The multitude of deposit and withdrawal methods across Indian casinos and real-money gaming platforms speaks for a hugely competitive market. This report seeks to outline the main industry logic and stakeholder integration, as well as to draw substantiated conclusions about the future of the digital payments market in India.

The Most Popular Payment Methods for Online Casino and Real-Money Gaming in India

The online gaming sector in India has rapidly expanded its user base, nearing half a billion players. A third of those are estimated to be real-money gamers, populating segments like fantasy, casino, lottery, table, and card games. These are all online gaming niches that do not rely on advertisement as a primary monetization scheme.

Consequently, real-money gaming (RMG) needs a reliable provision of secure payment methods including technical gateways, clearance mechanisms, and service support. India, in particular, has its own systematic framework of financial platforms providing institutions and enterprises with ways of handling payment flow in a manner independent of any foreign intermediation.

Nevertheless, the top-ranked and most used payment methods that have been adopted for online gaming, entertainment, and other related services represent a mixture of native Indian and prominent global solutions and providers.

The most popular payment methods in the Union cannot be prescinded from the United Payments Interface (UPI), a system with numerous applications from Net Banking to card-linked payments. E-Wallets and mobile solutions by local fintech giants Paytm, PhonePe, and Jio Money serve a substantial portion of the market, but leading foreign players like Google Pay are widely accepted along with neo-banking competitors like Ecopayz, Skrill, Neteller, Astropay, and Paysafecard. The latter group is mostly incentivized by and compatible with offshore gaming operators.

While there are dozens of E-Wallets available for gaming and entertainment payments, the bank card market is dominated by a select few, seeing VISA and Mastercard struggling to hold their positions against the dominance of the Indian card system RuPay. Despite the gray-area status of cryptocurrencies and other virtual assets (e.g., NFTs), many online gaming platforms accept at least Bitcoin and/or Ether.

The complex mixture of payment methods results from the market’s dynamic growth and competitiveness, particularly influenced by desi and other Asian tech startups in the segment. Moreover, it is affected by the gaming market’s fragmentation in terms of legal and financial regulations, access channels, and platform compatibility. Lastly, the commercial and service support made available by the vast number of offshore gaming operators also plays in, stimulating the adoption of third-party payment solutions by the Indian market.

Online Gaming Payments Lack the Recognition of Entertainment Spending

The constantly expanding internet penetration and the convenience of online commerce and services naturally result in a new mindset among most Indians. Newfound preferences and consumption patterns are also backed by a growing confidence in online transactions, with payments a particularly sensitive aspect of a consumer’s web presence.

Consequently, the payment gateway market has become highly competitive, populated by both native and foreign solutions with elevated levels of reliability and security. Government initiatives contribute further to the popularity of digital payments in the Union, promoting and supporting digital transactions and payments as a way to a cashless, more transparent, and digitally independent economy.

The Digital India flagship initiative is more than a theoretical policy; it has already produced tangible results, particularly among rural communities. Contextual demonetization (in late 2016) made an estimated 86% of the paper currency invalid. Authorities stress the importance of such an approach in the fight against money laundering and other high-profile criminal activities. But it has done more to boost the adoption of payment gateways across the nation.

During Fiscal Year 22 (April 1, 2021 – March 31, 2022), a total of 7,422 crores (74 billion) of digital payment transactions were executed in India, according to the Ministry of Electronics and IT (MeitY). This was a substantial rise compared to FY 21, with 5,554 crores of reported transactions.

What is more, India was stably at the top of real-time digital transactions on a global level – in 2020, these were estimated at 25.5 billion, ahead of China’s 15.7 billion and South Korea’s 6 billion. ACI Worldwide, an American banking software provider, reported last year that even the US (with roughly 1.2 billion real-time digital transactions annually) is ranked 9th globally.

In fact, India has been leading the digital payments market since 2019, industry data shows. The UPI platform, developed and run by the National Payments Corporation of India (NPCI), has had a dominant role in achieving such volumes. It has driven up the use of compatible payment apps, particularly since the onset of the Covid pandemic. Online stores, entertainment platforms, and various aggregator sites swiftly joined the revolution.

How did these inherently positive trends in the digital space affect online gaming? It is a particular industry, so it does not follow the same dynamics since many other social, political, and legal factors come into play. Adding to the complexity of the online gaming market, the motivators for real-money gaming are worth keeping in mind in an attempt to understand the behavior and expectations of paying gamers.

The Indian market is remarkable for the immense availability of free game alternatives to some of the better paid games. A serious barrier to payment conversion is that paying for games is rarely associated with adequate value for most players.

On the other hand, KPMG experts confirm that gamers with high levels of engagement (eSports, fantasy, casino, and many others) find sufficient triggers for paying for content or gaming sessions. They also expect their choices to lead to a much better gaming experience than freemium solutions.

Statistically speaking, desi gamers spend more on downloads and upgrades – reportedly more than 59 percent. Less is channeled to paid sessions, prize pools, and other skill or chance-based monetary rewards. This exposes the responsibility of game developers and platform operators to offer more diverse monetization schemes, crossover real-money genres, and gaming products.

Nevertheless, Indians have always had the positive attitude that spending on gaming is considered entertainment – over 80 percent of paying players agree with such a statement. Yet paid gaming and real-money genres often bear the stigma of a spending category that is a burden to an individual or a family budget.

Crucially, many of the existing legal hurdles make the entire online gaming and betting scene more cautious about their commercial agreements and payment providers. This has prompted various gaming industry stakeholders to find workarounds, open offshore accounts, or rely primarily on E-Wallet payments that enjoy greater operational freedom on the Indian market.

Online gaming platforms as a whole have always had faith in the potential of the vast Indian market. Many real-money operators have made it their mission (and signature element) to offer more convenient payment methods to their users – be it in rupees, via native fintech solutions, or other payment methods currently popular in India.

When the NPCI announced a ban on all UPI gaming transactions below Rs 50, it claimed to do it to bring relief to the national payments system. With the Indian Premier League (IPL) in full swing, hundreds of millions of micro-transactions tend to clog online banking in India, leading to technical declines for more substantial payment transactions.

This confirms the frequency of low-amount peer transfers made by Indians, but it also exposes the importance of gaming and betting payments made via UPI and other local digital means. In fact, gaming industry exponents complained that such a policy might stifle the segment.

Fortunately, numerous other E-Wallets and payment methods can be (and are) used for micro-transactions, with Indian gamers proving to be keen adopters of mobile and online technology. Despite the Indian government’s overall positive attitude towards digitization, it also has a history of inconsistent or protectionist policies that often pose challenges for gaming businesses. In this sense, the extensive diversification of payment methods for gaming purposes has proven to have a decisively positive impact on both operators and players.

Fast Withdrawals a Priority for Online Players

Online casinos with fast and easy withdrawals have always been in demand. Often touted as a superior feature by some of the better-known offshore operators, withdrawals are a function of preceding know-your-customer (KYC) procedures and the efficiency of the very payment methods chosen to withdraw. Most operators process withdrawal requests via the same method used for depositing, but some accommodate player requests for alternative destinations (although this slows down the withdrawal more often than not).

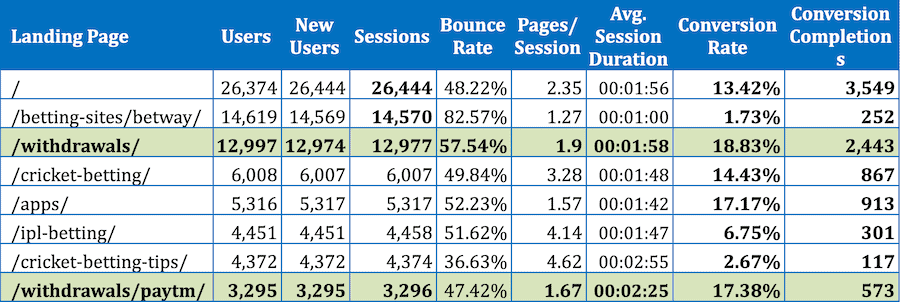

The demand for hassle-free withdrawals transpires when looking through SERP results as well. The online betting review portal Bet India provided us with Google Analytics data on organic acquisition traffic. Segmenting the sessions and behavior of 127,723 users over the course of a year (from April 2021 to April 2022), we see the following datasets.

Source: BetRallyIndia.com

After the home page, /withdrawals is one of the strongest performing pages, and it is the second most visited, surpassed only by a branded betting page. However, combined with the page dedicated to Paytm, the withdrawals category draws more users and sessions than any other page. Similar traffic patterns have been reported by leading casino comparison websites Guide2Gambling and SevenJackpots.

Withdrawals also have some of the lowest bounce rates, along with long session durations and high conversion rates for all users. Leaving aside subjective virtues and qualities of these pages, this shows consistent user interest that cannot be ignored.

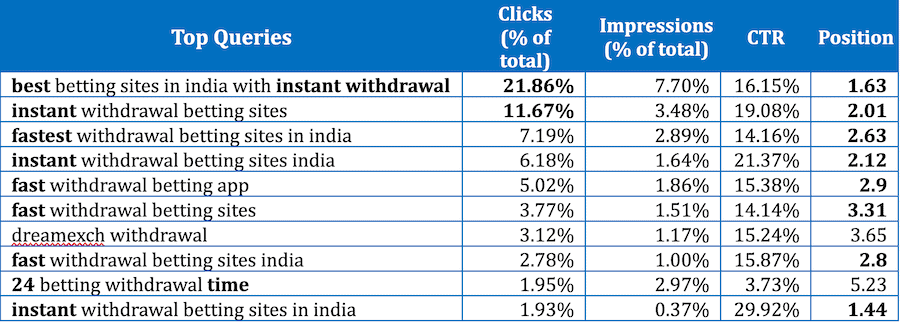

We can also see a clear pattern by turning our attention to the kind of casino withdrawal features sought within that content group. Again, based on primary data from Bet India, we see where organic traffic comes from and what people search for.

Source: Bet India

Over nearly 100 thousand impressions (98,483 to be precise), we see that the top queries are all linked to speed (and related ease) of withdrawal. In the top 20 performing queries, we see users searching for terms like fastest, instant, quick, as well as minimum, easy and best.

90.2 percent of the impressions (and 93.9 percent of clicks) came from smartphones, while 9.5 percent of impressions were generated by desktop searches (along with only 5.6 percent of all clicks). This is yet another point favoring a mobile-first society that has adopted fintech apps and mobile payments as go-to solutions.

The highly competitive market has considerably sped up withdrawals in recent times. It has also practically eliminated processing fees, and other similar practices deemed irritating by players, including the responsibility of subsequent tax declarations on winnings. Still, different payment methods have different times and technical requirements.

Minimum and maximum withdrawal limits remain an industry standard. Banks and payment providers may add incoming transfer fees or other processing costs, but those are never related to the online gaming platform.

Limitations of Western Payment Methods

Players looking for quick and problem-free withdrawals also expect better customer support. This usually means handling the amounts in rupees and not a foreign currency but, above all, language support in case of issues that need resolving. Dedicated Hindi, Bengali, Marathi, Telugu, Urdu, or Tamil support is now more easily found on online desi casinos, making payments and withdrawals more understandable to players. But it is not always the case.

Technical discrepancies between Indian and offshore operators might also make payments and withdrawals challenging, particularly if the players’ digital literacy or e-banking options are limited. An off-hand example is the Indian Financial System Code (IFSC), used for domestic money transfers in India. It corresponds logically to the IBAN found in and requested by most offshore accounts. However, the desi financial system does not promote or accept it and vice versa.

The IBAN system is currently used for international money transfers in 80 countries, mostly in Europe, the Middle East, and the Caribbean. Many top-rated online casinos are based in Europe, while others have gaming licenses issued by Caribbean jurisdictions. Consequently, those that wish to use net banking – from service providers to players – need to work with that system.

Another development affecting the online payments market is the limitation placed by the Reserve Bank of India (RBI) on some bank card issuers. Currently (and since July of 2021), there is no onboarding of Mastercard clients allowed to any Indian bank. Even after a year of lobbying and striving to meet stringent requirements, the RBI remains adamant that more needs to be done in terms of personal data localization.

It turns out there is more behind this move on behalf of the Central banking regulator (see below). At least existing cards are always accepted, which is crucial for paying offshore gaming operators in the absence of alternative payment means.

The Rise of Native Desi Solutions

Conflicting or even incompatible payment and clearance systems have stimulated the rise of homegrown solutions for the Indian market. Several public and private banks have launched their own digital payment systems. Inter-system settlements have also been set up over the past decade, facilitated by desi gateways and providers, more often than not serving the domestic market exclusively.

Since UPI has become the primary interface for digital payments in India, local banks have dedicated more efforts to ensure full compatibility with the NPCI system, particularly as payment service providers. Some financial institutions have introduced fees on transfers from e-wallets to bank accounts to discourage consumers and merchants from crossing over these two realities. Yet the increased competition, again, has done more good to the market and the options available to all stakeholders.

A prime example is the integration of Mobile Payment Services Providers (MPSP) with gaming operators’ portfolios. Not only do they make mobile gaming payments easy for the tech-savvy Indian youth, but they also permit P2P payments that are useful for horizontal transfers and personal settlements for gaming sessions among friends and family.

MPSP were also the ones that made QR code-based payments more relevant, particularly in everyday retail and bill payments. After the UPI revolution, QRs were another important step in making digital mobile payments accepted across desi society, quickly becoming integrated into native bank and fintech apps.

Industry experts agree that, as a whole, the Central government has been an enabler in the digitization process. Digital India has been a flagship effort (launched in 2015), and it contains over 30 programs and intervention categories related to Infrastructure, Services, and the digital Empowerment of India’s population.

However, it has also regularly clashed with business practices and financial frameworks used by foreign entities in a desire to achieve a higher degree of digital and economic independence. Western card-issuing systems like Mastercard, American Express, and Discover have all had setbacks in their operations in India. Authorities have cited data storage violations, but experts suggest that the RBI is trying to push them off the market gradually, if not completely.

Government officials have gone as far as considering international card networks as foreign policy instruments. While VISA manages to fly under the radar, for now, most of its American competitors face an uphill battle to maintain positions in the face of the State-promoted RuPay system.

Russia has its “Mir” network; China has “UnionPay.” India has had the RuPay card network since 2012, again developed by the NPCI. According to Reuters, the protectionist policy in support of RuPay has been seen as excessive more recently, with VISA even complaining to the US government about the “lack of an even playing field.” And while the RBI has allowed Discover’s Diners Club and American Express to resume card issuing in India, Mastercard has not been let off the hook just yet, almost a year after the initial ban.

The RBI has also been tough on some domestic neo-banking service providers. In early 2022 it ordered Paytm Payments Bank to halt the onboarding of any new customers. Paytm is the leading fintech E-Wallet in the country. Yet, it sees its banking ambitions limited, formally over IT system concerns, realistically as a further protectionist measure in favor of traditional banks.

Meanwhile, public financial institutions and state-owned banks like SBI, CBI, and Canara have boosted the issuing of RuPay cards. Private banks have also been encouraged to do so, bringing the total number to over 600 million and an effective share of over 60 percent of all bank cards. Notably, the RBI claims that this share was only 15 percent back in 2017. The biggest impulse was provided by the financial inclusion campaigns for rural communities, leading to the issuing of a huge number of debit cards linked to basic bank accounts. Consumers with higher purchasing power still hold and use their cards issued by American networks, but RuPay has become more than a mere alternative and a fair competitor.

Looking at India’s leading payment gateway providers, 3 out of the top 5 are Indian or based in India – Paytm, Razorpay, and CCAvenue, with PayU and PayPal completing the shortlist. The flourishing fintech market has crowned native e-wallets like Paytm and PhonePe as the leading solutions in the niche.

We also expect to see increasing G2C (Government to citizens) services to complete the circle, sending payments through desi apps and gateways. Some might have prerequisites and preset options that block social payments from being used for gaming and entertainment. This is yet to be seen, and, moreover, users could easily channel funds elsewhere first.

The RBI has aimed to make the national fintech and e-banking system more stable, establishing rules for secure online transactions. In 2021, additional authentication factors (AFA) were imposed on all recurring bank card payments. These impact bill payments but also entertainment and gaming subscriptions. Payment companies were also required to replace card details with a token code, adding extra security between physical and online payments.

Leading Payment Methods in India by Volume

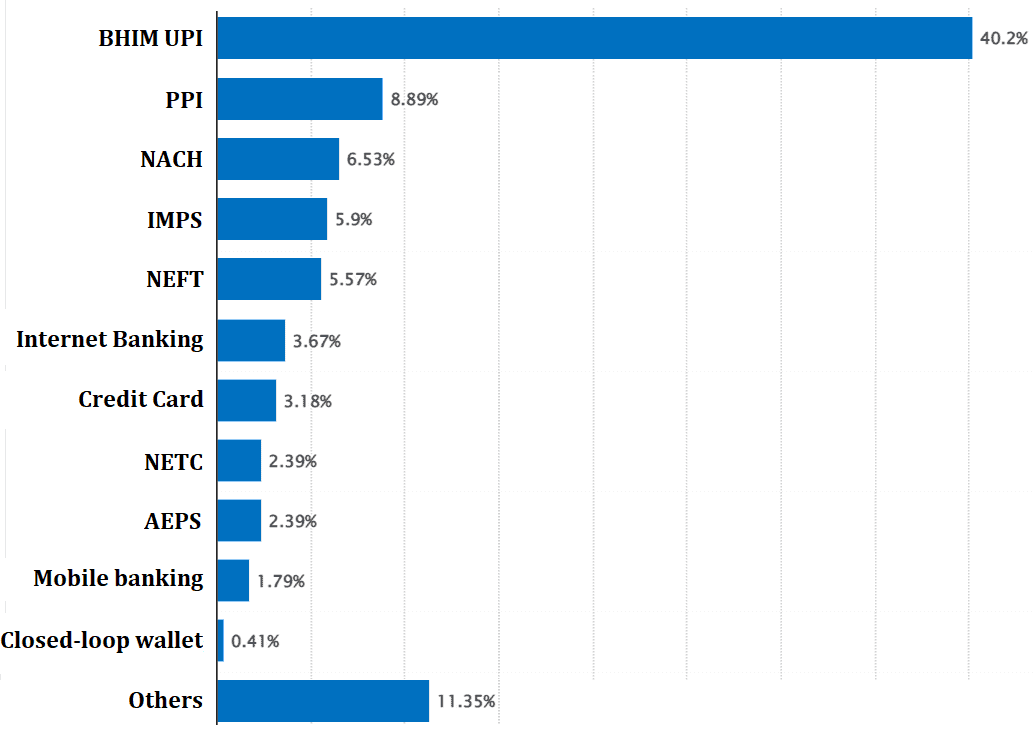

According to the RBI annual report for the FY 2021, UPI has a commanding lead over any other payment and settlement systems. Among retail transactions, UPI is followed by the Immediate Payment Service (IMPS) and prepaid transactions, the latter including E-Wallet payments.

Source: Statista 2022

In the above graph, PPI stands for Prepaid Payment Instruments, i.e., e-wallets and vouchers; NACH is the National Automated Clearing House that processes bulk and repetitive bank transactions; IMPS services instant interbank transfers. Closed-loop wallets are prepaid gift cards.

UPI had a share above 40 percent in FY 2021, as the above data shows. Prepaid digital payments were responsible for 9 percent of the 55 billion transactions. As previously indicated, total numbers increased in FY22, with transactions reaching 74 billion.

PhonePe stood at the top among UPI-based apps, with 2.12 billion transactions in February 2022, and Google Pay followed with 1.52 billion transactions. As per NPCI data, the total volume of UPI transactions during that month was almost double the amount recorded a year ago.

These figures show that banks, card issuers, mobile wallets, and other fintech providers have managed to build a bridge with their consumers and, essentially, between each other. Be it VISA or RuPay, a card can be registered on Paytm (for example) and made simple enough and as widely accepted as possible. This approach is also seen in most real-money gaming platforms, with payment integration spreading further into features and in-game elements.

Beyond Gaming: India’s Consumer Market Financial Solutions

Payment channels and monetization options have always been at the heart of online entertainment and gaming businesses. Internet platforms, as a whole, have done much to diversify significantly what has been a cash-first market for a long time. The digital payments market grew tenfold in merely five years (between 2015 and 2020).

Within the same timeframe, mobile data usage rose 24 times. This boosted mobile and e-commerce (2.4 times growth), with underpinning digital technologies taking a parallel but supporting path. The trade association of the nation’s tech industry, NASSCOM, accounted for record foreign investment levels in Indian fintech. With some marginal exceptions, state and federal policies have contributed to nationwide digital inclusion, and desi experts see the payments ecosystem accelerating its growth in the short and middle term.

Low-cost payment platforms (free to the consumer in most cases) have brought India to global leadership in real-time digital payments. Their mass appeal as a user-friendly and free payment intermediary has integrated well with online gambling, betting, and other forms of real-money entertainment.

We have seen the effect that lockdowns have had on mobile, remote and cashless payments, bringing digital finance to its current impressive mainstream outreach. This “new normal” extends to tech companies that operate in the fields of e-commerce and fintech but also e-health, other remote well-being services, and even flexible product manufacturing, supply, and delivery chains. So much so that regulators worldwide often need to catch up on this reality with updated or entirely new legislation. Embracing the innovation agenda is rarely a choice at this point; the concern is how.

Remote transaction clearances have been at the forefront of such business processes in the past few years. Digital finance has proven its ability to improve B2B and B2C efficiency along with other market links and dynamics. Common challenges are “resolved” by mass adoption, and payments are channeled through an actor’s preferred digital medium.

Immersive entertainment and Over-the-top (OTT) content have normalized paying for games. Gradually, Tier-2 and Tier-3 cities have joined the mainstream adoption of digital payments for entertainment, in line with other forms of online consumption. All stakeholders expect friction-free payments, especially important for monetization in multi-gaming platforms – e.g., card and online casino games but also sports, contests, and various prize pool gaming.

Even with consistent improvements due to digital business models and payment services, it is not all smooth sailing after that. Like many other internet markets, online gaming sees some of its biggest challenges related to monetization. Operators and various industry stakeholders have dedicated much of their development and commercial creativity to finding alternative and hybrid monetization schemes.

Out of 433 million reported Indian gamers in early 2022, there are an estimated 92 million real-money players and 60 million fantasy sports gamers, alone adding up to over 150 million fans of paid gaming. Casual gaming is still largely advertisement-driven, while real-money games depend upon direct money deposits. A new generation of crossover genres, including fantasy and immersive (hard-core) esports, rely increasingly on in-game purchases and paid features. These close the circle and bring back the focus on the integration of payment methods.

The competitiveness of its domestic digital finance might be satisfactory, but India is always looking to improve. Fintech is among the most intensively funded sectors, along with consumer technology and software as a service (SaaS). These three accounted for about 75 percent of all venture capital investments in FY 2021. Payment solutions are particularly sought-after in the fintech niche, as they represent a “meeting point” of all of the above technology categories.

Zooming out of the narrowly-defined subject of this research, we also need to get a broader understanding of what related technologies and frameworks India uses to operate its financial system. Arguably, the current reality of digital banking sees the convergence of two main trends – traditional finance looking to be more tech-driven while fintech (also called neo-banking) aiming to obtain or mirror full-scale banking licenses. Both do it to innovate and improve their customers’ experience and, above all, to keep up with the fierce competition.

The answer to both is known as “full-stack” digital banks, boasting independence yet fully regulated (by the RBI in India’s case) while operating their own brands and mobile fintech solutions. These converging entities are expected to grow in actual presence and importance to the financial system.

But as it stands, the Union payment systems are dominated by a few institutions and circuits. As its name suggests, the NPCI is a special division of the RBI, responsible for the development and innovation within the payments ecosystem. Established as a non-profit entity, it oversees the UPI framework and the RuPay card circuit.

A prime example of NCPI’s importance and operational scope is that it can set a zero merchant discount rate (Zero-MDR) across the board for all UPI stakeholders – banks, payment service providers, and others – cutting effectively any possibility of earning commissions related to UPI digital transactions.

Still, bank transfers stand at the bottom of all clearance and settlement operations. Identified by their IFSC code, banks and branches accept and execute online money transfers via three common digital payment methods governed by the RBI.

- The Immediate Payment Service (IMPS) is an interbank fund transfer set up by the NPCI. Real-time online transactions are possible via multiple channels (mobile, ATM, even SMS), making IMPS the affordable way of sending payments instantly between bank accounts. This is the simplest possible method as it only needs a mobile phone number. Accepted payments start from 1 rupee and have a Rs 20,00,000 limit. IMPS is the only one overseen by the NPCI, while the two below are managed by the main RBI division.

- The National Electronic Fund Transfer (NEFT) is used primarily for inter-bank account transfers. NEFT-enabled accounts receive clearance from Monday to Saturday and range from Re 1 to Rs 20,00,000 per transaction (some banks have a lower transaction limit). Transfers are possible from the banks’ web portals or dedicated apps.

- The Real–Time Gross Settlement (RTGS) method settles money transfers instantly. This makes it more suitable for high-value transactions between enabled accounts, with minimum amounts set at Rs 2 lakhs and upper limits at Rs 20,00,000.

The NPCI also maintains a National Automated Clearing House (NACH); however, that is intended mostly for financial institutions, corporate and government purposes as a web-based that handles high-volume interbank transactions, particularly repetitive and periodic ones.

Payment Methods Close the Circle for Online Gaming Needs

Assembling a complete list of payment channels made available to online gamers is quite challenging, as they are close to a hundred currently. Nevertheless, this report aims to group and explain the main categories and types of payment (and withdrawal) methods.

- Bank cards come first in this list, having paved the way for online payments. Credit, debit, or prepaid, belong to global circuits like Visa, Mastercard, Maestro, AMEX, DinersClub, Discover, Switch, Laser etc. VISA cards are still the most popular and widely accepted online RMG. However, we have already touched upon the expansive growth of India’s native circuit, RuPay, actively promoted by authorities and public institutions. Although not quite common for gaming payments, most operators readily accept it and push against card systems that have had their trouble with the RBI (i.e., Mastercard and Discover).

- E-Wallets come next in importance, despite the fragmentation of the category. Immense volumes are being processed by Paytm, Google Pay, and PhonePe. Paytm alone boasts over 350 million registered users. Native desi wallets like MobiKwik, Jio Money, Freecharge, and PayZapp have their fair shares, with other notable solutions including Jeton, RapidTransfer, KwickGo, PassNGo, and MuchBetter.

Many Indian fintech apps allow users to earn points and awards and participate in various prize drawings. Other notable global players like PayPal, Skrill, Neteller, and Paysafe are also known, albeit remaining more popular abroad. However, this is another reason for being well-accepted on offshore gaming platforms and online casinos, as they work well with Western operators. The same is valid for Apple Pay – iPhones hold only around 3% of the mobile market, mostly in urban contexts.

- Cryptocurrencies are well integrated into the Indian RMG scene. Bitcoin, Ether, Litecoin, and XRP are often among the top payment choices. Non-fungible tokens (NFT) are also growing as an in-game alternative, while prepaid game vouchers can often be added through crypto-based payments. (More on the crypto assets for gaming is provided below).

- Net Banking most often refers to direct bank transfers. Recipients can be Indian (e.g., Axis Bank, ICICI Bank, SBI, HDFC Bank) or foreign banks. Yet again, UPI is the most popular system enabling bank transfers up to Rs 100,000. Transfers via IMPS are also frequent because of the many native bank apps and ATM access.

- Cash-to-Code eVouchers are less common for online gaming but can be bought via physical and online retail points linked to providers like Dundle or OffGamers. Prepaid vouchers are then accepted (like gift cards) at participating gaming operators and platforms.

As we have seen so far, the Unified Payments Interface is the biggest tech enabler in the Indian payments market, gaming, and elsewhere. Launched in 2016, the NPCI-backed system is a cornerstone of P2P and P2M transactions. Over 300 banks in Bharat are linked to UPI, and in February 2022 alone, it was the gateway for 4.52 million transactions worth over Rs 8 lakh crore ($110 billion).

The umbrella solution requires only an ID (or a phone number) and a PIN to send and receive funds. With more than 150 million active monthly users, it continued increasing its share in FY22 to over 50%, passing a total value of $1 trillion. Between July and September 2021 alone, UPI rose 103 percent in volume and 100 percent in value compared to Q3 of 2020.

A Worldline India report shows that 54 percent of UPI transactions involve people (P2P), and 46 percent are directed to merchants (P2M). Still, UPI requires a bank card, which led the market to another milestone, with over 1 billion cards currently in circulation.

Credit cards count for merely 7 percent of the total. The debit card market (the remaining 93 percent) is well-supported by private banks (issuing 21 percent of cards), but the public sector has issued 68 percent of all debit cards, truly boosting the financial inclusion effort of the government. Many of these accounts were set up within the Jan-Dhan scheme, an initiative to support affordable financial inclusion for ages ten and up.

And finally, the Aadhaar Enabled Payment System (AePS) is also worth noting because it allows several different types of digital transactions at MicroATM points-of-sale (PoS). For gaming purposes, it is as rare as they come, but users can still prepay vouchers and cards and pay for subscriptions.

In the figure below, the highlighted methods are the ones mainly used and available for gaming and entertainment services.

Digital Payment Methods. Source: Cashless India

While the payments infrastructure is constantly improving, the digital literacy of consumers and businesses also needs to be at certain levels, despite a series of simplifications. The fundamental threshold is the standard set of KYC procedures that a gaming platform requires of its users. However, similar data is needed for Indians to open a bank account.

Another friction point is the merchant discount rate (MDR), a fee charged to businesses ranging between 1 and 3 percent. It might prompt gaming companies to choose one payment over another, limiting the choices available to players. Many RuPay and UPI payments incur a zero MDR, although authorities have been trying to roll the incentive back since the Finance Ministry estimated annual losses of about Rs 5,500 crore. Similar missed opportunities impair the ability of payment providers and gateways to invest in their infrastructure, industry exponents have complained.

All other bank cards have a 0.9 percent MDR cap but sometimes decide to join the zero-MDR policy voluntarily to avoid missing out on commercial agreements and UPI transactions.

Multi-Gaming Platform Integration with Payment Methods

The multitude of payment methods cannot even begin to compare with the online gaming sector’s diversity of genres and titles. However, both can roughly be combined into categories and platform aggregators. In the case of online games (be those RMG or others), we see the growing influence of multi-game platforms.

A glaring example of the latter is India’s own Paytm First Games. With over 200 different games and over 80 million registered users, this mobile platform offers anything from fantasy sports to table and card games. Naturally, it is all linked to the Paytm mobile wallet and closes the RMG cycle – from signup through bonus offers to deposits and withdrawals.

Similar multi-game platforms attract highly competitive third-party developers and publishers, many of which are unique for the desi market. Distributors maintain rich game libraries and pay attention to legal and financial aspects. Users can play directly in their browsers the majority of games or can download them.

The Mobile Premier League (MPL) provides similar app and site integration. It also boasts hundreds of RMG and casual games and more than 60 million registered users. The “social gaming” and entertainment platform WinZO has also gained much following recently.

WhatsApp represents another form of an integrated ecosystem that is even somewhat underexploited. Meta’s messenger has nearly half a billion users on the subcontinent, and it can rely on both the popularity of Facebook as a vertical integration as well as the payment features of WhatsApp Pay. The latter is not fully rolled out due to RBI limitations, but its sheer potential is enormous. In-app mini-games hold much of the industry’s future, as WeChat’s success reveals.

Non-related tech enterprises also team up to make the best of their user pools. Recently, Xsolla, a dedicated video game engine for publishers and developers, announced its cooperation with Paytm as a payment gateway provider. From a marketing and distribution perspective, the American company is better positioned as a global game commerce provider but needs the payment solutions that Paytm can offer for the Indian market.

Monetization is a key priority for all gaming tech brands – from individual publishers to specialized gaming stores (i.e., Steam, Valve, Krafton, Roblox) and media platforms (using their own site or third-party outlets like Twitch or Mixer). The new face of immersive mobile gaming stimulates the industry to look for crossover opportunities and explore global brands such as YouTube Gaming and Facebook Gaming.

On the other hand, whether based in India or abroad, gaming operators and developers need to be able to offer multiple payment methods to their users. The complexity of the payments scene is resolved through PSPs and gateways, which have a simple interface and integrate well with local and international payment methods.

Are There Significant Differences between Deposit and Withdrawal Options?

Most RMG platforms and stand-alone apps have rather straightforward procedures for online deposits and withdrawals. Subject to a player’s details and existing accounts, industry standards see transfers in both directions usually processed using the same method.

Account verification (via an ID, utility bills, or bank statements) is crucial, enabling identity confirmation and a range of payment options. KYC protocols and digital identities save these details for future use while mobile wallets transfer them across gaming platforms and apps. Personal information shared with various fintech solutions is easily conveyed between stakeholders along the payment vertical.

Unless it is explicitly given as an option for intermediary confirmation or choice, withdrawals use the same channel as deposits. If this is not possible due to the nature of the outgoing payment (e.g., prepaid cards or accounts, game tokens, or other limited-functionality deposits), players are given a chance to choose from many withdrawal methods or prize options.

Limits are often imposed on the minimum and maximum deposit and withdrawal amounts. The smaller these sums (some are as low as Rs 250), the more attractive these operators and payment means are to most players.

NFT and Crypto Payments, the New Face of Gaming

Web3 is definitely a buzzword and a widely exploited topic in the online industry at this point. Web3 is specified as the technology that can lead the internet into a new stage of decentralized ownership, privacy, and economic “fairness” to the extent that these concepts are inherently possible in a highly connected ecosystem with big players.

Namely, these tech giants have had their ambitions tied to blockchain technology and web3 projects for a while. The world’s largest technology-focused venture capital fund, the Softbank Vision Fund, has been exploring web3 possibilities and holding funding rounds directed at decentralized finance and technology.

Put simply, financial and other sensitive information are stored in various types of digital wallets instead of company data centers. Wallets are blockchain-verified, and users access them via web3 applications run on the same technology. Disconnecting results in complete personal and financial data log-off, allowing the owner to take “the key” with them.

This approach has been used by gaming platforms for a few years, including virtual reality environments and anonymous peer payments, both in-game and as separate digital transactions. Cryptocurrencies are particularly suitable for such web3 applications. Developers, distributors, and other small-time stakeholders have actively in promoting them as payment methods for virtual items and their labor, services, and gaming features made available.

Notably, mainstream financial system operators like Visa, Mastercard, JP Morgan, and other banks have begun investing time and resources into their web3 presence. With a multitude of upcoming and already existing metaverse applications, they want to maintain market shares among payment methods and branch out into the future of virtual finance.

Cryptocurrencies as Gaming Payments

Crypto payments have been accepted for online gaming and casinos for several years. The leading RMG brands and gaming platforms may not push them actively as priority payment methods to call themselves crypto casinos (or bitcoin casinos, e.g.). But many exhibit them proudly as payment options since they allow a level of extra privacy and security, which some other methods might not have in the eyes of most players.

Bitcoin still leads in trade volumes, market capitalization, and acceptance across gaming and entertainment platforms. Ether follows it closely, as its underlying blockchain tech is more often used for third-party applications and tokenization (see below). Litecoin also records notable payment volumes.

After an initial period of resistance, even Central banks worldwide started exploring the possibilities of launching and promoting their own national crypto assets, including as mainstream payment tender. This provides more legitimacy to the kind of financial assets that need to be decentralized to maintain certain added values. Yet, this is good news for web3 advocates as even centralized digital currencies enable technology and market opportunities compatible with decentralized finance (DeFi).

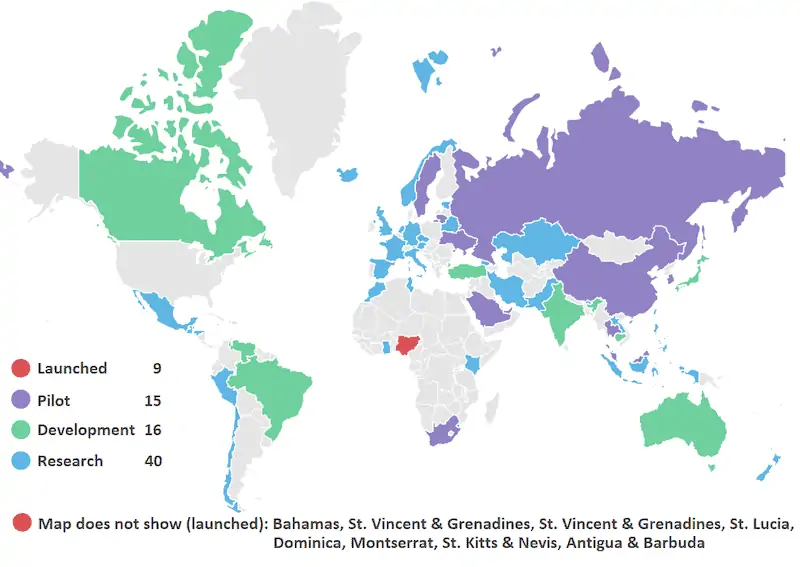

The figure below shows the 80 nations currently pursuing their Central Bank Digital Currencies (CBDC), with the USA the most recent high-profile addition.

Source: Bankless Times

As a matter of fact, India and other emerging markets did not take long to explore the matter in-depth. The political hesitancy was more evident initially while there was an underground debate among financial circles and tech experts. The RBI has announced the digital rupee as planned for the Financial Year 2022-2023.

In-Game Tokenization

NFT are not new on the gaming scene, although they have become more prominent recently through digital arts and collectible trades. In-game items are unique and linked to specific digital content. However, their most practical and integrated mainstream case use is found in tokens used for payments and in-game clearance.

Some leading games issue their own NFT and accept them as payment. The success of Axies (AXS) – the in-game tokens offered by Axie Infinity – reveals the potential of such virtual assets. Axies are used to pay for virtual features, in-game services, and objects, even land plots within the game. Like real-world assets, ownership is guaranteed, and Axies can be traded at the virtual marketplace for fiat currency.

Behind the scenes, Axies run on the Ethereum blockchain with the support of a “sidechain” named Ronin designed to optimize transactions. The gaming studio that worked on Axie Infinity (Singapore-based Sky Mavis) placed a successful Initial Coin Offering (ICO) in late 2020. Since then, they have achieved a market cap of slightly under USD 2 billion.

The relevance of NFT transactions for the real-money gaming world and the payment industry is notable. Not only because this is a “secondary” level of payments, both within games and parallel to their worlds, but also because there is already an entire “play-to-earn” economy surrounding the most popular titles.

In Axie Infinity’s case, players can perform tasks and earn SLP tokens, the second kind of NFT circulating in the game, also based on Ethereum. While AXS tokens are more about game governance and investment, SLP tokens are dedicated to exploiting the earning potential of games that are not initially intended as real-money genres. In turn, they can both be used to invest in features and virtual assets like “land plots” in the Genesis universe. It may surprise the uninitiated, but some plots are already selling for millions of USD, and experts have spoken of a real-estate bubble within that context. As a matter of fact, there are paid academies and even university programs that teach gameplay courses, with some offering scholarships.

More narrowly related to payment channels, leading cryptocurrency exchanges like Binance and FTX have made AXS and other game NFTs available. Some like Coinbase have kept away from this stage of crypto crossovers, but most decentralized platforms like Uniswap or SushiSwap thrive on such assets.

There are other global success stories bridging environments like the metaverse and technology such as NFTs as the foundation of the in-game virtual economy. Decentraland is also based on Ethereum and has a crypto named MANA of similar market cap proportions. Roblox is a prominent game platform synonymous with independent game building for end-users. It has also launched its blockchain-based virtual world, PlayDapp, positioning itself as the Roblox metaverse within the gaming ecosystem.

As mentioned above, payment providers like Mastercard aim to capitalize on the expansion of metaverse applications, having filed for numerous related patents and trademarks. These regard payments within the metaverse, and digital marketplace platforms for secondary goods and services in some way related to the virtual environment. VISA is also circulating in industry news as getting a “metaverse makeover,” while British bank HSBC even purchased virtual land in the Sandbox metaverse as a channel enabling it to engage with young gamers and esports enthusiasts.

Indian Market Grows Beyond Banking

All of the above concepts and trends have shown that modern fintech is evolving much faster than traditional banking. Payment methods and gateways are weighted against their speed, ease, compatibility, and the fees that make them more or less attractive to players and companies.

In all of this, the financial regulators need to make these two different realities reconcile. The RBI has launched a procedure to select new umbrella entities (NUE) that can offer a range of services in retail payment, ATMs, and other kinds of virtual PoS terminals. The selected consortium will be required to work with Aadhar-based payments to maintain certain financial inclusion standards. However, the NUEs (one or more) will be able to offer P2P remittance and develop new payment methods. The initiative aims to limit the monopoly of the RBI’s own NPCI division.

So far, six applications have been received by consortiums, including tech giants like Google, Meta, Jio Platforms, and SoHum Bharat. Tata Group is heading a consortium listing local powerhouses like Kotak Mahindra, and HDFC among banks, Flipkart, Mastercard, and PayU among payment providers, and the Airtel Digital telecom brand. Amazon leads another consortium, including tech and finance giants ICICI Bank, Axis Bank, Visa, and Pine Labs. Paytm coordinates the efforts of mostly desi startups. Regardless of which and how many of these NUEs get RBI approval, we expect new fintech solutions and payment systems pretty soon.

Other alternative digital payment channels have been explored in offline settings. The RBI has also initiated a technical debate on a framework allowing small-time payments (between Rs 200 and 2000) to be made even without Internet connectivity. This would allow remote payments in rural areas or by users who only have feature phones. Such a move would undoubtedly raise inclusion levels among users with fewer tech skills and will expand the digital payments market to Tier-3 and Tier-4 areas.

Desi fintech startups are joining forces to make such payments easy and quick. Although the Assisted Payment and Financial Services program will end up creating solutions mostly for local retailers and daily spending, it can and will likely also be used for the most popular real-money game in India, the lottery.

A similar wave of digital growth was experienced by rural payment markets when the Jan-Dhan Yojana scheme (PMJDY) was launched in 2014 as a National Mission for Financial Inclusion. Basic bank accounts, peer remittance, credit, insurance, and pension transfers were made affordable and digitally accessible. But the pivotal moment was also used to deploy PoS kiosks and other micro ATM devices, encourage mobile bill payment, raising the cash flow directed to native Indian E-Wallets, UPI, and other e-banking solutions.

The “Bankless” Generations Welcome New-Age Fintech

RBI data cites up to “120 million formally employed Indians without a bank card.” Worldbank sources place account ownership at almost 80%, yet the sheer size of the unbanked population means nearly 280 million (and at least 200 million adults) do not have a bank account.

This limits the payments market as much as digital lending and other mobile finance efforts. Still, 44 percent of fintech funding in 2020 has gone to mobile lending startups. This is where established banking institutions may need to collaborate more with new players on the digital finance market.

At any rate, the desi fintech sector is healthy and fertile. While bank account ownership is considered a given fact in post-industrialized countries, most unbanked adults live in emerging markets. In turn, good internet access and the need to operate with personal finances make the fintech segment more active and productive in such conditions and markets.

Indian society has “skipped” certain adoption patterns for Western banking services. It simply did not have the time to move from a cash-based economy to its present dynamic state of immense volumes of digital transactions.

Federal authorities understand these challenges well. Apart from offline digital transactions (see above), the Unstructured Supplementary Service Data service (USSD) introduced in 2016 was aimed precisely at those with low-cost feature phones that need to work with UPI payments. Also known as the *99# service, the USSD works with mobile banking gateways with just a phone number and caters to the underbanked society.

Another illustration can be provided by the inapplicability of traditional credit history checks to young and unbanked Indian adults who have their income and spending passing through a PPI wallet. Millennials, especially Gen Z consumers, do not have such data on them, and they may be disadvantaged by traditional banking. Still, they would be easily enabled by mobile fintech up to certain financing levels. That does not mean overlooking security or legality – fintech can easily combine KYC with Anti-Money Laundering (AML) and other identification protocols. At the end of the day, the vast unbanked population of important emerging markets can now participate more actively in the digital economy.

This often means that desi youth readily go “beyond banking.” Not needing physical accounts or even cards, they are the perfect target market for domestic and foreign mobile fintech solutions that build the bridge between cash-first generations and the bankless ones.

Fintech Prospects and the Future of Online Gaming Payments

Payment methods for online gambling and real-money gaming abound in present-day mobile-first India. For the most part, it is a matter of personal choice and benefit/cost analysis for users, as most digital payment gateways provide sufficient safety and security protocols to operators and end-users.

Industry reports confirm that lockdowns have acted as catalysts to increase gaming engagement and mainstream digital monetization. The RMG segment has expanded from the casino and card-based games into fantasy sports and casual games. With estimates between 400 and 500 million desi gamers, the monetization of the latter niche has become fundamental for the industry, subject to more regulatory clarity in many cases. Multi-gaming platforms provide sufficient scope and crossover genres in that sense, achieving more popularity among non-professional gamers and drawing increased investor interest.

In such a context, the established reliance on a few UPI-based apps and mobile wallets do not do justice to the potential of the Indian gaming market. Contrary to the ambition of offshore platforms and global gaming giants, native desi wallets often target low-value microtransactions. Yet they do their part in boosting the digital payments market. However, this is why enabling various payment channels and monetization schemes is crucial for Indian online gaming.

The above analysis has shown that the online gaming market is seeking its role in relation to payment ecosystems and the wider entertainment monetization business models. Fintech startups and the RBI seem to be more than able to support the mutual growth of the tech industry. Payment vertical stakeholders are constantly innovating and creating flexible and inclusive financial instruments. More importantly, with solutions ranging from offline transactions and vouchers to the CBDC digital rupee, the main systemic players are looking beyond the dominance of the UPI platform.

Indian banks and fintech startups have tacitly agreed that it is in their common interest to provide incentives to develop a robust and scalable digital payment framework. Bridging over and exploiting the best practices from the two historically diverging financial models has expanded the reach and usefulness of both.

It seems inevitable that the most competitive future solutions will be part of the decentralized financial paradigm (DeFi). Blockchain has proven its ability to revolutionize both the iGaming world and the payments market, and DeFi technology is especially valuable in automating secure actions and supporting smart contracts. Even if a completely bankless society seems unattainable, the current adoption of crypto-asset settlements and in-game NFT transactions bode well for the independence and prospects of the new-age RMG market.

In the short period, we expect to see the continued dominance of the leading E-Wallets on the Indian market, most linked to the UPI system, and the growing influence of the RuPay card circuit. The elevated competition among the online RMG operators will fuel more innovation across the payment gateway market, giving more flexibility to the vertical to cover the full range of consumer preferences as possible.

Ultimately, the current ecosystem of payment methods and any upcoming fintech solutions can provide quality backend support to Indian online gaming. More importantly, the dynamic reality of digital finance manages to drive forward technological innovation, ultimately contributing to the growth and improvement of the online gaming industry.