This post is also available in:

Despite the Brazilian government’s best efforts to ban offshore casino websites, new ones will invariably pop up. In addition, these too will be indexed and returned by Google for keywords related to casino games and sports betting.

Google also doesn’t crack down on hacked URLs. Without actually hacking an entire website, this is a technique used by offshore operators to hide their illegal content under legitimate URLs, such as those of Brazilian federal universities.

According to ENV Media’s research, the impacts caused by Google are even more drastic. After the mandatory bet.br domain migration, licensed operators lost 79% of search traffic as Google’s algorithm limited them to two positions per query on the Search Engine Results Page – SERP. In contrast, it boosted the visibility of illegal .com sites.

Consequently, this problem drove users to unauthorized platforms, causing monthly losses of over R$575,000 for the top Brazilian licensed operators. The overall impact therefore undermined tax revenues and the regulated market itself.

Due to these intricate technological challenges, in the first couple of months of 2025, the illegal market accounted for approximately RS$350,000,00 in losses to licensed operators and therefore taxes in Brazil.

Can the Brazilian Authorities Stop the Money Drain to Tax Havens? And If So, How?

As shown by ENV Media’s research on the Brazilian iGaming taxation framework, licensed operators are subject to a 12% tax on Gross Gaming Revenue (GGR) plus a 15% tax on player winnings. And not only that. Licensed operators also face a standard corporate income tax of 34%, with higher rates for financial institutions. Additional levies like PIS/COFINS and ISS are also charged.

Thus, Brazil’s total tax burden on iGaming exceeds 50%, with the 12% GGR tax nearly doubling the charge. Of the remaining 88%, barely 40% of the GGR is left after marketing and operational costs are covered. On top of that, a further 45%-48% is taxed, depending on the registration. However, in Brazil, Education, Sports, Tourism, Security and Health are all supported by the reallocation of the 12% tax.

On the other hand, offshore operators are unburdened as they are based in tax havens. Tax havens are countries that offer low tax rates and poor financial controls to attract capital. As a result, offshore operators shift their revenues to tax havens such as Curaçao, and away from Brazil.

Naturally, Brazil is not the only jurisdiction targeted by offshore operators. However, the difference with more mature regulated markets, such as the US, is that rather than just relying on online blocking, they employ a range of strategies to tackle the problem from different angles. Blocking payment methods – including cryptocurrencies – is key to disrupt offshore operations in these jurisdictions.

Offshore operators harm players and cannibalise regulated markets, while depriving citizens of tax benefits. This study therefore analyses Brazilian initiatives in comparison with successful measures taken worldwide to prevent this from happening.

Major actions against offshore operators in Brazil

- ANATEL blocked 3,440 illegal websites in October 2024, rising to 12,500 by March 2025 – a 263.37% increase in offshore casino blocks by the Secretariat of Prizes and Betting – SPA.

- In January 2025, the SPA conducted 75 inspections, 51 targeting influencers. That same month, YouTube (Google) announced penalties for content promoting illegal casinos and sports betting sites.

- In March 2025, the National Secretariat for Sports Betting and Economic Development – SNAED – ordered the suspension of 53 YouTube accounts and 25 channels that promoted false winnings to an audience over 100,000 viewers.

- According to the Brazilian Central Bank, R$20 billion was spent in monthly betting through Pix between January and August 2024. In 2024, Pix was the general favorite payment method in Brazil, accounting for over 7 million monthly transactions in January.

Blocking strategies in Brazil

Generally, offshore casino websites are located in countries where regulation is lax and taxation is low. In addition, the decentralised nature of the online environment allows them to spread freely across legal jurisdictions.

Blocking the Internet Protocol address (IP), Domain Name System (DNS) or Uniform Resource Locators (URLs) is the most common tactic used to shut down offshore platforms worldwide.

In Brazil, the National Telecommunications Agency – ANATEL employs DNS blocking as it is the most cost-effective and simplest approach. Blocklist requests are provided by the Secretariat of Prizes and Betting – SPA.

However, as has been the pattern for illegal operators facing blockage across all regulated markets, when one site goes down, another takes its place.

In October 2024, ANATEL initially blocked 3,440 illegal websites. By March 2025, the total number of blocked offshore platforms reached 12,500. Approximately, this represents a staggering 263.37% increase in the number of illegal websites identified by the SPA.

According to an in-depth literature review on blocking strategies against offshore operators, different approaches to shutting down illegal casinos websites can also produce different results.

For example, Denmark has developed an automated search engine for identifying illegal online casinos. This measure has speeded up the pace at which offshore operators can be tracked and blocked in the country.

In contrast, countries such as Greece, Cyprus and Brazil update their blocklists manually. Cyprus, on the other hand, publishes its blocklist online to raise awareness.

Therefore, in terms of publicity, DNS blocking can be more effective when combined with education, for example. As the study suggests, the tactic can be improved by allowing users to read the reason why the site has been blocked, rather than simply finding a 404 Error blank page.

But while DNS blocking is by all means mandatory, it alone won’t stop offshore casinos from operating illegally. Thus, influencers who promote unlicensed operators on social media have also been targeted by the Brazilian government.

In January 2025, the SPA carried out 75 inspections – 51 of which related to influencers. Also in January, YouTube – Google’s video platform – announced that it would penalise content that advertises illegal casinos and sports betting sites.

Within two months, however, the National Secretariat for Sports Betting and Economic Development – SNAED – of the Ministry of Sport ordered the suspension of 53 YouTube accounts and 25 channels promising false winnings to an audience of over 100,000 viewers per live stream.

Also in March 2025, we manually identified over 100 videos still available on YouTube that either promoted illegal platforms, promised easy winnings or bogus casino strategies. One of them, a video featuring fake hacks for Fortune Tiger, accumulated 115,000 views over the last 2 years.

Online blocking is a major and permanent task for regulators, though it can be viewed as mopping up ice. When combined with a payments block, though, it raises the stakes.

Payment blocking

Payment blocking prevents deposits and withdrawals from illegal operators. It also cuts off their transactions with payment service providers such as PayPal, ultimately disrupting their business.

Despite the literature gap on the effectiveness of payment blocking, important markets such as the US and France have these measures in place. While these do not provide a 100% solution, when combined with other tactics, payment blocking contributes to a much safer, fairer environment.

In the US, under the authority of the Federal Reserve System, payment blocking was introduced in 2006 and can be less complex than website bans. Financial institutions, such as banks, must suspend the restricted transactions at the request of the Federal Reserve System.

For its part, in 2022 the French National Gambling Authority – ANJ – was granted the power to enforce payment blocks against illegal operators. While website blocking is also bureaucratic and requires a warrant in France, the ANJ is still able to tackle the problem at its roots.

In this sense, most transactions within the global iGaming market are made via PayPal. Other less popular methods include credit cards, bank transfers and services such as Google or Apple Pay.

Pix dominates in Brazil

So far, Brazil has banned the use of credit cards, including the Bolsa Família social benefit, on casino and sports betting platforms. The decision was aimed at preventing indebtedness, and licensed operators banned credit cards even before it was formally requested by the Ministry of Finance.

However, while the measure has been effective in preventing debt, it hasn’t been enough to battle offshore operators, who don’t follow Responsible Gambling policies. Thus, as financial institutions such as banks and fintechs continue to facilitate transactions with illegal platforms, they still put consumers at risk.

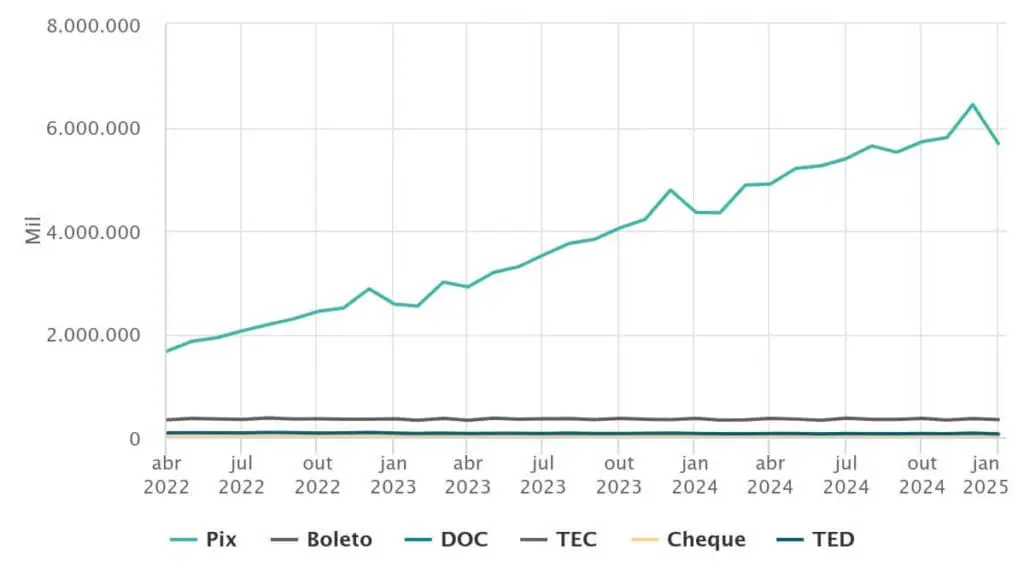

The Central Bank monitors and controls the activities of financial institutions in Brazil. According to its 2024 Payment Methods Report, instant payment Pix largely dominates monthly transactions in the country. In January 2024, Pix exceeded 7 million monthly transactions, leaving all other payment methods behind.

Source: The Brazilian Central Bank 2024 Payment Methods Report

As mentioned in the ENV Media’s study on the new registration process at licensed platforms, although disputed by market experts, the Central Bank announced that R$20 billion was spent in monthly deposits through Pix between January and August 2024.

Since the Central Bank had access to these transactions, it could have also evaluated how much of these monthly volumes were otherwise directed to illegal platforms. Therefore, as it has been done with the blocking of credit cards, instant payments through Pix with illegal operators should also be banned.

Since blocking Pix would require players to open bank accounts abroad, it would become harder to make deposits on unauthorized casino and sports betting websites.

Key strategies to shut down offshore operators

The Brazilian regulation secures numerous benefits for licensed operators, such as the exclusive domain ‘bet.br’. However, in practice these advantages are undermined by weaknesses in Big Tech’s governance.

These involve algorithms or machine learning processes that fail to distinguish illegal content. Addressing such issues in the context of the Brazilian Internet Civil Rights Framework with Big Tech companies’ representatives is therefore urgent.

On the other hand, if Brazil were to follow Cyprus’ example and publish its blocklist online, it would greatly benefit from this educational, potentially engaging tactic.

Yet, compared to blocking strategies in more mature markets such as the US, the opposite is true in Brazil. While blocking illegal casino platforms and social media is standard practice, requesting financial institutions to block payments is apparently more challenging.

The role of the Brazilian Central Bank – the country’s top monetary authority – should therefore be significantly more active in the fight against the illegal market. Given that the Central Bank is also improving the security of Pix transactions by excluding irregular accounts from using the tool, its cooperation with the SPA is long overdue.

Additionally, since the majority of transactions with iGaming operators worldwide are made via PayPal, engaging the Central Bank is also necessary to reach agreements with fintechs as well to safeguard legality in Brazil.

As is common in the long-established US iGaming industry, payment blocking – and Pix in particular – would highly improve player security and Responsible Gambling standards in Brazil. In turn, it would ensure a thriving Brazilian market and that its operations translate into increased tax benefits.