2,200,000 | 2 |

| F12.bet | 521,300 | 1,770,000 | 1,145,650 | 1 |

Since the estimates for organic traffic differ greatly in some cases, we consider the mean (average) value when ranking the website traffic and, consequently, assigning the weighted points for that indicator.

Bet365 takes over the top position from Betano. In fact, it is one of the biggest gainers for the reporting period, as both SEO tools estimate that its traffic is more than double that of its closest competitors in that metric – Esportes da Sorte and Betano. Esportesdasorte.com is indeed the other big growing brand in terms of organic traffic estimates, coming in strongly at second position from a (distant) fourth.

Betnacional and Sportingbet were – and remain – among the top 5 gambling brands in Brazil by organic traffic.

Bandwagon Effect Implications

The bandwagon effect is a phenomenon where individuals tend to align with popular choices. This is especially common in the absence of in-depth expertise and plays a significant role in brand recognition.

In the iGaming sector, such behavior would suggest that the most recognizable operators, or those perceived as leaders, are more likely to be chosen by consumers. However, it’s interesting to note that while some operators may be more recognizable in reality, they might not always be the top choices or at least not by such a wide margin.

Why Do Players Switch? Frequency and Motivations for Choosing a New Online Casino or Sportsbook

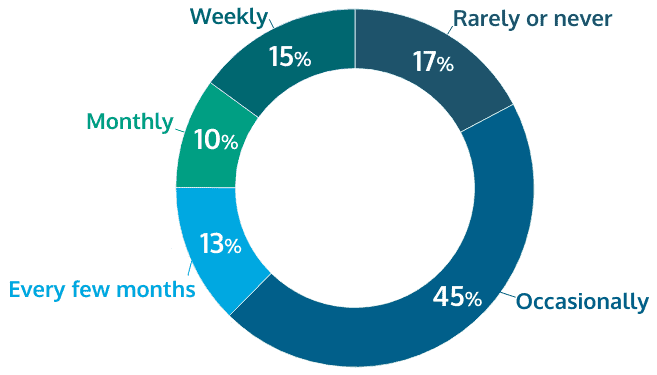

Our survey also reveals the consistency and loyalty of player engagement with leading iGaming operators. The largest share of respondents (45.1%) only occasionally switches between different iGaming operators. Interestingly, this is the option that has grown the most, by over 10%, suggesting an early trend of developing some brand loyalty. Combined with those that rarely or never switch (17.3%), we have almost two-thirds of players who have a largely routine pattern or gaming.

On the other hand, a quarter of all players switch operators at regular intervals – 10% do so monthly, and 15% weekly. This highlights a group actively seeking new gaming experiences and promotions.

Discovery Channels for New Gaming Platforms

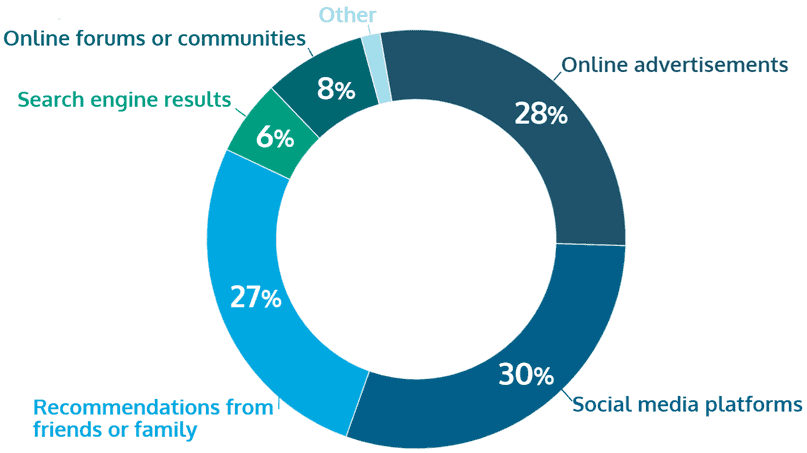

When it comes to discovering new iGaming sites or apps, social media platforms have become the primary method for 30% of respondents. This indicates that real-money gaming has become a more natural part of daily life and entertainment for its fans. This is also the discovery channel which posts the most significant growth.

Combined with the 28.3% attributed to online advertisements, it underscores the effectiveness of digital marketing strategies in the industry. On the other hand, the fact that direct online advertisement is cited in 14% less cases shows that players possibly find their own channels of information and discovery, yet again a sign of a slowly maturing market.

The relatively high impact of personal recommendations (26.6%) is always expected and is, in fact, growing by more than 5%. The perception of community gaming is complemented by the 7.9% attributed to online forums.

The propensity for occasional switching among operators suggests a market driven by curiosity and the pursuit of better offers or experiences.

Reasons for Switching – Non-Gaming Factors and Desired Improvements

As we noticed, there are a number of factors that influence the choice of an iGaming platform, many of which lay outside of those directly related to one’s gaming experience.

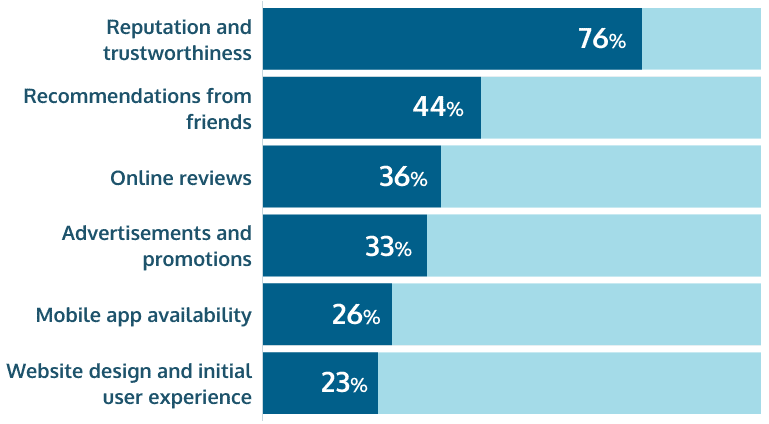

Reputation and perceived trustworthiness are the most influential non-gaming factors, with over three quarters (76.1%) of respondents. In other words, trust and credibility in the iGaming industry goes a long way, for most users. This is also the factor that grows the most over the quarter.

Recommendations from friends (43.9%) maintain their importance and are always decisive, as are online reviews (35.8%) and promotions (32.9%).

The fact that both mobile app availability (and therefore compatibility) and website design and UX are growing – by 9% and 4% respectively – shows that players have become more demanding in terms of their overall experience. These have become crucial factors for one in four users.

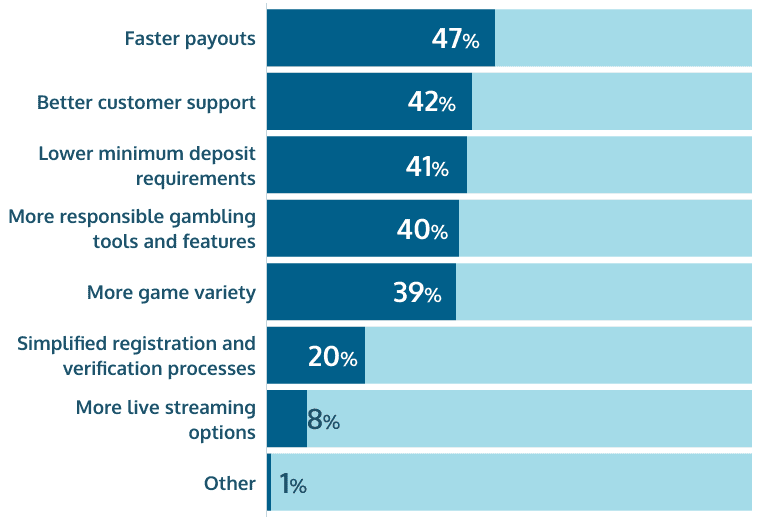

Even when some key features are not decisive for gamers, many are eager to see improvements in certain areas.

Faster payments (47%) were and remain the most desired improvement. Better customer support (42.2%) is again second in importance and largely keeps the votes from the last report. Naturally, a smooth and trouble-free gaming experience is at the forefront of gamer expectations.

Lower minimum deposit requirements (41.2%) and more responsible gaming tools (39.5%) are both growing slightly and becoming more prominent. These point to the need for better accessibility in a safe and responsible manner – all features of a maturing market, once again. Accessibility is also a factor for a fifth of all gamers, those that picked “simplified registration and verification” (20.2%).

Game variety is the improvement area which posts the biggest growth, by 5%, and is emphasized by 38.9% of respondents.

Gaming Brand Followers on Major Social Media Networks in Brazil

Last but not least, our analysis needs to factor in the importance of Social Media followers in Brazil. The table below shows the adherence of users to these channels. Again, we only consider dedicated Brazilian accounts for the iGaming brands in the study.

| Brand | Instagram followers | X followers | Facebook followers | Total | Pts |

|---|---|---|---|---|---|

| Betano | 428,000 | 64,000 | 71,600 | 563,600 | 5 |

| bet365 | 83,000 | n/a | 5,600 | 88,600 | 1 |

| Sportingbet | 362,000 | 13,400 | 267,000 | 642,400 | 5 |

| Betnacional | 154,500 | 8,600 | 7,600 | 170,700 | 1 |

| Betfair | 207,600 | 143,200 | n/a | 350,800 | 3 |

| Pixbet | 860,000 | 28,900 | 9,500 | 898,400 | 8 |

| Novibet | 26,400 | 2,200 | 300 | 28,900 | 0 |

| KTO | 186,200 | 35,400 | n/a | 221,600 | 2 |

| Parimatch | 46,000 | 16,700 | n/a | 62,700 | 1 |

| Galera bet | 108,600 | 4,300 | 2,000 | 114,900 | 1 |

| Betsul | 51,000 | 4,100 | n/a | 55,100 | 0 |

| Betway | 16,000 | 37,600 | 37,700 | 91,300 | 1 |

| Esportes da Sorte | 2,300,000 | 28,900 | 10,300 | 2,339,200 | 20 |

| Leovegas | 5,700 | 2,700 | n/a | 8,400 | 0 |

| Pokerstars | 27,000 | 54,800 | n/a | 81,800 | 1 |

| Mr Jack | 89,300 | 7,000 | 2,700 | 99,000 | 1 |

| Betsson | 20,500 | 4,100 | 42,000 | 66,600 | 1 |

| Stake.com | 38,000 | 1,100 | n/a | 39,100 | 0 |

| Estrelabet | 1,900 | 23,200 | 1,700 | 26,800 | 0 |

| F12.bet | 687,400 | 6,500 | 2,500 | 696,400 | 6 |

Unsurprisingly, Instagram is the most popular Social Media platform where iGaming operators create and maintain an account. Twitter, despite not being the biggest SM network, is still quite mobile friendly which explains why iGaming profiles there outperform Facebook.

Facebook is still big in Brazil but not so much for gaming, especially if we think about mobile games and modern real-money entertainment at the palm of one’s hand. Despite that, we consider the followers in a cumulative count, even if many of these might be overlapping and registered across more than one Social Media platform.

Esportes da Sorte proves its powerful outreach on social media, dominating in total followers and extending its lead over its competitors. Pixbet and F12 remain second and third, respectively, posting more modest growth. The top 5 is once again completed by Sportingbet and Betano, as we see these two brands invert positions, even if with only a slight difference in total followers.

Final Evaluation on iGaming Operator “Share of Voice” Rankings in Brazil

Most of the operator metrics complement the survey responses we analyzed earlier, point in the same direction or act an extra dimension when painting the complete picture of the online visibility of the top 20 gambling brands in Brazil. This allows us to combine these sources and rank the most popular online gaming operators in the country.

| Brand | Final Score | Google Trends | Survey picks | Overall SoV | Casino SoV | Roulette SoV | Slots SoV | Branded | Mo. Traffic | SM Follow |

|---|---|---|---|---|---|---|---|---|---|---|

| Betano | 84 | 20 | 20 | 3 | 4 | 3 | 1 | 20 | 8 | 5 |

| bet365 | 66 | 13 | 18 | 0 | 0 | 0 | 1 | 13 | 20 | 1 |

| Sportingbet | 37 | 3 | 15 | 3 | 3 | 0 | 0 | 4 | 4 | 5 |

| Betnacional | 26 | 3 | 12 | 0 | 0 | 0 | 0 | 5 | 5 | 1 |

| Betfair | 86 | 2 | 11 | 20 | 20 | 19 | 8 | 1 | 2 | 3 |

| Pixbet | 24 | 1 | 11 | 0 | 0 | 0 | 0 | 1 | 3 | 8 |

| Novibet | 27 | 1 | 10 | 3 | 4 | 4 | 3 | 1 | 1 | 0 |

| KTO | 74 | 1 | 10 | 15 | 11 | 12 | 20 | 1 | 2 | 2 |

| Parimatch | 37 | 0 | 8 | 8 | 2 | 1 | 17 | 0 | 0 | 1 |

| Galera bet | 10 | 0 | 8 | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Betsul | 10 | 0 | 5 | 1 | 1 | 3 | 0 | 0 | 0 | 0 |

| Betway | 48 | 0 | 4 | 13 | 12 | 13 | 5 | 0 | 0 | 1 |

| Esportes da Sorte | 34 | 0 | 4 | 0 | 0 | 0 | 0 | 1 | 9 | 20 |

| LeoVegas | 9 | 0 | 4 | 1 | 1 | 2 | 1 | 0 | 0 | 0 |

| Pokerstars | 48 | 0 | 4 | 12 | 2 | 20 | 9 | 0 | 0 | 1 |

| Mr. Jack | 5 | 0 | 3 | 0 | 0 | 0 | 0 | 0 | 1 | 1 |

| Betsson | 11 | 0 | 3 | 2 | 4 | 1 | 0 | 0 | 0 | 1 |

| Stake.com | 3 | 0 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Estrelabet | 11 | 3 | 3 | 0 | 0 | 0 | 0 | 3 | 2 | 0 |

| F12.bet | 9 | 0 | 2 | 0 | 0 | 0 | 0 | 0 | 1 | 6 |

The table above contains the combined rankings of the iGaming operators in Brazil, showing the separate categories side by side. Based on the above methodology, we can see how these brands rate against one another.

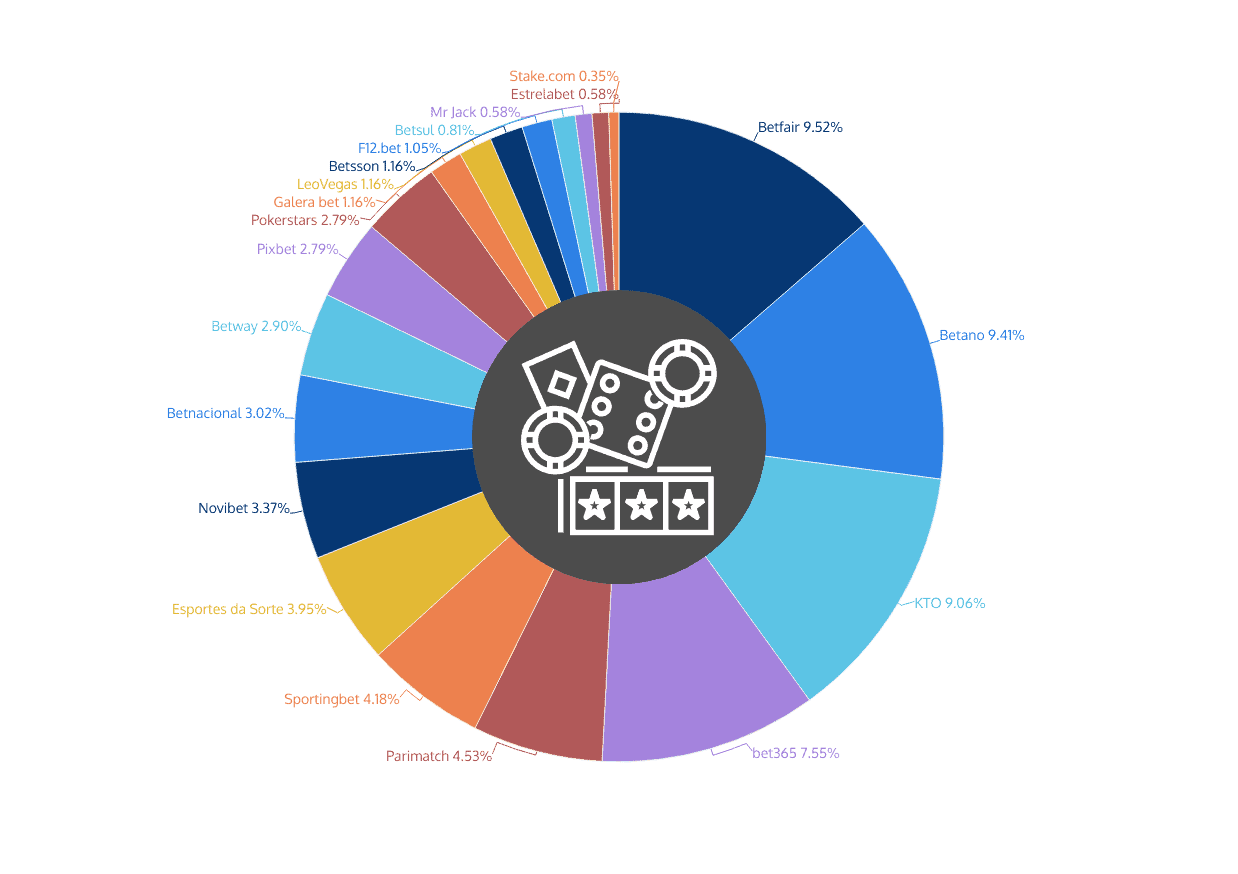

However, the way our points system ranks them, we do not perceive an estimation of the market shares and online Share of Voice of these gambling brands in their most pragmatic expression – percentages.

With the due conditional provisions, we can provide a solution based on the average monthly estimated traffic (see above). The latter adds up to around 69.9 million organic visits for all brands in our study. Earlier ENV Media research had shown that – out of just about 100 million adult real-money gamers in Brazil – most play “occasionally throughout the year” or approximately “once a month”.

Such levels of real-money gaming frequency combine for 61%, taking the median value reasonably close to “once a month”. This would see the resulting gaming activity correspond closely with the concept of unique monthly visitors.

Therefore, it is reasonable to accept that the above top 20 operators – their online traffic, visibility and weighted points as assigned in our study – cover a comparable total combined share of the market, 69.9%.

Our systematic approach leads us to conclude that the Share of Voice of the top 20 iGaming operators in Brazil is reasonably well represented (in market share percentages) by the table below:

| Betfair | 9.52% |

| Betano | 9.41% |

| KTO | 9.06% |

| bet365 | 7.55% |

| Parimatch | 4.53% |

| Sportingbet | 4.18% |

| Esportes da Sorte | 3.95% |

| Novibet | 3.37% |

| Betnacional | 3.02% |

| Betway | 2.90% |

| Pixbet | 2.79% |

| Pokerstars | 2.79% |

| Estrelabet | 1.17% |

| Galera bet | 1.16% |

| LeoVegas | 1.16% |

| Betsson | 1.16% |

| F12.bet | 1.05% |

| Betsul | 0.81% |

| Mr Jack | 0.58% |

| Stake.com | 0.35% |

N.B. This methodology naturally excludes users who play across multiple platforms, creating overlapping market shares.

Ultimately, standout operators like Betfair, Betano and KTO confirm their dominant performance in terms of Share of Voice (SoV) and overall digital market presence. Based on our weighted points system, we can objectively assess the top 20 online gaming operators in Brazil in terms of their online traction – especially relative to their competitors – and effectively highlight their strengths and weaknesses.

There are a couple of significant changes we need to analyze when comparing the results to our last report. The first one sees Betfair capture the top spot in estimated market share in Brazil. The difference is only marginal with its closest competitor, Betano, but a stronger SERP performance pushes it into the lead.

Quite relevantly, the rest of the top 7 is composed by KTO, bet365, Parimatch, Sportingbet and Esportes da Sorte.

Pixbet, on the other hand, drops out of the top 10, below Novibet, Betnacional and Betway.

The other significant difference from last time around is that the operator shares (in absolute figures) have decreased for practically all brands in the top 10. This indicates a much more competitive landscape where non-overlapping unique consumer outreach is harder to achieve.

We see that the popularity of leading iGaming verticals like sports betting and casino games (particularly online slots and live roulette) defines the digital gambling landscape of Brazil.

Ultimately, the above findings illustrate the profound impact of targeted SEO strategies. Operators with optimized content and superior digital marketing practices rank higher in search engine results and enjoy enhanced visibility and organic traffic. Finely-tuned SEO operations are indispensable for achieving a competitive edge in the iGaming industry as they translate directly into greater market penetration and player engagement.