This post is also available in:

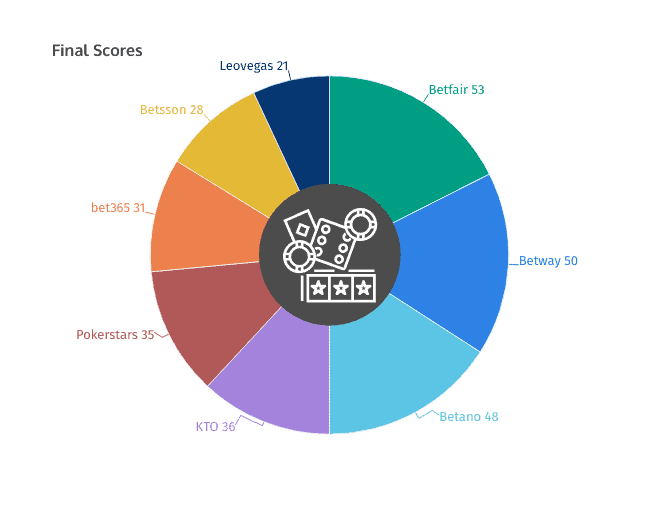

The analyses in this Share of Voice (SoV) study are conducted considering the three months prior to December 2023. In this edition of the report, we take a look at the top 8 of the best-known gambling brands in Brazil and the results presented below make up and justify the final score ranking.

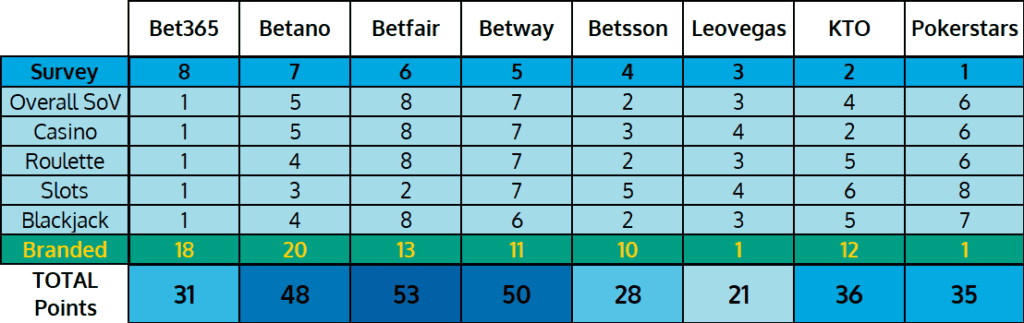

Total operator scores reflect online SoV visibility for casino-related keywords as detected by SEO tools, as well as branded searches, social media presence and estimated organic traffic, in addition to original survey responses.

Ultimately, we designed a Weighted Points System which sees the respective leader get the most points, this time from 8 (the most) to 1 (the least), even when the bottom position had marginal presence.

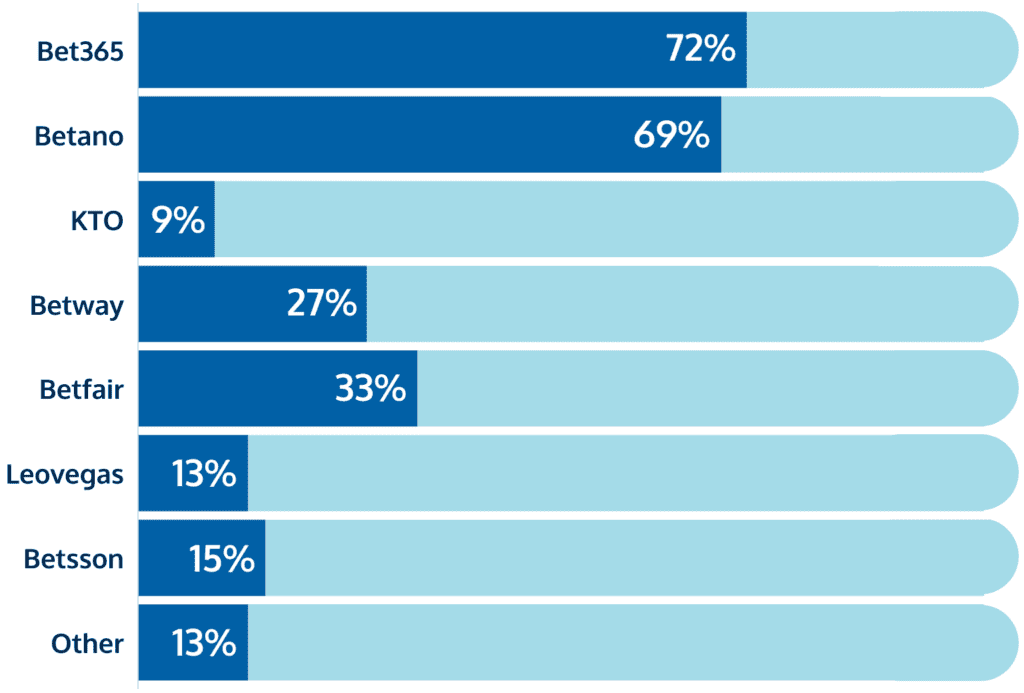

Brand Recognition and Trust

The first and most important ranking we need to take a look at reveals the most recognized and trusted iGaming brands in Brazil based on survey responses. When asked which of the following brands Brazilians knew (and judged as reliable), we saw the results below.

Respondents picked out brands like Bet365 and Betano above all others. Those were recognized (and potentially trusted) by 72.29% and 68.54% of respondents, respectively.

Other notable brands such as Betfair (33.33%) and Betway (27.29%) also demonstrated significant recognition and trust among the participants. Somewhat behind, we see brands like Betsson (15.21%), Leovegas (12.71%) and KTO (9.38%), still garnering sufficient recognition by Brazilian gamers and easily placed within the top 8 brands in the country.

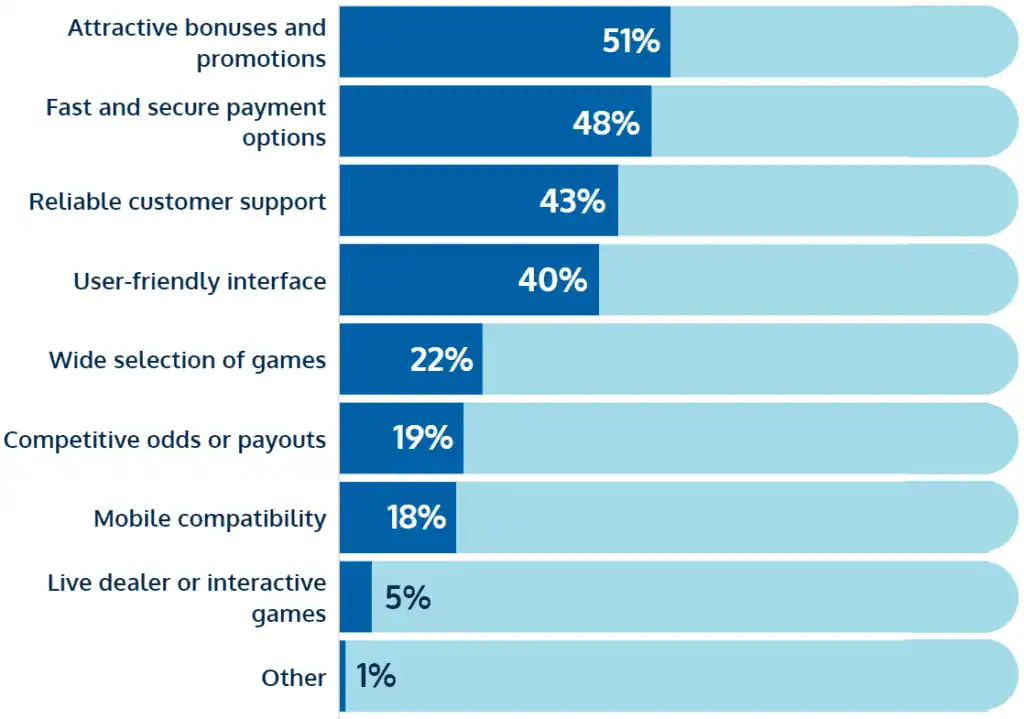

Key Factors for Choosing a Brand

To appreciate what shapes these preferences, we also need to know what Brazilian players deem as most important when choosing an iGaming operator.

Attractive bonuses and promotions were cited at the forefront of the deciding factors for Brazilian iGaming enthusiasts, over over half of respondents (50.63%) emphasizing their importance. Reliable customer support follows closely, valued by 42.71% of respondents, reminding that efficient and responsive support systems are crucial for player satisfaction. Almost equally significant, we see fast and secure payment options, rated crucial by 47.71% of gamers.

The next tier of preferences includes a user-friendly interface, regarded as decisive by 40.42% of the survey participants. This preference underscores the role of a seamless and intuitive user experience in attracting and retaining players.

Additionally, although not as paramount as the above factors, we see the selection of games (i.e., variety) being important to 21.67%. Also, not so critical but still relevant, we see competitive odds and payouts (in terms of Return-to-Player percentages, RTP) still a noteworthy consideration for 18.75% of users. Not far behind we see mobile device compatibility, still an issue for 17.92% of users.

Perhaps surprisingly, the support for “live dealer games” – i.e., immersive and interactive real-money genres – holds less sway in the decision-making process (4.58%). This demonstrates that such features, while innovative and engaging, do not have a primary influence on the choice of an iGaming brand among Brazilian players.

Earlier responses which generate the SoV ranking of operators are likely unaffected by the list of impact factors we just presented. SoV presence is usually based on paid advertising, online and offline visibility, straightforward fame or notoriety, as well as recent gaming experiences. However, these elements all weigh in when ultimately making a decision to play on a given platform.

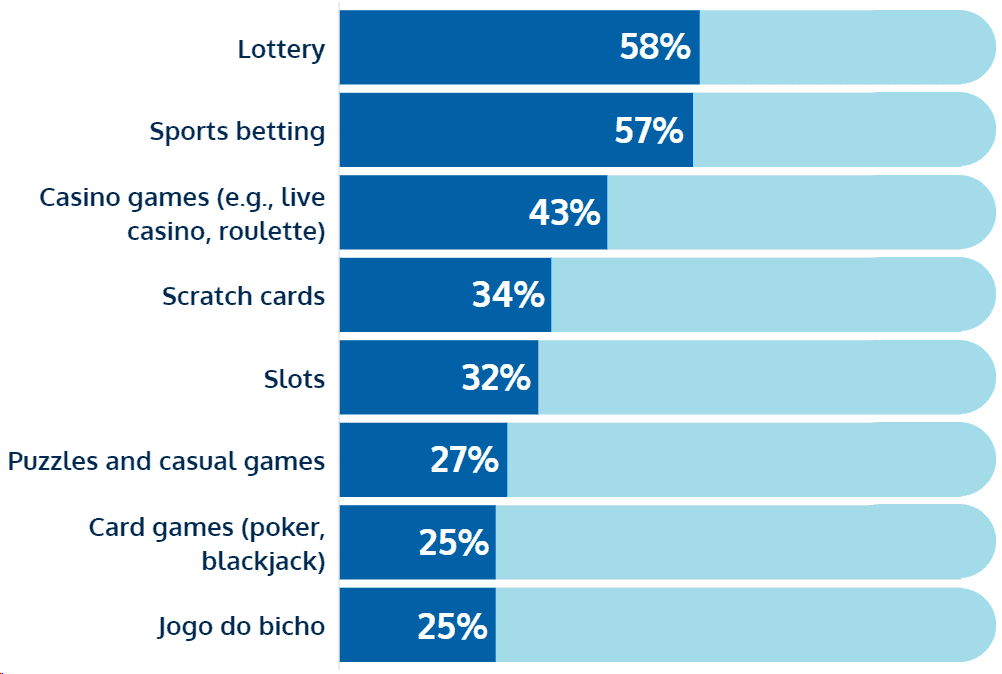

Most Engaging Gaming Verticals

As a next step in our evaluation of generic market shares, we need to analyze the verticals that have the biggest pull among Brazilian real-money gamers.

The most popular games among respondents were lotteries (58.46%) and sports betting (56.58%), followed by casino games (42.80%).

These do not come as a surprise, as we have already seen comparative market shares that put them in a similar order. Casino audiences are also the most diverse, encompassing roulette players but also fans of slots games (32.15%) and card classics like poker and blackjack (25.47%) as well.

We also notice a considerable share of games (27.14%) that are considered casual by nature but that can also be structured as real-money contests and random prize gaming sessions.

The sizable shares of scratch-card games (34.45%) are often considered in industry analyses under the lottery family of random draws. The classic (and unregulated) game of “jogo do bicho” continues drawing interest by nearly a quarter (24.63%) of all adult real-money gamers in Brazil.

Why Do Players Switch? Frequency and Motivations for Choosing a New Online Casino or Sportsbook

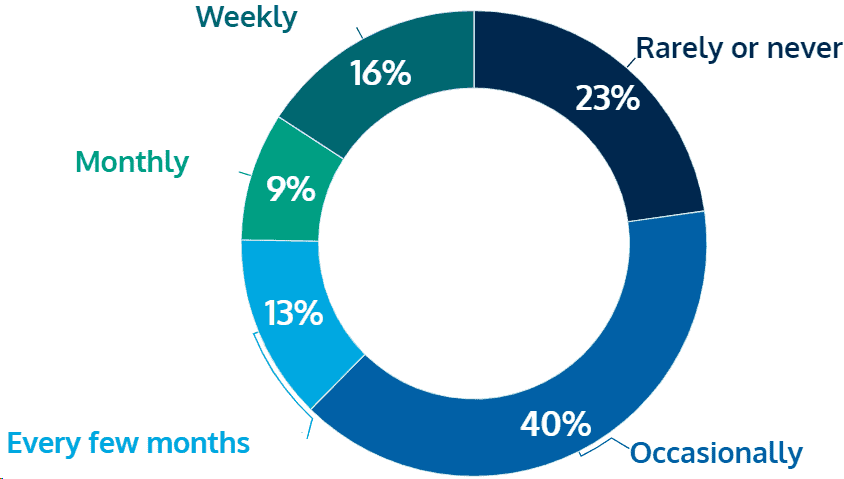

Our survey also reveals the consistency and loyalty of player engagement with leading iGaming operators. The largest share of respondents (39.58%) occasionally switches between different iGaming operators, suggesting a tendency to explore various options. On the other hand, almost a quarter (22.71%) rarely or never switch, indicating a significant level of brand loyalty among a segment of users.

A smaller yet still significant portion of players switch operators at regular intervals – 9.38% do so monthly, and 15.63% weekly. This highlights a group actively seeking new gaming experiences and promotions.

Discovery Channels for New Gaming Platforms

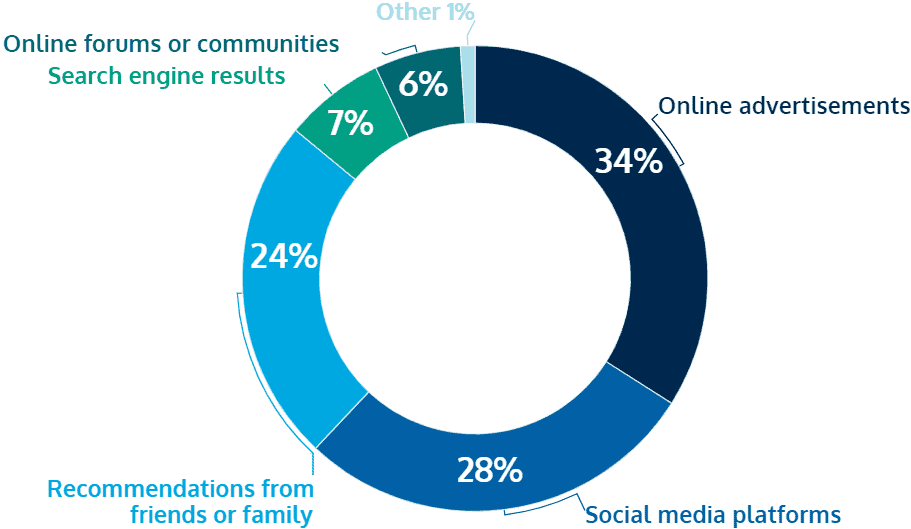

When it comes to discovering new iGaming sites or apps, online advertisements are the primary method for 33.54% of respondents. This underscores the effectiveness of digital marketing strategies in the industry.

Social media platforms also play a pivotal role, being the chosen source for 28.33% of gamers in finding new games.

Personal recommendations (23.96%), along with forums and online communities (5.83%), and search engine results (7.29%), though less prevalent, are still notable means for discovering new gaming opportunities.

The propensity for occasional switching among operators suggests a market driven by curiosity and the pursuit of better offers or experiences. In turn, these trends confirm the significant impact of online advertising and social media in discovering new gaming opportunities.

Reasons for Switching – Non-Gaming Factors and Desired Improvements

As we noticed, there are a number of factors that influence the choice of an iGaming platform, many of which lay outside of those directly related to one’s gaming experience.

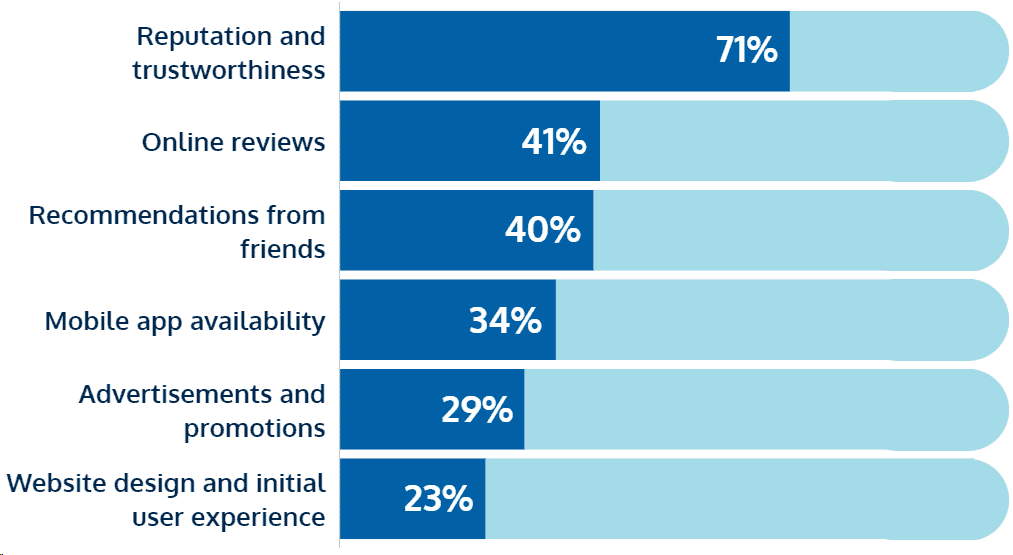

Reputation and reliability are the most influential non-gaming factors, with 71.46% of respondents prioritizing these. In other words, trust and credibility in the iGaming industry goes a long way, for most users.

Recommendations from friends (39.79%), online reviews (40.63%), and the design of the site (23.33%) also play significant roles in influencing user choices. The availability of mobile applications is still an issue for 33.75% of respondents, despite most games and platforms having quite optimized mobile browser versions, in most cases.

Even when some key features do not represent a decisive factor (or a deal-breaker) for gamers, many are eager to see improvements in certain areas.

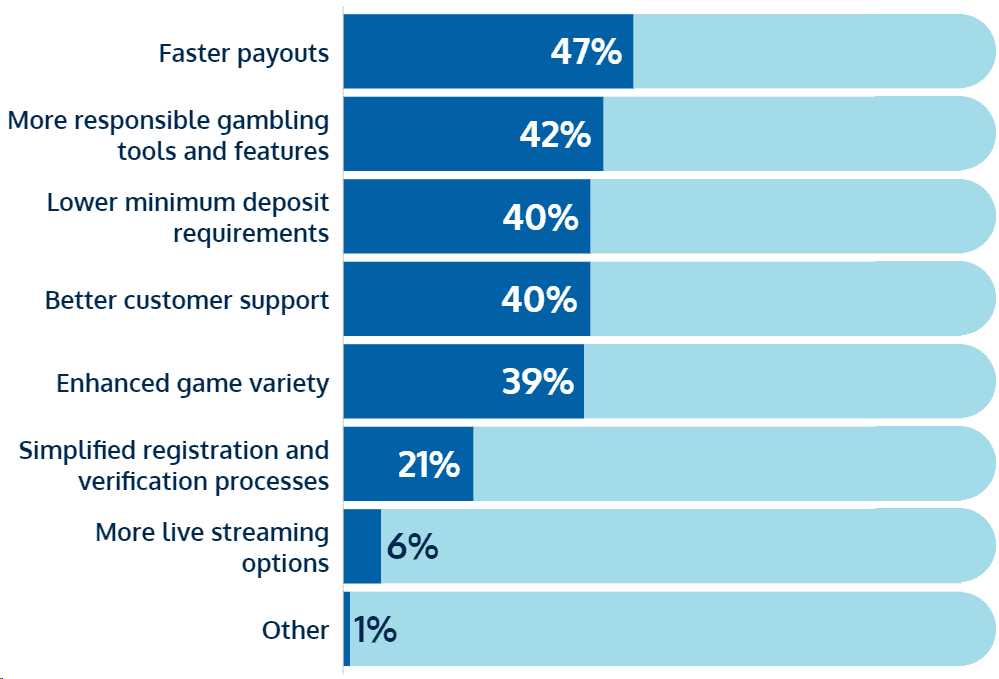

The most desired improvement was faster payments (47.29%), followed closely by lower deposit requirements (40.21%). These factors are naturally related to what we were reminded above – the need for quick and convenient financial transactions in gaming.

A greater variety of games (39.17%) and improved customer support (39.58%) were also seen as areas where significant improvements could be made. Such responses emphasize the lasting demand for diverse gaming experiences and reliable assistance.

Last but not least, the demand for more responsible gaming tools (41.67%) suggests a growing awareness and concern for safe gaming practices among users.

Exploring Online Casino Search Trends and Generic Game Popularity

As we often point out, online casino is the richest and most diverse iGaming vertical. With plenty of games to choose from, we need to identify the game categories which draw the most online traction.

We have also seen previously that Brazilian casino fans are split between slots and crash games as quick-play options on one hand, as well as live casino games like roulette and blackjack on the other. And we expect these to get the most mentions and search demand.

However, an operator’s online visibility is closely linked to their SEO performance. Achieving top rankings in search engines for popular casino-related keywords is a challenging feat, requiring dedicated on-page and off-page SEO efforts. Established operators with a rich history of optimized content would rank higher in the SERP compared to newer competitors or those with minimal optimization efforts for our focus keywords.

In pragmatic terms, we expect to see older websites (i.e., established operators) with a high volume of optimised content to show up more often on top of search results with the biggest volumes, more so than newer competitors and websites with little or no optimisation towards our focus keywords.

We used Mangools.com to identify the most popular casino-related search queries in Brazil over a three-month period. The data below shows average monthly search volumes, reflecting proportional online demand.

| Keyword | Avg. Search Volume |

|---|---|

| cassino online | 595,000 |

| cassino | 450,000 |

| jogos de cassino | 12,100 |

| jogos cassino | 8,100 |

| jogar cassino | 8,100 |

| jogar cassino online | 4,100 |

| cassino online brasil | 1,300 |

| casino online dinheiro real | 1,000 |

| Keyword | Avg. Search Volume |

|---|---|

| roleta | 636,000 |

| roleta online | 398,000 |

| jogo roleta | 14,800 |

| roleta cassino | 5,400 |

| roleta brasileira | 4,900 |

| roleta de cassino | 1,900 |

| roleta ao vivo | 1,300 |

| jogo de roleta online | 400 |

| Keyword | Avg. Search Volume |

|---|---|

| blackjack | 684,000 |

| blackjack online | 2,400 |

| blackjack jogo | 940 |

| jogar blackjack | 390 |

| blackjack 21 | 350 |

| blackjack game | 230 |

| blackjack casino | 190 |

| blackjack como jogar | n/a |

| Keyword | Avg. Search Volume |

|---|---|

| slots | 40,500 |

| slot | 33,100 |

| caça niqueis | 27,100 |

| slots casino | 9,900 |

| slot casino | 9,900 |

| jogo slots | 6,600 |

| jogos caça niqueis | 6,000 |

| jogo de slots | 3,600 |

The data reveals that generic, short-tail keywords such as “cassino”, “roleta”, “blackjack”, and “slots”, along with their online variations, generate the highest search volumes. This underscores the importance of focusing on basic queries – as much as on branded keywords, if not more – to achieve and maintain consistent online visibility.

On the other hand, specific game searches are more prevalent than undefined game terms, as evidenced by the relatively low search volume for “jogos de cassino” (12,100 searches) compared to “roleta”, “blackjack” and “slot” variations.

All real-money gaming searches seem to have experienced a notable increase in the past three months. Combined queries for keywords related to “cassino” and “roleta” both surpass 1 million monthly hits each.

Even “blackjack” has more than 700 thousand. However, it is evident that search volumes for roulette-related terms significantly outpace those for blackjack, suggesting a lastingly higher popularity for online roulette.

The above figures show that the hugely popular slot games need a different positioning approach. Slot-related queries are much more fragmented, reflecting the popularity of single game titles (and even game studios) which combine to outrank generic slot queries.

Evaluating Brand Awareness via Monthly Search Volumes

In our quest to weigh brand recognition among iGaming operators in Brazil, we analyzed brand-specific online queries for some of the leading gaming platforms. The ranking below encompasses some of the most recognized brands locally, providing a snapshot of their market presence.

It’s important to keep in mind that the total figures do not mean unique users; they include recurring searches by the same users finding the page through Google Brazil.

| Brand | Monthly Searches |

|---|---|

| Betano | 37,200,000 |

| Bet365 | 30,400,000 |

| Betfair | 3,350,000 |

| KTO | 2,030,000 |

| Estrelabet | 686,000 |

| Parimatch | 550,000 |

| Betway | 368,000 |

| Betsson | 122,000 |

| Pokerstars | 82,200 |

| Leovegas | 74,000 |

Betano emerges as the most searched brand in Brazil, with over 37 million monthly searches, closely followed by Bet365 with 30 million.

The middle-tier operators include Betfair (3.35 million) and KTO (2 million), with their respective search volumes still indicating a strong market presence.

While brands like Bet365, and Betfair have been around for quite some time, it’s impressive that relatively young brands rate quite well, e.g., KTO grabbing the fourth position. What is even more important is that many brands outside the top 2 have been adding visibility faster than the leaders in the past few months since we started tracking their Share of Voice.

Most of the operator brands operlap with the responses received in our survey, as well as the ones tracked for online SoV in Wincher (see data below). This allows us to combine these sources and rank the top 8 real-money gaming brands in Brazil.

Bandwagon Effect Implications

The bandwagon effect is a phenomenon where individuals tend to align with popular choices. This is especially common in the absence of in-depth expertise and plays a significant role in brand recognition.

In the iGaming sector, such behavior would suggest that the most recognizable operators, or those perceived as leaders, are more likely to be chosen by consumers. However, it’s interesting to note that while some operators may be more recognizable in reality, they might not always be the top choices or at least not by such a wide margin.

Broader Marketing Strategies and Brand Visibility

A more granular look at branded searches also reveals that while Betano and Betfair manage to grab significant SoV with generic queries, Bet365 isn’t reaching any SoV in Brazil through generic search terms. A lack of content focus on the website could explain the gap in exposure, a fact which brings it somewhat down in our final rankings.

Then again, we know that a brand’s Share of Voice covers many other aspects of acknowledgement and awareness. Bet365 remains one of the world’s most well-known gambling operators, partly due to its effective use of ambassadors, sponsorships, and advertisements.

Ultimately, broader marketing strategies play a crucial role in shaping an operator’s visibility and recognition in the market.

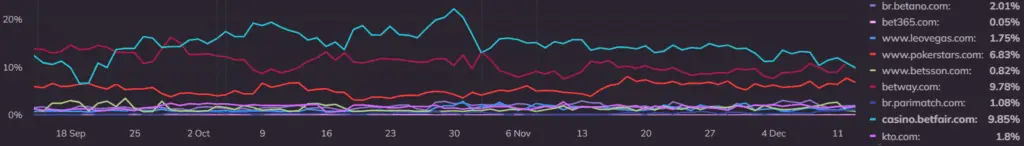

Overall Share of Voice Based on Generic Queries

Our breakdown of SoV rankings for various iGaming operators in Brazil takes into account a list of generic queries. These cover essential game categories – namely slots, roulette and blackjack, in addition to general casino terms – altogether 40 generic keywords tracked for the past 3 months.

Towards the end of 2023, Betfair (casino.betfair.com) stands out with a 9.85% market SoV, based on all query terms included. But it is closely followed by Betway (9.78%) and Pokerstars (6.83%) as all individual competitors generate less than 10%.

Betfair was first launched in the year 2000 and PokerStars just a year later, giving both operators over 20 years of online presence. This is one of the linear explanations for their Share of Voice being much larger than the rest.

Despite their distance from the more visible peers, brands like Betano (2.01%), KTO (1.8%), Leovegas (1.75%) and Betsson (0.82%) still claim a noticeable market share. Bet365 (0.05%) lacks the digital footprint we would expect across all generic queries.

In particular, KTO, Betsson and Leovegas have been part of the top 5 casinos in Brazil repeatedly and at different times during the 3-month period under examination.

Interestingly, brands like Blaze (engulfed in a series of scandals in Brazil) and Parimatch (with noteworthy shares in other markets) have scarce following in Latin America’s largest gaming market.

When comparing the SoV positions assigned by Wincher to our original survey results, we notice that the market leaders are more or less the same, albeit with somewhat different positions within the top 8.

Noteworthy shifts are observed in the ranking of Betano, for example, which is rated higher (2nd) by our survey respondents. KTO, on the other hand, has bigger SoV traction (5th) according to the online tracking tools.

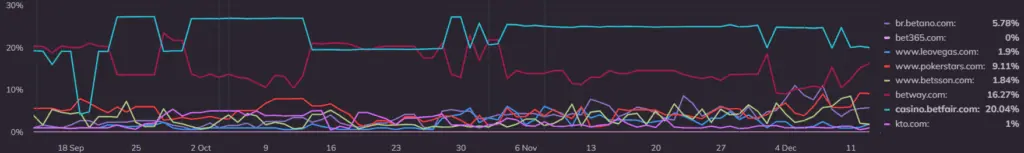

Share of Voice in Casino Queries

For casino-related searches, yet another broad query, we can see Betfair (20.04%) lead the pack among Brazil’s operators. Betway (16.27%) is not far behind. We see Pokerstars climb to third (9.11%) ahead of Betano (5.78%).

In both general terms and casino-related queries, we see that Betfair has gradually overtaken Betway over the past few months. There were periods of close contention (for casino especially) but their leadership was more or less stably held since October 2023.

More than the quality of their product, we attribute such performance to better SEO support and superior targeting of the Brazilian market. We saw them also rank higher in our field survey, albeit behind three other direct competitors in overall recognition.

Behind these leading four in this segmentation, we see some close contenders – Leovegas (1.9%), Betsson (1.84%) and KTO (1%). As above, Bet365 does not have a noticeable online presence for casino-related terms.

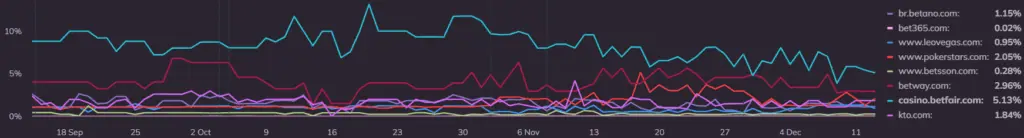

Share of Voice in Roulette Queries

Looking at roulette-related queries, we see SoV competitor shares closer to one another. Betfair (5.13%) again precedes Betway (2.96%), with Pokerstars (2.05%) and KTO (1.84%) very close behind.

Besides being a casino classic, online roulette remains one of the most sought-after gaming products on a global level, particularly in its live casino version. Constantly high (and rising) levels of online demand make it a difficult vertical to compete for, and that is why we are not surprised to see the leading operators rank so closely to each other.

The roulette keywords we track place prominent platforms like Betano (1.15%) and Leovegas (0.95%) around shares of 1 percent. Others, like Betsson, are even way below that mark, while Bet365 barely registers.

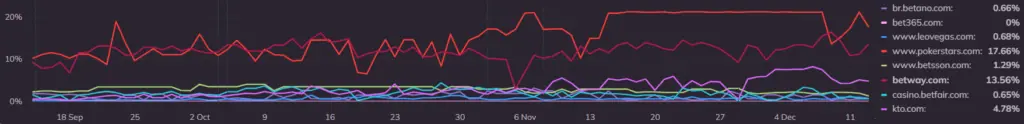

Share of Voice in Slot Queries

Contrastingly, slot-related queries divide the group. Here, Pokerstars pulls way ahead of every other operator, with 17.66%. Betway might have lost the top spot in November but it still ranks second with 13.56%.

The only other operator which comes anywhere close to these two is KTO, with 4.78% Share of Voice. Betsson comes next (1.29%), while every other operator is below 1% – Leovegas (0.68%), Betano (0.66%) and Betfair (0.65%).

The online slots niche is possibly one of the most dynamic segments in real-money gaming. Tens of thousands of games are already on the market and hundreds come out each week. Being able to maintain high levels of online visibility and market recognition requires coordinated efforts in SEO, product delivery and superior player support.

It’s important to keep in mind that slot-related queries in Brazil include both “slot” and “caça niqueis” keywords. This is the only keyword category that uses both the English and Brazilian terminology for the game, so operators with SEO efforts in both will have a clear advantage here.

Moreover, effective SEO depends on precise targeting of specific titles and providers, as noted above. Operators also face daily challenges with social media trends and naming customs (nicknames for games and characters).

Share of Voice in Blackjack Queries

As with the roulette keywords, Betfair leads for blackjack-related queries with 13.01%. The runner-up, Pokerstars, is kept at some distance (11.53%) as is the case of the third-placed Betway (8.53%).

All other competitors rate below 1% and only KTO (0.98%) and Betano (0.96%) come close.

Final Evaluation on iGaming Operator “Share of Voice” Rankings in Brazil

In both versions of our Share of Voice rankings, we see some operators fare consistently better than others. While there is no undisputed leader across the board, we see the likes of Betfair and Betway and Betano come in the top 3 consistently in all gaming verticals and various online casino game categories.

The trio is followed by a mid-level group of constantly improving competitors which may rank better in a particular vertical or gaming niche – KTO and Pokerstars. Bet365 gets the player votes and ranks well in branded searches.

Established operators consistently demonstrate strong SoV across various gaming verticals, benefiting from their long-standing online presence and robust marketing strategies.

Emerging trends indicate that while traditional casino games like roulette and blackjack maintain steady popularity, the rapidly evolving slots segment presents a unique challenge, requiring operators to adapt continuously to maintain visibility and player engagement.

The importance of targeted SEO efforts, especially in a diverse market like Brazil, is underscored by the preferences in local game terminology and the monitoring of quickly evolving online trends. Achieving higher SoV shares requires a synergy between SEO and broader marketing strategies to shape gambling operators’ visibility.