This post is also available in:

If we look at the broader spectrum of digital games, females account for 69.8% of Brazilian players. When it comes down to real-money games alone, our own studies have shown that Brazilian women engage with online casino and sports betting equally if not more than men.

This research paper focuses on the specific characteristics, motivations, habits and preferences of Brazilian female players who actively participate in online real-money games.

Main Takeaways

- Female Engagement – Approximately 54.07% of female players participate in sports betting and 49.8% of them prefer online casino games. In addition, 39.6% of female players bet on a weekly basis, with 17.30% betting between R$10.00 and R$50.00 per week.

- Platform preferences – Special offers and bonuses attract the most consistent share (29.7%) of female gamers when choosing an online gambling platform.

- Demographic profile – The majority of female players (81.3%) are between the ages of 18 and 39 and are mostly middle class. In terms of education, 52.7% of them have a university degree, while 45.3% have completed high school.

- Geographical distribution – The state of São Paulo has the highest concentration of female players, with 10.26% of the total, followed by Bahia with 8.49% and Rio de Janeiro with 4.94%.

Methodology

This study is based largely on responses of active female players in Brazil to original surveys on preferences and knowledge of real-money games. Both online casino and sports betting verticals were included as subject topics.

We have consistently supported these findings with secondary research and publicly available data sources.

Brazilian Women a Majority in iGaming

According to the Brazilian Institute of Geography and Statistics (IBGE) 2022 census, 51,5% of the Brazilian population – 104.548.325 inhabitants – are women, while men correspond to 48,5% – 98.532.431 inhabitants.

Since the 25-34 age group is the most active in the local iGaming market for both genders, it is important to note that among Brazilian adults in the 25-29 age group, the number of women is also higher than that of men.

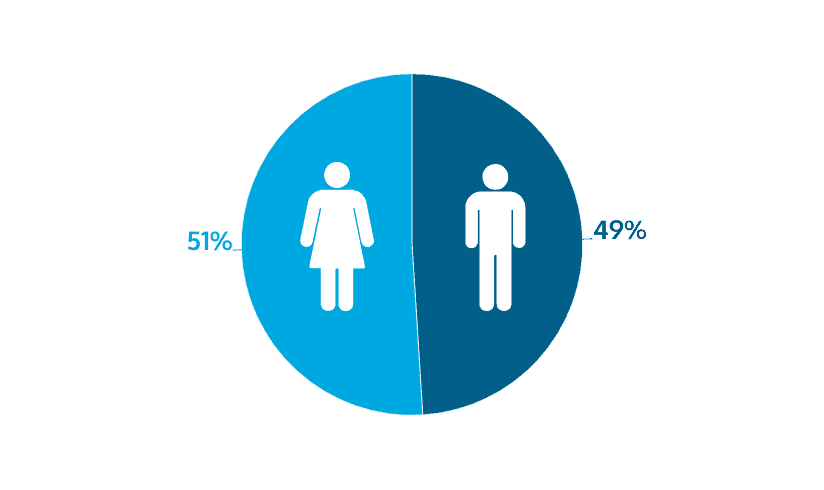

In line with these data, an ENV Media study on the profile of Brazilian online players showed that women’s participation in real-money games already exceeds that of men. Among the 550 active players surveyed, 51% were female, compared to 49% male that play online real-money games.

When did this trend start? Two thirds (66%) of Brazilian adult women have only started playing online casino games in 2023, according to a survey published in September 2024. That was the case of nearly half (49%) of the general population by that time, led by men early on.

This suggests that most Brazilian women have started to play online real-money games due to the widely discussed regulation of casino and sports betting platforms. Likewise, it indicates that, in Brazil, women are possibly more aware of the legal aspects of online gambling than men.

Who Are the Brazilian Female Online Casino and Sports Betting Gamers?

In general, when it comes to preferences and habits, the profile of Brazilian women who gamble online does not differ radically from that of men. Rather, there are mostly subtleties about their preferences in sports, methods of staying informed or learning about betting, as well as personal tastes and knowledge of terminology.

However, there are significant differences in terms of age group dynamics and geographic distribution. In particular, despite being more active, female players in the higher socioeconomic strata have significantly lower numbers than men.

Age range

Just as it is the case of the general population of online gambling fans, most Brazilian female players are between the ages of 18 to 29 (45.90%), followed by players aged 30-39 years old (35.34%). The majority of women gamers between 18 and 39 years adds up to 81.3%.

Active female players between the ages of 40-49 come in third place with 11.65%. A much smaller share of respondents over the age of 49 (8.13%) suggests that mature women become less likely to play or become interested in playing online games for money.

Place of Residence

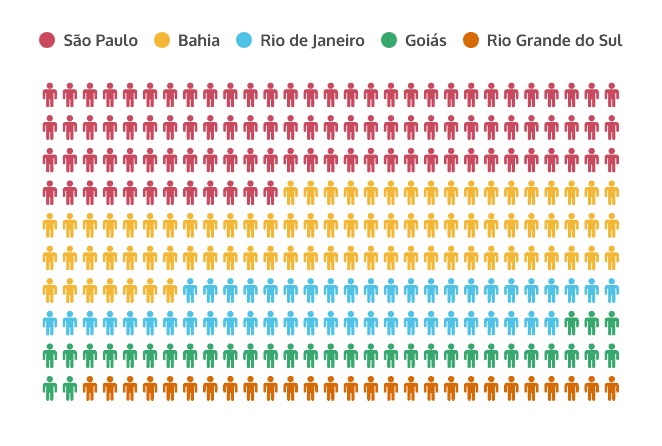

Looking at how female players are distributed across Brazil, the five states with the highest number of female players are the following:

- São Paulo: 10.26% – the largest concentration of female players in a single state.

- Bahia: 8.49% – the second largest group is located in the northeastern state.

- Rio de Janeiro: 4.94% is third place.

- Goiás: 3.54% of players reside in the central western state.

- Rio Grande do Sul: 2.83% – the fifth place in number of female players is the southern state.

While there are more female players in Bahia than in Rio de Janeiro, we saw previously that the opposite is true for the total active population of players.

If we segment female gamblers in Brazil according to macro regions, we see the most consistent groups in the Northeast (39.89%), followed by the Southeast (33.6%). To an extent, that is also in contrast to the overall population of gamers in Brazil.

Many Brazilian female players are also clustered in the interior (64%), while residents of state capitals account for 23% – the second largest group among our respondents.

Education Levels

When it comes to education, the absolute majority of female gamers have graduated from either high school or university:

- University: 52.7% female players have a B.A. degree.

- High School: 45.3% have completed high school.

This helps to explain the higher percentage of female players who are aware of the Brazilian regulation of online casinos and sports betting platforms, as well as their implications in terms of safety, fairness and social responsibility.

Socioeconomic Classes

With regard to the relationship between socioeconomic class and real-money online games, the participation of women tends to be more balanced, as the data suggests:

- B1: 16.95% – most female players belong to the B1 class.

- C1: 16.61% – the second largest group by a very narrow margin belongs to class C1.

- A1: 12.72% – female players in the higher strata are third place.

- C2: 11.65% – C2 players are not far behind A1 as well, showing the strength of diversity among female players.

- B2: 10.59% – fifth largest group by a small margin.

Socioeconomic class A1 has 12.72% of female players, while the B1 class has 16.95% of them. However, if we combine socioeconomic classes B2, C1 and C2 (38.85%), we see that most Brazilian female players generally belong to the middle class.

Additionally, none of the female gamblers sampled belonged to socioeconomic classes D or E. We can safely assume that women in financially vulnerable situations tend to avoid participating in online games for money.

Gender Inequality in Brazil and the iGaming Market

In the total population of active players surveyed for this study, 16% are in socioeconomic class A1 and 22% in class B1. However, when it comes to the higher income strata, female players represent only 35.05% of A1 and 33.94% of B1 socioeconomic classes.

This stark difference can therefore only be explained as a reflection of the historical inequality between men and women in Brazil.

In 2018, IBGE published its latest edition of the Gender Statistics Social Indicators of Women in Brazil, showing that women still earn lower salaries than men in the country, despite being the majority of the population with university education.

Regarding political and management positions, as well, by 2017 and 2016, respectively, only 10.5% and 39.1% were occupied by women. Consequently, as representatives of their socioeconomic class, A1 female players are still a minority.

In this sense, Bolsa Família is a successful federal government program intended to provide families in poverty with basic resources. Proving the persistence of gender inequality in Brazil, women are 83.4% of the social program beneficiaries.

Social Benefit Recipients and Gambling in Brazil

In September 2024, the Central Bank of Brazil’s report Technical analysis of the online betting market in Brazil and the profile of bettors, claimed that, in August, 4 million among the 20.7 million Bolsa Família recipients – approximately 19.32% – have spent an average of R$100,00 in online betting platforms – a total of R$3 billion.

However, the Gaming and Betting Division of the Ministry of Finance itself questioned the reliability of the survey’s data, as internal assessments suggested that some aspects might be overstated. In a technical note also published in September, the Ministry of Development, Industry, Trade and Services have dismissed allegations that spending on online sports betting or casinos has caused a fall in retail sales and increased public indebtedness.

For its part, a study commissioned by the Brazilian iGaming industry and published in October estimates that Bolsa Família beneficiaries actually spent R$210 million in August. The analysis, carried out by LCA Economic Consulting, shows that the Central Bank did not take into account the amount returned in winnings, including the 93% RTP practiced by the Brazilian sector.

According to the LCA’s study as well, and contrary to the Central Bank’s report, despite the growth of the iGaming market in Brazil, its financial impact on families is therefore limited. Online gambling expenditures actually represent only 0.2% to 0.5% of total household consumption and 0.1% to 0.3% of GDP. Additionally, household debt related to online gambling has remained relatively stable.

Nevertheless, the Ministry of Finance was faced with the dilemma of whether to patronize the beneficiaries or allow them to risk assistance for their basic needs. As a result, it began to plan how to ensure that Bolsa Família recipients don’t misuse their benefit – as at least the 2.040 illegal online casinos (recently scheduled for blocking) were operating in Brazil.

Also, it is important to note that it would be impossible for the 96 national and 18 state legal operators to distinguish between the registration documents of beneficiaries and non-beneficiaries without warning. Particularly since – according to the Central Bank – the method of payment used by beneficiaries was instant payment (PIX).

In this regard, unauthorized betting platforms have been prohibited from operating as of October 10, 2024. As a result, the following day, the National Telecommunications Agency (ANATEL) began banning illegal casino platforms.

Starting in January 2025, only legitimate operators will be allowed to exploit the domain “bet.br“, which will help distinguish them from unlicensed gambling platforms in Brazil.

Based on the data collected for this study, therefore, despite the fact that Brazilian women are the majority of gamers as well as Bolsa Família beneficiaries, it is possible to infer that most of the players identified by the Central Bank weren’t female.

Female Gamblers’ Preferences

Regarding types of online real-money games, women’s preferences are very similar to those of men. When asked how often they bet on sports, the answers were also similar. And so were the motivations and the frequency they employ betting strategies.

However, the ways they learn about gambling and develop their own knowledge are slightly different in terms of favorite sources of information.

Female Player´s Favorite Real-Money Games

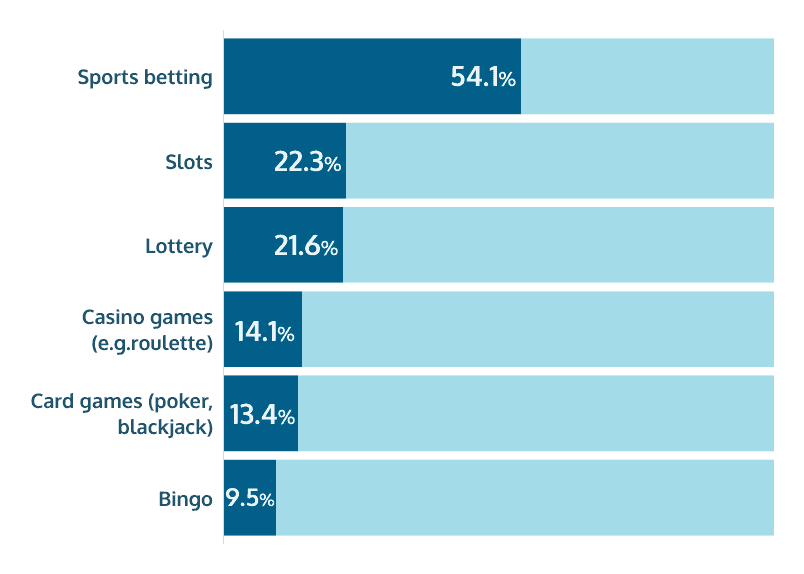

The most relevant difference between men and women gamblers is the way both genders rank gaming verticals. The lottery is the second most favorite real-money game among the total population in this study, but sports betting and online slots are the two most popular verticals among female players.

For female players, thus, the lottery is third on their list of 6 most favored games for money, followed by online casino and card games:

- Sports betting: 54.07% – the majority of female players participate in online sports betting, among those, however, 12.37% exclusively bet on sports.

- Casino slots: 22.25% – the second major group plays online slots.

- Lottery: 21.57% – also bet on the federal lotteries such as Mega-Sena.

- Casino games (e.g. roulette): 14.14% – the fourth largest group gamble online.

- Card Games (poker, blackjack): 13.41% engage in online card games.

- Bingo: 9.54% participate in online bingo matches.

Gambling Frequency for Women in Brazil

Regarding how often women bet on sports specifically, there is also a distinction between both genders. The largest groups of both men and women bet once a week, but men are more likely to engage in daily betting than female players:

- Weekly: 39.6% – most female players engage with sports betting once a week

- Once a month: 12.7% – the second largest group bet on a monthly basis.

- Rarely: 12.7% – in third place are the female players who only seldom engage in sports betting.

- Daily: 11.3% – the smallest proportion of female players bet everyday.

Motivations – Why Do Brazilian Women Bet?

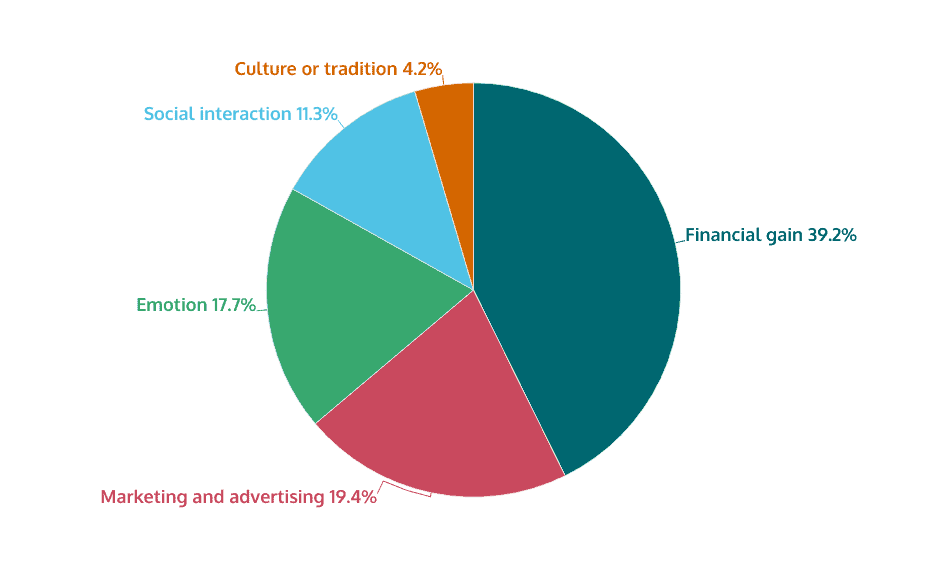

As to the factors that influence female players to bet online, similar to male respondents, most of them perceive online casino games and sports betting as a means to achieve financial gains:

- Financial gain: 39.2% – the largest group of female players are motivated by payouts.

- Marketing and advertising: 19.4% of female players are influenced by the media visibility of online sports betting platforms.

- Emotion: 17.7% bet on sports due to the emotion it adds to watching live football matches.

- Social interaction: 11.3% of Brazilian female sports bettors are driven by the wish to interact with friends, relatives and coworkers.

- Culture or tradition: 4.2% attribute their gambling preferences to Brazilian culture or tradition.

Level of Expertise and Knowledge

Again similar to men – but noting that women have started playing later – most female players – 20.5% – consider themselves to be at an intermediate level when it comes to online casino games or sports betting.

Those who consider themselves beginners are 10.6%, followed by 8.1% of advanced players and only 2.1% who believe they have reached professional level.

Knowledge of Sports Betting Terminology

In terms of knowledge on sports betting terminology, aside from the single bet category – understood by 85.1% – almost half of female players don’t know what accumulators and live bets are – 48.3% and 44.5% respectively. In this aspect, they differ entirely from male players’ responses.

Regarding probabilities and how they work in sports betting, it is important to note that women who entirely understand probabilities correspond to 24.2% of 47% respondents of the whole survey.

Thus, in relation to the knowledge of probabilities, female players have:

- Some understanding: 51.9% – the majority knows what probabilities are but still have doubts.

- Perfect understanding: 25.8% – know what probabilities are and how they function.

The third largest group of female players, though – 22.3% – have never heard about probabilities.

As to the terms “handicap”, “over/under” and “moneyline”, most women – 47.29% – are not familiar with any of them. Those acquainted with all the three terms are only 15.55%, while 37.16% do not know anything about them.

When it comes to bet types they are unfamiliar with, 45.6% of respondents were unfamiliar with all bet types, while 23% had at least heard of them. At 17.7%, the handicap bet is the least known among female players.

How Do Women Learn to Bet Online?

While most men learn to bet from family and friends, followed by those who learn from the sports betting platforms themselves, these are not the most preferred sources for female players. Women favor YouTube videos – which are third place among men:

- YouTube: 19.44% – most women learn how to bet by watching tutorial videos, a popular trend in Brazil for any subject.

- Friends and relatives: 16.95% seek out betting tips from friends and family.

- Sports betting platforms: 13.77% have learned how to bet from the betting platforms themselves.

- Online guides: 10.95% have read online guides on sports betting.

Information Sources

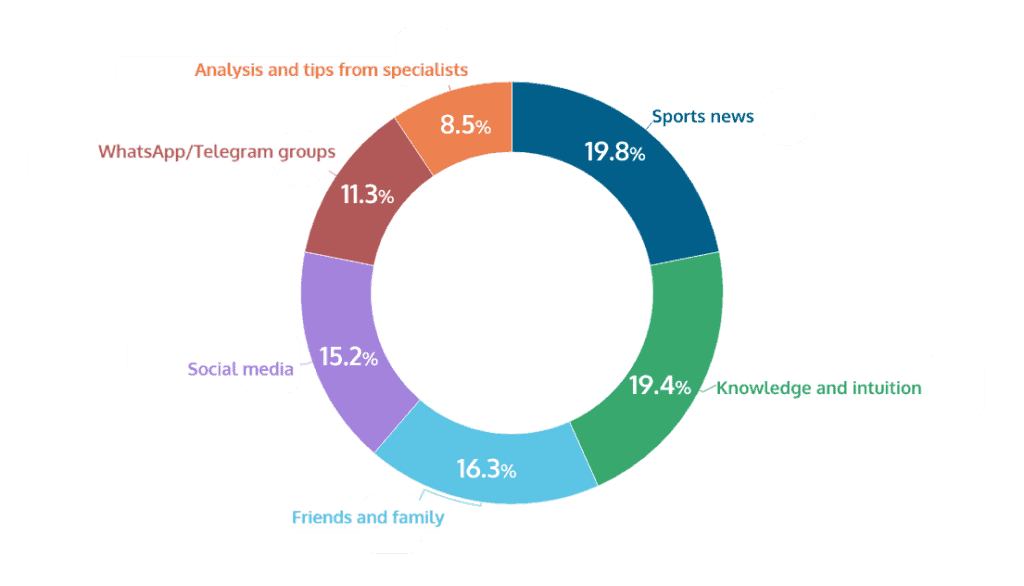

Female gamblers in Brazil also like to stay informed before placing a bet. The sources considered most reliable are cited below:

- Sports news: 19.79% stay informed through sports news. However, of those, 4.94% also check groups in messaging apps.

- Knowledge and intuition: 19.44% rely on their own knowledge and intuition, with 2.83% who also check sports news.

- Friends and family: 16.26% look for information from friends and family.

- Social media: 15.2% check social media feeds and profiles.

- WhatsApp/Telegram groups: 11.31% rely on messaging apps groups.

- Analysis and tips from specialists: 8.48% seek professional analyses.

An average 23.33% of female players combine at least two different sources of information, however, only 2.12% of them combine all 6 sources.

Unlike online casino games – which are completely random and can’t be manipulated – sports betting requires knowledge of championship results and team performances, for instance. Therefore, doing some research is usually necessary for both genders.

With the exception of only 2.12%, all female respondents admitted to doing some research before placing a bet, the difference between them being the amount of time it takes:

- 30 minutes to 1 hour: 11.31%

- 1 to 2 hours: 6.36%

- Less than 30 minutes: 5.66%

Thus, on average, female players spend approximately 11.7minutes researching before placing a bet.

Betting Strategies

As most male players, only a minority of female players – 5.30% – admitted to using any betting strategies. However, differently from them, the majority of female players never employ any sort of strategies:

- Don’t use betting strategies: 57.23% – the majority of female players never employ any sort of strategy when betting.

- Occasionally use betting strategies: 37.47% – the second largest group admitted to using strategies sometimes.

- Frequently use betting strategies : 5.30% – the smaller group of female players use strategies such as betting on the favorite team and browsing teams and players records.

In terms of when they place their bets on a game, female players are more likely to place their bets before the game starts rather than in real time. However, most of them combine both categories:

- Both before and live: 55.81%

- Before the match: 34.66%

- Live: 9.53%

How much do women spend in online real-money games?

In terms of how much money they bet per week, and consistent with their socioeconomic distribution, the largest groups of female players spend as follows:

If they do win, the vast majority of female players – 21.56% – bet a part of the payout back and withdraw another. The rest of the players are evenly split between betting everything back – 5.66% – and withdrawing everything – 5.66%.

The vast majority of female players – 79.49% – don’t opt for early withdrawal to maximize their gains and reduce their losses. In comparison, though, most of the whole population of the survey – 57% – apply this strategy.

What Makes Brazilian Women Pick an Online Gambling Platform?

When it comes to choosing an online casino or sports betting platform, the largest group of female players – 29.7% – look for promotions and bonuses. However, for 12.4% of players, brand loyalty is the main reason for their choice.

The variety of betting options is more important to 10.3% of players, followed by the user experience – 9.9 %. Sponsorships are relevant to 8.1% and 7.8% are more concerned with payment methods.

Additionally, among the female players, 6.7% care about competitive odds, while reputation, reliability, reviews and withdrawal speed are respectively necessary to 4 respondents – 1.4%.

When looking at combinations, 10.59% of female players associate bonuses with brand loyalty. For 8.84%, though, the combination of user experience and competitive odds is more important, while for 7.07% of female players, brand loyalty is related to the variety of betting options.

Finally, when choosing an online casino and sports betting platform, special offers and bonuses are just as important as sponsorship for 5.30%.

New Online Casino and Sports Betting Sites

All female players admitted to trying out new online casinos and sports betting platforms/apps at least once in a while. The most common frequency with which they do so is as follows:

- Occasionally: 21.91%

- Once every few months: 9.19%

- Weekly: 6.71%

The smallest groups of female players are those who rarely try new online casinos and sports betting platforms and those who do so every month. Thus, despite the fact that 5.66% of respondents barely check them out, at least 3.54% try new platforms or apps on a monthly basis.

Information on Switching Gambling Operators

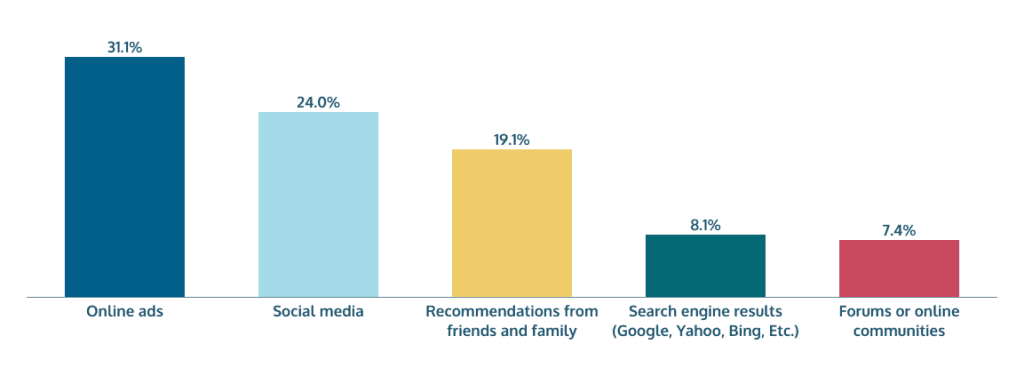

In terms of how they find out about new online casino and sport betting platforms, most female players watch online ads – 31.1% – followed by 24% who prefer using social media. The third largest group of players – 19.1% – rely on recommendations from friends and relatives.

Search engines are used by 8.1% of female players, while 7.4% consult online forums or communities. Interestingly, though, only one respondent specifically described that they follow social media influencers.

On the other hand, 28.9% of female players combine at least two different sources of information when considering trying a new iGaming app or platform.

Female Sports Bettor Preferences

Prior ENV Media research showed that 38% of active Brazilian female players prefer sports betting in comparison to 54% of active male players.

Given that most women started betting after the 2023 regulation, and that they represent half of the whole Brazilian football fandom, it’s likely that these numbers actually reflect an upward trend.

In this sense, the difference between the numbers of women and men within the overall Brazilian football audience is minimum – 49% and 51%, respectively. Also, according to the respondents surveyed for this study, sports betting already is the preference of most female players, just as it is for their male counterparts.

Most Popular Betting Markets for Women in Brazil

When it comes to sports betting preferences, 43.5% of female players are drawn to betting on match results. Other popular bets include total points or goals, which is preferred by 14.8%. Both teams to score is the third favorite type of bet for 13.4%.

- Match result: the majority – 43.5% – prefer betting on the outcome of a match.

- Total number of points or goals: 14.8% prefer betting on how many points or goals a team will make.

- Both teams to score: 13.4% prefer betting that both teams will score during a match.

Most Popular Football Leagues

Among Brazilian female sports bettors, the Brasileirão Serie A stands out as the top choice with 37.1% of them favoring it. Internationally, the Premier League attracts 8.5% of female bettors, while 7.4% prefer to bet on Spanish La Liga matches.

- Brasileirão Serie A: 37.1% make it the most preferred by Brazilian female sports bettors.

- Premier League: 8.5% bet on the English championship.

- La Liga: 7.4% bet on the Spanish national championships.

Regarding Copa Libertadores and the Champions League, the percentages for each championship are very similar in terms of how often they bet during the rounds.

The majority – 24.7% – bet on every match of the Latin American professional football championship, while 21.6% bet on every match of the European competition. As for the qualifying rounds of both, 10.6% bet on the Libertadores and 10.3% on the Champions League.

However, among those who don’t bet on these championships, 9.2% skip the Champions League, while only 1.8% don’t bet on Libertadores.

Most Popular Local Football Competitions

As for Brazilian football championships, the majority of female bettors’ preferences are the following:

- Brasileirão Serie A: 41.7% of female players bet on the serie A rounds.

- Brazilian Cup: 17% bet on the rounds of the knockout football tournament.

- Brasileirão Serie B: 10.9% bet on the second tier of professional Brazilian football.

Female Players’ Favorite Sports

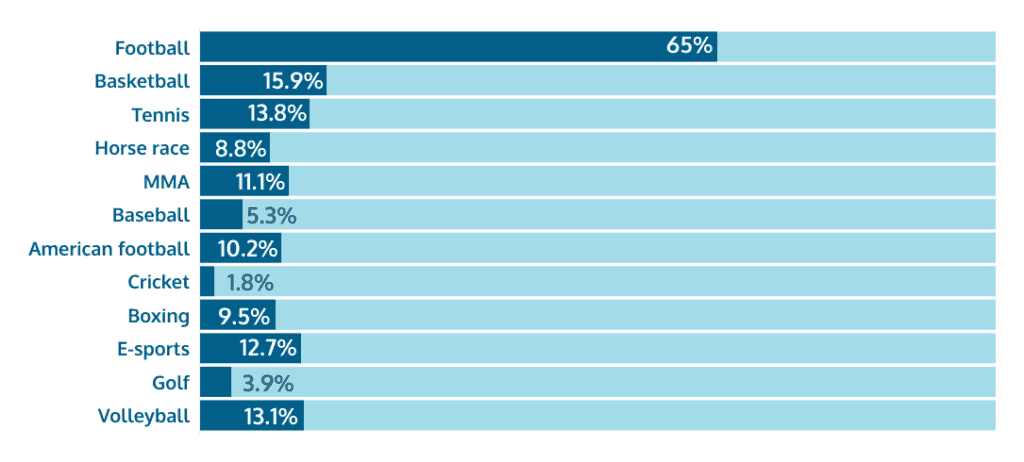

When it comes to their favorite sports, the most female players are into football – 28.66% – followed by E-Sports – 4.59% – the same major preferences of men.

Unlike their male counterparts, who prefer boxing, though, volleyball is the preference of the third largest group of female players – 3.89%. They rank boxing fourth, tied with horse racing – each accounting for 3.53%.

Cricket is the least preferred sport by women with only 1.06%.

Sports Women Actually Bet on in Brazil

With the exception of football, volleyball, and cricket – the most, third, and least popular sports among female players, respectively – the sports in which women bet the most are not in the same order of their favorite sports.

For example, tennis is more popular among them in terms of betting than eSports, which is female players’ second most favorite category:

Similar to the male respondents, football leads with 65.0% of female bettors, followed by basketball with 15.9%.

In relation to betting preferences, sports such as cricket – 1.8% – as mentioned above, and golf – 3.9% – are the least popular among women but also among men who actively bet on sports online.

Women at Play – Shaping the Brazilian iGaming Landscape

In the rapidly maturing Brazilian iGaming scene, women are consistently developing their own preferences and improving competences to and skills at sports betting and online casino games.

Despite their growing experience, when it comes to casino verticals like online slots, crash games and roulette, both women and men need to improve their knowledge of odds and probabilities. Only by truly understanding that there is no way to manipulate these games can they make the most of their entertainment experience.

Despite the age-old gender bias in Brazil in relation to sports knowledge, we see that women prove to be on par with male gamblers, taking on average the same amount of time as men to research the performance of teams, athletes and the outcomes of matches.

Ultimately, although many began playing online real-money games later than men, when it comes to knowledge and expertise of betting of any kind, Brazilian women are just as adept as their male counterparts.