This post is also available in:

Share of Voice of Online Gambling Operators in Brazil

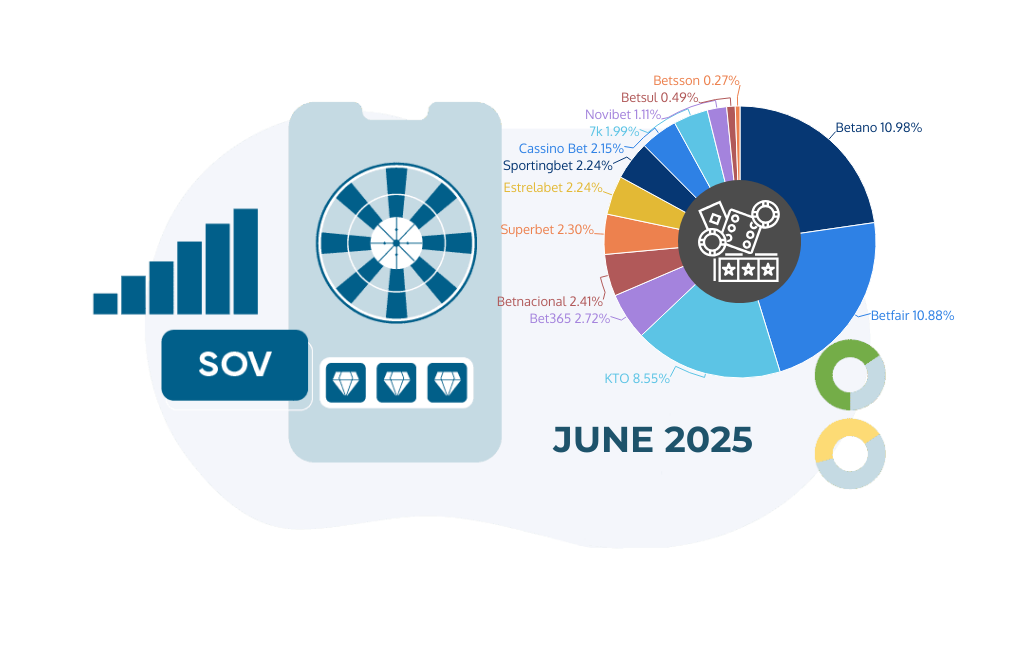

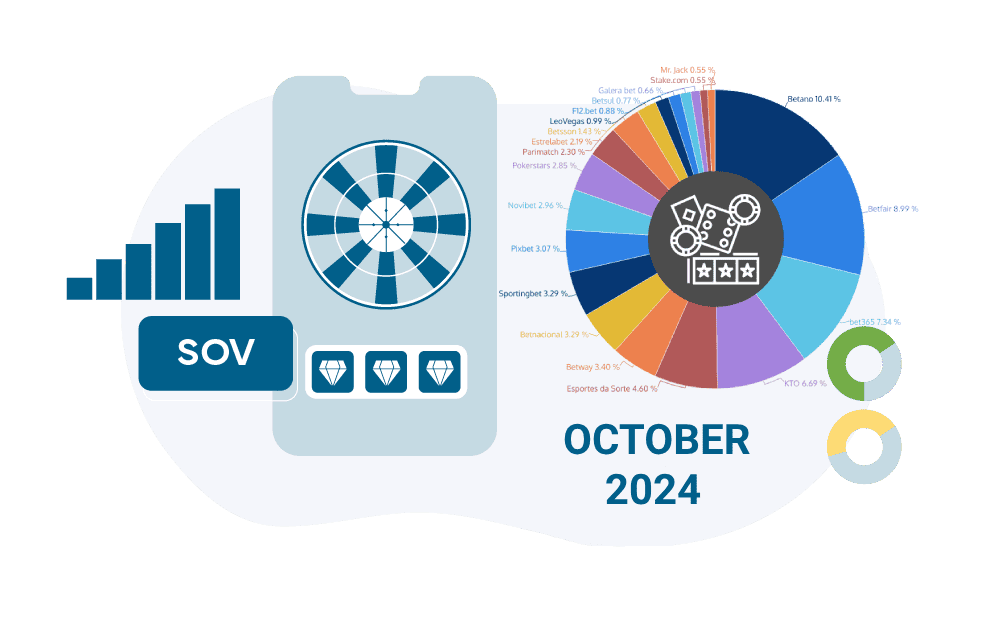

We present a series of studies centered on the concept of “Share of Voice” (SoV), analyzing gambling brands’ visibility and market shares among online casinos in Brazil.

While there are over a hundred licensed online platforms that have offered casino games and sports betting to Brazilians, we focus our research on the most popular ones available in the biggest regulated market globally.

Scroll down to read a detailed explanation of terms and methodology, as well as a clear breakdown of chosen metrics, data sources and ranking criteria.

Latest Share of Voice Reports

Our Share of Voice study is based on concrete metrics but we also analyze consumer preferences and brand loyalty. These put the spotlight on the brands and gaming verticals that engage the Brazilian audience most effectively. Our team meticulously examines direct survey feedback, topical online traction and branded search data.

Consistent monitoring is key to a balanced interpretation of these results. This research is meant as an ongoing and revolving effort, tracking monthly volumes and aiming to pinpoint the standout iGaming operators and real-money verticals as chosen by Brazilian players. We will measure and report on market trends and SoV changes periodically.

What Is a Share of Voice?

“Share of Voice” is a pivotal metric in the iGaming industry. In simple terms, it offers a comprehensive view of a brand’s market presence relative to its competitors.

As a concept, SoV does not estimate market shares based on actual subscribers or active players. Yet, SoV goes deeper, assessing a brand’s visibility and dominance in industry conversations across various online marketing channels.

As a combined metric, it encapsulates everything from the volume of brand mentions to the extent of digital marketing efforts, including social media engagement, website traffic, and keyword prominence in iGaming-related searches.

Although SoV is affected by paid advertising, it also extends beyond that. It encompasses the entire spectrum of a brand’s digital footprint, including organic reach and the impact of content marketing strategies.

In our research, we apply the SoV concept for gaming verticals such as sports betting, lottery and online casino (along with corresponding sub-categories like slots or card games). This approach provides us with a contextual understanding of how various real-money gaming segments resonate within the market.

Explaining Our Methodology

As a starting point, our Share of Voice study breaks down a comprehensive survey, following the same coherent and well-structured approach. The field study collects data from a diverse demographic of 500 Brazilian adults, ensuring a representative sample of the target audience.

- Original survey of Brazilian adult gamers

Our survey allows us to produce a detailed demographic segmentation (age, gender, socio-economic class, education level and occupation). What we present in our quarterly reports, however, focuses on brand recognition and its impact on gaming habits, including factors that influence choices and discovery channels for new platforms.

These findings are subsequently enriched with third-party data. Given our experience in SEO and lead generation, we focus our tracking efforts on relevant keywords divided between branded and generic searches. Generic searches zoom in on the casino vertical and its specific game categories, based on monthly search volumes.

- Keyword tracking

The primary tool we use to measure the Share of Voice is Wincher.com. We present the selected indicators over an ample timeframe, which ensures illustrative and balanced data samples.

- Volume of branded searches

One of the most relevant ways of ranking the brands is the intensity of direct branded lookups coming from Brazilian IPs. We break down monthly averages for branded queries through Mangools.com.

- Brand interest trends on Google

Although much less concrete in its figures, Google Trends provides a very relevant overview of the amount and intensity of online demand for a brand.

- Organic traffic estimates

We monitor and list the amount of organic traffic that the most popular brands receive from Brazil. To ensure a more balanced and representative estimate of their online traction, we perform this task via Ahrefs.com and Semrush.com, two of the leading digital marketing facilitator platforms.

- Social Media followers – Instagram, X and Facebook

Given the impact of social networks and their ability to deliver marketing messages, compiling a ranking of iGaming brands’ presence on social media (SM) is also a valid criterion to judge their digital success.

There are some objective standards when evaluating the visibility of a brand on the domestic market. First and foremost, branded searches have the highest relevance. We measure them both in terms of trending volumes as well as direct brand name queries.

Secondly, big-data measurements weigh much more than survey answers, often based on personal preferences and possibly extemporaneous. Therefore, we consider mid- and long-term traffic data, tracking several months at a time for Share of Voice and search volumes.

And naturally, these digital indicators cannot estimate subjective factors like reputation, visibility and word-of-mouth impact of brands that often have ample off-line presence – billboards, TV and radio ads, sports team and event sponsorships, ambassadors and influential publicity figures, and much more.

Ultimately, we designed a Weighted Points System which sees every indicator in the above list transformed into points – from 20 (assigned to the respective leader in a given segmentation) down to 0, when the bottom position has marginal or non-existent presence.

For every ranking and every indicator, we proceed systematically by assigning points via the following formula:

| Share(BrandX) / Share(Leader) x 20 pts = BrandX pts |

The resulting points are rounded off to the nearest whole integer.

This methodology ensures that the brands receive the weighted importance of their visibility, instead of assigning a simple algebraic scale-down by a single point for every position in the list.

In pragmatic terms, we take inspiration from the approach adopted by Google Trends which assigns the peak value at 100 and calculates the weighted curve based on that volume. Our weighted points system scales the comparison curve down from 20.

Casino Share of Voice and Brand Loyalty

Besides weighted estimates of the share of voice of online casino operators, our study sheds light on player behavior and brand loyalty. A detailed look at game preferences, frequency of play and trust in specific brands also helps understand the factors influencing players’ choices when it comes to choosing or changing a gaming platform.

Multiple elements may affect these choices, such as website design, mobile app availability, and recommendations from friends. These insights are crucial in understanding the dynamics of brand loyalty and player engagement in the Brazilian iGaming market.

To see the latest Share of Voice rankings and track back the relative changes in the brands’ standing for since 2023, consult the respective report from the list.